Fair Isaac Continues Growth But Valuation Is High

Summary

- Fair Isaac Corporation recently reported strong financial results, beating revenue and EPS estimates.

- The company offers credit scoring and software solutions to organizations globally.

- Revenue growth is accelerating, but the stock's valuation is high and loan originations may slow due to higher-for-longer interest rates.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

gesrey/iStock via Getty Images

A Quick Take On Fair Isaac

Fair Isaac Corporation (NYSE:FICO) reported its FQ3 2023 financial results on August 2, 2023, beating revenue and EPS consensus estimates.

The firm provides a range of credit scoring and software capabilities to organizations worldwide.

I previously wrote about Fair Isaac with a Hold outlook.

Revenue growth is accelerating and sales cycles are shortening, but the stock’s valuation appears to be elevated and loan originations-related activity may slow due to higher-for-longer interest rate expectations.

I reiterate my Neutral [Hold] outlook for the near term.

Fair Isaac Overview And Market

Bozeman, Montana-based Fair Isaac Corporation was founded in 1956 to provide credit scoring and later software solutions to businesses seeking to determine the creditworthiness of their customers.

The firm is headed by Chief Executive Officer Will Lansing, who was previously CEO of Infospace and ValueVision Media.

The company’s primary offerings include:

FICO Platform

Business Scoring

Consumer Scoring

Fraud Management.

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals and online marketing.

According to a 2021 market research report by Allied Market Research, the market for credit rating software was an estimated $420 million in 2020 and is expected to reach $1.92 billion by 2030.

This represents a forecast CAGR of 16.5% from 2021 to 2030.

The main drivers for this expected growth are a growing demand for loans of all types by consumers and businesses worldwide.

Also, the cloud method of deployment is forecast to grow at the expense of on-premise installations, with growth estimated to be 18.3% from 2021 to 2030.

Major competitive or other industry participants include:

Equifax (EFX)

Experian (OTCQX:EXPGF)

Pega

Brighterion.

The company operates in other information and business & consumer intelligence markets.

