Goosehead Insurance: Growing Quickly But At An Unappealing Price Still

Summary

- Goosehead Insurance Inc. experienced impressive growth in Q2 FY2023 with total written premiums reaching $767 million, a 36% increase.

- The market remains pessimistic about GSHD, with a short interest of 9.2%, and a drop in share price is possible if volumes decrease.

- GSHD operates as a holding company for Goosehead Financial LLC, offering a wide range of insurance coverage, and has shown strong revenue growth since 2019.

Chalirmpoj Pimpisarn/iStock via Getty Images

Introduction

Growth has been impressive on the side of Goosehead Insurance Inc (NASDAQ:GSHD) as total written premiums reached $767 million in Q2 FY2023, an increase of 36%. I think however that despite the large growth, the price right now is unappealing to buy into. Even with tailwinds like higher interest rates which are pushing NII higher, it will take a long time until GSHD eventually reaches a valuation in line with the sector. Expectations are high and I think we are likely to see a bumpy road but if the projections of a nearly 30% yearly EPS growth rate are achieved, then making GSHD a hold seems reasonable at least.

There seems to be some pessimism on the side of the market here for GSHD still as the short interest sits at 9.2%. I think we might see a drop in the share price if GSHD posts a report showcasing a drop in volumes. There isn't a dividend to collect yet from the company, but with an ROE of 47%, I don’t think we are that far away from one being established either honestly.

Company Structure

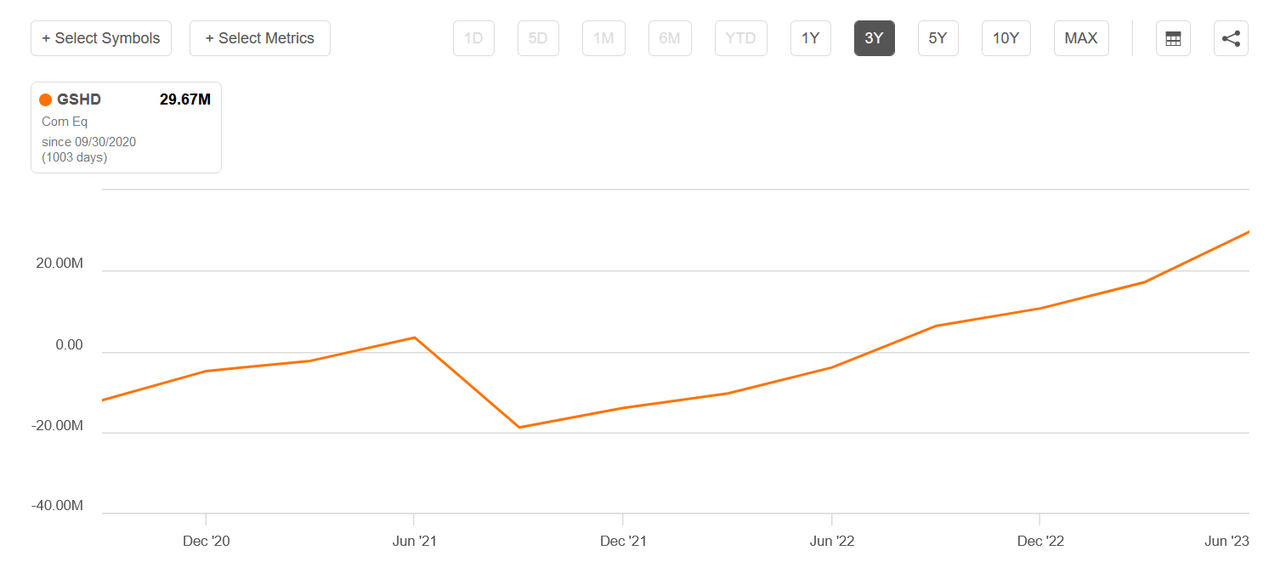

In the insurance brokers industry, GSHD has made a name for itself and grown impressively over the years. Boasting one of the best ROE I have seen the development of this as the common equity continues upwards.

