Telesat: Turning Around With Q2 Results, 1x EBITDA

Summary

- Telesat Corporation's Q2 results halted its share price decline, which had fallen roughly 70% in the past year and a half.

- Telesat's collaboration with MDA to build advanced satellites for the Telesat Lightspeed Low Earth Orbit program reduces capital expenditure estimates.

- Stock is priced at about 1x EBITDA. That's cheap.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

enot-poloskun/E+ via Getty Images

Investment Thesis

Telesat Corporation (NASDAQ:TSAT) is a Canadian satellite communications company that provides satellite-based communication solutions and services worldwide.

Its recent Q2 results last week were cheered by investors and put a firm stop to its share price consistent decline, which had fallen roughly 70% in the past year and a half.

This investment thesis is not blemish-free. There are ample reasons to be put off from investing in Telesat. However, I argue that paying around 1x EBITDA already compensates investors for a lot of negative considerations.

Why Telesat? Why Now?

Telesat's satellites provide coverage across various regions, enabling connectivity in remote and rural areas, maritime environments, aviation, and other industries that require reliable and widespread communication capabilities. Telesat plays a role in expanding global connectivity and supporting various sectors that rely on satellite-based communication solutions.

During the earnings call, we heard Telesat declare that by working with MDA Ltd. (OTCPK:MDALF) it will build 198 advanced satellites for the Telesat Lightspeed Low Earth Orbit (''LEO'') program. Furthermore, crucially, the way the deal is packaged it will now see up to US$2 billion being required as capex compared to Telesat's prior capital estimate.

Furthermore, Telesat received validation from the Federal Communications Commission (''FCC'') for C-band clearing. C-band clearing is like making room for new technology by rearranging radio frequencies. Telesat is adjusting its operations to free up space in the C-band spectrum for faster wireless services like 5G. This clearing market was an important milestone for Telesat that saw it recognize CAD$260 million.

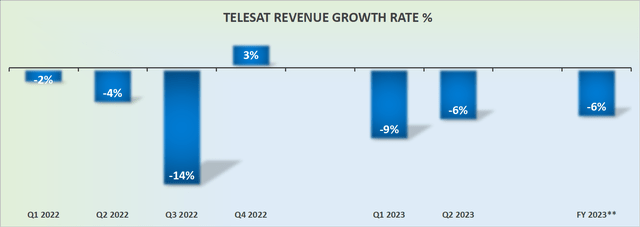

Revenue Growth Rates Are the Bear Case

Putting aside the excitement over its new endeavor, the Telesat Lightspeed program, this wasn't enough to change its guidance for the full year 2023.

Indeed, since the start of 2023, Telesat has consistently declared that this year it would see its revenue growth rates decline by 6% y/y.

However, one weighs up Telesat, the fact of the matter is that this investment thesis is not a growth opportunity.

Profitability Profile Discussed

Before discussing Telesat's profitability, let's discuss its balance sheet. Telesat holds about approximately CAD$1.6 billion of net debt. Indeed, the company has succeeded in taking advantage of the fact that its debt has been priced at a distressed valuation in the debt market to actively repurchase a portion of its debt during Q2.

Case in point: during the quarter, Telesat repurchased close to US$300 million worth of debt.

Next, onto its profitability. Telesat's EBITDA this year points to around $515 million. This is a figure that management will undoubtedly seek to beat. Perhaps the full year 2023 will see its EBITDA reaching $525 million. This means that in 2023, Telesat's EBITDA will have shrunk by around 8x y/y.

On the other hand, keep in mind that Telesat is only priced at around 1x this year's EBITDA.

Yes, Telesat's balance sheet is far from pristine. Yes, Telesat's legacy revenues are dragging down its overall revenue growth rates into negative territory. But at 1x EBITDA, I'm inclined to believe that a lot of bad news is already priced in.

The Bottom Line

Telesat Corporation caught my attention with its recent Q2 results, marking a turnaround from its steep share price decline over the past year and a half.

Although there are valid reasons for hesitation, the fact that the stock is trading at approximately 1x EBITDA seems to offset several of these concerns.

Telesat's collaboration with MDA to build advanced satellites for the Telesat Lightspeed Low Earth Orbit program is a promising move, particularly as it reduces their capital expenditure estimates.

Moreover, the FCC's approval for C-band clearing demonstrates progress in adjusting their operations for faster wireless services like 5G.

Despite projecting a 6% y/y decline in revenue growth rates for 2023, the valuation of around 1x EBITDA indicates that much of the negativity is already priced in.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.