Quipt: Continued Display Of Economic Growth Levers, Reiterate Buy

Summary

- The pullback in Quipt Home Medical Corp. has created a buying opportunity in my view as the stock price sets higher lows and breaks key technical levels.

- The company's Q3 numbers showed strong growth, with revenues up 64% YoY on 58% growth in the customer base.

- Quipt's economic characteristics, including its asset-light model and acquisition strategy, support its growth potential and intrinsic value.

- Net-net, reiterate buy.

Pgiam/iStock via Getty Images

Investment briefing

Following its latest set of numbers the investment case for Quipt Home Medical Corp. (NASDAQ:QIPT) has only ripened further in my opinion. Since my April publication the company has sold off with a c.$3/share correction. The price line is now wedging up, setting higher lows after closing higher on enormous buying volume in late June [Figure 1]. It just broke a key technical level in breaching the 50DMA this week and given the economic factors discussed here today, there is support for this to extend and break through the resistance formed over the past 13 weeks.

QIPT could do $221mm in sales this year and stretch this to $317mm out to FY'25, and potentially compound earnings at >100% per year over this period. This is backed by robust unit economics and regulatory tailwinds in the respiratory market. Net-net I reiterate QIPT a buy at $10.50/share at the upper band of valuation.

Figure 1. QIPT price evolution, weekly bars, 2022-date

Critical facts to reiterated buy thesis

Intelligent investors know that growth is the compass that guides capital appreciation over the long term. In my view, QIPT's Q3 numbers exemplify this principle, along with contributions from the economic drivers to shareholder value.

1. Q3 FY'23 earnings insights

The firm's Q3 numbers continue an upward trajectory that's been in situ for the last 3-years. Revenues were up 64% YoY to $60mm on adj. EBITDA of $14mm, up 80% YoY with 200bps of margin decompression. The $60mm in sales, of which 80% is now recurring revenue, tells me two things:

- The firm's customer base is stable and thus protected from volatility in disease patterns and regulatory pressures;

- The top-line is hedged from large sigma events that could impact the broader economy and healthcare market.

Critically, cash flows closely track revenue growth, indicating the firm's high inventory turnover and propensity to convert receivables to cash. The percentage of OCF backing turnover has jumped from 18% in Q1 FY'21 to 47% last period, after pulling in $27mm off the c.$60mm in sales.

Figure 2.

Organic growth in the firm's legacy units hit 4% (16% annualized) sequentially and thus more than double the firm's targeted sequential pace of 2%-2.5% (10% annualized). The company's geographical expansion-particularly in new states-was pivotal in this growth schedule. Over the last 18 to 24 months, it has added ~13 new states, expanding the sales force headcount to c.70 from 50 just 8 months ago. The average revenue per rep was thus $0.857mm, up from $0.734mm on a comparable basis last year. Hence, more reps, and more productive reps-key drivers of the economic flywheel.

Most critically, were the improvements in unit economics:

- The customer base widened by 58%, with c.141,000 unique patients served compared to about 89,000 this time last year.

- The cadence of setup deliveries continued in Q3 as well. It clocked ~203,000 setups, a 52% rise compared to ~134,000 arrangements. Significantly, respiratory resupply setups/deliveries also grew 73% YoY, reaching 108,391. One of the key drivers for this is the company's move to a centralized intake process. From the looks of it, this has had a benefit to inventory management.

- As of Q3, 81% of the company's product mix was comprised of its respiratory offerings. This is key given regulatory changes from CMS in the last few years that 1) allow chronic respiratory patients to bring oxygen home for use, and 2) allows them to order home oxygen equipment. The product/margin mix is certainly a factor for consideration in my view.

The momentum built over the 9 months in QIPT's fiscal '23 set it on the path to do $221mm in sales this year on my assumptions, calling for 58% growth at the top line. It could do $0.04 in earnings on this, but stretch this to $0.13 in FY'24 and then $0.34 in FY'25 in my opinion. Given the pace at which it is attracting new accounts, booking revenues on these, and then collecting cash receipts, is supportive of this view. This could mean a compounding growth rate of 104% per year at the bottom line into FY'25-tremendously attractive in my view.

Figure 3.

2. Economic levers to business growth

Analysis of the firm's economic characteristics corroborates a bullish view in my opinion. QIPT mines the acquisition pipeline for high-margin tuck-in companies that complement its current business lines. It has integrated 18 acquisitions over the past 5 years. The Great Elm acquisition in Q1 CY'23 was the firm's largest at $73mm, adding another 8 states and 1.5mm COPD patient lives to the company's books.

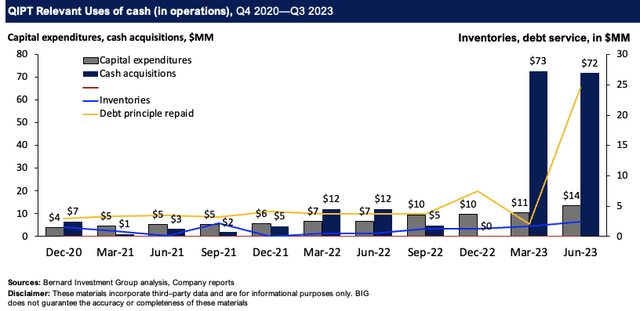

Critically, QIPT's is an asset-light operating model that employs relatively thin sums of capital into its steady-state and growth operations. The bulk of surplus cash is diverted to acquisitions, as mentioned, with only a small percentage rotated back into fixed and intangible assets (new and existing). The firm's uses of cash since 2020, on a quarterly basis, are observed in Figure 4.

Figure 4.

