IBM: One Stop Artificial Intelligence Shop For Global Business

Summary

- Artificial Intelligence is a hot trend, but investors should focus on companies with near-term profit potential and those that will benefit from the hype.

- IBM is well-positioned to help companies implement their AI strategies and capitalize on the AI trend, with a track record and expertise in the field.

- IBM's WatsonX offering provides comprehensive solutions for companies to develop cohesive AI strategies, making it a key player in the AI revolution.

Tim Boyle

Obvious prospects for physical growth in a business do not translate into obvious profits for investors. The experts do not have dependable ways of selecting and concentrating on the most promising companies in the most promising industries.

- Benjamin Graham, The Intelligent Investor

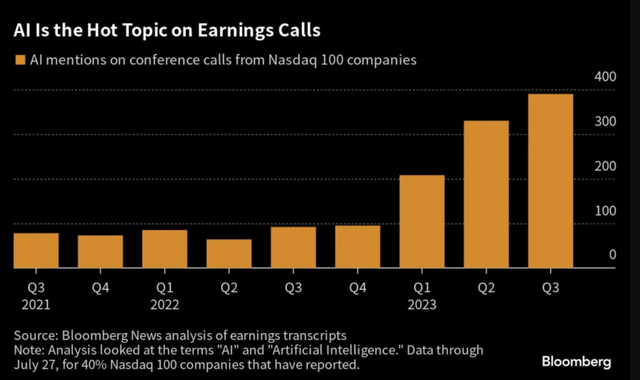

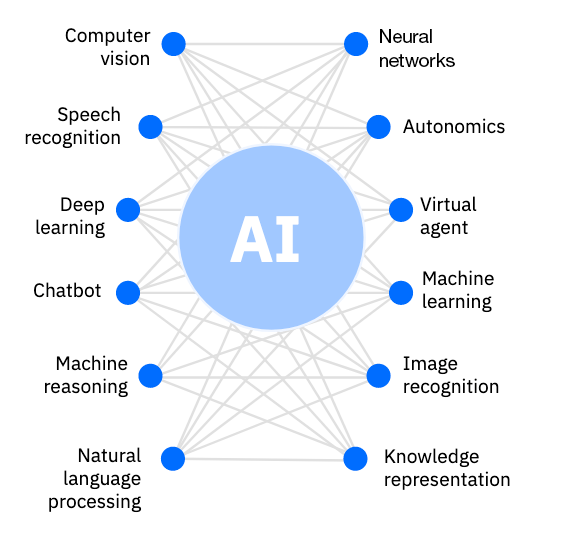

Artificial Intelligence has made a dramatic entrance into markets and our imaginations in the past year. The hype has begun, and thus it's essential to focus on the companies with good near-term prospects for making money from the trend, not unproven pipe dreams. Not only that, if possible, it's best to pick companies that will make money from the hype itself.

I want to own a company that will help other companies implement their AI strategy. I think discerning investors will make money and stay ahead of the crowd, while the less astute will chase the hottest trend. Furthermore, while the Internet revolution favored smaller companies with few assets, I suspect artificial intelligence will favor more established companies with a lot of data.

When thematically investing in an emerging technological trend, I think it is essential to understand the technology with a particular eye on how it can be commercially applied. This led me to International Business Machine Corp. (NYSE:IBM); it has a platform that will be most useful to companies scrambling for an AI strategy. It will capitalize on the hype itself.

The dazzling aspects and breakthroughs will distract folks, and the herd of today's winners will be culled more and more as time progresses. But IBM will be charging companies to implement a better AI strategy than they otherwise would for the foreseeable future in my view, regardless of who is leading the technological pack.

What attracts me to AI is that IBM is somewhat of a Mecca for global business regarding AI. Its consulting and software businesses rely heavily on it, and infrastructure provides tangential benefits. Furthermore, the social pushback and governance issues with AI are just beginning to surface, and IBM's practice in this area is world-class.