It's important to know that GSHD operates as a holdings company for Goosehead Financial LLC which provides personal lines insurance agencies in the United States. Insurances are covering a wide basis of areas which seems to have been a leading cause for the growth of the business, covering all from automotive to flood and wind insurance, but also life insurance. As with any insurance company, proper risk management is important, and achieving a good ROC is what will set companies apart from each other. For GSHD that number sits at 12% right now, more than twice as high as the sector.

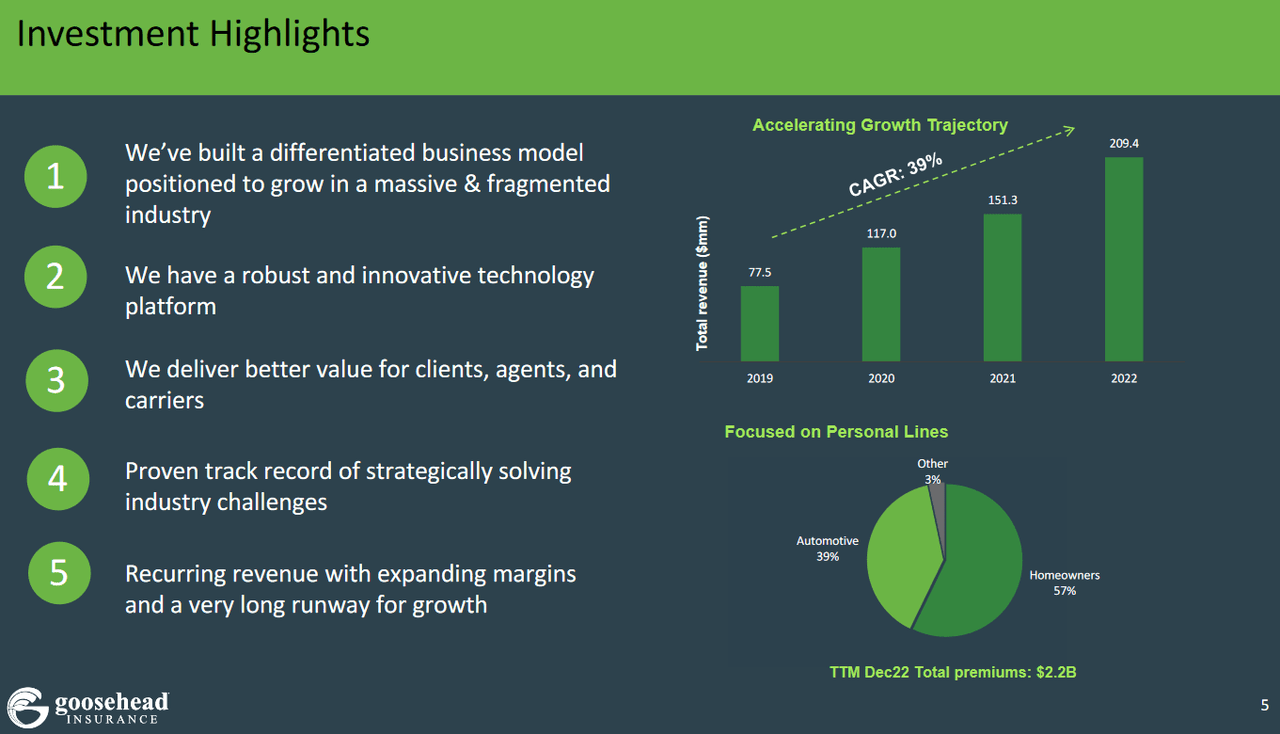

Investment Highlights (Investor Presentation)

So far the growth has been incredible for GSHD as they continue generating strong revenues, growing at 39% CAGR since 2019. With a differentiated business model, it seems that the focus on creating value for clients and agents are paying off very well. This momentum and showcase of growth are what has led the business to be valued where it is today, as a growing company like no other. The p/s sits at 5.9, which is a tough premium to get over in comparison to what other companies in the sector are valued at.

