Buy Teladoc: AI Will Likely Spur Healthcare Deflation

Summary

- Aging demographics and rising healthcare costs are major concerns for the global economy.

- Artificial Intelligence has the potential to significantly reduce healthcare costs and improve diagnosis and treatment plans.

- Teledoc, in partnership with Microsoft, is well-positioned to utilize AI and become a leader in bringing down healthcare costs.

- I rate TDOC a strong buy at current price levels.

PhonlamaiPhoto

The first step in my investment process is to identify secular trends. One of the biggest secular trends on the planet is aging demographics.

As populations get older, national healthcare expenses increase. The four largest economies, the United States, European Union, China and Japan are already straining under the cost of healthcare. It is essential that there is a wave of healthcare deflation to avoid a global economic collapse.

Another secular trend, Artificial Intelligence, is the likely cure for rising healthcare costs. In testing AI diagnostic platforms, we are seeing AI significantly outperform doctors in diagnosis and prescribing treatment plans. Integrating AI with traditional medicine, will be the key to getting AI's full benefits.

Teladoc Health, Inc. (NYSE:TDOC) stands to be a leader in utilizing AI in bringing down healthcare costs. Its expansive data and reach, combined with AI, will make it a leader and takeover target.

Teledoc shares are my top pick for best AI investment of the next year in general and in healthcare specifically. It is vital that Teledoc, and others, succeed in bringing deflation to the healthcare system. I think they will.

Problems In The Cost Of Healthcare

There are three core problems in healthcare that are driving up prices.

- The healthcare system is now largely profits driven, so healthcare providers have little incentive to see the system shrink. This applies to hospitals, pharma and insurance companies among others. More healthcare spend means more profits even if margins stay the same.

- There is a shortage of nurses and a developing shortage of doctors. While a national education program for healthcare workers would be great, I am still waiting on a callback from my Senators about that.

- Aging demographics are driving demand for healthcare higher, and if we increase immigration to fill labor shortages as Boomers retire, that will drive healthcare demand higher as well.

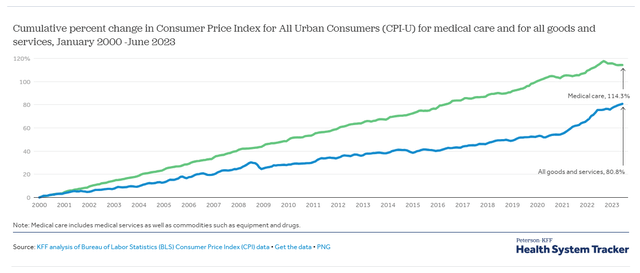

Healthcare inflation has outpaced the general consumer price index in the past four decades since the healthcare system was shifted away from non-profits in the 1980s.

According to a Medical Economics review of CPI data, "... the value of medical care has increased by 115.1% in 23 years. The value of consumer goods and services has bumped up by 78.2% in the same amount of time."

Healthcare Inflation vs CPI (healthsystemtracker.org)

Even if we had more non-profits, it still would not change the equation much. We need a solution that supersedes the more egregious supply and demand imbalances that are only getting worse. In addition, organizations need room to lower prices while roughly maintaining profits, i.e. higher margins.

Implementation of AI could be a large part of the solutions.

Potential Healthcare Deflation From AI

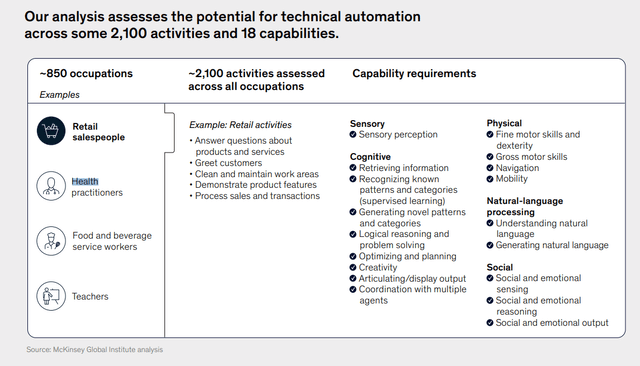

According to McKinsey, generative AI has the potential, and likelihood, of unleashing the next wave of productivity. I have described this to various professionals seeking input that the easiest way to think of AI is as a super assistant.

