Homebuilders Consolidating

Summary

- As the national average for a 30-year fixed rate mortgage eclipsed 7.5% recently, homebuilder sentiment has turned lower.

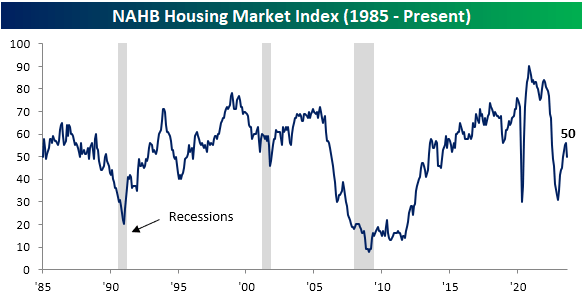

- The Housing Market Index from the NAHB fell to 50 in August from 56 the previous month.

- That six point drop month over month ranks as the eleventh largest decline in the survey’s nearly 40-year history.

Justin Sullivan

As the national average for a 30-year fixed rate mortgage eclipsed 7.5% recently, homebuilder sentiment has turned lower. The Housing Market Index from the NAHB fell to 50 in August from 56 the previous month. That six-point drop month-over-month ranks as the eleventh largest decline in the survey’s nearly 40-year history.

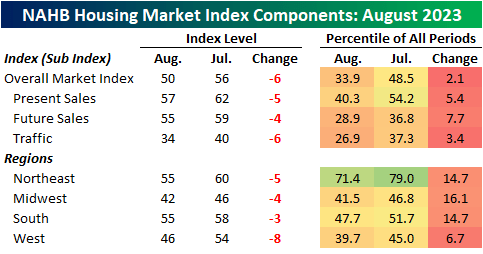

Homebuilders reported significantly weaker sentiment across the board with mid-single-digit declines for present and futures sales as well as traffic. Geographically likewise also saw broad declines.

The West experienced the biggest drop and now has the lowest reading with respect to its historical range. Meanwhile, the Northeast index has managed to hold at a more historically healthy level, albeit it too fell significantly in August.

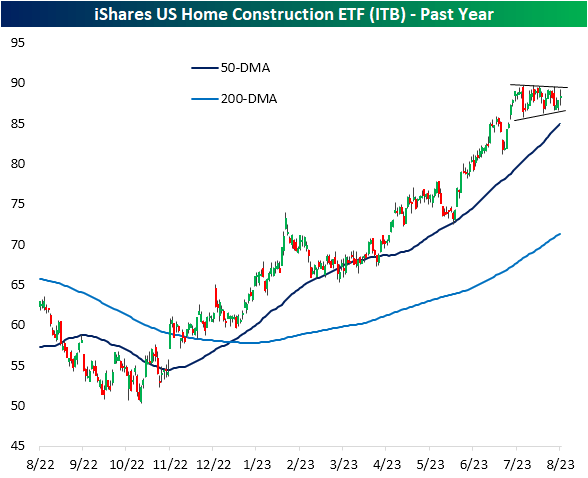

Homebuilder stocks are trading higher today, but they have come well off the early highs since the release of the sentiment numbers. As things stand for the group, the past month has seen the homebuilders consolidating as they continue to trade handily above their respective 50 DMAs.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by