It's The Best Time In 14+ Years To Buy These Buffett-Style Dividend Aristocrats

Summary

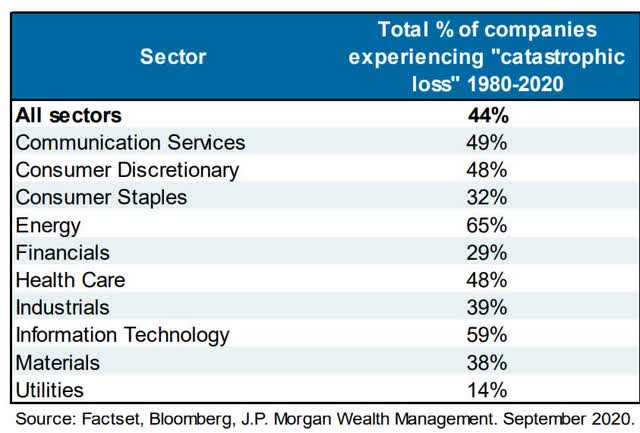

- 44% of all U.S. stocks suffer permanent 70+% crashes. Avoiding value traps is critical to long-term investing success.

- Here are two dividend aristocrats that have been slammed for different reasons, but both are 52% to 56% undervalued, Buffett-style "fat pitch" aristocrat opportunities.

- One is crashing due to lower commodity prices, but even using the trough 2025 earnings, it's trading at 7X cash-adjusted earnings, the lowest P/E in 14 years, and could double by 2025.

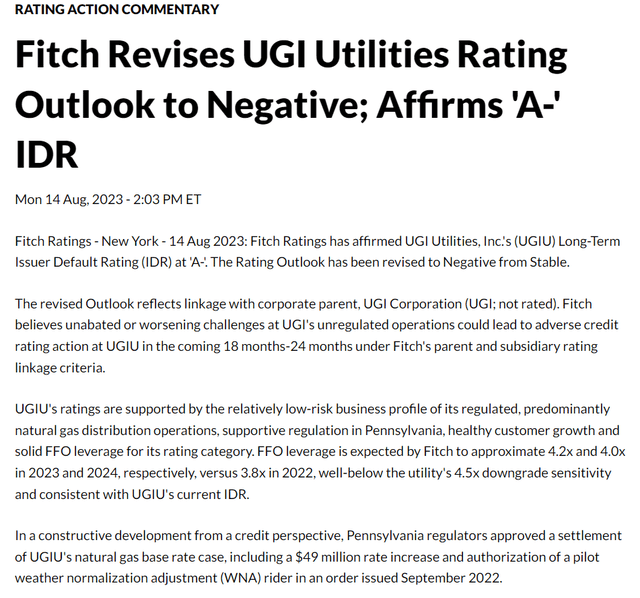

- The other is getting hurt by struggles at one of its subsidiaries, which Fitch estimates has a 25% chance of bankruptcy. But this utility dividend aristocrat's speculative deep value thesis remains intact.

- This aristocrat has a 35-year dividend growth streak and hasn't cut its dividend in 138 years. I'm 70% confident that you'll be very happy in 5+ years if you buy more today. UGI has almost 50% annual return potential through 2025, thanks to the lowest P/E in at least 20 years.

shapecharge

The most important thing to remember if you want to retire rich and stay rich in retirement is facts matter.

You're right because your facts are right and your reasoning is right - that's the only thing that makes you right. And if your facts and reasoning are right, you don't have to worry about anybody else. It is not necessary to do extraordinary things to get extraordinary results." - George Ilian, Warren Buffett: The Life and Business Lessons of Warren Buffett (emphasis original).

And guess what? The only constant in life is change. The best available facts today will invariably change tomorrow. This is why the John Templeton and Howard Marks 80% certainty limit exists.

Templeton concedes that when people say things are different, 20 percent of the time they are right." - Howard Marks (emphasis original).

