Tracking Akre Capital Management Portfolio - Q2 2023 Update

Summary

- Akre Capital Management's 13F portfolio value increased by 6% to $12 billion this quarter.

- The largest five stakes in the portfolio are Mastercard, Moody's, American Tower, Visa, and O'Reilly Automotive.

- The Akre Focus Mutual Fund has outperformed the S&P 500 Index with annualized returns of 14.54%.

thitimon toyai

This article is part of a series that provides an ongoing analysis of the changes made to Akre Capital Management's 13F portfolio on a quarterly basis. It is based on Akre's regulatory 13F Form filed on 8/11/2023. Please visit our Tracking Akre Capital Management Portfolio series to get an idea of their investment philosophy and our last update for their moves in Q1 2023.

This quarter, Akre's 13F portfolio value increased ~6% from $11.37B to $12B. The number of positions decreased from 19 to 18. The largest five stakes are Mastercard, Moody's, American Tower, Visa, and O'Reilly Auto. They account for ~64% of the total portfolio value.

AUM is distributed among private funds, separately managed accounts, and the Akre Focus Mutual Fund (MUTF:AKREX) (MUTF:AKRIX). Since the 2009 inception through Q2 2023, the mutual fund's annualized returns are at 14.54% compared to 13.44% for the S&P 500 Index. For H1 2023, the fund returned 14.89% compared to 16.89% for the S&P 500 Index. Their cash allocation is currently at 2.7% near the bottom end of their historical range. Akre coined the term "compounding machines" to describe the type of businesses he invests in. To learn more about that investing style, check out 100 to 1 in the Stock Market.

Note: positions in the mutual fund not reported through the 13F filings include Constellation Software (OTCPK:CNSWF), Lumine Group (OTCPK:LMGIF), and Topicus.com (OTCPK:TOITF). Topicus.com and Lumine Group are spinoffs from Constellation Software.

Stake Disposals:

Alphabet (GOOG) Calls: The leveraged long stake in GOOGL through Calls was a very small 0.09% of the portfolio position established in Q2 2022. It was disposed this quarter. GOOG currently goes for ~$130.

Stake Increases:

KKR & Company (KKR): KKR is a 7.11% of the portfolio position established in Q1 2018 at prices between $20 and $24.50 and doubled next quarter at prices between $19.50 and $25.50. There was another ~25% increase in Q4 2018 at prices between $18.50 and $28. The first three quarters of 2020 also saw a ~15% increase. The stock currently trades at ~$59. The last several quarters saw only minor adjustments.

Note: KKR converted from a partnership to a corporation effective July 1, 2018.

Brookfield Corp. (BN), previously Brookfield Asset Management: BN is a 5.13% of the portfolio stake established in Q3 2019 at prices between $20 and $24 and increased by ~18% next quarter at prices between $22 and $27. The first three quarters of 2020 saw another ~45% increase at prices between $10 and $33.50. That was followed with another ~30% stake increase during Q4 2022 at prices between ~$31 and ~$35. The stock currently trades at $32.52. There were minor further increases in the last two quarters.

Note: the prices quoted above are adjusted for the Asset Management Business spinoff completed last December. Shares of the spinoff, which assumed the name Brookfield Asset Management, were distributed at a ratio of 1 share of the separated business for every 4 Class A shares held. The parent company was then renamed Brookfield Corp.

Danaher Corporation (DHR): DHR is a 3.58% of the portfolio position established in Q4 2013 at prices between $47 and $55 and increased by roughly five-times in Q2 2014 at prices between $52 and $59. The stock is now at ~$253. There was a ~8% stake increase during Q4 2022. There was a marginal further increase this quarter.

Note: The prices quoted above are adjusted for the Fortive spinoff in July 2017.

Stake Decreases:

Moody's Corporation (MCO): The initial purchase of MCO happened in Q1 & Q2 2012 in the high-30s price-range. Since then, the position size has doubled at higher prices. Recent activity follows: Q4 2016 saw a ~15% increase at prices between $94 and $109 and that was followed with a ~22% increase the following quarter at prices between $95 and $114. Since then, the activity has been minor. It currently trades at ~$329 and is now the second-largest stake at 15.30% of the portfolio.

Note: Akre's cost-basis on MCO is ~$39.

American Tower (AMT): AMT has been in the portfolio for over two decades. It is the second-largest stake at ~13% of the portfolio. Recent activity follows: the six years through Q3 2018 saw consistent buying almost every quarter. The share count increased over four times from 1.7M shares to 7.1M shares during that period. The buying happened at prices between $65 and $118. Since then, there have only been minor adjustments. The stock is now at ~$176. There was a ~4% trimming this quarter.

Note: Akre is very bullish on AMT as incremental margins are at over 90% and growth in wireless communication is a significant tailwind.

O'Reilly Automotive (ORLY): ORLY is a large (top five) 8.86% portfolio stake first purchased in 2005. Over 800K shares were purchased at the time. The position was at 825K shares as of Q1 2017 - every year had seen adjustments but overall, the stake had remained remarkably steady over that twelve-year period - the stock returned ~10x during that time. 2017 saw a ~130% stake increase at an average cost of ~$195. Q1 2021 saw a ~14% selling at prices between ~$425 and ~$509. There was a ~20% selling during Q4 2022 at prices between ~$703 and ~$865. The stock is now at ~$932. There was a ~6% trimming this quarter.