Fair Isaac’s Recent Financial Trends

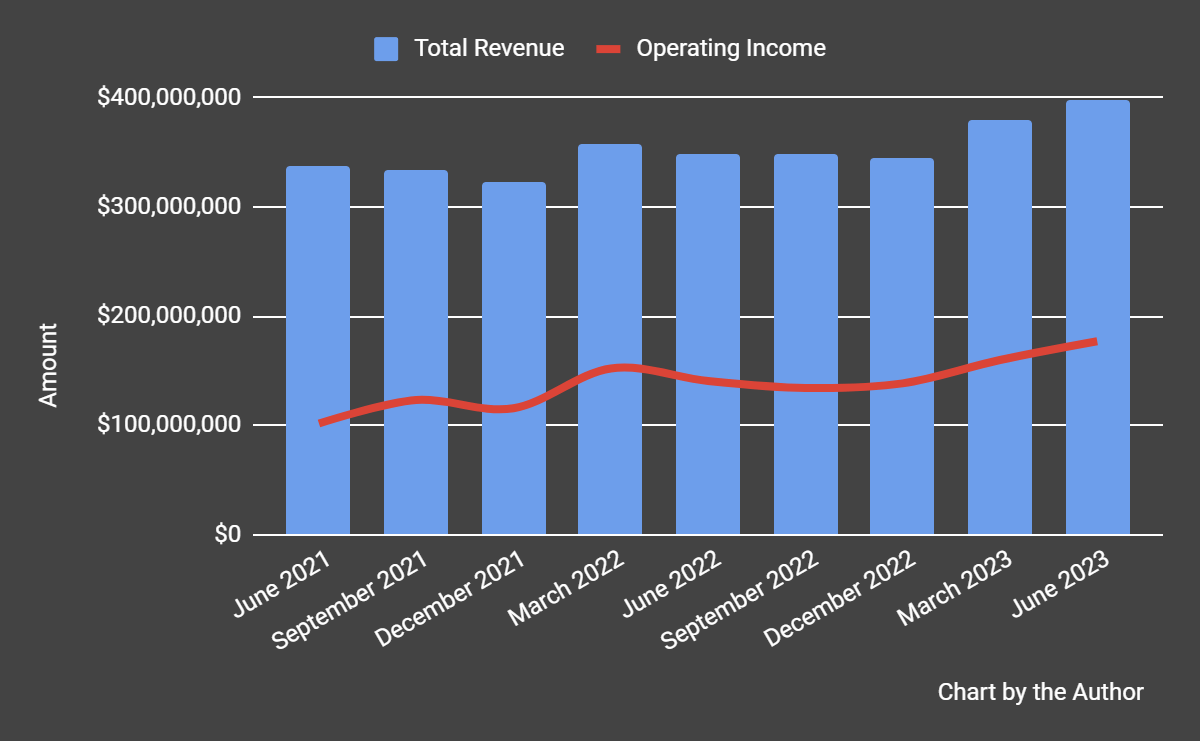

Total revenue by quarter has continued to grow; Operating income by quarter has produced impressive growth in recent quarters:

Total Revenue and Operating Income (Seeking Alpha)

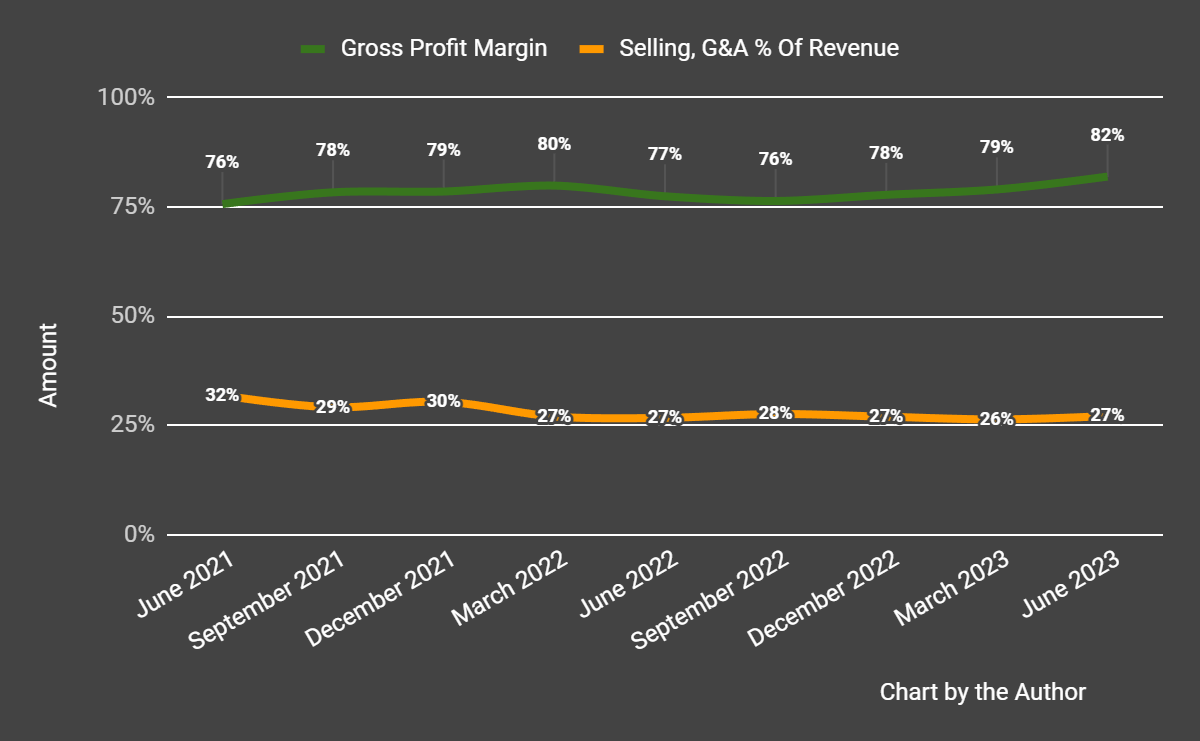

Gross profit margin by quarter has trended higher; Selling, G&A expenses as a percentage of total revenue by quarter have trended slightly lower in recent quarters.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