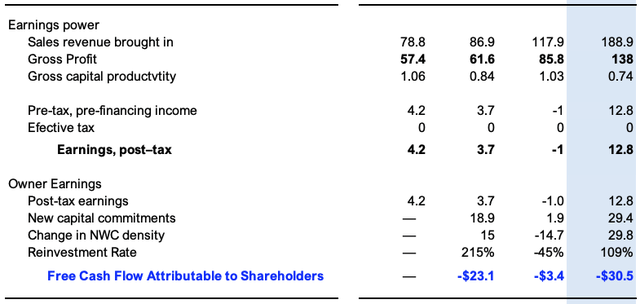

Much is gleaned by reconciling the capital attributed to QIPT's owners (shareholders) to the earnings produced on these assets. Investors have provided the company with $173mm in external financing (debt, equity), to which QIPT has put 107% of this at risk, deployed into the business, at $186mm or $4.44/share in total.

Figure 5.

Sources: BIG Insights, Company filings

Taking a rolling TTM approach, the company earned $0.30/share on the $4.44/share of capital deployed, or ~7% ($12.8mm on $186mm). Taking the OCF produced on this, the return is $1.17/share or 26.5%. More impressively, it returned $0.74 in gross for every $1 at risk, in line with the rolling averages since 2020. Throughout 2021 to date, you can see the firm has recycled more than 100% of its post-tax income back into the business, where it deployed another $29mm last quarter (excluding any acquisition effects).

Figure 6.

Sources: BIG Insights, Company filings

From this, it appears the company's strengths lie in its cost differentiation strategy that sees it turn over invested capital ~1-1.4x each period. This aligns with the findings above, whereby the company focuses on recycling inventory values and deploying cash flows towards acquisitions. Thus, the capital-light model is conducive to the firm earning ~7% on the cash it has employed into the business, compounding its intrinsic value at single digits each period.

Figure 7.

Sources: BIG Insights, Company filings

Valuation

What these points say to QIPT's intrinsic valuation is telling. The stock trades at just 6.6x forward EBITDA and is basically at par on forward sales multiples. The market has priced its net assets with $2.40 in market value for every $1 in book value. Critically, it trades at a discount to the sector on earnings/sales multiples, but at a premium vs. the sector on net asset value. To me this suggests QIPT is creating value for equity holders above its peers, but may be mispriced on the earnings power going forward.

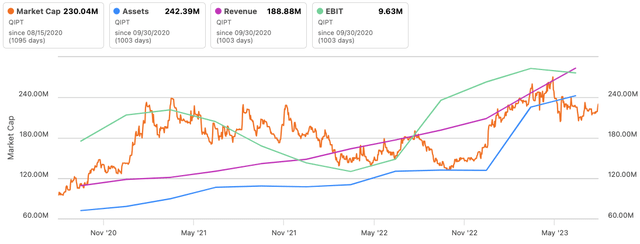

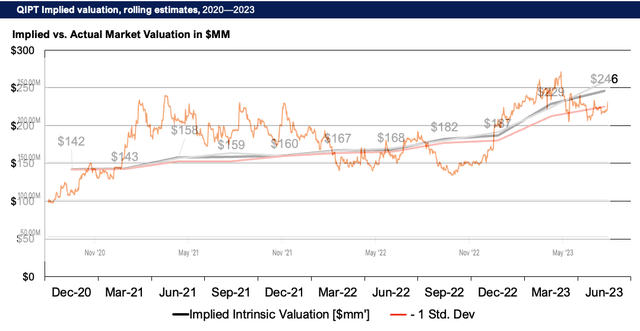

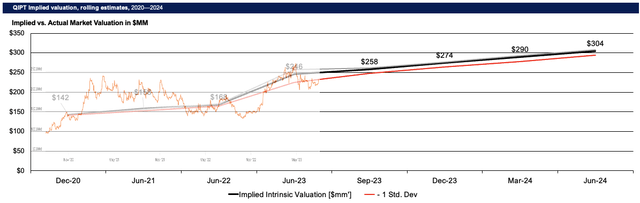

A firm compounds its intrinsic value at the multiple of what it earns on capital invested and the amount it redeploys at these rates of return (i.e.: ROIC x reinvestment). Plugging this calculus into the model for QIPT spits out $246mm in implied market value, around $5.80/share. Hence, the market looks to be an accurate judge of fair value given where QIPT sells today. You can clearly see it is valuing QIPT on asset factors and earnings power in Figure 8.

Figure 8.

Figure 9.

Sources: BIG Estimates, Seeking Alpha

Extending my growth assumptions out to FY'24 I get to $304mm or $7.20 in market value discounted to today. This represents value to me and applying QIPT's historical EV/EBITDA multiple of 10x forward gets me to $10.50/share at my FY'24 assumptions of $44mm on $265mm in sales. These valuations support a buy and suggest QIPT is undervalued with the latest selloff, which looks driven by exogenous market factors in my view.

Figure 10.

Sources: BIG Estimates, Market cap line retrieved from Seeking Alpha

In short

QIPT displays all of the economic characteristics I am searching for in an investment-grade company. One, qualified sales growth built from expanding unit economics, two, asset-light business model, three multiple opportunities to deploy surplus capital (via acquisitions), and compounding intrinsic value as a combination of all 3. Factoring in all these data points gets me to a valuation band of $7-$10.50/share on forward earnings power, 29% to 94% upside potential. This supports a buy rating.

The key risks to the investment thesis are:

- QIPT failing to hit its forward growth numbers, whereby a slow-down in sales and earnings upside could ensue.

- Planned acquisitions being erosive to intrinsic value, costing shareholders in opportunity cost and FCF growth.

- Exogenous market factors that would impact broad equities on the macro-level, including the rates/inflation axis.

- Roll out of institutional ownership of QIPT's equity stock, with ~41.5% of the float currently held by institutions/funds.

Investors should realize these risks in full before proceeding any further or making any investment decisions.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QIPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)