AngloGold Ashanti: Cheap For A Reason, Or Worth A Buy?

Summary

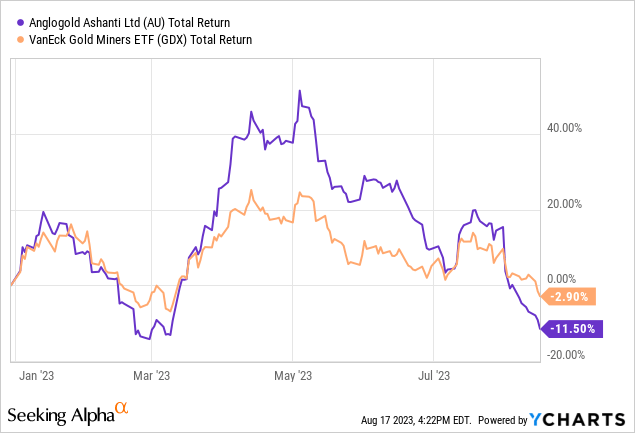

- AngloGold Ashanti Limited stock has declined by 11.50% year-to-date, lagging behind other gold mining competitors.

- The company's profits have declined due to a rise in cash costs and additional expenses related to new legislation and a corporate transition.

- Despite potential positive developments in Nevada projects, the company's valuation and high costs make it less compelling as a buy.

- The Gold Bull Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

jasonbennee

AngloGold Ashanti: Cheap for a Reason, or Worth a Buy?

AngloGold Ashanti Limited (NYSE:AU), a senior gold mining company operating in Africa, the Americas, and Australia, has seen its stock decline by 11.50% year-to-date (total return), lagging behind other gold mining competitors (GDX).

This performance comes in the wake of disappointing financial results for H1 2023, signaling possible further struggles for what was once a standout company.

AngloGold Ashanti: What Happened?

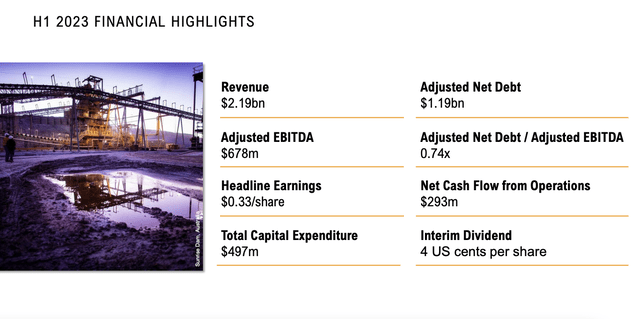

For the year's first half, gold production remained stagnant at 1.236 million ounces, nearly matching the previous figure of 1.233 million ounces.

While higher grades helped balance out lower ore tonnages processed in Brazil, Tanzania, and Guinea during the first quarter, the numbers are hardly inspiring. Although, on a positive note, AngloGold expects to reach its 2023 production target, which ranges between 2.45 million ounces and 2.61 million ounces.

AngloGold reported that its headline earnings per share - South Africa's primary profit metric - were $0.33 for the six months ending June 30, a drop from $0.71 during the same timeframe last year - a more than 50% decline.

Cash costs on the rise

This decline in profits can be attributed mainly to a sharp rise in cash costs.

All-in-sustaining costs (AISC) increased by 12% year-on-year to $1,587 per ounce in the first half of 2023, up from $1,418 per ounce the previous year.

AngloGold blamed this rise in AISC on higher total cash costs and a planned increase in sustaining capital expenditure. However, that doesn’t tell the whole story: AngloGold says it also faced $38 million in net environmental provisions following new Brazilian legislation regarding the management of mineral waste storage facilities.

Furthermore, the company's planned transition from its primary listing in Johannesburg to New York, coupled with a new corporate base in London, added $14 million in legal and project fees.

Reasons For Optimism: Nevada Projects

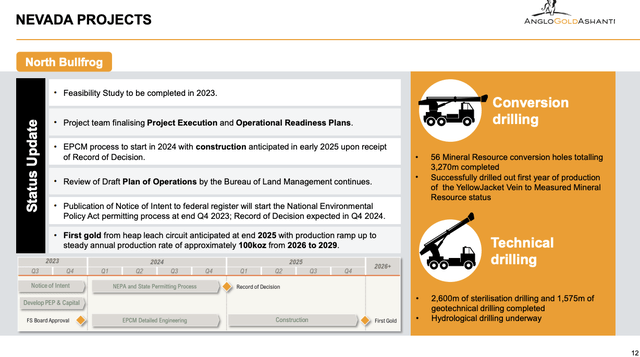

While challenges persist, there may be positive developments on the horizon, such as the expected production of gold at the end of 2025 in Nevada's Beatty District.