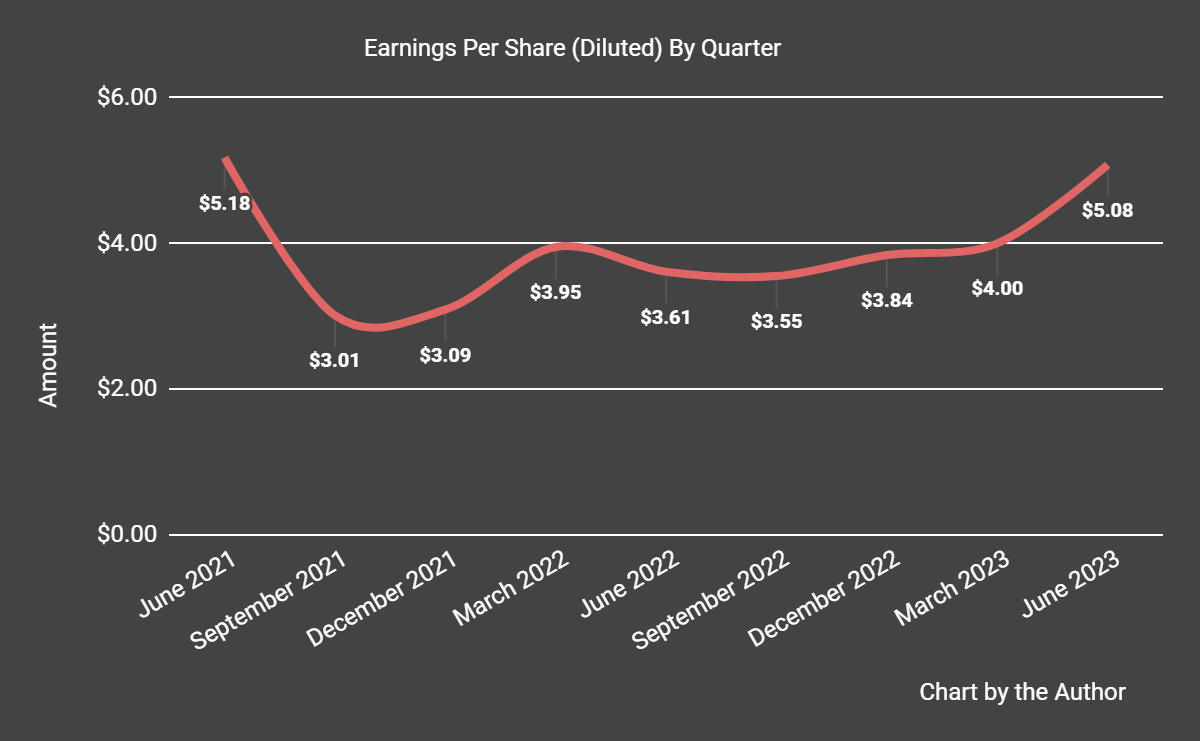

Earnings per share (Diluted) have grown substantially in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

