Coherent Q4 Earnings: This Stock Is A Hold After 30% Drop

Summary

- Coherent's shares dropped nearly 30% after issuing a weak forecast for Q1/2024, with its non-GAAP EPS significantly below consensus.

- The company posted a GAAP net earnings loss of $178.2 million due to non-cash impairment charges and restructuring charges.

- Coherent's CEO highlighted the contribution of the Finisar acquisition and the firm's ability to respond to market demands, but the weak outlook caused the stock to fall.

- Looking for more investing ideas like this one? Get them exclusively at DIY Value Investing. Learn More »

kasezo

When buyers bid shares of Coherent (NYSE:COHR) in June 2023, its struggle to hold the $50 proved ominous. Shares traded as low as below $30 at noon on Aug. 16, 2023. It closed at $32.97, down nearly 30% after issuing a weak forecast. Its peer, Lumentum (LITE), fell in sympathy, down by 9% on the day.

Investors who noticed the weak backlog growth would have expected this revenue to exceed expectations only slightly. However, its Q1/2024 guidance is below expectations. Its non-GAAP EPS is nowhere near consensus. Might investors who waited for the stock correction buy COHR shares today, despite the weak outlook?

Coherent Fourth Quarter 2023 Results

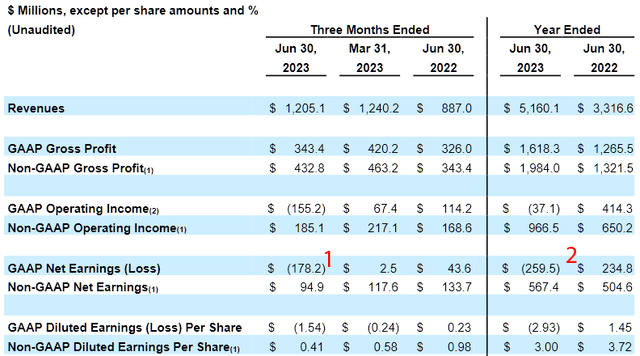

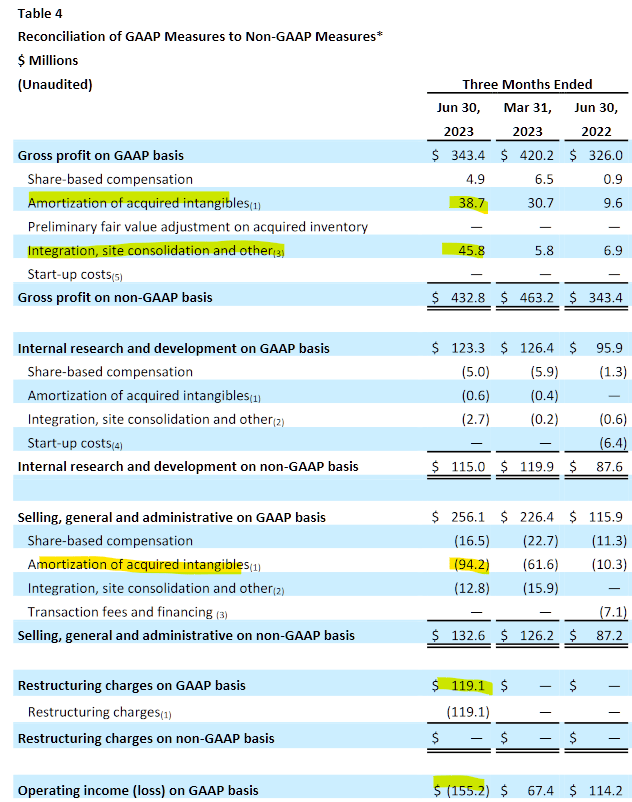

Coherent posted revenue growing by 36.4% to $1.21 billion. It earned 41 cents a share on a non-GAAP basis. Shareholders will notice the large difference in GAAP EPS compared to non-GAAP. In the table below marked "1," Coherent posted a GAAP net earnings loss of $178.2 million. The loss is due to a $39 million non-cash impairment charge for intangible assets. The firm characterizes those assets as acquired technology that is no longer in use. They also include trade names that do not align with Coherent's rebranding.

The firm incurred $119.1 million in restructuring charges. This is one of the biggest items accounting for the reporting differences.

For the full year of 2023 (item 2, above), the GAAP net earnings loss of $259.5 million is significantly different from the non-GAAP net earnings of $567.4 million.