Consider what it will be like in virtually any industry having ready answers and much of the grunt work done for you. Bankers can underwrite faster, writers can edit faster, doctors can diagnose faster and with greater accuracy.

AI Assistance Capabilities (McKinsey)

According to McKinsey, AI could reduce annual healthcare costs by a quarter trillion dollars per year imminently. I think over time that number becomes dramatically bigger with implementation and improvements to the process.

Consider that the U.S. Federal Deficit sits at about $1.4 trillion right now. If AI can help reduce that, it will be incorporated over time.

Here I will note that the train has already left the station. About two years ago, my then 93 year-old grandmother was rehabbing a broken hip. While still in the hospital, her rehabilitative nurse's (a traveling nurse) other core job was to incorporate AI into the processes at a large local hospital network.

AI is coming to healthcare.

Maybe the biggest benefit of AI for healthcare will be taking various data, such as symptoms, health history, genetics, diet, etc... and making the diagnosis and treatment plan process less time consuming. This will help with the labor shortage and potentially help hold the line on what is an out of control wage structure in nursing that has developed over the past decade.

Here's an example, again from McKinsey:

"... a clinician records a patient visit using the AI platform's mobile app. The platform adds the patient's information in real time, identifying any gaps and prompting the clinician to fill them in, effectively turning the dictation into a structured note with conversational language. Once the visit ends, the clinician reviews, on a computer, the AI-generated notes, which they can edit by voice or by typing, and submits them to the patient's electronic health record (Energy Hunter Resources (EHR) Stock Price Today, Quote & News). That near-instantaneous process makes the manual and time-consuming note-taking and administrative work that a clinician must complete for every patient interaction look archaic by comparison."

There are more uses of course from scheduling to information management to treatment coordination across different disciplines for folks treating multiple issues. This is exactly what medical systems and providers need to bring total spend down while maintaining margins high enough to support their profits.

McKinsey goes on to suggest that the quarter trillion in imminent savings, with better adoption, could unlock nearly a trillion in savings per annum eventually. As Boomers retire and go on Medicare, not only will savings spurred by AI be helpful, it will be necessary to prevent the destruction of an already overburdened and too expensive system.

There's no shortage of articles detailing the many ways that AI can assist in healthcare and help bring costs down dramatically. I invite you to search and read before being incredulous in the comments section that we can see healthcare deflation soon.

Another angle that almost no one is considering for healthcare is the current litigation risk that doctors face.

In today's society, litigation risk is so higher, that doctors are pushed to make the most minimalistic diagnosis and least intrusive treatment plan possible. So, it is not always that doctors don't have a good idea of what to do, but rather, they take the path least risky for themselves and their hospitals.

If the use of AI becomes a standard in healthcare, it can be used to mitigate litigation risks. This is a massive upgrade to the efficiency of the healthcare system just on diagnosing and prescribing in fewer steps.

Ultimately, the various ways that AI helps create deflation in healthcare will benefit both consumers and providers.

Teledoc, Microsoft And AI

Over the past decade, we have seen all of the major tech companies push into healthcare. It was big news when Amazon (AMZN) then led by Jeff Bezos formed a coalition to find solutions for healthcare. Today, it is all of the big tech players.

Teledoc and Microsoft Corporation (MSFT) have been partners since Covid. They recently expanded their partnership even more. So much so, that I will make my first comment on the stock since the opening paragraphs. I think Teledoc is a potential takeover target for Microsoft if the government allows it. Either way, the integrations in their systems are very supportive for Teledoc.

What McKinsey talked about above is the next step in Teledoc's use of Microsoft technology. The new collaboration will see Microsoft's Azure OpenAI, Azure Cognitive Services and the Nuance Dragon Ambient eXperience integrated into Teledoc's systems.

Teledoc expects a significant reduction in administrative work for doctors, nurses and systems. This is a margin expander for Teledoc. It is also an attraction for more hospitals, especially those not in large networks, to incorporate Teledoc.