Adobe Inc. (ADBE): ADBE is a 4.33% of the portfolio position purchased in Q1 2020 at prices between $285 and $383 and increased by roughly one-third in Q1 2021 at prices between ~$421 and ~$502. There was a ~25% reduction during Q4 2022 at prices between ~$275 and ~$346. That was followed by a ~15% selling in the last two quarters at prices between ~$321 and ~$495. The stock currently trades at ~$512.

CarMax Inc. (KMX): The ~2% KMX stake is a very long-term position first purchased in 2002. The bulk of the current stake was built over the four quarters through Q2 2016 at prices between $42 and $68. There was a ~10% stake increase in Q4 2018 at prices between $57 and $74. 2019 had also seen a ~17% stake increase at prices between $58 and $98 and that was followed with a ~20% further increase in Q1 2020 at prices between $44 and $102. The two quarters through Q1 2021 had seen a ~12% selling. That was followed with a ~60% reduction in the last three quarters at prices between ~$56 and ~$86. The stock is now at $81.65.

DigitalBridge (DBRG) previously Colony Capital: The DBRG stake saw a ~6x increase in Q3 2020 at prices between ~$7.20 and ~$11.60. Q2 2022 saw a ~55% stake increase at prices between ~$18.20 and ~$30.20. That was followed with a ~22% increase in the last two quarters at prices between ~$11.50 and ~$23.50. The stock currently trades at ~$16. The stake is still very small at 0.62% of the portfolio. There was a minor ~2% trimming this quarter.

Note: The prices quoted above are adjusted for the one-for-four reverse stock-split last August.

Kept Steady:

Mastercard (MA): MA is currently the largest 13F stake at ~19% of the portfolio. It was first purchased in 2010 and has consistently increased since. Their overall cost-basis is ~$22 compared to the current price of ~$393 per share. Q1 2020 saw a ~9% stake increase while Q2 2022 saw a ~14% selling at prices between ~$309 and ~$379.

Visa Inc. (V): Visa is a large (top five) ~10% of the portfolio stake. It was established in Q2 2012 at a cost-basis of around $30. Q2 2013 saw a one-third increase in the low-40s and that was followed with a 60% increase in Q2 2016 in the high 70s. Q1 2017 also saw another roughly one-third increase at prices between $79.50 and $90. Since then, the activity has been minor. The stock is now at ~$237. There was a ~6% trimming during Q4 2022.

Note: Visa stock split 4-for-1 in March 2015. The prices quoted above are adjusted for that split.

Roper Technologies (ROP): ROP is a 6.63% of the portfolio position first purchased in Q2 & Q3 2014 at prices between $129 and $150. The stake saw incremental buying in the following quarters. In Q2 2016, there was a ~20% increase at prices between $165 and $185. The first three quarters of 2020 saw a ~22% stake increase at prices between $254 and $453. The stock is now at ~$487. H1 2021 saw a ~12% trimming.

CoStar Group (CSGP): The 5.27% CSGP stake was purchased in Q4 2019 at prices between ~$54 and ~$62 and increased by ~75% next quarter at prices between ~$52 and ~$74. Q2 2020 saw another ~120% stake increase at prices between ~$53 and ~$73. There was a ~25% reduction in Q2 2022 at prices between ~$54 and ~$68. The stock currently trades at ~$78.

Note: The prices quoted above are adjusted for the 10-for-1 stock split last June.

Brookfield Asset Management (BAM): BAM is a small ~1% of the portfolio position established as a result of the spinoff from Brookfield Corp. The stock currently trades at $33.88.

Goosehead Insurance (GSHD): GSHD is a minutely small position established in Q4 2018 and increased over the next two quarters. There has been periodic buying since. Goosehead had an IPO in April 2018 priced at $10. Q3 2022 saw a ~30% selling at prices between ~$36 and ~$71. It currently trades at $61.26. The position is very small at 0.13% of the portfolio.

Dollar Tree (DLTR): DLTR position was first purchased in 2010 at a cost-basis in the low-20s. Recent activity follows. There was a ~15% stake increase in Q2 2017 at prices between $66.50 and $83. Q1 2020 saw a ~10% selling and that was followed with marginal trimming in the next three quarters. Q1 2021 saw a ~20% reduction at prices between ~$98 and ~$116. That was followed with a ~25% selling in Q4 2021 at prices between ~$96 and ~$147. The position was almost sold out next quarter at prices between ~$126 and ~$160. The stock currently trades at ~$142.

Berkshire Hathaway (BRK.B) and Verisk Analytics (VRSK): These two minutely small stakes were kept steady this quarter.

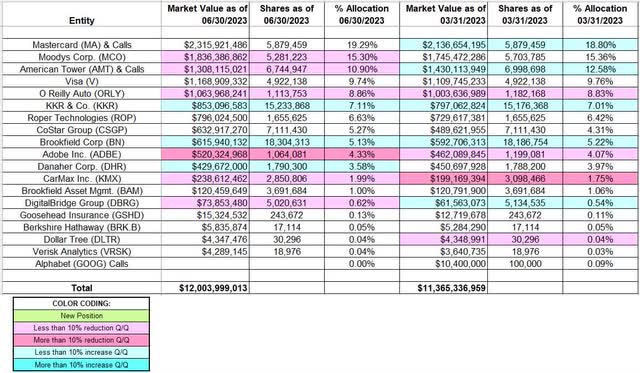

Below is a spreadsheet that highlights the changes to Akre Capital Management's 13F stock portfolio as of Q2 2023:

Chuck Akre - Akre Capital Management's Q2 2023 13F Report Q/Q Comparison (John Vincent (author))

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

For example they have what they call Workbench positions, are those reported on they 13F or they only include them on the fund after they become Core positions?