IBM Valuation

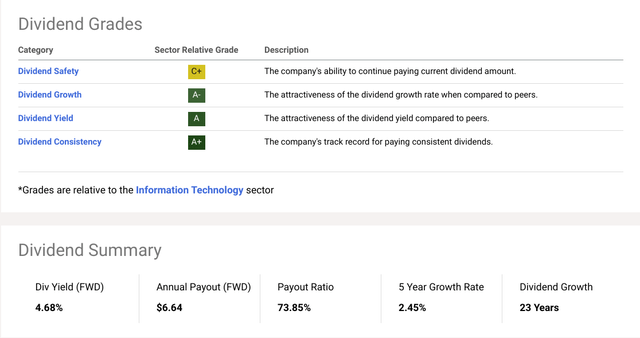

You don't usually think of dividend aristocrats when you think of hot new technology trends, but this mature company has more experience in AI than any other company. Importantly, it has some high-profile failures that I'm betting its folks have learned from. Furthermore, the dividend adds an excellent reason to hold this stock to benefit from compounding.

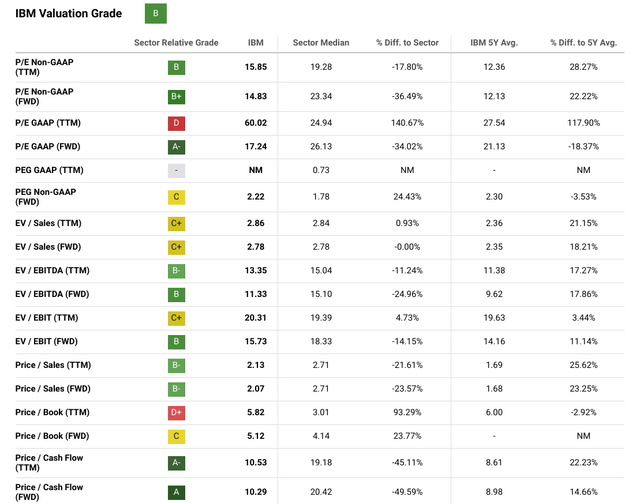

And, of course, the high dividend yield is a nice margin of safety to have, mainly when investing in a disruptive technological trend. It's important to remember that dividends are crucial to beating the market long-term, even (or maybe primarily) when investing in the coolest new thing. IBM is overvalued by many intrinsic metrics, mainly because growth has slowed as the company has matured.

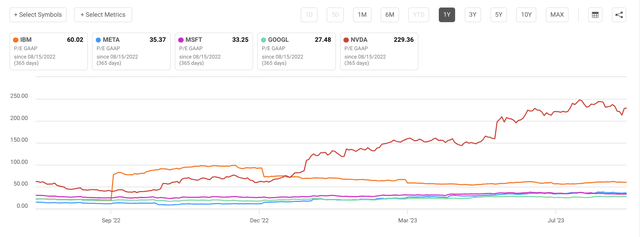

On a relative valuation basis, when you consider the inherent AI potential of this firm, it looks more attractive. Though this company doesn't have the attention of the crowd that leaders like Nvidia (NVDA) and Alphabet (GOOG) (GOOGL) have, it also comes at a diminished valuation because of this fact. Yet, it likely has a much higher proportion of its current earnings derived from AI business than Magnificent Seven Tech darlings that have the biggest lead in AI.

Price to Sales (Seeking Alpha)

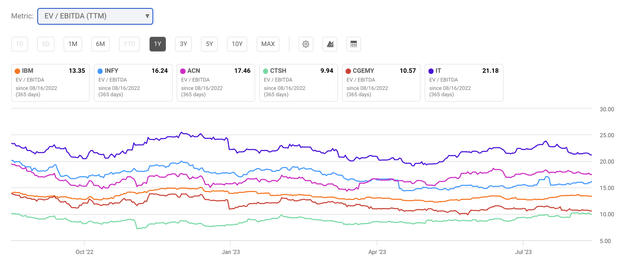

Further comparisons with more direct peers along EV/EBITDA find that IBM is surprisingly cheap. So, when you go beyond the P/E ratio on IBM, you find that some measures attractively value it despite the slow growth profile of a mature company. But, again, that is something its impressive efforts in AI could reverse.

