CAVA Group Stock: The Growth Is Real

Summary

- CAVA Group's Q2 earnings release validates its growth story, but the stock remains too expensive to buy.

- CAVA's positive earnings and improved unit margins and sales distance it from competitor Sweetgreen.

- Despite its high valuation, CAVA's growth trajectory and potential profitability make it worth watching.

Spencer Platt/Getty Images News

Back in June, I profiled the CAVA Group (NYSE:CAVA) IPO, specifically their compelling unit economics. The valuation was high enough that I shied away from buying, but the stock proceeded to more than double from the offering price. The recent earnings release continues to validate the growth story, but the stock remains too expensive for me to justify a position.

Addressing The Bears

There have been two main bear arguments on CAVA:

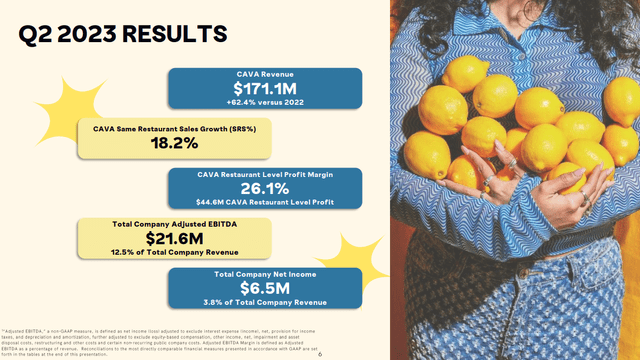

But CAVA's Q2 numbers begin to fight these narratives. Analysts had forecasted CAVA would post a loss, instead they posted positive $0.21 EPS. Yes, even if you annualize that, CAVA still trades over 50 times earnings, it's not "cheap". But despite street analyst estimates, CAVA is now profitable.

The good developments continued, with unit margins up to 26% vs 24% a year ago, 18% Same-Store Sales ("SSS"), and Average Unit Volumes ("AUV") up to $2.6m. I noted they were on track for ~$54m adjusted EBITDA based on their S1 numbers, but the guidance exceeds this:

Cava FY23 Guidance (Cava Q2 Report)

CAVA continues to put distance between themselves and busted-IPO Sweetgreen (SG), who reported 3% SSS and 20% unit margins a couple weeks ago. Unlike Sweetgreen, CAVA is actually generating earnings from their operations.

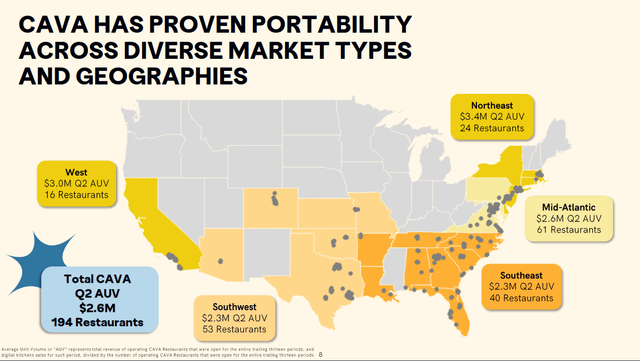

Unit margins and AUVs will be two of the most important things to track for CAVA shareholders going forward. Average profit margins of 26% at their units are one of the things that makes CAVA an elite restaurant concept - few fast-casual chains can achieve these numbers. Even larger peers like Shake Shack (SHAK) only do 18% unit margins, albeit at higher sales volumes. The risk to CAVA will be that as they expand, they will have fewer prime locations to operate, diluting AUVs and margins with new locations. There is little sign of this so far, but a ~270 location chain is a different animal than a 500 or 1,000 location operation. So far, CAVA has done well across a variety of geographies:

Cava Locations (Cava Investor Deck)

One item of note was SG&A contracting to $23.3m in Q2 after $29.0m in Q1, an encouraging sign that costs are not out of control at the corporate level. The comparison is somewhat muddied by CAVA reporting a 16 week Q1 and 12 week Q2, so I encourage anyone reviewing these results to be aware of this oddity. If you look at SG&A/week for the above, it's $1.81m/week in Q1 and $1.94m/week in Q2.

CAVA Stock Valuation

With about 115m shares outstanding, and shares trading hands after-hours at $51, CAVA is being valued at a ~$6B market cap, or nearly 100x adjusted EBITDA. This is certainly very expensive and why I have avoided owning shares so far.

However, consider the growth trajectory CAVA is pursuing. They are sitting on over $350m of cash and want to open 1,000 restaurants by 2032. 500 by the end of 2025 appears attainable. If AUVs can hold $2.5m, and margins hold 23%, CAVA could be generating nearly $300m of restaurant profit exiting 2025. This valuation would keep them in a similar zip code as Chipotle (CMG), with a long growth runway.

Now, I don't really want to pay above a Chipotle multiple for a stock that has a lot left to prove, but I also don't want to short it. This concept is showing they have real demand for their product, they can expand profitably, and they are beating estimates. For now, CAVA will remain on the watchlist, where I can remember not getting in on the $22 IPO.

What's Next?

If you're involved with CAVA, I wouldn't be surprised to see the company try to raise more cash at this valuation. If you're being valued like Chipotle, there's a lot to be said for expanding your war chest at a $6B valuation and extending your runway for growth. As a shareholder, I think I'd prefer to see a capital raise here if they can sell more shares around $50.

CAVA's guidance does suggest they are cautious about a slowdown in the second half of FY23, so shareholders should be on the lookout for any further signs of deceleration. Hot growth stories that cool off can be a painful place to reside. But congratulations to those that bought into the IPO and believed the hype, you've had at least one very bright spot in your 2023 returns!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.