Brookfield Corp Is A 50 Cent Dollar: Follow Along My Seasoned Back-Of-The-Envelope

Summary

- Brookfield Corporation trades at a 50% NAV discount, even after a few careful adjustments.

- The following article offers investors a back-of-the-envelope framework to value BN on an ongoing basis themselves by stripping away some aggressive assumptions of Brookfield's management.

- A combination of modest return assumptions from underlying NAV returns, share buyback accretion and valuation rerating allows for an 18% CAGR.

Kanizphoto/iStock via Getty Images

I have been tracking Brookfield Corporation (and KKR) for around 5 years and have developed a framework of adjusting its somewhat aggressive valuation. Even after adjustments, Brookfield Corporation (NYSE:BN) trades at a 50% NAV discount. BN's corporate structure is quite convoluted so it is key to have a straightforward method of valuing the company for yourself. I personally recently bought BN (and PVF.UN, which has a similar exposure to BN, but at an additional discount). I provide a framework to investors to adjust for BN's aggressive elements and keep their own valuation of this great business up to date.

Much has been written about the recently spun-off asset manager, Brookfield Asset Management (BAM):

It has an incredible franchise and expertise in niches where major private equity houses have less expertise (energy, infrastructure)

The company benefits from heritage/storied history similar to luxury brands: No pension fund employees will get fired for putting institutional money at a large PE name

-

Earnings quality is sky-high:

Capital and fees are locked-up for 8+ years. The management fees aren’t even sensitive to the cycle most often

all earnings convert to free cash as the fee growth comes with virtually zero reinvested capital

Private equity houses get “commitments” from their clients to call their capital when they want within a certain time frame. This call option on capital is given to them for free and introduces a countercyclical element to their business, as this allows for leveraging (more of) other people’s money for a share of the profit when times are bad

A recent trend is the mix shift toward perpetual capital: needless to say, it’s an amazing business to be able to skim a part of the nominal return of other people’s forever

However, BAM is valued around 25X fee-related earnings while it won’t earn nearly as much carried interest as alt competitors for many years, as the spin-off agreement with BN has the following in place:

100% of carried interest on pre-existing funds pre-spin (‘22) to flow to BN

33% of carried interest on future funds to flow to BN

So in short, I view BAM as an amazing business, but a fully priced one.

This post is about BN (the balance sheet co-investor and 73% owner of BAM), and I will value BAM at market price, as BN does in its table (see below). I will reproduce this table with my own adjustments that I will explain in this post.

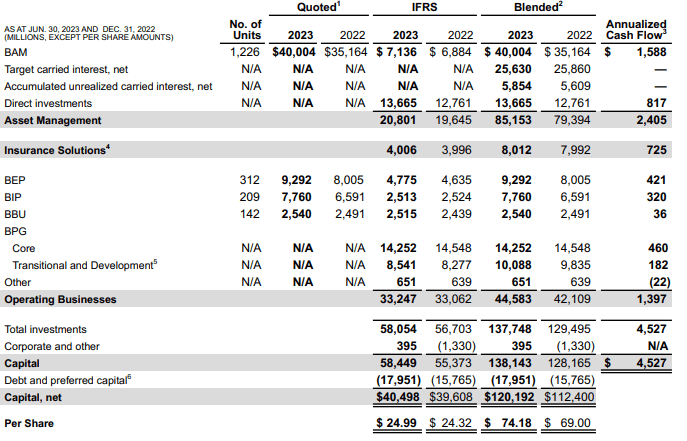

Brookfield Corporation Q2 '23 Supplemental Disclosure "Capital", p. 7

Readers are advised to keep my following reproduction of Brookfield's "Capital" table open while reading the rest of the post:

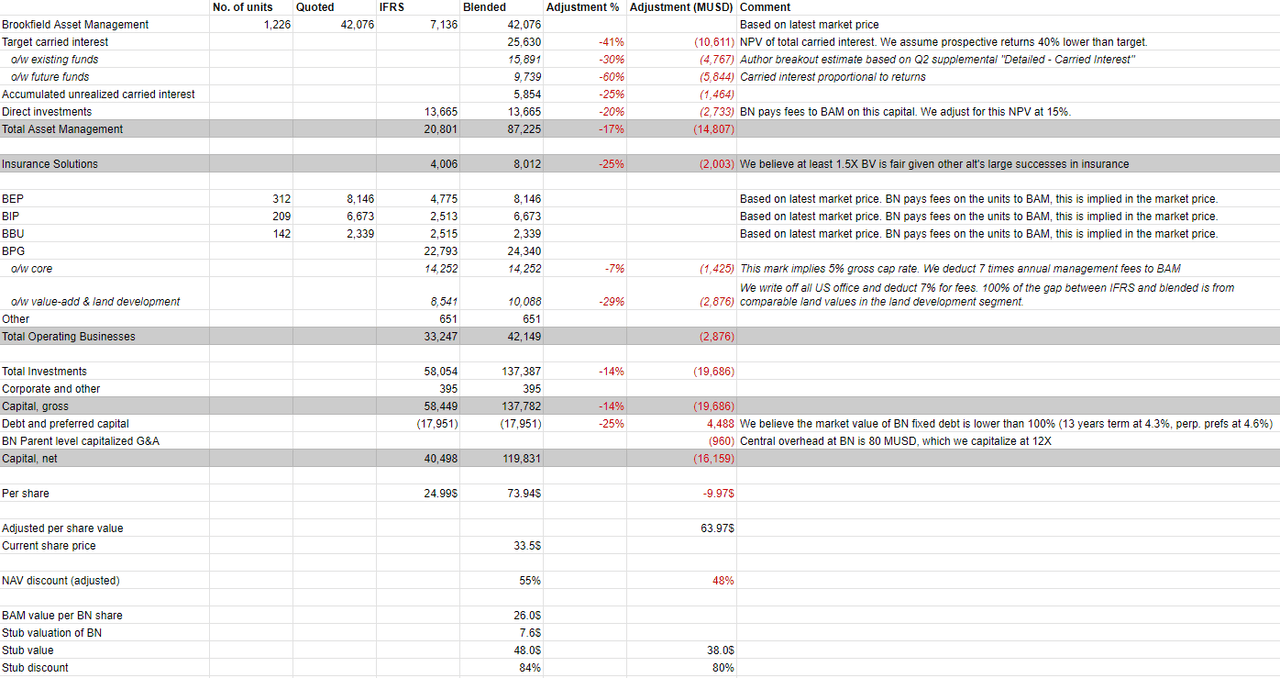

Author's reproduction and adjustment of Brookfield Corporation Supplemental capital table above

As I stated before, I’m willing to pay market price for BAM. Since BN reported the SOTP table, the share price has risen from 32.6 $ in the table to 34.3$. We adjust accordingly.

Carried interest adjustments

From top to bottom, the next items are related to carried interest. Target carried interest (25 860 MUSD in Brookfield’s own SOTP) is the net present value of carried interest BN would earn (100% for pre-existing funds pre-spin and 33% for all new funds as per pre-spin agreement) if BAM hits target returns on all its funds (12-20% with the lower value being credit-oriented and core real estate funds, and the higher the private equity flagships). In the past Brookfield has achieved this goal, but I find it a bit aggressive to extrapolate these ambitious returns on ever-growing pools of money (AUM is reaching for 1 trillion). Note that carried interest is very sensitive to return assumptions, as it is - obviously - charged on returns only. In addition, as Brookfield notes in its supplemental releases, carried interest is often calculated after a high single digit preferred LP return. This all means carried interest is levered (more than proportional) to return assumptions.

Based on Brookfield’s Q2 supplemental “Detailed” section disclosure on Carried Interest, we estimate about 62% of NPV (assuming target returns) come from existing funds. This assumes a simple model where all carried interest until 2029 is from existing funds (100% share to BN), and all from new funds thereafter (30% share to BN). After breaking down the values for existing/new funds, we adjust for our own return assumptions:

Future returns will be 40% short of target (i.e. a returns range of 7% to 12%)

the percent haircut to new funds’ carried interest should be the fall in returns in excess of the preferred returns (5-9% range according to the Supplemental footnotes) in case these exist. We thus assume a fall of 60% because of this leverage

Returns on existing funds will be 20% of target (remember around half of returns on these funds have already been made), and a haircut of 30% given the preferred return leverage

For transparency, assuming a fund return 40% short of target means an unlevered return 20% short of target given the debt at the fund level. We get a fair NPV of (total) target carried interest of around 15 BUSD.

Accumulated unrealized carried interest is even less sensitive to general market gyrations than carried interest on existing funds, as this type of carried interest has built up on mature investments, and hence the underlying companies have de-levered (a lot). We adjust for a de-rating of 25%.

I believe that even in a scenario where returns turn out 40% lower than expected, this is consistent with BAM being fairly valued. In other words, it will continue to grow modestly thanks to its long historical track record and name, and the fact that alts are not marked to (a volatile) market.

Wrapping up the value pillar of asset management

Direct investments are LP interests BN owns along other LP's, and pay fees to BAM (worth 10% of the capital, and Brookfield has a history of double-counting the value of fees, by not adjusting them at the balance sheet level, and using market price for the BAM level), and values could be inflated (assume 10%), so we adjust their value by 20%.

As a result of the adjustments for carried interest and direct investments, we get a total downward adjustment for asset management of 17%.

Operating businesses

For insurance, we use 1.5X book value instead of 2.0X (Brookfield assumption) given other alt’s large successes in this segment, but Brookfield being somewhat late to this party.

Regarding the public perpetual vehicles, these pay fees to BAM, but this is implicitly captured by market prices, which we believe are somewhat pessimistic today given the fundamental track record of these vehicles. We use market prices here.