When you measure with P/E, the firm is overvalued compared to its peers. The dividend helps compensate for this overvaluation, but I'm mainly willing to buy this firm because of the AI upside.

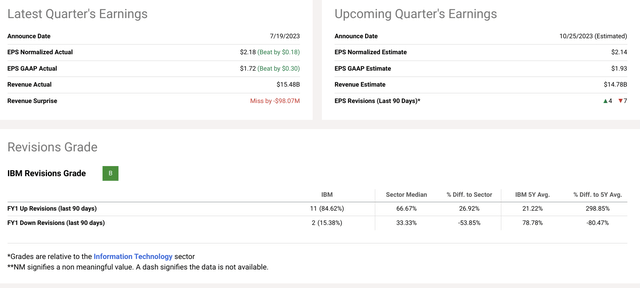

The price/sales valuation is also significant because I think it is safe to say (though impossible to prove) that a much more significant proportion of IBM's current sales have to do with AI compared to Big Tech, as awe-inspiring as some of their achievements are. IBM's earnings prospects are improving, and it is on an upswing regarding revisions.

Ultimately, when considering what stocks you want to own for the long term, I think cash flow should always be a valuation. It also cuts through some of the accounting irregularities that can occur with other methods. On some of the more meaningful valuation measures, IBM stands out compared to peers.

Price/Cashflow (Seeking Alpha)

Therefore, despite a mixed valuation picture for IBM, I still think the stock is a buy. There is no denying it is an AI-maven, and given recent failures and its status as a very mature company, it may be able to outperform expectations and experience significant multiple expansions.

The Technological Future of AI is Much Less Certain Than IBM's Place In It

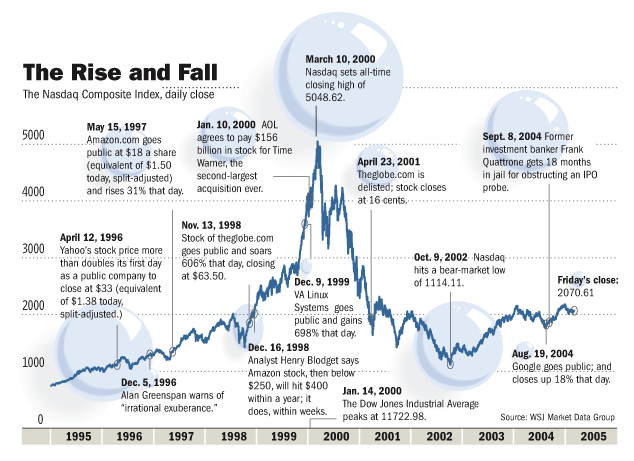

The only question in the mind of the froth-mouthed crowd seems to be whether AI will be more significant than fire or the Gutenberg Printing Press. Of course, the other principal question is whether it will destroy or save the human race. But sometimes technological revolutions are slow. For example, the consequences of gunpowder took centuries to play out and are continuing to evolve at this very moment.

Now I'm not wholly discounting the enthusiasm by any means. AI is indeed a profound technology that's making a real difference commercially. And while we are likely at the beginning of a bubble, I think we are in the earlier stages. I concur with analyst Dan Ives that it's more like 1995 than 1999.

