Ingersoll Rand Dominates Specialized Industrial Markets With Margin And Scale Growth Potential

Summary

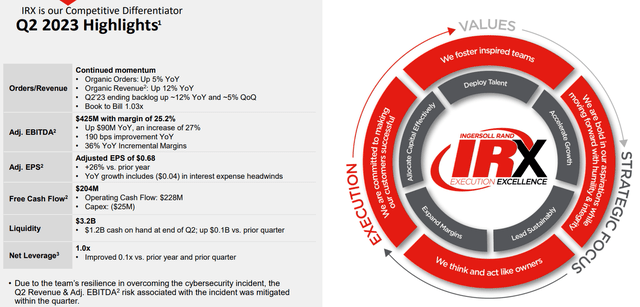

- Ingersoll Rand achieved Q2 revenue of $1.69bn, a 17.13% increase, and a net income of $179.50mn, a 29.60% increase.

- IR aims to expand its double-digit growth, enhance its work environment and sustainability position, and raise FY23 guidance.

- The Company is undervalued by 15% according to discounted cash flow analysis and has positive analyst sentiment with an average 1Y price target of $74.86.

artas/iStock via Getty Images

Ingersoll Rand (NYSE:IR) is a Davidson, North Carolina-based flow creation and industrial products manufacturer and distributor. Formed in early 2020, IR operates through its >40 brands to provide products between its two core segments; Industrial Technologies & Services and Precision & Science Technologies.

Ingersoll Rand Q2'23 Presentation

Through these activities, IR has achieved Q2 revenues of $1.69bn - a 17.13% increase - alongside a net income of $179.50mn - a 29.60% increase - and a free cash flow of $198.30mn - a 21.14% increase driven by rising operating and financing cash flows.

Introduction

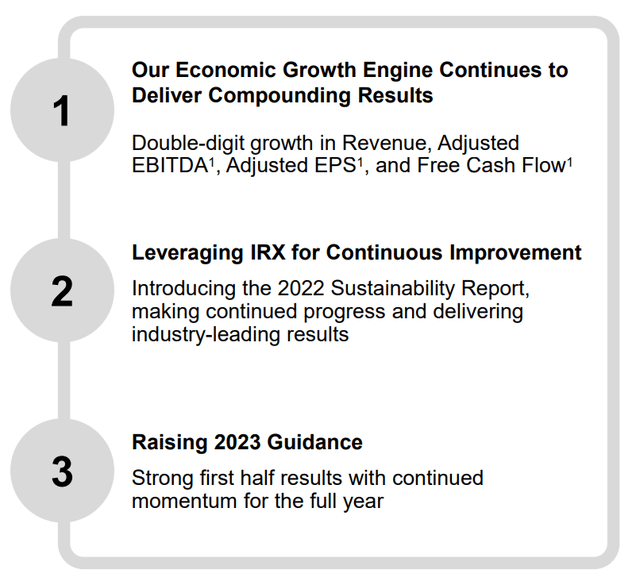

Looking forward, IR has laid out three principal short-run objectives to maximize operational and shareholder returns; the firm aims to expand upon its 'economic engine' of leveraging macro trends and utilizing existing expertise to enhance its double-digit growth across the income and cash flow statements while supporting a superior work environment and sustainability position for greater talent retention and ESG inclusion, and ultimately raising FY23 guidance to build longer-term momentum.

Ingersoll Rand Q2'23 Presentation

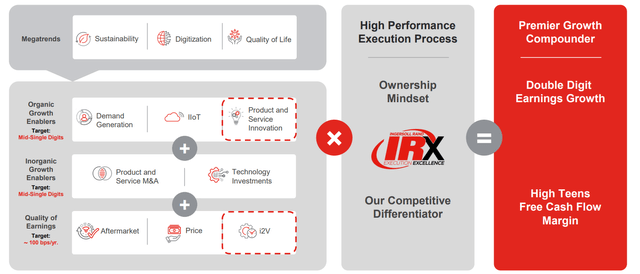

As demonstrated below, IR's economic growth engine remains core to the firm's philosophy. IR seeks to work within a megatrend framework to capture organic growth, particularly through product and service innovation, inorganic growth to expand verticals and accessible technologies and enhance the quality of its earnings through margin expansionary initiatives. All this combines with IR's core qualities to support higher earnings growth and a greater free cash flow margin.