AngloGold Ashanti wholly owns several exploration-stage projects in Nevada. These include North Bullfrog and Mother Lode, acquired through the purchase of Corvus Gold in January 2022, and Sterling, obtained by acquiring Coeur Sterling in November 2022. These projects, along with the Silicon project and other exploration targets, present the potential for creating a world-class operational hub within Nevada's Beatty district, according to the company.

North Bullfrog is the most advanced within the Beatty district. An initial resource at Silicon was reported in 2021, while North Bullfrog, Mother Lode, and Sterling declared their initial resource last year. Combined, they carry a resource measuring 8 million ounces of gold.

Currently, the North Bullfrog project is undergoing a feasibility study, with the Silicon project at the pre-feasibility stage, but advancing rapidly.

This holds the potential for over 300,000 ounces of annual gold production for multiple decades at Tier 1 costs (likely under $1,200/oz AISC).

Why AngloGold is NOT a Buy Here

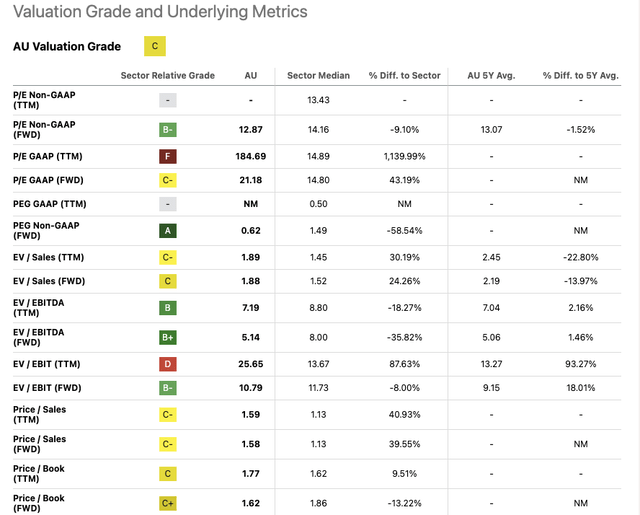

However, AngloGold Ashanti Limited's valuation here just doesn’t look all that compelling given the magnitude of risks facing the company.

Despite appearing inexpensive with a P/E of 12.87 and an EV/EBITDA of 7.19 (both below industry averages), I believe there's a reason for the stock's low price. With AISC nearing $1,600 per ounce, AngloGold is now considered a higher-cost gold miner, surpassing rivals like Barrick Gold (GOLD), Agnico Eagle Mines (AEM), and Newmont (NEM), which recently reported AISC of $1,212/oz, $1,150/oz, and $1,472/oz, respectively. And there's no signs those costs will fall meaningfully in the near future.

Moreover, when examining forward earnings, the stock doesn't appear as affordable, presenting a forward P/E of 21.18 (compared to the sector median of 14.8).

Finally, investors should consider that while AngloGold has made strides to diversify its future production by investing heavily in Nevada projects, it still carries considerable jurisdiction risk. Only a small percentage of its production comes from jurisdictions I would consider “tier-1,” such as the U.S. and Australia. More than half of its current output comes from mines in Africa - Ghana, Tanzania, DRC.

(Note: In the latest Fraser Institute Mining Survey, Tanzania and DRC ranked in the bottom 10 of all jurisdictions for “policy perception index”, while Ghana rated slightly more favorably.)

AngloGold: More Risk Than Reward Ahead

One key risk: A short-term decline in gold prices (GLD) due to a "hard-landing recession" and subsequent gold market selloff could further exacerbate its profitability struggles and lead to a steeper decline in the stock. AngloGold would likely perform worse in such a scenario than lower-cost gold miners.

There simply isn’t much room for error here. Currently, I see far more favorable risk vs. reward set-ups in the gold mining sector, and I would rate AngloGold as a HOLD. Agnico Eagle Mines (AEM), in particular, looks far superior here. I’d be much more interested in upgrading my rating to a BUY should the stock fall to the $10-$12 level.

Looking for buying opportunities? Join the exclusive community of smart investors who trust The Gold Bull Portfolio for expert analysis on all commodity stocks! When you subscribe today, you'll gain immediate access to my top picks, personal portfolio insights, and in-depth analysis of over 140 stocks. And, as a special welcome offer, new subscribers can try out our service risk-free with a free 2-week trial and receive a 10% discount on annual subscriptions. Don't miss this opportunity to take control of your investment strategy and grow your wealth – subscribe now!

This article was written by

With over a decade of experience in the investment industry, I am a highly skilled private investor with a proven track record of success in the commodities and hard assets sector. My areas of expertise include investing in gold and silver miners, royalty and streaming companies, pure exploration companies, as well as oil and gas producers and MLPs. My comprehensive understanding of these markets and my ability to identify and capitalize on profitable opportunities have enabled me to consistently deliver strong returns for my subscribers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.