Global Entrepreneurship Institute

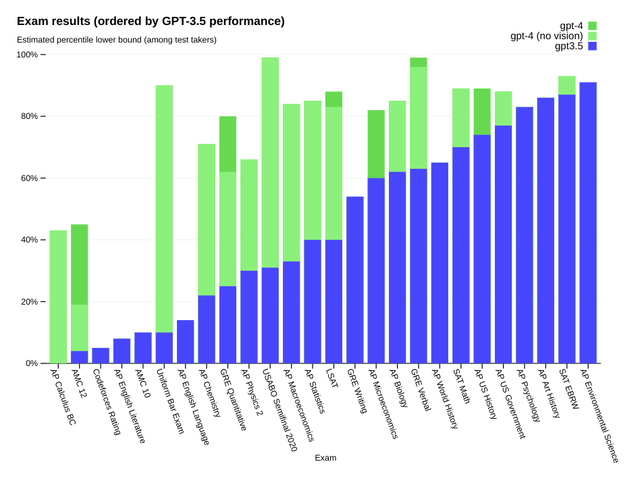

Though AI is promising, it is also widely misunderstood: enthusiastic managers are trying to show conscientiousness by starting AI initiatives, and investors and analysts are trying to assess their commercial worthiness. And some companies are making real money and breathtaking advances, like Microsoft's unveiling of Chat GPT.

And the progress seems as fast as the functionality is breathtaking, to be sure. And I do believe Microsoft has a killer AI strategy that will be able to be monetized a lot more quickly than some realize. Nonetheless, AI is a massive umbrella that covers a lot of technology. And there's some reason to believe the Large Language Models at the heart of ChatGPT's success may be nearing a plateau of their commercial usefulness. Furthermore, significant obstacles like recent publishing issues are emerging.

As OpenAI CEO Sam Altman says, "I think we're at the end of the era where it's going to be there, like, giant, giant models. We'll make them better in different ways." In my estimation, this is a trustworthy source on AI, and if he is saying it is true, then this development favors IBM. The firm specializes in smaller models for specific industries and tasks, like Chemistry.

So IBM is using the LLM technology that everyone's hot on. Still, it can also pair it with even more sophisticated functionality it has built out over the decades for a more comprehensive solution to business than any other firm can likely offer. And it has these solutions across multiple industries and specialties.