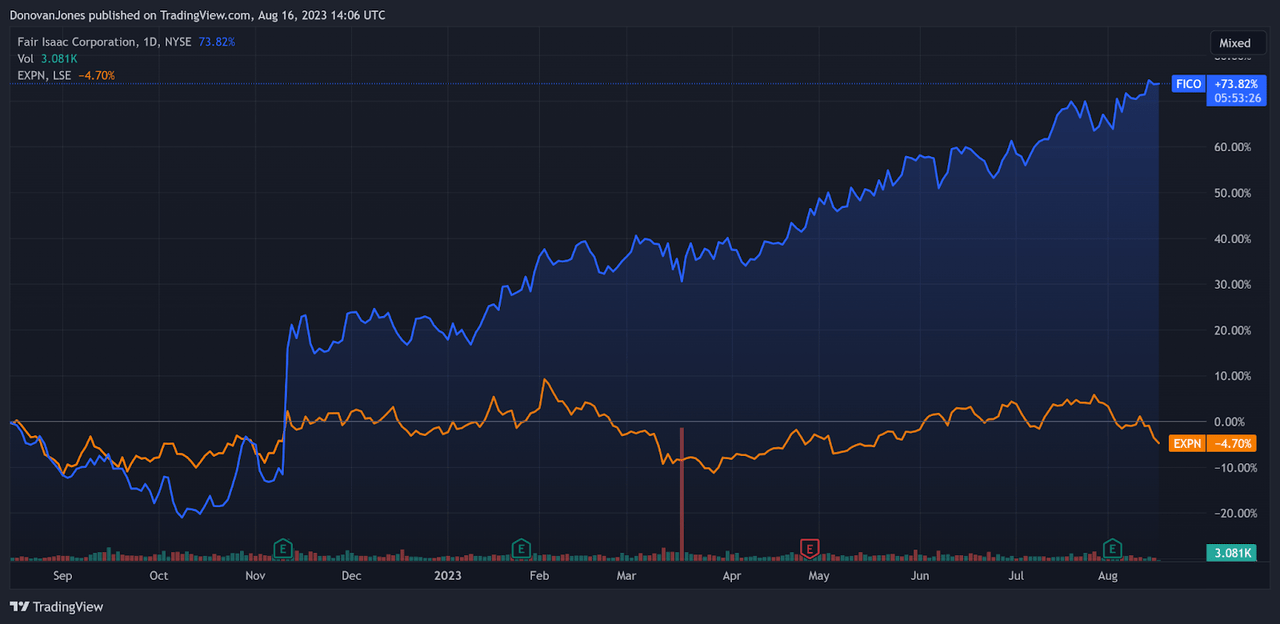

In the past 12 months, FICO’s stock price has risen 73.82% vs. that of Experian plc’s (EXPGF) fall of 4.7%, as the chart indicates below:

52-Week Stock Price Comparison (TradingView)

For the balance sheet, the firm ended the quarter with $163.0 million in cash and equivalents and $1.93 billion in total debt, of which $115.0 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $439.6 million, during which capital expenditures were only $10.1 million. The company paid $118.7 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Fair Isaac

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 16.0 |

Enterprise Value / EBITDA | 37.7 |

Price / Sales | 14.9 |

Revenue Growth Rate | 8.0% |

Net Income Margin | 28.4% |

EBITDA % | 43.5% |

Market Capitalization | $21,770,000,000 |

Enterprise Value | $23,580,000,000 |

Operating Cash Flow | $449,690,000 |

Earnings Per Share (Fully Diluted) | $16.47 |

(Source - Seeking Alpha.)