Although the firm had integration and site consolidation costs, they totaled only $45.8 million.

Coherent

Coherent navigated the challenging macroeconomic environment well. The business generated $182 million in operating cash flow. It invested $93 million in capital equipment and retired $121 million of its debt.

Strengths

Chief Executive Officer Dr. Chuck Mattera highlighted the contribution of Coherent's Finisar acquisition. The CEO said the firm demonstrated its unique scale while generating 20% of its FY 2023 revenue from just two customers: one from Communications and one in Electronics.

Coherent can leverage its vertically integrated platform. It will respond to market demands from different market sectors. Although CEO Mattera alluded to market demand now in AI, markets did not care. COHR stock fell in response to the company's weak outlook

Weak Forecast

For Q1/24, the company's revenue guidance of approximately $1.0 to $1.1 billion is below the $1.17 billion consensus. Non-GAAP EPS is even lower than the $0.45 consensus, at $0.05 - $0.20. For the fiscal 2024 year, Coherent's revenue guidance of $4.5 billion to $4.7 billion is below the $5.10 billion guidance. Non-GAAP EPS of $1.00 to $1.50 is just half the consensus expectation of $2.95.

Investors who were caught up in buying anything loosely associated with artificial intelligence in June now know what the sector is worth for Coherent. CEO Mattera said that Q4 bookings "was all about AI." Markets are likely "selling on the news" after the earnings report.

The firm included 800G transceiver revenue in its $4.5-$4.7 billion guidance. However, it will deliver most of the product and recognize the revenue toward the second half of the year. The supply chain is a headwind.

Although I previously rated the stock a "sell" on the irrational run-up, the stock may potentially reward patient investors. Markets are typically impatient: the moment the firm warns about delays, the stock sells off.

Risks

Coherent is confident that 800G transceivers will account for $200 million in revenue. However, Datacom transceiver sales for the AI-related business are not as clear. It is too early to predict how big the 1.6T market will become at this time.

The sustained downtrend in telecom stocks like AT&T (T) and Verizon (VZ) would presumably hurt Coherent's telecom business. Fortunately, CEO Mattera said that the company expects a stronger second half of the year compared to the first half. The industry is showing signs of a recovery before the end of this calendar year.

The comment on a rebounding telecom sector would hint that income investors with paper losses in T and VZ stock may fare better toward the end of this year. Conversely, the outlook may apply only to Coherent's customers like Lumentum, Cisco (CSCO), and Apple (AAPL).

COHR Stock Score

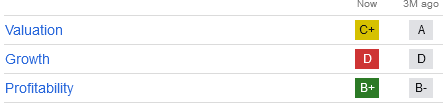

Look for Coherent's valuation score to return to the A to B+ range. Before the sell-off, the stock scored a C+ on value. Speculators betting on quick rebound should notice its growth score is weak.

COHR stock score (seekingalpha premium)

Coherent will need at least two quarters before earning back its investor's confidence. In the five-year chart below, Coherent attracted many buyers between 2021-2022. They paid $50 - $75. Early buyers who overpaid may take advantage of any rally back to $50 by selling.

Your Takeaway

Just as markets over-reacted to Coherent's AI potential in June by rising, it over-reacted to the weaker outlook on Aug. 16. On the day of the sell-off, shares crawled back from $30 at noon to close at $32.97.

Look for Coherent to attract strong buying in the $28 to $30 range. It will form a good uptrend if the firm resolves its supply chain issues sooner. This would lead it to post stronger results in the second half of the year.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the "follow" button beside my name. Join DIY investing today.

This article was written by

Individual investor with three decades of experience who runs DIY Value Investing.

Affiliate partner at StockRover.Chris (diyvalueinvestor@gmail.com) is an Hon B.Sc graduate (with distinction) in Science and Economics. He holds a PMP (Project Management Professional) designation.

Do. Act. Invest.

About Do-it-Yourself Value Investing: Sectors include life science, technology, and dividend-growth income stocks. Through top DIY model holdings, members learn how to manage their trading and investments.

Once you are convinced the ideas have merit, Act on it and put a trading plan together, together with an entry and exit point, based on the DIY Top ideas.

Invest and buy the stock. Then wait for the idea to bear fruit.

I seek undervalued, unappreciated value stock ideas and share them first with DIY members. Follows Warren Buffett's mantra: do not lose money.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.