Ingersoll Rand Q2'23 Presentation

IR's economic growth engine strategy, combined with high-quality products, a modest undervaluation, and a strong overall financial position lead me to rate the company a 'buy'.

Valuation & Financials

General Overview

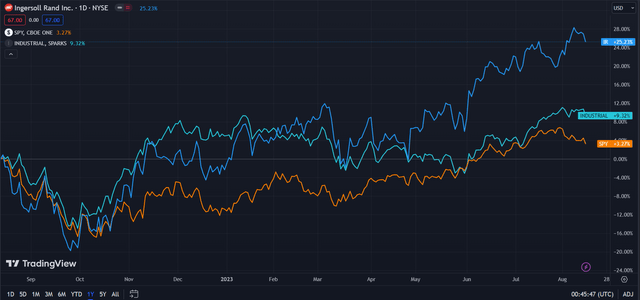

In the TTM period, IR's stock - up 25.23% - has experienced superior price action to both TradingView's Industrial Index- up 9.32% - and the broader market, as represented by the S&P 500 (SPY) - up 3.27%.

Ingersoll Rand (Dark Blue) vs Industry & Market (TradingView)

I believe the industrial industry's general outperformance mirrors the broader macro recovery theme from COVID-19 and the immediate stressors of other black swan events.

That said, IR seems to have outperformed due to their presence across inelastic products and services, better positioned to handle recessionary and inflationary impacts when servicing product categories from life sciences to industrials to infrastructure, and so on.

Comparable Companies

The industrial and engineering sector is a highly fragmented one, with differently-sized firms operating across thoroughly specialized niches. Although this forms moats for companies operating within the engineering industry, it also means IR does not necessarily have any direct competitors. As such, I sought to compare IR with similarly-sized engineering/industrial companies. This group includes Japan-based automation-oriented robotics and manufacturing firm, FANUC (OTCPK:FANUY), Everett, Washington-based industrial technology conglomerate, Fortive (FTV), Wilmington, Massachusetts-based warehouse automation firm, Symbotic (SYM), and Washington, DC-based water technology provider, Xylem (XYL).

As demonstrated above, IR has experienced the third-best QoQ price action, coming off the back of the second-best YoY price performance. Despite this, when considering the firm's multiples-based value and growth capabilities, IR maintains a superior growth positioning.

For instance, although IR maintains the third-highest trailing price/earnings ratio, the firm maintains the second-lowest P/E forward ratio, demonstrating the firm's evolving value proposition.

Additionally, IR demonstrates outsized growth capabilities, with the lowest PEG ratio in the peer group, the second-highest PEG ratio, and the highest earnings and revenue growth capabilities. Moreover, with a low debt/equity ratio, the firm is able to effectively reinvest to capture increased growth.

Valuation

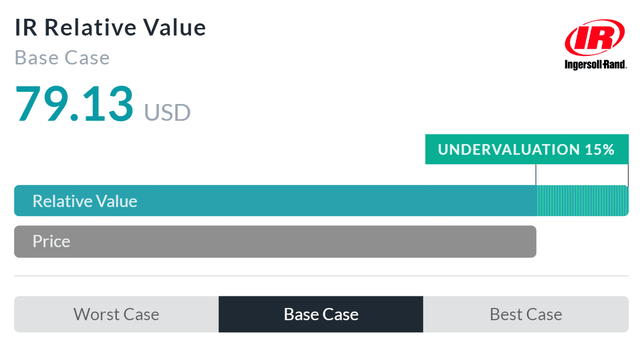

According to my discounted cash flow analysis, at its base case, the net present value of IR is $78.78, meaning at its current price of $67.00, the stock is undervalued by 15%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 8%, reflecting the firm's debt-light cap structure and low equity risk premium. Moreover, to remain conservative, I calculated a forward 5Y average revenue growth rate of 10%, not accounting for potential M&A, which elevated IR's trailing 5Y average revenue growth rate to 54.53%.

Alpha Spread's multiples-based relative valuation model corroborates my thesis on IR's undervaluation, estimating a base case undervaluation of 15% to a price of $79.13.