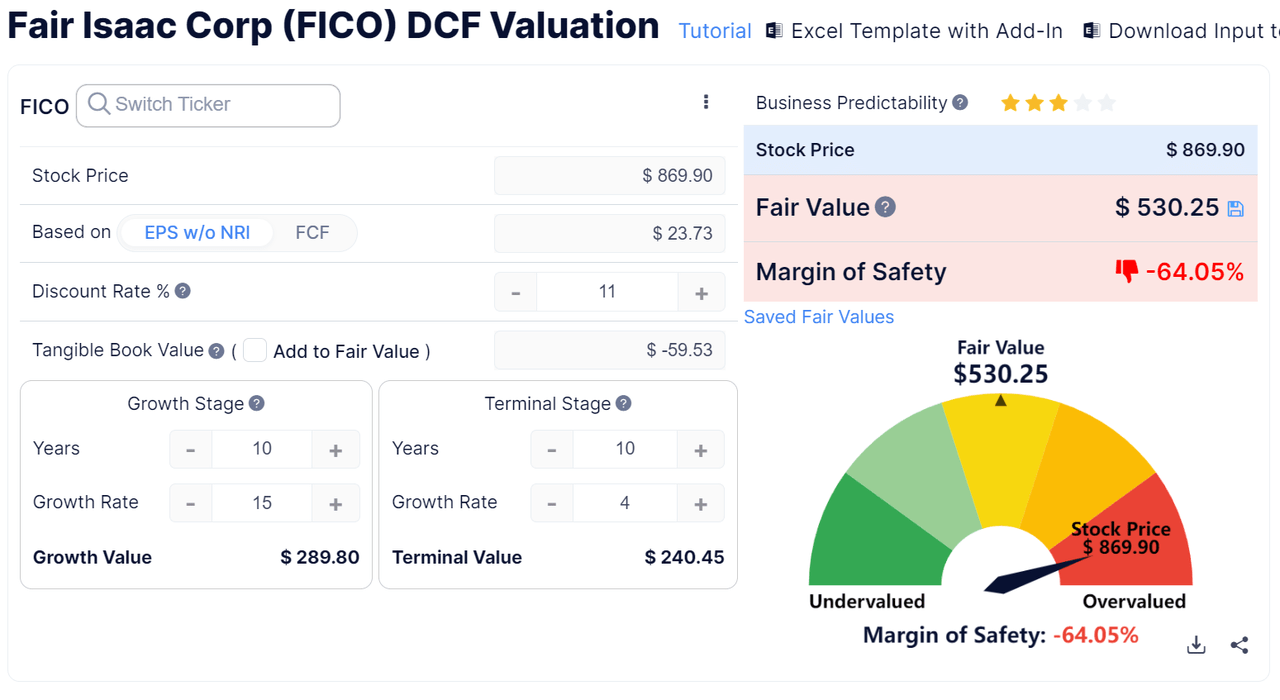

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation - FICO (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $530.25 versus the current price of $869.90, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be Experian (EXPGY); shown below is a comparison of their primary valuation metrics:

Metric [TTM] | Experian | Fair Isaac Corporation | Variance |

Enterprise Value / Sales | 5.7 | 16.0 | 183.4% |

Enterprise Value / EBITDA | 20.1 | 37.7 | 88.0% |

Revenue Growth Rate | 5.3% | 8.0% | 52.7% |

Net Income Margin | 11.6% | 28.4% | 144.5% |

Operating Cash Flow | $1,720,000,000 | $449,690,000 | -73.9% |

(Source - Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

FICO’s most recent unadjusted Rule of 40 calculation was 51.5% as of FQ3 2023’s results, so the firm has performed very well in this regard, per the table below:

Rule of 40 Performance (Unadjusted) | FQ3 2022 | FQ3 2023 |

Revenue Growth % | 0.50% | 8.0% |

EBITDA % | 40.5% | 43.5% |

Total | 41.0% | 51.5% |

(Source - Seeking Alpha.)

Commentary On Fair Isaac

In its last earnings call (Source - Seeking Alpha), covering FQ3 2023’s results, management highlighted growth in its annual contract value bookings of 13% year-over-year.

Various B2B loan originations revenue rose markedly, with mortgage originations up 135% YoY and auto originations up 5%.

Its FICO Platform continues to grow remarkably, growing by 53% and notching its "15th straight quarter of platform ARR (Annual Recurring Revenue) growth in excess of 40%.”

The Platform combines AI and analytics to improve credit scoring and business decision-making for customers.

The company’s overall net revenue retention rate was 117%, indicating solid product/market fit and a well-executed land & expand sales & marketing effort.

Total revenue for FQ3 2023 rose by 14.2% year-over-year and gross profit margin improved by 4.5%.

Selling, G&A expenses as a percentage of revenue dropped by 0.4% YoY while operating profit increased by an impressive 25.9%.

The company's financial position is moderate, with some liquidity against nearly $2 billion in total debt but very strong free cash flow generation.

FICO’s Rule of 40 performance has been high and rising.

According to consensus estimates, fiscal 2023’s revenue is expected to grow by 9.6%.

If achieved, this would represent an increase in revenue growth versus fiscal 2022’s growth rate of 4.6% over fiscal 2021, showing an expected accelerating revenue growth rate.

Analysts questioned company leadership about pricing for its various segments and management has been able to pass through CPI level price increases to customers.

Also, the company is seeing shorter pipeline and sales cycles, a positive signal that many other software or services companies are not experiencing.

Regarding valuation, my discounted cash flow calculation, with very generous earnings and growth assumptions, indicates that the stock is potentially quite overvalued.

While the firm’s fundamentals are strong, a drop in origination revenue due to higher for longer interest rates would likely cause a reduction in operating results, putting a damper on the company's growth story and valuation.

A potential upside for the stock could include continued strong adoption of its FICO Platform as companies seek AI-enhanced insights into their customers and creditworthiness.

However, I’m cautious about its high market valuation and the potential for a slowdown in origination revenue growth, so I remain Neutral [Hold] on Fair Isaac Corporation for the near term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)