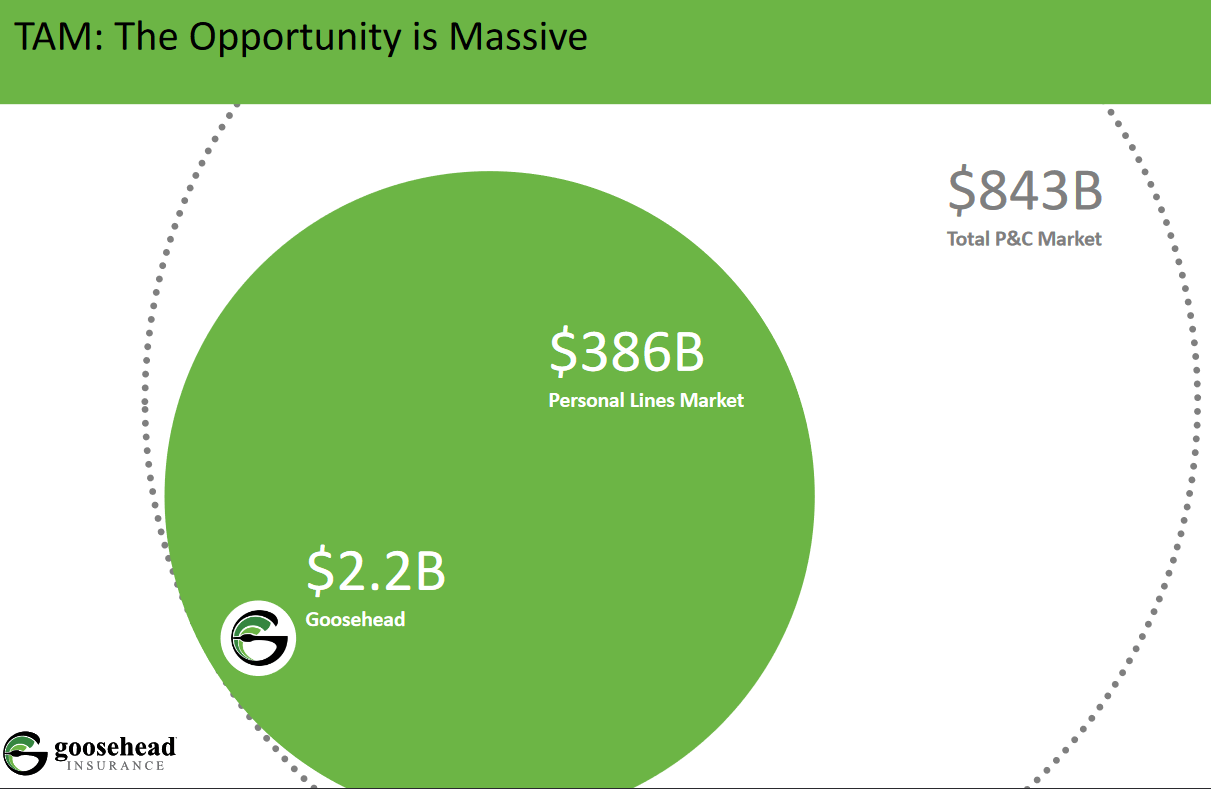

TAM (Investor Presentation)

GSHD remains very optimistic about the prospects as the TAM for the p&c market is estimated to be worth $843 billion. The current market cap of GSHD is $2.5 billion and continues to grow. In comparison to the rest it has a lot of room for growth and this is of course what it's being priced as.