If every fact about a stock says this is the opportunity of a lifetime, if every fact agrees that a stock is a Buffett-style "fat pitch," then there is a 20% chance that something will still go wrong.

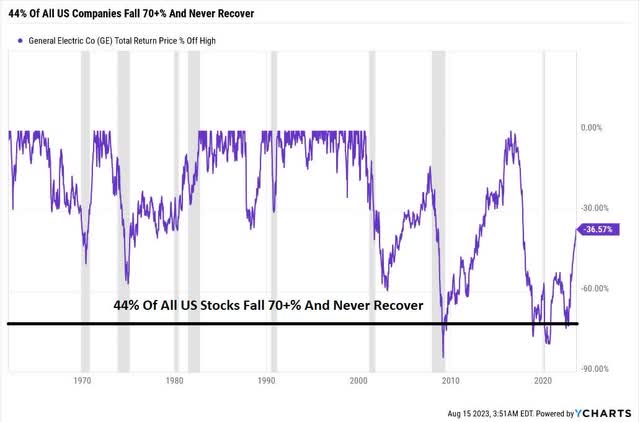

After all, General Electric (GE) was once an AAA-rated dividend aristocrat with a CEO that was Fortune's "CEO of the Century." But the facts changed, and the ultimate widows and orphans aristocrats suffered a 70+% catastrophic decline.

GE has suffered numerous catastrophic declines, but it is one of the 44% of U.S. stocks that have suffered what JPMorgan calls a "permanent catastrophic decline."

Likely, GE will eventually recover to new highs; it will probably take 25 to 30 years for those buying at the tech bubble high, when GE was the most valuable company on earth, to make their money back.

- inflation since 2000 has been 81%

- so even if GE investors break even, they are down about 40%.

If a company doesn't go bankrupt, you'll eventually recover your losses, including inflation. It just might take you 40 to 60 to accomplish.

The smart move if you are faced with owning the next GE, AT&T, CenturyLink (now Lumen), or any other failed thesis blue-chip is to sell and make back your money with a better company.

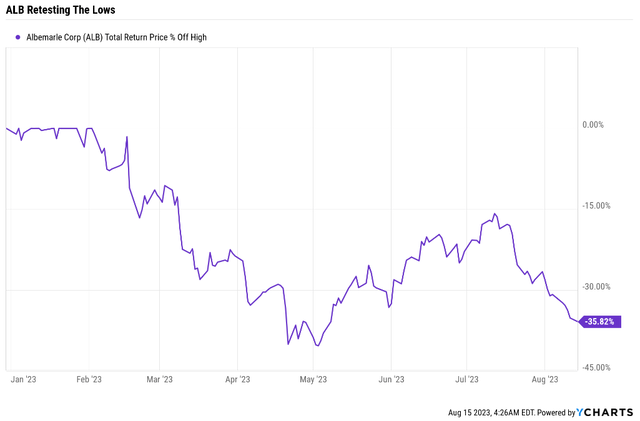

But today I will update Albemarle (ALB) and UGI Corp (UGI), two dividend aristocrats that have been hammered especially hard in the last few months.

Dividend Kings members want to know, "Is the thesis broken? Is this the next VFC or AT&T or GE?"

No, it's the best time in X years to buy these two Buffett-style "fat pitch" deep-value aristocrats.

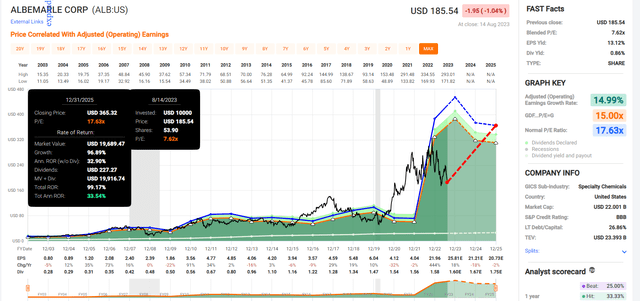

Albemarle: The Global King Of Lithium Is A Buffett-Style Wonderful Company At A Wonderful Price

ALB is retesting its lows for this year. That's the lows so far set in a 34% bear market.

