Aqua Metals: Questioning Their Ability To Deploy And Scale In Light Of New Stock Offering

Summary

- We doubt Aqua Metals' ability to deploy and scale its recycling plants within the proposed timeline.

- The recent $17 million stock offering only provides temporary liquidity and may lead to expensive and dilutive equity raises in the future.

- The company's history of delays, lack of revenue, and shareholder lawsuits raises concerns about its ability to deliver on its promises.

Khanchit Khirisutchalual/iStock via Getty Images

We seriously question the ability of Aqua Metals (NASDAQ:AQMS) to successfully deploy and scale their promised plants at the proposed timeline. The company recently closed a $17 million stock offering of 15 million shares, meaning that certain investors are still supporting the company. We think that this offering is only buying another year of liquidity with little impact on the operational and scaling projects of Aqua. Without breakthrough developments, the company will be forced at new expensive and very dilutive equity raises in the next 12 months.

The business model and the history

Aqua Metals is engaged in the business of applying its commercialized clean, water-based recycling technology principles to develop clean and cost-efficient recycling solutions for both lead and lithium-ion ("Li") batteries. Basically, the company aims to extract significant valuable resources from its proprietary recycling process.

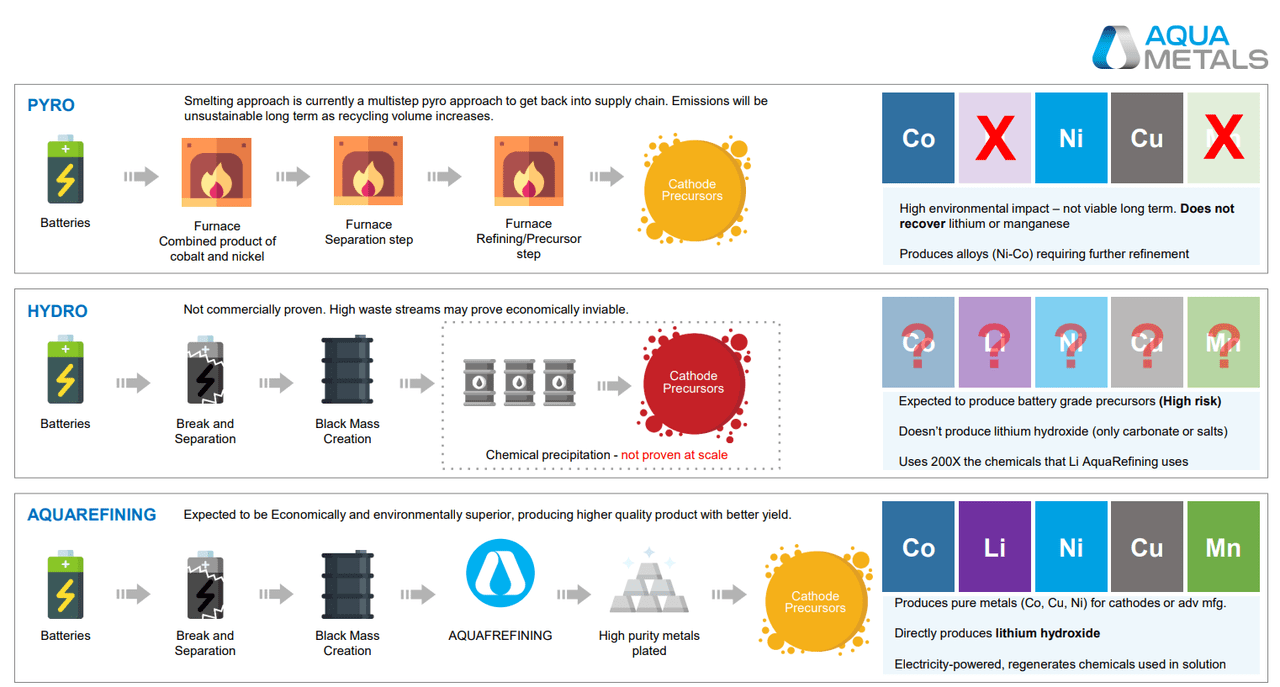

Aqua Materials process (Latest presentation)

This slide from their latest presentation shows a comparison between currently deployed processes and Aqua's proposed solution. By "Aquarefining", the company's patent-protected solution, they claim to be able to save a larger set of valuable resources from the managed waste. But as one can imagine, to do so they need expensive plants that have the capacity to replicate what's done in the lab, but at scale. And this is where our concerns come in.

