Natura &Co: Available At A Beautiful Value

Summary

- NTCO has been marred by tepid consumer spends, particularly in the international markets dragged by Avon and The Body Shop.

- It began a series of strategic transformation, including selling its priced Aesop brand, which would make its balance sheet almost debt-free.

- Its focus on profitability over growth visible through turnaround initiatives in Avon bodes well for the long term prospects.

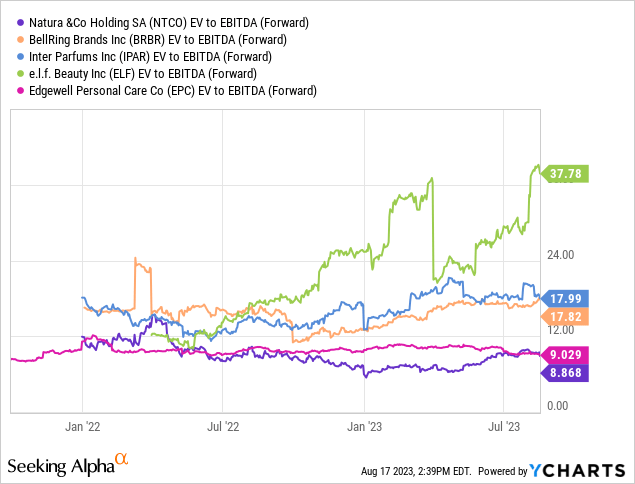

- NTCO is a Buy at current levels (9x EV/ Fwd EBITDA) as the Street does not seem to ascribe much value to its international brands.

Nils Versemann/iStock Editorial via Getty Images

Investment Thesis

Natura &Co (NYSE:NTCO) is a pure play beauty company with strong presence in LatAm as well as international markets through its The Body Shop (TBS) and Avon International brands. It had multi-fold problems including weakness in Avon International and The Body Shop compounded by tough economic backdrop as well as leveraged balance sheet that has led to shares cratering over 65% after peaking in July 2021. Since then, it has embarked upon series of strategic steps including its sale of Aesop to L'Oréal and focus on profitability and cash conversion while stalling growth plans. We believe the company may further divest underperforming assets across different geographies. Turnaround in Avon International has been visible driven by focus on mix and pricing actions with constant currency revenue decline being curtailed back to a large extent despite the weakness in home & style categories.

Turnaround in Avon International

Robust growth in LatAm as well as turnaround in Avon and sequential improvements in TBS along with cheap valuation makes it a Buy case.

Company Overview

NTCO is the fourth largest beauty company globally created following its acquisition of Avon Products in 2020. It operates through three key brands that includes Natura, The Body Shop and Avon with presence in over 100 countries. It was formed through a string of acquisitions having acquired Aesop in 2013 which it subsequently sold it this year to L'Oreal for over US$2.5 bn to deleverage its balance sheet while it acquired The Body Shop in 2017.