ALB Bear Markets Since 1994

If you aren't comfortable owning a cyclical dividend aristocrat that can fall as much as 60%, you shouldn't own ALB.

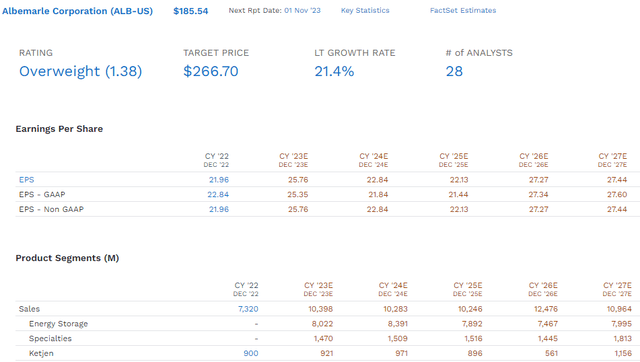

Let's consider a quick snapshot to see if there are any signs that ALB is a value trap.

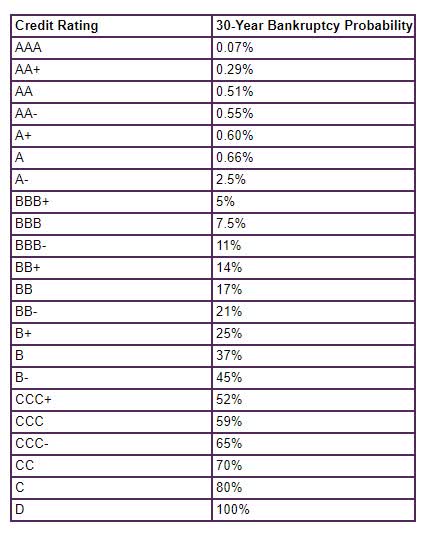

Is ALB drowning in debt? Nope. It has a stable BBB credit rating from S&P, indicating a 7.5% 30-year bankruptcy risk.

- ALB's 29-year bonds yield 6.43% which wouldn't be happening if it were collapsing.

Is it shrinking? Over the last three years, it's been one of the fastest-growing companies on earth.

Is it not profitable? Nope, its net margins and returns on capital in the last year have been outstanding, in the top 5% of all companies on Earth.

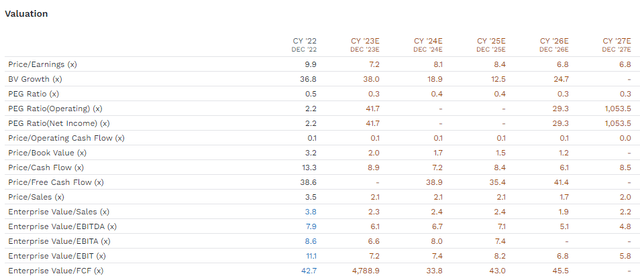

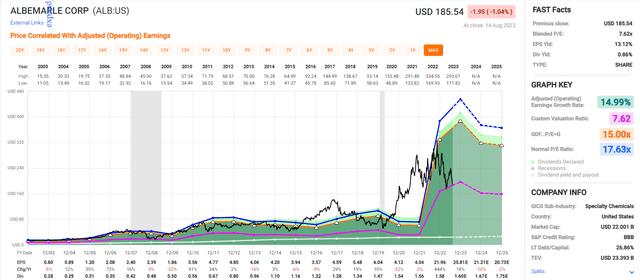

Is it undervalued? It's trading at under 6X trailing earnings, and even if we use the trough earnings from declines in lithium prices, it's trading at 8.4X earnings, an anti-bubble valuation, according to Ben Graham.