Therefore, averaging my NPV and Alpha Spread's relative value, the fair value of IR is $78.96, with the stock undervalued by ~15%.

IR's Proprietary Platforms Combine With Inorganic Propositions to Boost Cash Flow Generation

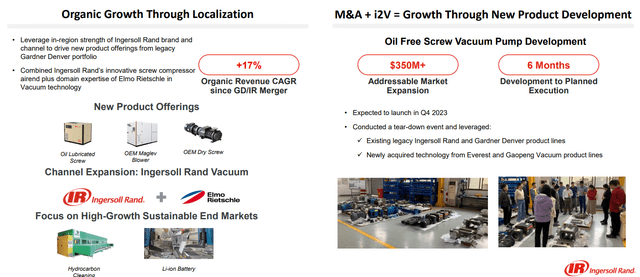

As a primary component of IR's 'economic growth engine', IR has developed a multi-sided approach to supporting organic growth. Among its strategies, the firm aims to rapidly expand scale and margin growth through new product offerings and a focus on high-growth end markets. For instance, IR has established a significant presence in hydrocarbon cleaning industries and lithium-ion battery production. The company's organic growth capabilities are well-supported by its aggressive inorganic growth strategy, with M&A working alongside margin growth as a key contributor to scalability.

Ingersoll Rand Q2'23 Presentation

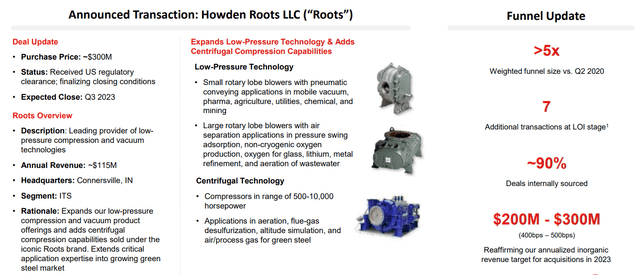

On a more granular level, the $300mn acquisition of Howden Roots best manifests IR's general inorganic growth efforts. Through Howden Roots, the firm is able to boost revenues by $200-$300mn, effectively developing multi-hundred million dollar synergies. Operationally, this acquisition expands IR's presence in low-pressure compression and vacuum products, whilst enabling a foray into centrifugal compression under the Howden Roots brand.

Ingersoll Rand Q2'23 Presentation

Wall Street Consensus

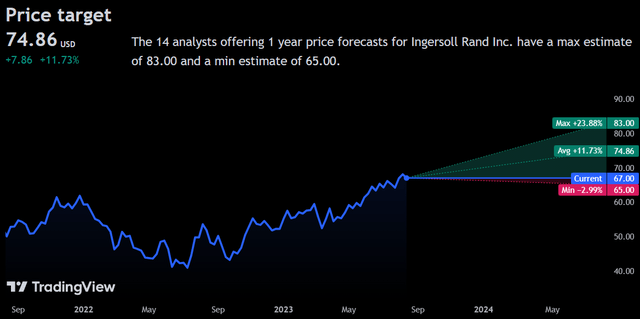

Analysts generally echo my positive sentiment on IR, projecting an average 1Y price target of $74.86, an 11.73% increase.

Even at the minimum predicted price target of $65.00, analysts expect only a 2.99% decline, indicating analyst opinion both on IR's operational capabilities and equity price resilience.

Risks & Challenges

Aggressive M&A May Lead to Excess Expense Base if Poorly Managed

Although inorganic remains central to IR's historic and forward growth outlook, aggressive expansion not only reduces the capability of the company to focus on core efficacy but also may increase the cost of capital without necessarily supporting greater margins. As such, investors may wish to price in potential long-run margin compression or growth slowdown concerns.

IR Remains Dependent Upon Sustained Innovation for Moat and Success

As I discussed in the 'Comparable Companies' section of this article, the industrials and engineering industries remain fragmented due to the inherent moat associated with specialized product fulfillment. However, to maintain this moat, IR requires constant innovation, itself an objective which leads to high capital expenditures and operational expenditures when considering human capital. As such, any increased competitive intensity may increase costs for IR, leading to lower profitability.

Conclusion

Going forward, IR's 'economic growth engine' and highly accretive M&A strategy support long-run price growth as well as a more immediate reversion from undervaluation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.