We notice in one of the slides that the company aims to be able to scale its current facility to produce up to $60 million of commodities value. But we seriously doubt this ability as (1) the past track record sets bad precedents in terms of the execution ability of Aqua, and (2) the capital needs might be actually higher and more dilution can be expected.

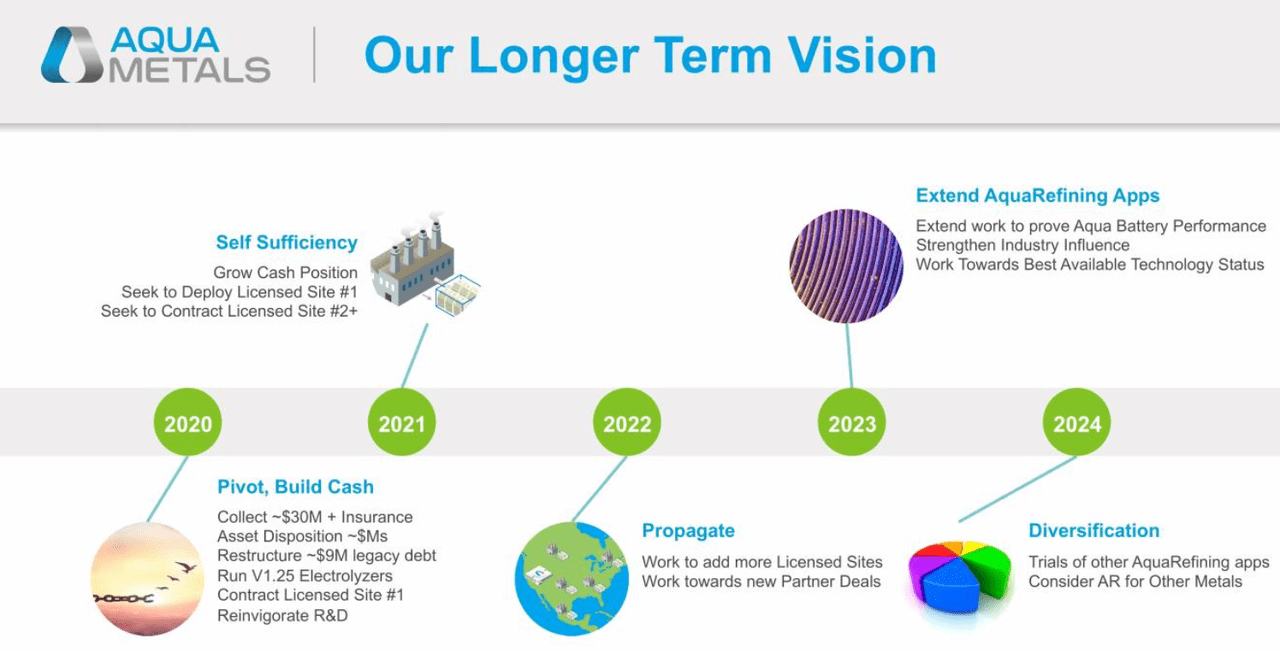

To propose an example, this is what the company was presenting to investors in 2020:

At that time, Aqua Metals had a much different vision and was focused on licensing rather than production. It was guiding "Self Sufficiency" in terms of capital and liquidity needs. However, since this presentation the number of shares outstanding passed from 60 million to more than 95 million (including the latest capital raise). A dilution of close to 50% of the outstanding capital. This is not only concerning in terms of the economics of the company over time but also the sudden change of strategy - from licensing to production - is worrying. The potential players in this market are not interested in this technology? Is it actually working as promised? All questions that are arising from these changes and we await answers that should come with a potential production / commercial contract.

We also denote that the trust in the management of this company is somehow shattered by past actions. Indeed, Aqua settled claims from a shareholders' derivative lawsuit in which certain individuals claimed breaches of fiduciary duties by management. Of course, the company denied any wrongdoing in the settlement, but they agreed to restructure the governance structure as suggested by these shareholders. The form of the settlement can be found here.