Using EV/EBITDA, or cash-adjusted earnings, the favorite metric of private equity, ALB's trough cash-adjusted P/E, based on its worst earnings in this commodity cycle, is 7.1X.

That is the average Shark Tank multiple. Buy ALB today, and you're getting the same sweetheart deal as Billionaire Mark Cuban.

OK, but maybe ALB's growth is now in decline; maybe it's sliding into oblivion?

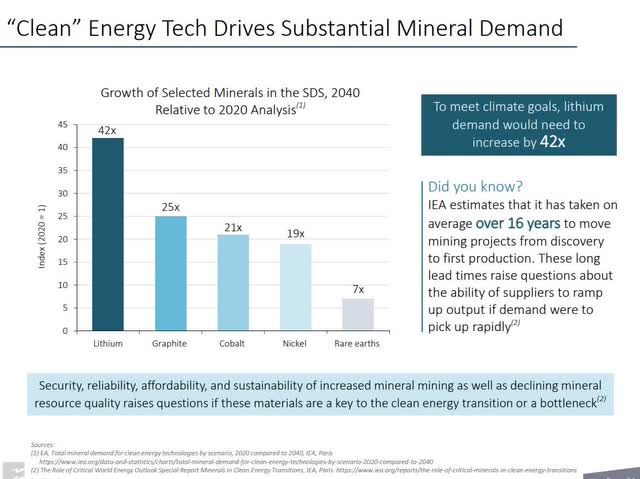

Lithium prices falling from $56,000 on average in 2023 to $27,000 in 2025 are expected to result in a modest decline in earnings through 2025 but then back to record-high earnings by 2026.

OK, but what about the dividend? Is the 28-year dividend growth streak at risk?

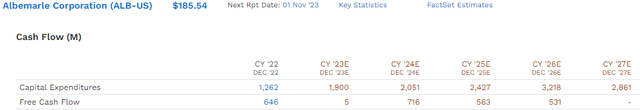

ALB is planning to nearly triple its growth spending to ramp up lithium production because the demand for lithium for EVs is insatiable.

We need 42X more annual lithium production to be carbon neutral by 2040.

- not possible, but you get the point.

$188 million per year is what the current dividend costs, and other than a lean 2023, ALB's free cash flow is expected to cover that dividend by about 3X in the coming years.

- 2024 and 2025 34% free cash flow payout ratio consensus.

So no, the dividend isn't unsafe, the balance sheet isn't imploding, and another thing.

Lowest P/E Since The Great Recession

ALB is now cheaper than at any time other than the Great Recession.

- current price: $185.54

- fair value (trough 2025 earnings): $390.15

- discount: 52%

- quality: 93% quality very low risk 13/13 Ultra SWAN dividend aristocrat

- DK rating: potential Buffett-style Ultra Value "fat pitch" buy

- Yield: 0.8%

- Growth consensus: 21.4%

- LT return potential: 22.2%.

ALB 2025 Consensus Analyst Total Return POTENTIAL

This is NOT a forecast. Or a price target. This means that IF ALB grows as analysts expect, and returns to objective historical market-determined 20-year fair value, then by the end of 2025, including dividends, you will double your money and earn 33% annual returns.

- that's what POTENTIAL means

- if a company grows as expected

- and it returns to fair value by a certain time

- THEN you make a certain return.

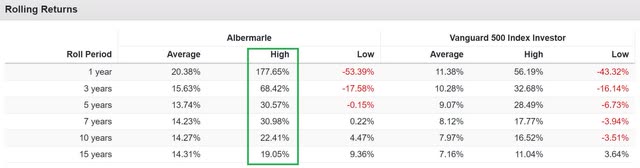

ALB's Best Returns Since 1994 (From Bear Market Lows)

If you buy ALB at Great Recession level valuations...like today, when it's objectively not broken, then Buffett-like returns for 15+ years are possible.

| Time Frame (Years) | Annual Returns | Total Returns |

| 1 | 178% | 178% |

| 3 | 68% | 378% |

| 5 | 31% | 280% |

| 7 | 31% | 561% |

| 10 | 22% | 655% |

| 15 | 19% | 1268% |

(Source: Portfolio Visualizer Premium.)