Already Teledoc does work for half of the Fortune 500, I can see their platform incorporating many more Russell 300 companies who look to manage their healthcare expenses.

Consider what happens when Teledoc has doctors start using AI across the board versus just at a handful of top hospitals and nurses have such clear treatment plans that their work becomes more efficient. That's another driver for margins and sales.

Teledoc By The Numbers

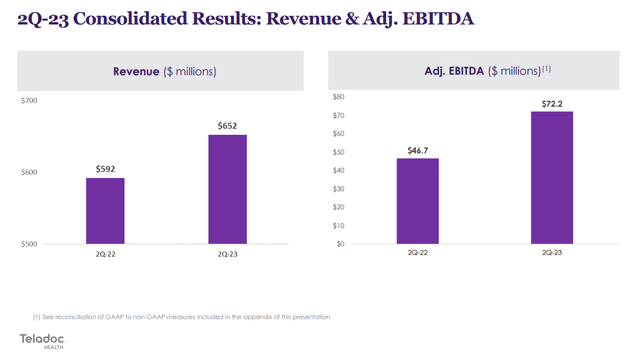

I think the most important financial numbers are the revenue and EBITDA jumps of the past year:

Teledoc Revenue & EBITDA (Teledoc)

That's a big jump. Remember, Teledoc serves about half of the Fortune 500 companies, so they are no start up.

While the company has had impressive growth, investors have been unhappy with profits. Well, that's been changing fast. Much like Zuckerberg's "year of efficiency" at (Meta Platforms, Inc. (META), Teledoc is improving margins, a shade over 70% in Q2. AI is a part of that and it's just getting started.

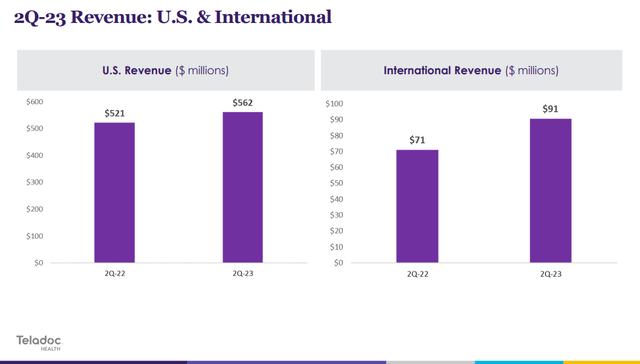

I would also point to the international opportunity for Teledoc, which I think will be bigger than U.S. revenues at some point.

Teledoc U.S. vs International Growth (Teledoc)

That's 28% year-over-year international growth versus about 8% in the U.S. At that pace Teledoc would have a billion dollars in revenues internationally in a decade. Presuming U.S. growth slows somewhat, U.S. revenues will be about a billion in a decade as well. That's a spicey AI meatball at 70% or even 60% margins!

Amazon And Other Competition

There will certainly be competition for Teledoc. The one that got the most attention recently was Amazon. At this point though, Amazon is far behind and deploying a system that is more direct to consumer.

Amazon is not racing to get into hospitals right now. I am sure that will change at some point, but Teledoc has a significant head start.

I also see Amazon as a bigger player in attracting small companies initially. In particular very small companies that use the Amazon platform for sales. That's where they have inroads already. In addition, I'm sure there's some type of "urgent care benefit" for Prime Members coming that might be tied into Amazon Pharmacy. Simply put, different animal than Teledoc.

The cap on Teledoc's growth seems to be pretty far into the future at this point. We will see what the largest healthcare networks do. I suspect many will contract Teledoc and Microsoft for tech support while deploying private labeled systems as building from scratch is no easy chore when cost is considered. We'll see.

Teledoc Technically Speaking Is A Buy

I have shown simple charts in recent articles to get folks more comfortable with technical analysis. The easiest short cut is to use RSI over longer time frames to find oversold and overbought conditions to ramp up research and decision making (investors R&D).