Real estate adjustments

The property segment pays fees to BAM but is in the process of selling properties outright, or to LP’s in BAM’s funds. We therefore capitalise 7 times annual management fees (from BPY SEC disclosure, we found 1% management fee and 1.3% incentive fee above pre-spin market value) and deduct this from IFRS value. The incentive fees won’t be paid in our assumption set as we will mark down the assets from pre-spin levels.

The assumptions in the Detailed section of the Brookfield supplementary report seem reasonable. Office only accounts for 50% of core NAV and 30% of value-add NAV. The values attributed to the core real estate present an average cap rate of 5%, given BPY discloses an around 50% LTV and a 14 BUSD equity, and the SOTP table reveals a 14 BUSD valuation for the equity. This seems reasonable given the stable trend in this segment for occupancy, and positive trend in rents.

Because non-recourse debt will work in investors’ favor by cutting NAV exposure to problematic properties quickly while retaining upside on those that are good, we won’t look at aggregate metrics of the value-add portfolio. Averages do not make sense given a varying level of non-recourse debt. Land development (in which Brookfield was highly successful) already accounts for 1.5 BUSD of this SOTP item. Because the US is overbuilt with mediocre offices, we completely write-off the US value-add offices (2.2BUSD reported in the Detailed supplementary report), and we deduct 7 years of 1% management fees. Only 5 BUSD of value-add real-estate is hence retained in my SOTP. From the core portfolio we deduct the same value for fees.

Corporate items

Debt and preferred capital at the BN level is particularly interesting. Brookfield reports an average term of 13 years at 4.3% average interest rate on 11 BUSD of corporate debt (a lot of this was raised before 2022), and 4 BUSD perpetual prefs. that yield only 4.6%. Since both instruments are long-term in nature and only yield 4.3%, I discount this debt by 25% (implying a fair return on these instruments of 4.5/0.75 = 6%).

Lastly, as opposed to Brookfield, I capitalize BN level corporate expenses at 12 times. In the supplemental disclosure “Corporate Activities”, this is revealed to be 80 MUSD p.a.

Undervaluation & prospective return

We now get an updated per share headline valuation of 74$ per BN share if we used Brookfield’s own methodology. My adjusted methodology subtracts 10$ to arrive at a 64$ per BN share valuation.

The NAV discount today is 55% on a headline basis, and 48% on my adjusted basis.

If investors want to value (and buy) BAM anyway, 26$ per share of BN is already covered by its 73% stake in BAM. The stub discount for the asset heavy side becomes 84% on a headline basis, and 80% on an adjusted basis.

As I showed, my adjusted basis takes into account lower carried interest and deducts the NPV of fees BN will pay to BAM on its assets.

Brookfield’s management has bought back around 1% of shares outstanding in the first half of 2023. As the NAV discount is 50% right now, this represents an immediate accretive 2 times money multiple on this capital employed, and increasing the per share value by 1%. Management also discussed the potential for a special issuer bid, but said it wanted to leave all options open for other accretive capital uses as well. Knowing Brookfield management has always been opportunistic, it would never give certainty on a special issuer bid, as it would drive up BN’s share price in anticipation. The NAV discount is quite historic, even when compared to the pre-spin further history. However, Brookfield has never done gigantic buybacks in percentage of shares outstanding, so I expect a small SIB to happen, probably covering around 2% to 5% of shares (increasing the per share value by the same amount at 50% discount).

In the next 3 years, my total return assumptions:

- I expect a 10% return on BN's NAV (both BAM shares and BN balance sheet assets)

- Share buybacks to add 1% accretion a year (40% discount on a 1.2% share buyback of share outstanding pace)

- As item one and two unfold, I expect a rerating towards NAV to an adjusted 35% discount (a total return of 25%)

Adding it all up, the total CAGR becomes 10% plus 1% plus 7.8% p.a. of multiple rerating, or a CAGR of 18.8%.

Risks

Highly levered subsidiaries: a lot of real estate is levered around 40-60% LTV (as per BPY SEC filings) with rising rates and a large part of the debt renewing in the next 3 years. The mitigant is negotiating leverage with banks as almost all debt is property-level and non-recourse. Brookfield can pick which property to default on and which to help with (modest) new parent equity injections. The corporate level has reasonable levels of debt, which is 13 year term and cheap, as discussed in the article.

Alignment with Brookfield Senior management: BN is aligned more than the perpetual affiliates or BAM, but the partners own BN via Partners Value Investment. Management share ownership is very high so this reasonably aligns the management with shareholders, but risks such as overpaying for management remain. Related-party transactions should be in favor of BN as it sits closer to the interests of the partners.

Political backlash against private equity: difficult to handicap, but this risk could materialize in the form of higher taxes on carried interest. This should be more of a risk for private equity employees. Another risk is more stringent related-party dealings on private equity owning life insurance arms

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BN, PVF.UN:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)