In the past, investors paying the same valuation for ALB as you can buy today have made as much as 1,268% total returns in the next 15 years.

And given the growth prospects for Lithium and the 21% annual growth consensus, long-term 22% returns are possible, and much more given the 52% historical discount to fair value.

- a 52% discount off 2025 trough earnings

- not 2023's elevated earnings.

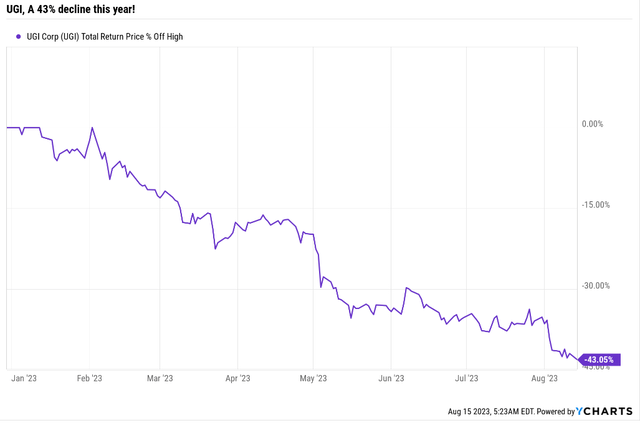

UGI: Rising Rate Concerns Haven't Broken The Investment Thesis

A 43% decline in about eight months, a seeming steady slide into the abyss.

This is either a value trap or a table-pounding Buffett-style aristocrat buy.

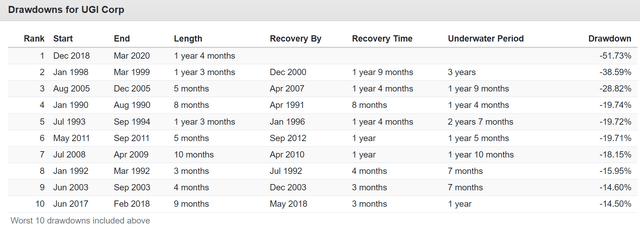

UGI Peak Declines Since 1988

UGI is in a 52% bear market, the worst in at least 35 years.

It's either a value trap or a table-pounding deep value opportunity.

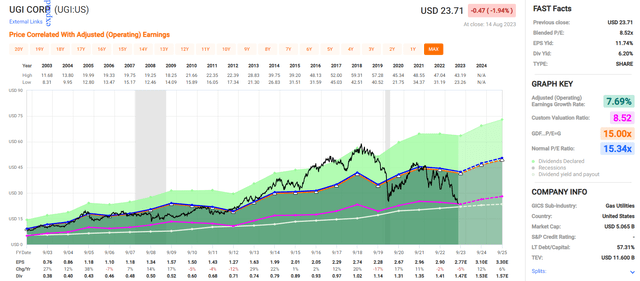

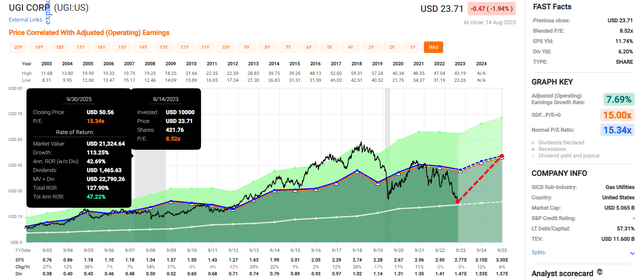

The Lowest PE In Over 20 Years

What kind of collapse in fundamentals might justify a 43% decline in less than a year?

- a 6% peak decline in EPS is expected.

What kind of dividend cut is expected to justify a 43% decline pushing the yield to 6.3%?