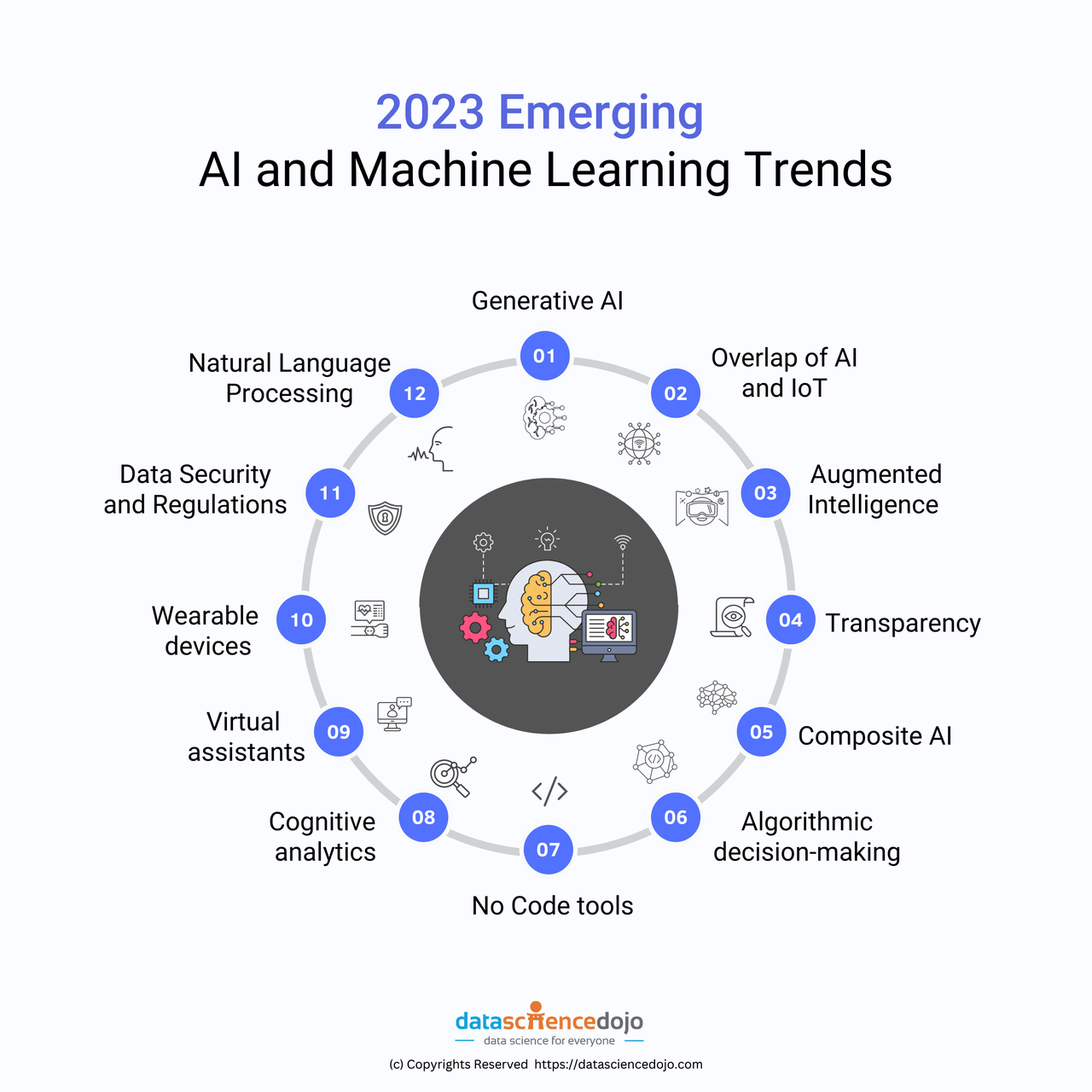

Data Science Dojo

So, AI is a giant sandbox. But importantly, IBM is not selling an LLM-enhanced product suite like Microsoft is. It sells an entire out-of-the-box solution to businesses. So, when a business gets questions from shareholders and board members about its AI strategy, the manager doesn't have one; the odds are that IBM will be on their shortlist of providers to call. IBM is perhaps the only true full-scope AI provider for large businesses with a demonstrable track record of success.

WatsonX: Big Businesses Picks and Shovels for the AI Revolution

Our mainframes have AI circuits-so is the mainframe business AI? I am going to do storage backup in the future with AI-is storage backup AI? Maintenance applications use AI. All of cybersecurity is going to use AI. Before the next five years are done, everything is going to have AI fused inside it.- Arvind Krishna, IBM CEO.

IBM has had some high-profile failures in AI. It has continued researching AI through several AI winters, making it crucial to its consulting and software segments. Some analysts chided IBM for not breaking out their AI revenue in more distinct ways. Still, the company has integrated AI into its core business so comprehensively that distinction has become impossible.

ChaiCharts![r/dataisbeautiful - [OC] IBM's 2023 "Six-Months Ended" Income Statement visualized with a Sankey Diagram](https://static.seekingalpha.com/uploads/2023/8/15/saupload_7mrj0vdmfqdb1.jpg)