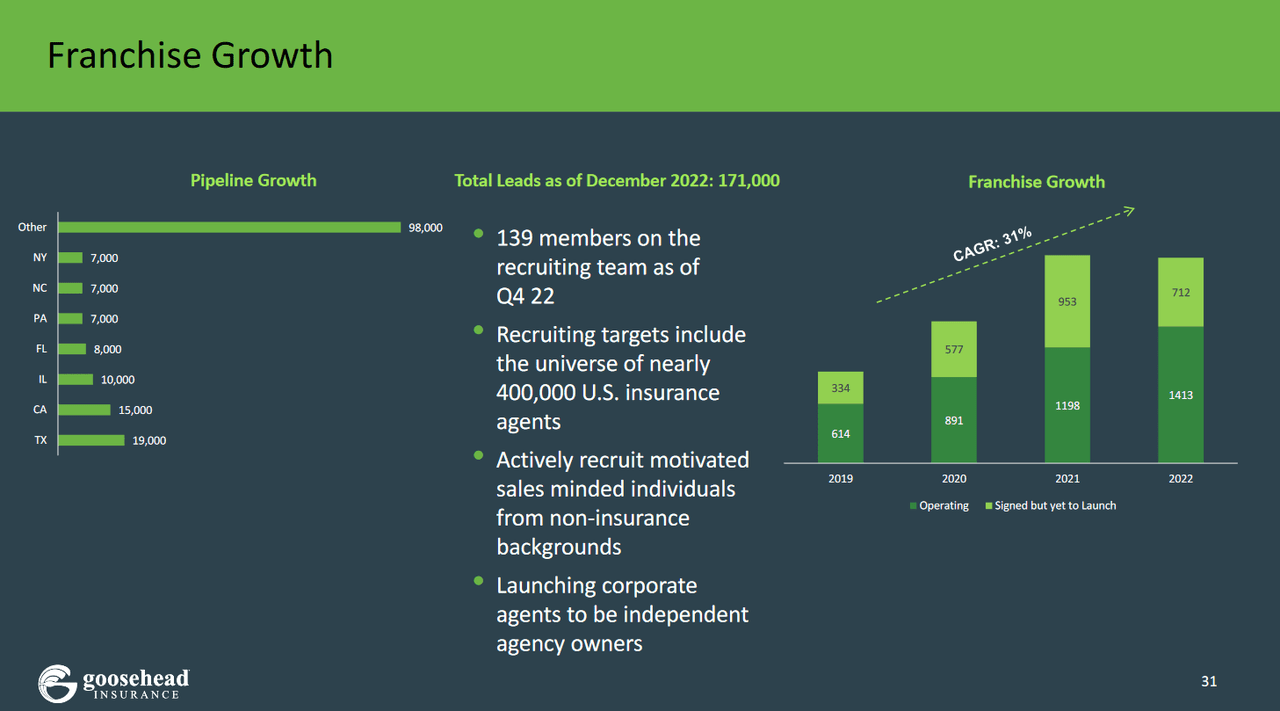

Company Growth (Investor Presentation)

The expansion has been immense and GSHD continues tending upwards. Some of the growth dries has been launching corporate agents to be independent agency owners instead and partnering. This has created an almost flooding effect as GSHD has operations in pretty much every state in the US.

Earnings Transcript

A lot of eyes were on the last earnings report for GSHD and I think they delivered very well. On July 26 we also got some comments from the CEO Mark Jones on the market dynamics they are in and the future of the company.

“Summary results for Q2 include 31% revenue growth 27% core revenue growth 36% growth in premium and adjusted EBITDA margin expansion of 900 basis points to 33%. These results underscore the strength of our strategy and quality of our execution focused tightly on the distribution link in the value chain with a powerful choice model”.

Results like these are why GSHD continues to be such an appealing buy for investors right now that are more risk-averse. As demand is growing in a high-interest environment the potential for volume growth in a lower-interest environment seems very good. I think this is what some investors are betting on too, that GSHD will maintain the high ROE and eventually establish a dividend after maturing for some time more.

“The restructuring of our corporate sales team has yielded extraordinary results. Productivity is up 57% in the quarter compared to Q2 2022. And this growth is despite the fact that we launched seven new franchises in the quarter from among our most productive corporate agents. In June, we began onboarding new agents primarily from college campuses, restarting capacity growth again”.

It's very good to see the management being very optimistic about the outlook of the market and that making restructuring plans and executing them is yielding such strong results too.

Risk Associated

The leading risk facing GSHD or an investment in them right now seems to come from the high valuation of the company. If there is a disappointment in volume growth and the potential for stagnation then I think the share price will drop like a stone.

What investors need to keep an eye on is the competence of the management team which right now seems to be solid as they make cost and restructuring efforts that are greatly boosting productivity which will carry the company forward and be the reason for a premium to the sector. However, if a CAGR of over 20% seems to end quicker than expected then seeing the share price around 15 - 20x earnings instead might come very quickly.

Investor Takeaway

One of the main issues I have with GSHD is the large premium you have to pay for them right now. It's valued as a high-growth company and then some it seems. With a fantastic ROE the chance of a dividend and buyback program being established I think is very high. This is sufficient for me to be rating the company a hold at least.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.