- 11% consensus dividend growth from 2022 to 2025

The peak payout ratio? 53% compared to 70% for utilities.

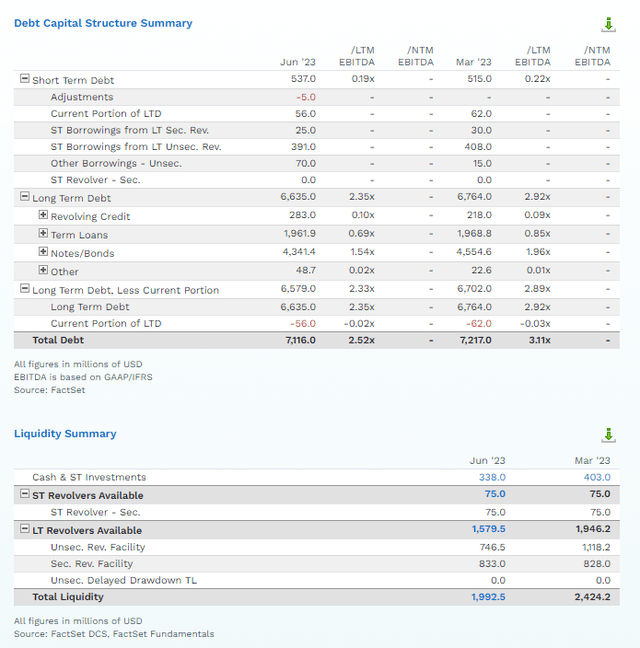

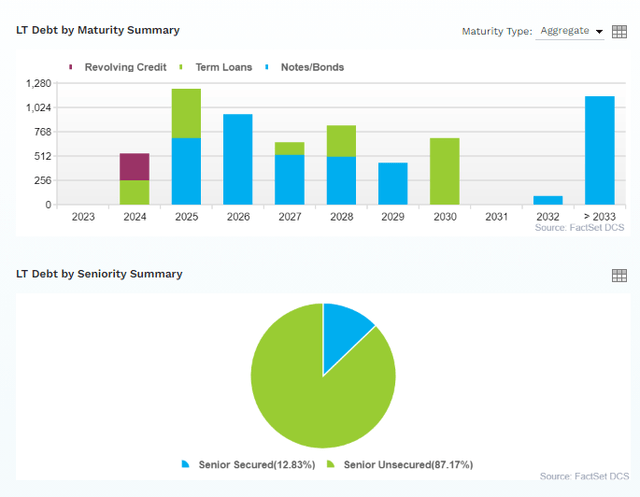

Drowning in debt? 57% debt/capital, while 60% is safe, according to rating agencies.

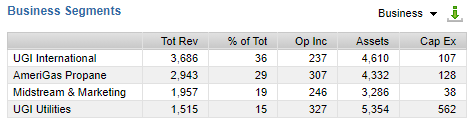

Fitch has a weighted rating of BB+ stable because while UGI Utilities is A-rated, the rest of the subsidiaries are junk bond rated (weighted by revenue, it's BB+ rated).

- UGI is thus "speculative" by definition

- NOT an Ultra SWAN, just a 13/13 quality blue-chip.

Fitch assigns a 33% chance of downgrading UGI to BBB+ in the next two years.

- UGI International is BB+ stable rated (as of May 2023)

- UGI Energy Services is BB stable rated (as of February 2023)

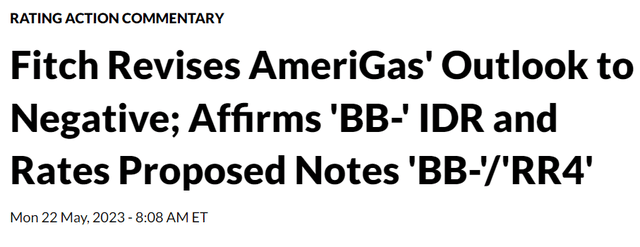

- Amerigas is rated BB- negative outlook (as of May 2023).

