AMD: On The Verge Of A Bear

Summary

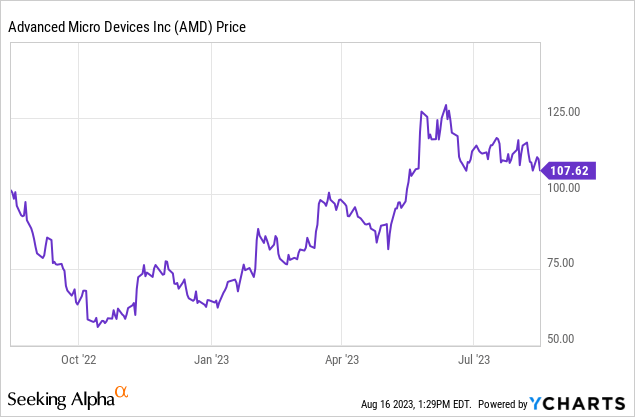

- Advanced Micro Devices, Inc. stock has declined 19% since its peak in June, and is about to enter a textbook bear period.

- A trade can be executed with target entry points that allow you to scale in.

- AMD's Q2 performance showed mixed results, with declining revenues and operating income, but margins have bottomed out.

- Looking for more investing ideas like this one? Get them exclusively at BAD BEAT Investing. Learn More »

Ryan McVay/DigitalVision via Getty Images

Advanced Micro Devices, Inc. (NASDAQ:AMD) stock has given up 19% of its value since peaking in June of this year at $132.83. Make no mistake, the chip sector, and tech more broadly, has been under pressure for a few weeks. After a massive run higher, we are in the middle of a correction.

But AMD stock is at a crossroads here. The so-called 20% decline in a stock marks it entering a bear market. But it does not mean you have to bail on shares, or go net short. Shorts have made some money here, and may continue to do so in coming weeks. We are in a seasonally weak period, and as our members know, we have been preparing for a sizable correction since the start of summer. We rallied a bit market-wise in July, but have been in a downtrend the last few weeks.

So what to do with AMD? We believe a trade can be executed here, but it will require a touch of patience in coming weeks as the stock consolidates further. Here is how we suggest playing it:

The play

Target entry 1: $106-$107 (25% of position).

Target entry 2: $101-$102 (35% of position).

Target entry 3: $96-$97 (40% of position).

Stop loss: $88.

Target exit: $118.

Options consideration: Option considerations are reserved for members of our investing group, but there are a number of call and put options/spreads that can be considered here.

Note: This trade is an example of what members receive along with the research at our investing group.

Discussion

So we are looking to start scaling in for a medium-term trade. One question we receive often is "what happens if the stock rallies from your first buy?" Well this is a high quality problem. While we intend to build a position, sometimes the stock rallies from the initial buy. This simply means you made money. Albeit, less than if you bought all at once. But if you buy all at once, and shares fall to $101, then to $96 let's say, instead of legging in and having a more reasonable average around $101, where you would need just over a 5% move to be even, you would instead need a near 12% rally just to be even. We embrace scaling in.

With that said, the earnings performance in Q2 supports a buy on this large pull back, in our opinion. The future is bright.

Performance was strong in Q2, though sales decline as expected

The AMD Q2 earnings were overall strong. The headline results were above consensus. We think that operations have or are close to troughing, and that bodes well. The AI revolution is only a boon to operations, even if it will take many quarters to really ramp up here, as competition is further along and dominating market share, for now. That said, in Q2, revenue was $5.36 billion and actually decreased 18.2% year-over-year. Sequentially we were effectively flat from Q1. There was mixed performance in most segments from last year.

One item we watch closely is gross margins, and these have been under some pressure. AMD's GAAP gross margins were 46%, flat year-over-year, but rising from 44% in Q1. It was also up from Q4 2022's 43%, and up from Q3 2022's 42%. So, we are seeing progress here. Adjusted gross margins were, however, down to 50%. This was flat from the sequential quarter's 50%, and down from 54% a year ago. Margin pressure persists, but we still believe margins have bottomed out.

Operating income declines following a revenue decline

As the revenues and adjusted margins were down from last year, AMD saw an unsurprising decline in gross profit. The one negative we saw was that operating expenses were high, nearly flat on a GAAP basis from a year ago but rising on an adjusted basis. This led to operating income declines and is a short-term bearish point. It is rarely a good combination to have revenues decline but operating expenses increase. Labor costs, and other investments for growth are weighing near-term. We do see demand accelerating toward the end of the year into next year, barring a severe recession, and AI engagements are increasing.

AMD Chair and CEO Dr. Lisa Su stated:

"Our AI engagements increased by more than seven times in the quarter as multiple customers initiated or expanded programs supporting future deployments of Instinct accelerators at scale. We made strong progress meeting key hardware and software milestones to address the growing customer pull for our data center AI solutions and are on track to launch and ramp production of MI300 accelerators in the fourth quarter."