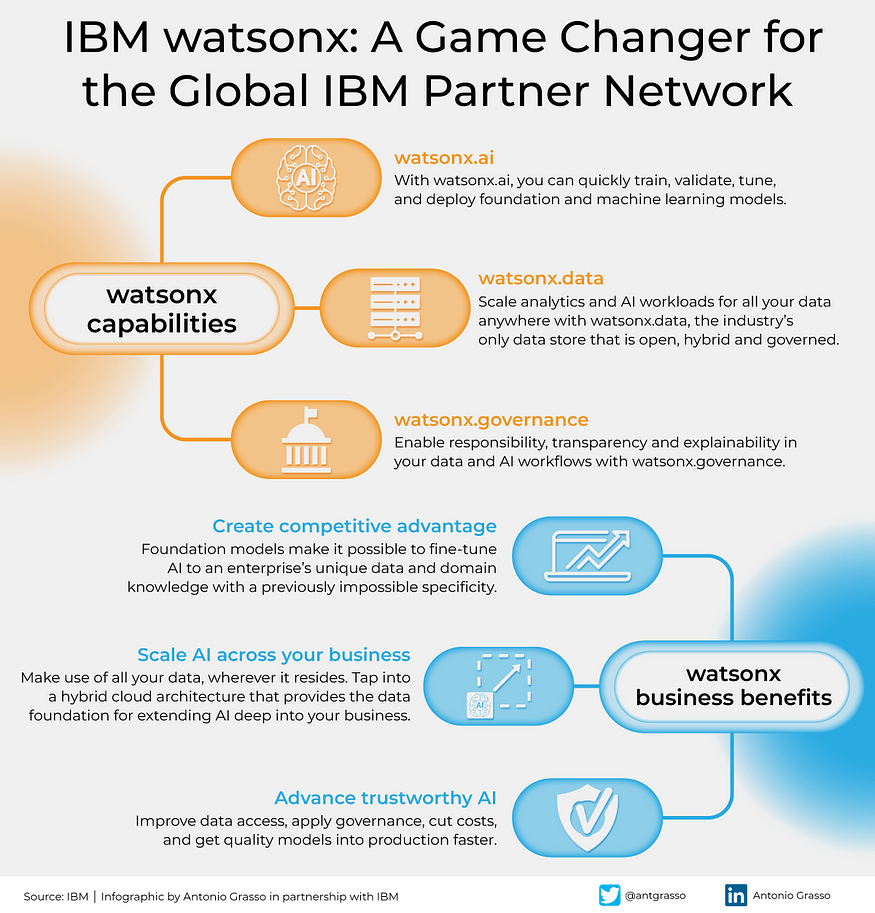

So, AI has been deeply integrated into IBM's whole corporate structure, but its new revamped Watson offering, WatsonX, is where I think there could be some upside that isn't currently priced into this cheaply priced AI maven. That is because Watson X is a comprehensive solution with three parts that helps companies set up cohesive AI strategies with the support of leading industry-specific tools and datasets.

IBM, Antonio Grasso

- Watson.AI - Assists customers in building AI models specific to their business and goals. Of course, with sparse AI talent, out-of-the-box solutions like the one provided by IBM help companies access the benefits of AI in a relatively capital-light fashion.

- Watson.Data - This segment helps firms with all of the data generation, collection, and curation needed to form the backbone of a successful AI strategy. The convergence of AI and data is significant since many highly regulated industries can benefit from AI. But they may be more comfortable doing so with the assistance of IBM's expertise.

- Watson.Governance - This segment helps companies monitor AI models' effectiveness, maintenance, and governance. Cognitive technology generally consists of data-intensive endeavors that can open a company to significant liability. Thus, having IBM as an additional safety layer is valuable to managers in more conservative industries with less direct technology know-how.