The Negative Outlook reflects the breach of AmeriGas' leverage and interest coverage ratios, which were cured at the close of 2Q FY23 after weaker operating performance over the FY23 winter heating season. Higher operating and administrative expenses, including costs related to a shortage of delivery drivers and adverse weather conditions, contributed to lower EBITDA generation. Additionally, AmeriGas has debt maturing yearly through FY27 in an elevated interest rate environment.

Fitch may resolve the Negative Outlook if AmeriGas can resolve its customer service issues and grow retail propane sales to provide headroom against financial covenants." - Fitch

Amerigas is working with creditors to give it breathing room under financially stressful conditions after a poor winter heating season.

UGI Support Provides Uplift: Fitch assesses AmeriGas' SCP at 'b+' based on standalone credit metrics and business risk. UGI's SCP is stronger given the diversity of cash flow from its various subsidiaries and low levels of parent-only debt. The linkage between the companies follows a strong parent/weak subsidiary approach. The legal incentive is weak, given the lack of guarantees. Strategic incentives are also weak as AmeriGas pays dividends up to UGI Corp., but the amount is varied and flexible. Operational incentives are assessed as a medium, given the expertise of sourcing liquefied petroleum gas (LPG) across AmeriGas and sister company UGI International (UGII; BB+/Stable). This results in AmeriGas' ratings receiving a one-notch uplift." - Fitch.

If creditors call in their loans immediately, Amerigas would be forced to file for bankruptcy.

- Fitch estimates this risk at 25% at the moment

S&P

Amerigas is the issue for UGI's stock and why it's a speculative company. Propane is not a growing industry; eventually, it will be replaced by superior natural gas and electricity.

Fitch estimates Amerigas's chances of defaulting in the next 30 years at 21% and possibly as high as 25%.

For now, it's still an important part of the rural community's energy mix and, at 29% of UGIs' business, is the key reason for the stock sliding today.

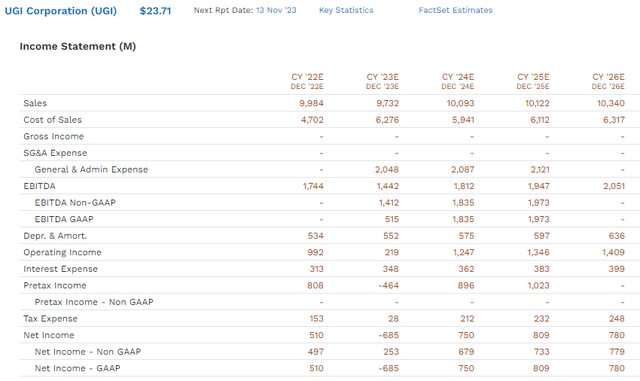

FactSet Research

UGI is supporting Amerigas, having acquired its propane MLP in 2019.

Is this one of the 20% of times, according to Templeton, when "this time is different"?

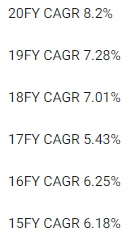

UGI Historical Growth Rate: 5% to 8%

FAST Graphs, FactSet

So what do the four analysts covering UGI for a living think?

Does this look like a dying company?

Yes, 2023 is a bad year for UGI, which is expected to lose money under GAAP accounting.

But then it is expected to return to slow and steady growth, driven mostly by its utility business, where 67% of its growth spending is focused.

4% annual dividend growth is expected through 2027, with a payout ratio of 53% today and dropping to 49% by 2027.

UGI's leverage ratio is fine as a company, though Amerigas is the issue for the stock and Fitch.

Liquidity isn't a problem, though Amerigas 4 year bonds trade at 9.3%, a tad high indicating the fundamental stress that business is under.

UGI isn't likely to face significant pressure unless inflation remains high for several years and then its various junk bond rated subsidiaries will have to refinance at significantly higher interest rates.

