Horizon Therapeutics: Can Investors Profit From Amgen Deal Confusion?

Summary

- Horizon Therapeutics accepted a bid of $116.50 per share to be acquired by Amgen in December last year - the deal value was $28.5bn in total.

- Horizon's drug products - led by Thyroid Eye Disease and gout therapies - earned $3.7bn last year.

- Amgen posted revenues of >$26bn last year but several key products are losing patent protection - hence the Horizon deal.

- The Federal Trade Commission has taken both companies to court to try to prevent any deal from happening on anti-competitive/anti-trust grounds.

- The fate of the deal remains uncertain - in this article I explain some of the key factors and what a positive/negative outcome may mean for the two companies share prices.

- Looking for a portfolio of ideas like this one? Members of Haggerston BioHealth get exclusive access to our subscriber-only portfolios. Learn More »

adventtr/iStock via Getty Images

Investment Overview: Horizon - Meet Amgen

The last time I covered Horizon Therapeutics (NASDAQ:HZNP) for Seeking Alpha was in July 2022, when I gave the company's stock a "Buy" recommendation based on the strength of its commercial drug portfolio - led by $2bn selling (in 2022) Thyroid Eye Disease therapy Tepezza and $700m-selling gout therapy Krystexxa, and the promise of a pipeline recently boosted by the company's acquisition of AstraZeneca's (AZN) spinout Viela Bio.

Initially, Horizon stock fell as Q2 2022 earnings disappointed, with Tepezza sales gaining only 6% year-on-year (as opposed to >100% in the prior year period) and FY22 earnings downgraded to $3.53bn-$3.6bn. Shares had slipped to a value of ~$65 by October last year.

At the end of 2022 however Horizon's fortunes - and its share price - picked up, when management announced on November 29 via a press release that:

It is engaged in highly preliminary discussions with Amgen Inc., Janssen Global Services, LLC and Sanofi (each a "Possible Offeror") which may or may not lead to an offer being made for the entire share capital of the Company.

Horizon's share price had risen above $100 in value by the middle of December 2022 as analysts speculated about what a final offer price might look like, with some concluding it could be as much as $135 per share.

After French Pharma giant Sanofi (SNY) and the world's largest Pharma by market cap, Johnson & Johnson (JNJ), had pulled out of the running, it was left to the Pharma from Thousand Oaks, California to strike a deal.

The price Amgen (AMGN) agreed to was $116.50 per share, which represented a premium to traded price of 20% and valued the company at ~$27.8bn - at the time, Amgen's Chairman and CEO Robert Bradway commented:

The acquisition of Horizon is a compelling opportunity for Amgen and one that is consistent with our strategy of delivering long-term growth by providing innovative medicines that address the needs of patients who suffer from serious diseases.

Amgen's decades of leadership in inflammation and nephrology, combined with our global presence and world-class biologics capabilities, will enable us to reach many more patients with first-in-class medicines like TEPEZZA, KRYSTEXXA and UPLIZNA.

Additionally, the potential new medicines in Horizon's pipeline strongly complement our own R&D portfolio. The acquisition of Horizon will drive growth in Amgen's revenue and non-GAAP EPS and is expected to be accretive from 2024.

8 Months On - Amgen Still Waiting To Complete Horizon Acquisition As FTC Sues

In 2022 Amgen drove $26.3bn of revenues, with nine "blockbuster" drugs accounting for >70% of total revenues, as shown in the table below:

Amgen key products - historical sales (My table using Amgen data)

11 other drugs made a revenue contribution of >$100m in 2022, with newly approved therapies such as lung cancer drug Lumakras, and Asthma therapy likely blockbusters in waiting, as are the Humira biosimilar Amjevita and leukemia drug Blincyto.

The significant issue Amgen has however is that lead drugs Enbrel, Prolia, Otezla, Xgeva, Aranesp and Neulasta will in all likelihood experience a loss of patent protection in the next three years. Once patent protection expires, generic drugs are permitted to be sold in place of the original drug at heavily discounted prices, damaging the drug's market share, and forcing its price downwards. Revenues from patent expired drugs often fall at a rate of >25% per annum.

Amgen has an intriguing pipeline - for example a weight loss candidate to rival Novo Nordisk's (NVO) Semaglutide or Eli Lilly's (LLY) Tirzepatide, a Phase 3 stage autoimmune drug, Rocatinlimab, and Phase 3 heart disease drug Olpasiran that leverages short interfering RNA ("siRNA"), and a burgeoning biosimilars division, but at the same time it is easy to see why Amgen would be attracted to Horizon's product portfolio and pipeline.

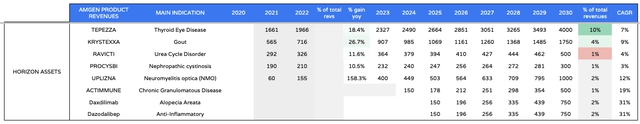

First of all there is the near-term $4bn per annum bump to revenues that Amgen gets upon completing the deal, based on Horizon's $3.6bn revenues generated in 2022. Secondly, there is the untapped potential of each product - my calculations - shown in a previous note on Amgen - suggest Horizon's portfolio and pipeline could generate >$10bn per annum by 2030

Forecast Horizon revenues - current products and pipeline (my forecasts)

Thirdly, Horizon, like Amgen, is a very profitable company, driving net income of $521m in 2022, and $535m in the prior year, the net profit margin being respectively 15% and 17%. Amgen's profit margin in 2021 and 2022 was respectively ~23%, and ~25%.