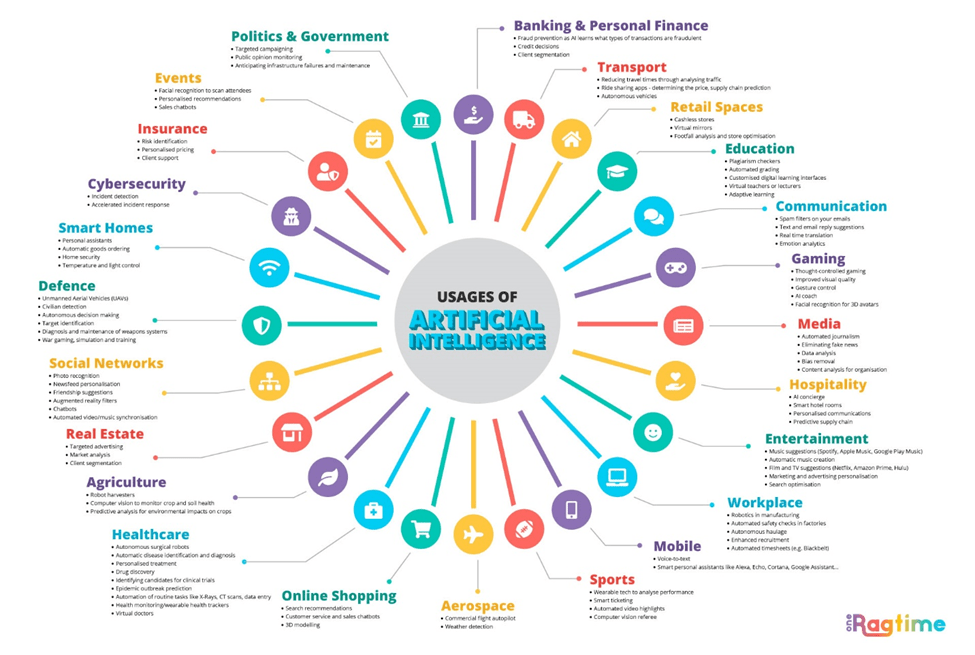

As you can see below, the potential for AI stretches across virtually the entire economy. However, the older and more established companies with decades-worth of data that can most benefit from the ongoing technological revolution are stodgy and old-fashioned. Sometimes, IBM can be described as that by critics.

OneRagTime.Com

However, in the emerging AI revolution, a helping hand of a familiar name will be the gateway so many firms need to unlock value. And of course, IBM will get its rightful piece, but what I like about IBM is that it can get a piece from so many different places. It's a pick's and shovel play to the AI revolution, and it can flourish despite the technological battles that will go on between other participants.

Risks and Where I Could Be Wrong

AI's record of barefaced public deception is unparalleled in the annals of academic study. - T. Rozak.