Long-Term Risk Management

DK uses S&P Global's global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

UGI Scores 54th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management.

| Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 | Very Good | Very Low Risk |

| Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| UGI | 54 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

Valuation:

- Quality Rating:

- Current Price: 56%

- Fair Value: $53.58

- Discount: $23.71

- DK Rating: potential speculative Ultra Value Buffett-style "fat pitch"

- yield: 6.4%

- Growth consensus: 9%

- LT total return potential: 15.4% (ignoring valuation).

2025 UGI Consensus Total Return POTENTIAL

The lowest P/E in at least 20 years means that if UGI grows as expected and returns to its historical market-determined 15.3 P/E it will deliver Buffett in his prime 47% annual returns through 2025.

That's not my opinion, it's the analyst consensus math.

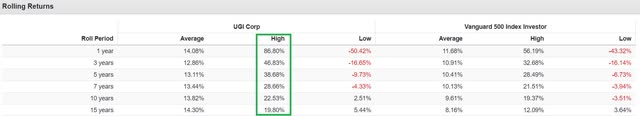

UGI's Best Returns Since 1988 (From Bear Market Lows)

| Time Frame (Years) | Annual Returns | Total Returns |

| 1 | 87% | 87% |

| 3 | 47% | 217% |

| 5 | 39% | 413% |

| 7 | 29% | 484% |

| 10 | 23% | 663% |

| 15 | 20% | 1403% |

(Source: Portfolio Visualizer Premium.)

The last time UGI was this undervalued it went up 15X in the next 15 years.

That's not my opinion, that's a historical fact.

And the growth rate is expected to be similar in the future, just the business will shift towards a more regulated utility focus.

Bottom Line: These Buffett-Style Aristocrats Are Table Pounding Buys For Anyone Comfortable With Their Risk Profiles

When the facts change I change my mind, what do you do sir?" - John Maynard Keynes.

My only loyalty is to you, which means to the facts as best as anyone can know them.

I don't get my news from Jim Cramer or some crank on YouTube.

I get my data from Morningstar, FactSet, and the Bloomberg Terminal.

Long-Term Isn't 12 Months; It's 10+ Years

| Time Frame (Years) | Total Returns Explained By Fundamentals/Valuations |

| 1 Day | 0.02% |

| 1 month | 0.33% |

| 3 month | 1.0% |

| 6 months | 2.0% |

| 1 | 4% |

| 2 | 12% |

| 3 | 20% |

| 4 | 28% |

| 5 | 36% |

| 6 | 47% |

| 7 | 58% |

| 8 | 68% |

| 9 | 79% |

| 10+ | 90% |

| 20+ | 91% |

| 30+ | 97% |

(Sources: JPMorgan, Bank of America, Princeton, RIA, Fidelity.)

I'm not a market timer and I couldn't care less if a stock price is down 25% or even 50% in the last year. The only thing that matters is the fundamentals.

If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes." ― Warren Buffett, The Essays of Warren Buffett : Lessons for Corporate America.

Is a company's fundamentals going off a cliff? Are they expected to recover? If the fundamentals are intact, then it's not a value trap.

If they have collapsed but are expected to recover, then it is speculative and maybe a value trap.

But in the case of ALB and UGI? No, the fundamentals do not support the current bear markets.

I can say with 80% statistical confidence, which is "I'll die on this hill" confidence, the Marks/Templeton certainty limit, that anyone buying a reasonable amount of ALB today will be happy they did in 5+ years.

UGI is speculative but I'd say I'm 70% absolutely confident that if you buy a 2.5% or less position today you will be very happy in 5+ years.

And if you already own it then buying more via rebalancing is a potentially prudent decision today.

That's how fact-based investing works.

When your facts and reasoning are right, and you use prudent risk management, you never have to worry about achieving your financial goals.

Success becomes a function of time and discipline, not luck.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's $2.5 million charity hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own ALB via VIG.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.