3 Closed-End Fund Buys In The Month Of July 2023

Summary

- This month I added to three of my already existing positions to grow my income.

- I'm continuing to avoid adding too much in terms of leveraged funds to deleverage my overall portfolio, and letting some cash build-up has a similar effect.

- The market overall is continuing to remain resilient despite another 25-basis point Fed hike and broader participation to the upside continued for a second month.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

marchmeena29/iStock via Getty Images

Every month I continue to add to my portfolio of closed-end funds, no matter the market environment. This is in an effort to snowball income growth over the long term through compounding every month by reinvesting and putting new capital to work.

That being said, with higher interest rates leading to attractive money market yields, I'm not as anxious to always put capital to work as fast as I was previously. Letting cash sit and accumulate can earn something these days as opposed to the previous zero-rate environment. Having cash accumulate can allow some patience for more opportune entry levels on pullbacks or dips.

Western Asset Investment Grade Income Fund (PAI)

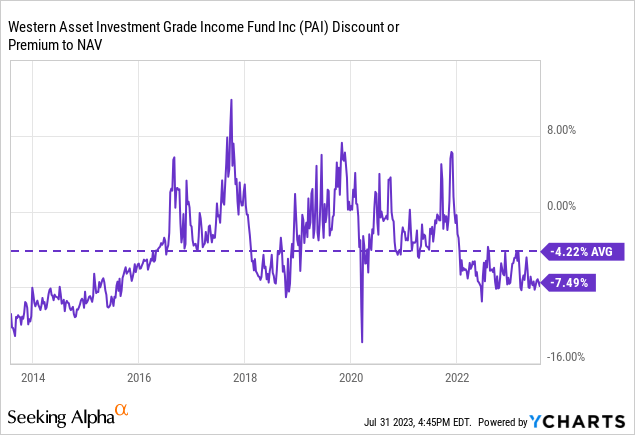

To start off the month, I added to my PAI position, which is a continuation of building up this position over this year. I initially started a position in April 2023, along with the inclusion of Nuveen AMT-Free Municipal Value Fund (NUW). This was followed up with another batch in May. PAI (as well as NUW) continues to trade at a decent discount, and that can make it a worthwhile investment.

Ycharts

Additionally, the higher-quality portfolio can provide some safety if we run into a recession. This could help balance out my mostly below-investment-grade portfolio skew elsewhere in the fixed-income space.

However, it's part of this safety that is one of the reasons why the fund was crushed when interest rates were driving up yields last year. The higher quality portfolio translates into generally longer maturities, which is the case for PAI, which then translates into generally longer duration.

At 7.32 years effective duration, for every 1% change in interest rates, the fund's underlying portfolio should move about 7.32%. That can work in an investor's favor; should interest rates get cut, that should translate into higher bond prices as yields come down. If we get some discount tightening as the fund has traded more historically at higher valuations, that could be an added boost. So it isn't necessarily investing just for the 4.76% distribution rate, but what could come in the next few years.

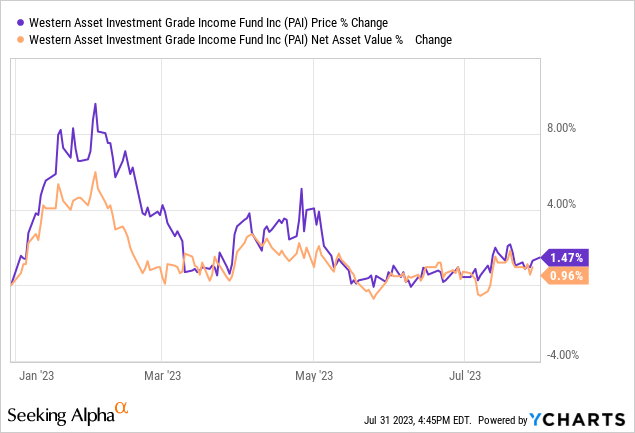

We've already seen the fund mostly stabilize this year as interest rate hikes have slowed, meaning less of a headwind regarding the fund's underlying value as yields stabilize. Note that the below chart only shows price and NAV results YTD; this does not include distributions.

Ycharts

Finally, the fund isn't leveraged and that can help keep volatility down, relatively speaking, compared to a similar portfolio. A theme in most of my investing in the last several months has been avoiding adding too much more leverage to my portfolio.

Miller/Howard High Income Equity (HIE)

Speaking of avoiding adding leverage, some investors familiar with HIE will know that this is a leveraged fund. However, they've dramatically taken down their leverage this year. Normally deleverage is often considered a bad thing. This is because it tends to happen when it is forced at a market low, and there is permanent damage to the fund. In this case, the fund has not been forced, as it wasn't overly leveraged heading into this year either. They had a leverage ratio of around 20%, and their last update puts it at around 6.8% now.