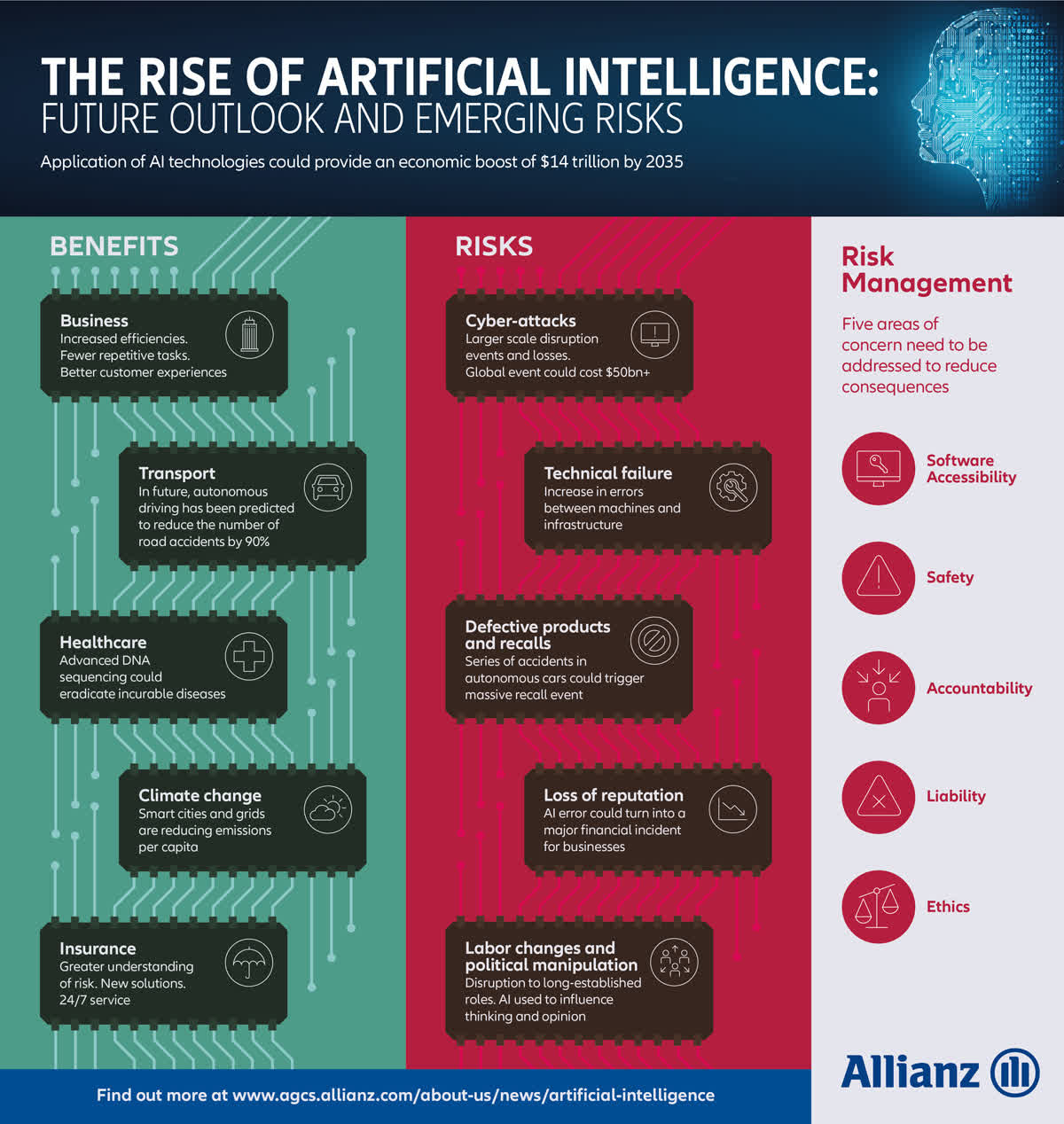

Artificial intelligence can be as confusing and deceitful as it can be promising and dazzling. There have been many instances of discoveries thought to be significant that were underwhelming upon closer examination. Furthermore, the public consciousness is particularly animated concerning AI. Few subjects have been thoroughly and disturbingly explored in cinema than the rise of malevolent AI. Though sentiments derived from these movies may lack a rational basis, they can still greatly influence public sentiment.

Allianz

In addition to the inherent risks with AI, which I think are mitigated by IBM's business diversified across multiple AI technologies, there are just the ordinary risks of being a mature company that IBM investors have fretted about for years. IBM has a lot of expensive employees, and it has a culture that has been described as old-fashioned and calcified by some.

Conclusion

AI is an exciting trend that will likely transform commerce as we know it. Gunpowder also transformed human government and society forever, but it took centuries. When we think of AI, we might think of the Terminator of Hal from 2001: A Space Odyssey, but today's AI is much more similar to future spreadsheets. The truth about AI is boring. It can be gleaned from this little anecdote about how NASA used AI.

It wasn't to design spaceships or new life support systems. They used some of the most basic AI functionalities, robotic process automation, to find efficiencies in basic human resources functions like IT spending and accounts payable.

IBM

The great thing about what IBM offers to businesses looking to take advantage of AI is that it has mastered these routine processes that can save real money and has access to much more advanced functionality. Notably, the company will take clients from knowing nothing about AI to giving them an industry-leading strategy. We cannot know what the future of AI holds, but I think that IBM has as durable and comprehensive an approach as any major company.

Editor's Note: This article was submitted as part of Seeking Alpha's Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition -- open to all contributors -- is one you don't want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)