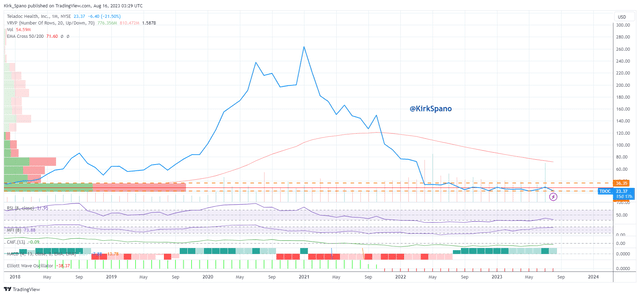

Here's Teledoc on a monthly chart:

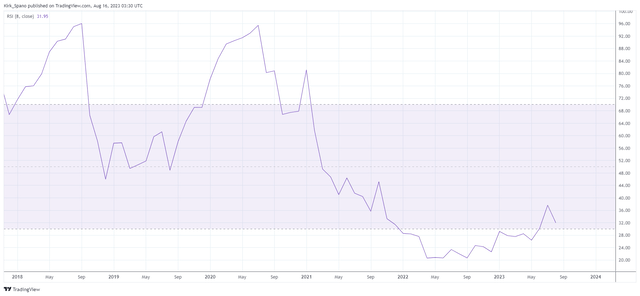

What you can see is that the stock has "round tripped" back to 5-year lows. You can also sort of see that monthly RSI is oversold. Here's a close up:

You can see that recently RSI has just started to turn up from absolute oversold. if you believe in the fundamental story, then it is clearly in buy the dips territory.

Let's switch over the weekly chart which measures at the end of each week instead of each month.

The first thing that should jump out at you is the long basing period for TDOC. That's a sign of an impending rise if the business continues to do well.

Next is that weekly RSI is on a pullback, which has to do with a generally weak market this month, but also the Amazon news, that I don't think really matters, but that retail chasers did.

Next, look left. Way on the far left is the volume weighted interest. There is a lot of interest in this stock down at these price levels. Check your favorite 13F source and you'll see bigger buyers drifting in.

Teledoc is set up for a big gain at some point. There's very little resistance for a price jump to climb well over $100 per share in the next few years. Big resistance first appears around $130 per share, again, look left.

Closing Investment Thoughts

While there will be competition for AI applications in healthcare, Teledoc's first mover advantage and scale give it an edge. In addition, having Microsoft at its back, plus the ability to incorporate other technology as needed, I believe gives Teledoc a margin of safety from these price levels.

I have taken a starter position in Teledoc shares in the middle $20s. I rate Teledoc a strong buy at these price levels.

Members are also selling cash-secured puts at different expiration dates and strike prices. By selling puts I am essentially setting limit prices below today's price and collecting premium. The premiums so far have been far above most dividend stocks.

Editor's Note: This article was submitted as part of Seeking Alpha's Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition -- open to all contributors -- is one you don't want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Find out how we knew to raise cash for January 2020 & January 2022 and what we plan to buy for the coming generational bull market!

Join us today to invest in a changing world with a Margin of Safety. Now 20% off your 1st year.

ETF Asset Allocation, Growth Stocks, Dividend Growth, Low Volatility Retiree Dividend Stocks, REITs, Option Selling For Income & Alternative Income.

This article was written by

25+ years of beating markets with less risk. Margin of Safety Investing. "The three most important words in investing are margin of safety." - Warren Buffett

Get my Macro view and analysis of secular trends which led to my being named "The World's Next Great Investing Columnist" at MarketWatch. Join our investing group to get ETF asset allocation, top growth & dividend stocks, as well as, learn a repeatable approach to option selling for making more retirement income.

I own and operate Bluemound Asset Management, LLC - a boutique registered investment advisory that manages and consults on 9 figures of wealth. I was lucky to have several mentors who managed billions of dollars, including, one who literally helped write the book on option selling. I have now managed money since the 1990s through several major market cycles.

In the past decade I have worked on private equity led real estate projects, as well as, consulted to several private equity firms, hedge funds and family offices. I currently actively help accredited investors find sustainable real estate investments through private equity.

Since 2011, I have been widely syndicated and appear as an investing expert in the media. Follow my work, as I try to help you make great returns with less risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TDOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We own shares and are actively selling cash-secured puts.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.