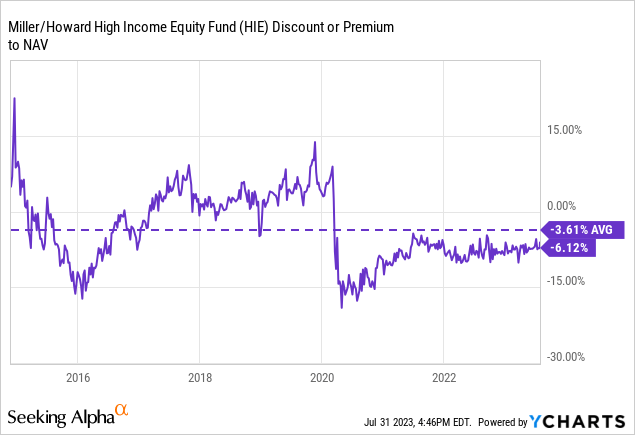

One of the main selling points for this CEF, as is generally the case with most CEFs, is the fund's discount. It's a volatile fund that is invested heavily in energy, so some discount seems appropriate as investors are still a bit cautious about leveraged energy funds since 2020. As we can see, this fund itself went from a premium to a discount dramatically.

Ycharts

This coincided with the fund also cutting its distribution, which was overly elevated. Today, the distribution rate is completely reasonable at a NAV rate of around 5.5%. In fact, I'd say that's quite low and one of the other reasons the fund continues to trade at a discount.

That being said, this fund is anticipated to terminate in November 2024, giving whatever the then NAV per share is of the fund back to investors. That would guarantee investors get their NAV back and therefore realize the discount. An extension by the Board for one year is always possible, and shareholders may be presented with the opportunity to change it to a perpetual fund with a vote. So it's not a guarantee that liquidation will occur; there are several examples of funds liquidating as expected but some funds that haven't.

BlackRock Health Sciences Trust II (BMEZ)

Finally, toward the end of the month, I added to my BMEZ position. This fund utilizes covered calls on a portfolio of riskier healthcare company positions. No leverage is utilized with this fund, much like the rest of the BlackRock (BLK) equity-focused CEFs.

This is a riskier healthcare fund because they focus on relatively smaller companies with a fairly meaningful portion of their portfolio in private investments. The portfolio is skewed towards more biotech holdings rather than traditional large-cap healthcare names that most investors and consumers are familiar with.

I've covered the differences previously for BMEZ compared to its older sister, BlackRock Health Sciences Trust (BME). However, for some context in terms of what they target, BME's average holding has a market cap of $160.146 billion. That can be compared to BMEZ's average market cap of underlying holdings coming in at $32 billion. Those are still significantly sized companies, but there is clearly a difference between the funds. BME had less than 1% of its portfolio listed as level 3 securities, whereas BMEZ was close to 8.5%. Their target is to run with around 25% of their investments being private.

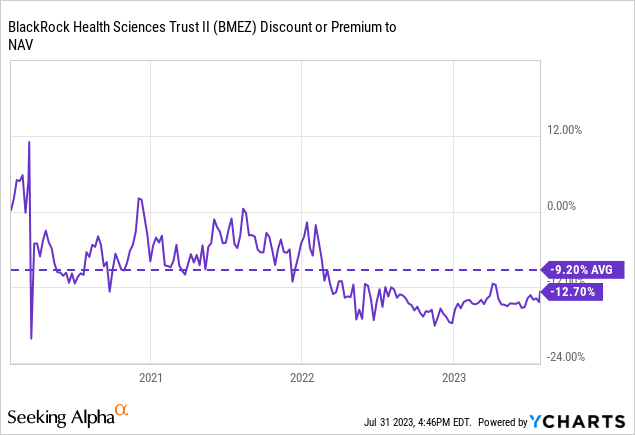

Some of the private exposure for BMEZ could be the reason for some of the fund's deep discounts. Valuations on these investments are a best guess and often won't get revalued unless they do a new round of funding to see what investors are willing to pay.

Ycharts

BMEZ was certainly a portfolio positioned to take advantage of the huge runup in 2020/2021, but it has been struggling since. By buying at a decent discount and at this current price level, I'm averaging my cost basis down.

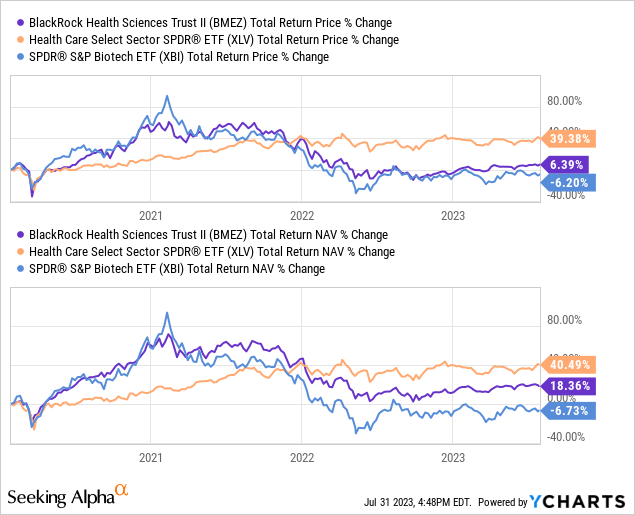

To provide some context of what has been the biggest detractor for BMEZ, we can take a look at a comparison between the Health Care Select Sector SPDR ETF (XLV) and the SPDR S&P Biotech ETF (XBI).

Ycharts

In terms of the total return price performance, the fund correlates closer to XBI, even as the fund's total NAV return basis comes somewhere in the middle of these two. This is expected because the fund is still weighted in other areas of the healthcare space as well. It's not a pure-biotech fund, just heavily skewed towards a biotech weighting with more than 50% of the fund's assets. This divergence for BMEZ has been what has resulted in the fund's discount opening up.

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BME, BMEZ, HIE, PAI, NUW, BLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.