A fourth - potential benefit of the deal is one of the explanations as to why its completion has been held up. The Federal Trade Commission ("FTC") began to look into the deal, and concluded there was a possibility that Amgen would leverage its power as a provider of blockbuster selling drugs like Prolia and Enbrel, to force insurance companies and Pharmacy Benefit Managers ("PBMs") to provide more favourable terms for reimbursement of Horizon's Tepezza, Krystexxa, and newly approved - in neuromyelitis optica spectrum disorder ("NMOSD") - Uplizna.

Unusually, instead of allowing the deal to proceed while insisting that certain drugs are sold for anti-competitive reasons - as was the case when Bristol Myers Squibb (BMY) acquired Celgene in 2019, and was forced to sell the psoriasis drug Otezla to Amgen - in May this year, the FTC opted to file a lawsuit to try to put a block on the entire deal.

The FTC's Objections To Amgen / Horizon Deal

In a statement, the FTC commented that:

The deal would allow Amgen to leverage its portfolio of blockbuster drugs to entrench the monopoly positions of Horizon medications used to treat two serious conditions, thyroid eye disease and chronic refractory gout.

The FTC's concern is that there is no proper competition in the Thyroid Eye Disease ("TED") or gout markets - FTC Bureau of Competition Director Holly Vedova commented that:

Rampant consolidation in the pharmaceutical industry has given powerful companies a pass to exorbitantly hike prescription drug prices, deny patients access to more affordable generics, and hamstring innovation in life-saving markets.

Today’s action --- the FTC’s first challenge to a pharmaceutical merger in recent memory --- sends a clear signal to the market: The FTC won't hesitate to challenge mergers that enable pharmaceutical conglomerates to entrench their monopolies at the expense of consumers and fair competition.

Ireland domiciled Horizon has a chequered history in this regard, having been accused of hiking the price of rheumatoid arthritis and osteoarthritis therapies Vimovo and Duexis (as I discussed in a previous note on the company) in the past, before reinventing itself in 2015 under its new tagline, "innovation-focused biopharma company".

Nevertheless, it could simply be a case of "wrong-time, wrong-place" for Horizon and Amgen, who were attempting to do the biggest M&A deal in the sector for some time - at least until Pfizer (PFE) bid $43bn for Seagen (SGEN) in March this year - another deal that is yet to be completed.

The FTC has clearly chosen to take a stand against certain business practices that it perceives as unjust and unfair to patients, and as a result, where a few years ago the deal may well have completed in a matter of months, now Horizon and Amgen are discussing December as the earliest any deal might complete.

Amgen's Response To The FTC's Stance On Horizon Deal

On the company's Q2'23 earnings call Amgen CEO Bradway had a lot to say on the Horizon deal, commenting that:

Life-changing medicines that Amgen and Horizon offer treat different diseases and different patient populations. Simply put, there are no competitive overlaps and no incentives to bundle our drugs with theirs.

We look forward to making our case in court in September and I’m confident that we will prevail. In the meantime, we’re working closely on integration plans with Horizon, so we can hit the ground running by mid-December, which is when we anticipate being able to close the deal.

The Judge of the trial - which has been set for next month - has said they would need around four weeks after the end of the hearing to make a final decision. Clearly, the outcome of the trial is very significant for all parties involved, and for the share prices of Amgen and Horizon.

In July, it was reported that the FTC and Amgen had called off settlement talks that might have avoided legal action, and that six states - California, Illinois, Minnesota, New York, Washington and Wisconsin - had joined the FTC's legal challenge. In short, there appears to be a credible risk that the FTC can prevent the deal from happening.

The Opportunities Investors Could Exploit In Stalled Amgen / Horizon Deal

Clearly as a result of the upcoming trial hearing - which ought to represent the final obstacle to the deal being completed, as the FTC is the only regulatory authority still objecting to the deal - Horizon's stock is trading a little lower than the proposed acquisition price of $116.50 per share - it is currently trading at $104.

That reflects the risk that the deal with Amgen does not go through. After all, is Horizon a $28bn market cap company when you consider its price to sales ratio of ~7x, and historical (based on 2022 earnings) price to earnings ratio of ~45x? Possibly, if there were no M&A interest, Horizon's share price would recapture former lows of ~$65 per share, particularly if shareholder's panic in the event of a "no deal".

In the case of Amgen, arguably shareholders were not as enthusiastic about the deal for Horizon as management was, and if it were to fall through, Amgen stock - which traded at >$285 immediately prior to announcing its deal for Horizon and <$230 a few months after, might actually respond positively. The stock price is up 17% in the past month, perhaps reflecting hopes the deal will be prevented from happening.

From an investor's perspective, events certainly throw out different ways to benefit. If you have a high conviction that the deal will go through despite the opposition of the FTC, then you can make an easy >10% return on investment by buying shares at the current discounted price. Conversely, if you believe the FTC's opposition will scupper the deal, then being short Horizon stock would be a way to exploit the negative sentiment that would likely follow a reverse in the courts.

If you hold Amgen shares, you may consider holding them at least until the conclusion of this takeover saga for the >3% dividend, or, if you believe the deal is inevitable, selling at the current share price of $267 - nor far from all-time highs - may be a wise move.

Ultimately, the fact that the FTC appears to be cracking down on biotech M&A may be impacting the sector negatively, and the repercussions of September's court case are likely to be felt across the industry. From an opportunistic investor's perspective, however, playing out the likely scenarios ahead of time may result in a rewarding high conviction position.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.

This article was written by

I write about Biotech, Pharma and Healthcare stocks and share investment tips. Find me at my marketplace channel, Haggerston BioHealth - model portfolio + 4 exclusive stock tips every week. I'm on twitter @edmundingham

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)