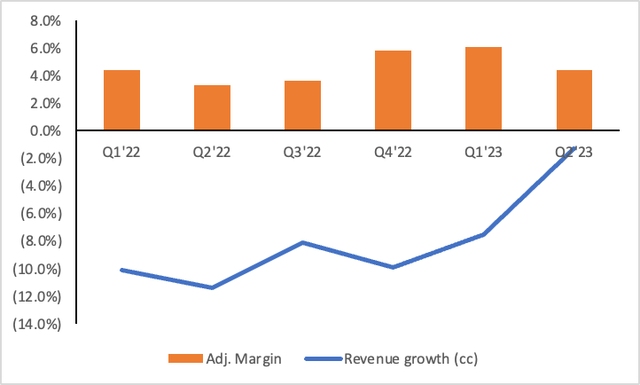

Strong Operational Improvements

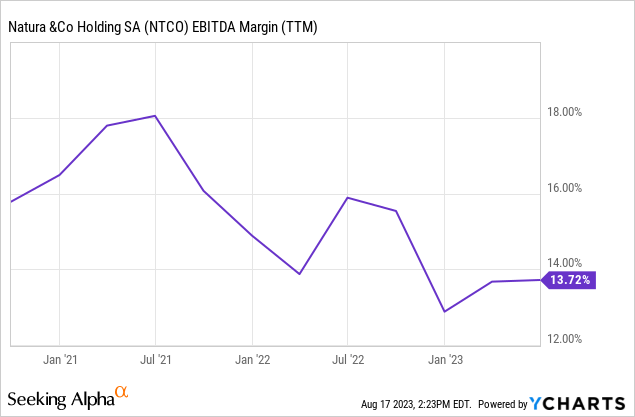

NTCO reported strong Q2 earnings with constant currency (cc) revenue growth of 1.9% driven by robust 5.8% constant currency growth in Natura &Co LatAm business. The growth in LatAm business was driven by strong double-digit growth in Natura brand within Brazil as a result of strong campaigns on Mother's Day and Valentine's Day partially offset by steeper decline of 37% (in cc terms) in Home & Style category along with 4% decrease in Avon brand. Avon International reported a relatively stable set of numbers with revenue declining by 1.3% YoY in cc terms driven by pricing actions in beauty category (up 5%) offset by a decline in Home & Style segment amid the planned portfolio reduction. The biggest drag remained its Body Shop brand which reported a 12.5% decline in revenue as European and other international markets continue to remain challenging with the management expecting the downward journey to continue, at least for the back half of the year. Gross margins expanded by 430 bps YoY driven by improvements across all the business units on the back of pricing actions and improving channel mix. Adj. EBITDA margins improved by 230 bps as a result of strong gross margins and cost controls in TBS partially offset by investments in Avon International and Natura. EBITDA margins have shown consistent improvement over the past couple of quarters post a shocking Q4 as it began focusing on profitability.

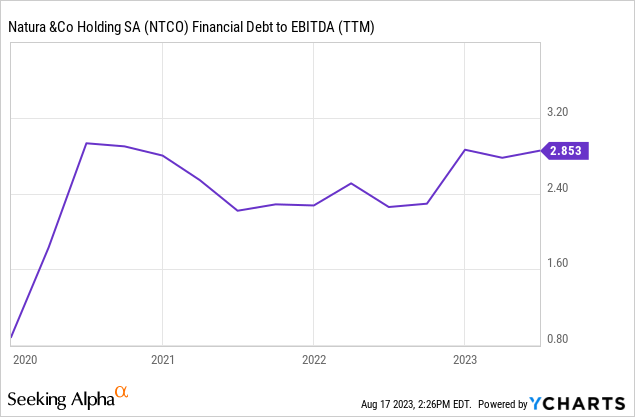

It ended up with US$718 mn in cash and short term investments with total debt outstanding of ~US$2.8 bn. Debt to EBITDA has consistently increased to 2.9x, however, post the proceeds from its divestiture of Aesop, the company is likely to be debt free while it may choose to invest some amount of proceeds to reinvigorate its Avon International brand while restructuring its TBS brand including investment in digital to accelerate its online growth.

Valuation

NTCO trades at an attractive valuation of under 9x below its long term average of 12x as well as relatively undervalued compared to its peers (including L'Oréal which trades at roughly 15x EV/ forward EBITDA) as the Street takes a harsh outlook on TBS brand amidst consistent macro headwinds and slowness in consumer spends elsewhere. We believe this provides a favorable risk reward at current levels driven by its strength in Natura &Co LatAm business as well as turnaround initiatives bearing fruit in Avon International.

Apart from that, NTCO appears cheap at 20x P/ 2024E earnings below its long term average as well as its peer range while L'Oréal trades at 33x 2024 earnings.

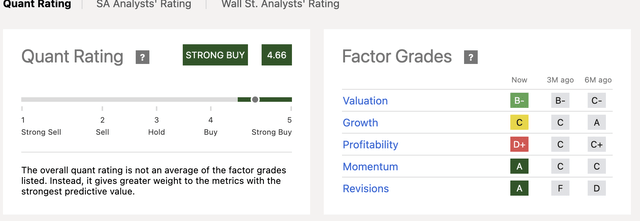

Seeking Alpha's quant grade ascribes a "Strong Buy" rating driven by positive momentum and revisions while profitability and growth remains a concern in the near term.

We ascribe a Buy rating as we expect the continued strength in its LatAm business, turnaround in Avon international as well as valuation comfort would likely offset the short term weakness in TBS brand.

Risks to Rating

1) NTCO has been severely impacted by macroeconomic challenges and any prolonged weakness could likely have an adverse impact on consumer spends and lead to huge impact on its topline growth and can push back the turnaround initiatives within Avon and TBS

2) NTCO relies heavily on direct selling and its inability to have its consultants sell through newer ways including social media and other ways could materially impact the business

3) It operates in several emerging economies within LatAm including Brazil, Peru, Chile and Argentina and is subject to political, foreign exchange and regulatory risks

Conclusion

NTCO has been affected significantly as a result of macroeconomic challenges as well as its own product portfolio and channel challenges. While LatAm continues to remain the bright spot, TBS has been a drag with consistent double-digit declines. While home & style segments continue to remain weak in line with macro as well as its own strategic shift to select SKUs, beauty has remained a silver lining for Avon. Its focus on growing sustainably and profitably with investments in Avon leading its turnaround efforts via portfolio optimization and focus on hero products bodes well for the company in long term. We believe at current valuations investors are not ascribing much value to its Avon and TBS brands. Initiate with a Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.