A closer look at the financials and cash position

The history of sources and uses of capital at AQMS is equally concerning. We estimate that the company raised more than $200 million after the IPO - excluding the recent raise. Considering that today (without considering the last raise) the cash balance stands at around $3 million, and the company is still generating zero revenues, the capital investments haven't been very rewarding.

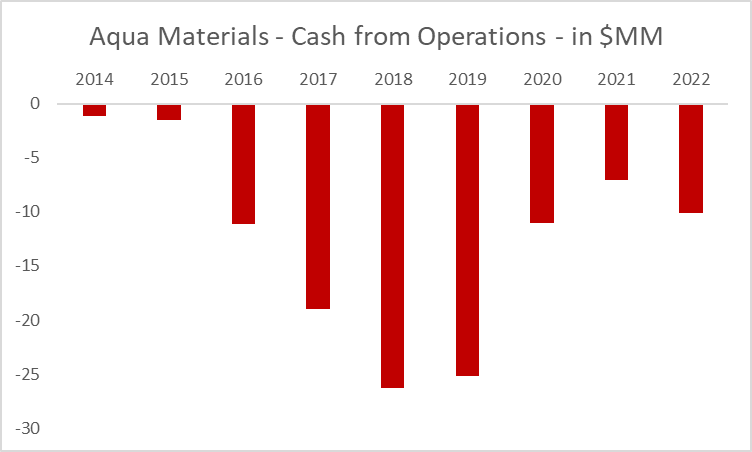

Aqua Materials - Cash burn (Seeking Alpha)

These are the cash losses over time. In recent years the company cut its losses by massively reducing Opex, in particular SG&A expenses. We recognize this as a success, and hopefully, a sign that the company can operate more efficiently in the future as well.

However, the cash burn is still around $10-15 million per year, and with $3 million in the bank the company really needed the recent raise (to avoid bankruptcy). Now they should have around $20 million in the bank by the end of the month, and this should extend the runaway to 2025. However, we think that given the past delays, this time will be no different and the company won't see any material production in H1 2024. This means that the company will likely need to raise more cash down the road, and that the market won't be as optimistic as today.

On the other hand, we also contemplate the possibility of some sort of production actually taking place within the next 12 months, but the capital requirements are likely vastly understated. Indeed, the company was building its infrastructure mainly in 2018 and 2019, right after the IPO in 2015. During this time they were burning up to $25 million per year. We estimate that a similar burn would be needed to sustain commercial-stage scaling at their plants, as the majority of the expenses would come from new employee additions. This essentially means raising 10-15% of the current market cap one year from now, as always at the expense of the existing shareholders.

In valuations terms, this means that the company will likely continue trading at depressed levels in light of more possible offerings. Since the company is pre-revenue, we are considering possible cash needs at the resulting share price that we estimate would be considered "fair" by the market.

- Scenario 1: No production, substantial cash burn in 2024 as the company tries to push manufacturing capabilities while continuing to spend for SG&A. We think under this scenario the company needs at least $10-20 million more, or 8% - 15% of the market cap, and a fair price would be fair in the $0.90 - $0.80 range, respectively.

- Scenario 2: Production starts in 2024, but as one may expect the capital needed to fund expansion and start-up is more than the mere $10 million AQMS will have by 1H 2024. We think that under this scenario the company needs at least $15-25 million more, with a fair price in the $0.85 - $0.75 range, respectively.

In both cases we see a downside of more than 20%, with further possible deterioration in the case the company needs to raise more.

The bright side: The odds of an operational success

The main reason for which we do not believe that the company is ready to commence production is one: history. As we stated earlier we believe that the technology is not validated, and we will remain doubtful until revenue is generated.

However, it is still possible that the company actually succeeds and is able to start production at its plant and reach the stated targets. We think that in this case, they should be able to generate $50 million or more in revenues in FY 2024. This will definitely contribute to stopping the cash burn, and even if we do not know the margins of their business post-production, they will likely do much fewer equity raises.

We think that given the company's previous history of 8 years of delays, cash burn, and zero material commercial orders/production, there is a sub-20% probability of this happening.

Conclusion

Aqua Metals is a recycling company that aims to disrupt its industry thanks to a patented "innovative" proprietary process. However, the company's history shows a pattern of delays and disappointing results, with very little delivered as of today. We think this is set to continue and the company will likely not commence production not even in 2024, leaving a heavy cash burn to be paid by shareholders, once again.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Lets see if the author corrects the error ???