We view this commentary positively. Of course, operating income, and earnings, were hit hard. In Q2, AMD's operating income, as adjusted, fell and was $1.07 billion, or down 46% from $1.98 billion a year ago. We would prefer more focus on controlling operating expenses in an environment where sales are declining.

Putting it altogether, AMD's net income fell to under $1 billion again, hitting $948 million from a year ago. Earnings per share fell, however, to $0.58 vs. $1.05 last year, but did beat by $0.01. We believe this is the bottom for earnings near-term. The company has a great balance sheet, and issued a positive outlook in our estimation.

AMD has a strong balance sheet

The AMD balance sheet is quite healthy. At the end of Q2, cash was $3.8 billion. Cash from operations was $379 million compared to $1.03 billion a year ago, while free cash flow was $254 million compared to $906 million a year ago. Free cash flow was also down from Q1's $328 million. Total debt stood at $2.46 billion, so net cash is a very strong $1.3 billion.

Outlook

So, our thesis is that we have seen a bottoming in performance and that AMD stock is revaluing lower on uncertainty and in a seasonal correction. As we look ahead, we still see ongoing weakness for PCs and client revenue. We continue to think that data center leads the way, along with gaming and then embedded revenue. On this selloff, we would look to see if repurchases are resumed in coming weeks.

For Q3, we believe AMD starts to see a performance ramp-up after the Q2 trough. That is our thesis here. AMD guided for revenue to be approximately $5.4-$6.0 billion, while gross margin will be around 51%, a notable improvement from Q2.

Our view for the year on revenues is $21.5-$24.5 billion. We see revenue strength ramping later this year, and into 2024. Assuming at least a 50% margin, and even roughly comparable capex and opex, we see EPS of $2.80-$3.00 for 2023 as likely. Assuming the midpoint, AMD shares are trading at about 37X FWD earnings. AMD stock is not cheap, but on a pullback below $100, this gets attractive once again and would encourage new money to re-enter. However, we think starting that position over $100 is acceptable, but scale in.

Take-home

Advanced Micro Devices, Inc. stock is on the verge of bear territory, but we want to get in down a good 20%. We expect market weakness continues in coming weeks in this seasonally weak period for stocks. Let the stock come down and do some buying for a trade.

Our members are thriving during this chaos, and you should be too

Stop wasting time and join the community of traders at BAD BEAT Investing.

- Access an expert team of 4 analysts, available all day during market hours.

- Rapid-return trade ideas each week with crystal clear target entries, profit levels, and stops, and we protect you on the downside

- Stocks, options, trades, dividends, and one-on-one attention

- Money-back guarantee

- Education, tools, and conversation

This article was written by

We've made several millionaires! We are VERY proud to have created thousands of WINNERS. We are the team behind the top performing investing group BAD BEAT Investing. Quad 7 Capital was founded in 2017 by a team that consists of a long time investor, health researcher, financial author, professor, professional cardplayer, and hedge fund analysts.

The BAD BEAT Investing service is a specialized carve out of Quad 7 Capital and launched in 2018. The service is run by a team of hedge fund analysts. This a top performing investing group service relative to market returns. It is focused on trading opportunistic inflections, and leveraging mispriced stocks and momentum driven events for rapid-return swing trades, options education, and long-term investments. We also teach investors how to hedge their portfolios. Further, it offers a direct access line to our traders all day during market hours and provides daily market commentary.

Quad 7 Capital as a whole has expertise in business, policy, economics, mathematics, game theory and the sciences. The company has experience with government, academia, and private industry, including investment banking, boutique trading firms, and hedge funds. We offer market opinion and analysis, and we cover a wide range of sectors and companies, with particular emphasis on news related items and analyses on growth companies, dividend stocks, banks/financials, industrials, mREITS, biotechnology/ pharmaceuticals, precious metals, and small-cap companies.

If you want to win, follow us, and if you want to make real money, sign up to BAD BEAT Investing today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Buy zone 2: $90 (200SMA)If momentum trader wait until pivot point of $115Fair value:Blended: $114.87

Margin of safety entry: $89.46

Long term exit/trim $155.67

The smartest thing would be to hold on rate hikes. If they do raise rates expect a recession in a hurry.

Amd definitely has a bigger chance of hitting $100 before it goes back up. Earnings are coming down and the rate hikes are just beginning to trickle down. The travel and spending bug inspired by the Covid imprisonment over the last few years are probably in their last legs.

But food and gas ain’t going down, definitely not with rate hikes. It just creates more cost for businesses and farmers.

Definitely would wait for Nvda to report earnings because if Nvda shoots up Amd will as well.