Leidos: Hold On To This Undervalued Govt Contractor With Positive Earnings Growth

Summary

- Leidos gets a neutral/hold rating today, in line with the Seeking Alpha quant system rating.

- Positives: Valuation below sector average, capital strength, proven YoY earnings growth.

- Headwinds: Current share price vs moving average, dividend yield not competitive vs sector average.

JHVEPhoto/iStock Editorial via Getty Images

Research Brief

Leidos Holdings (NYSE:LDOS) has been added to my watchlist after my recent coverage of some of its peers in the national security/federal contracting space, particularly firms that are innovation-driven and have large pipelines of projects and work going on already.

It joins other contractors in my federal series of articles lately, including Booz Allen Hamilton (BAH), General Dynamics (GD), and L3Harris Technologies (LHX), to name a few.

This Reston Virginia-based firm recently had its Q2 earnings release on August 1st, so we will look at some of that data together today and determine if this stock is a buying opportunity right now or not.

Some notable points about this firm, from their website and brochure, and for readers unfamiliar with the company: Key business lines are civil, defense, health, and intelligence. Listed #274 on the Fortune 500 in 2021. 45K employees globally. 2022 revenue $14B. The defense solutions segment alone is worth $8.2B.

Rating Method

The goal is to find value-buying opportunities in the following sectors I focus on: Financials/banks/insurance, tech/innovation, and managed services (MSPs).

My 5-step approach is to break down the overall "holistic score" into 5 categories: Share price, dividends, valuation, earnings growth, and capital strength.

If I recommend this stock in at least 3 of these categories, it gets a hold rating, and if I recommend at least 4 out of 5 then it gets a buy rating.

Share Price: Not Recommended

Let's start this discussion by answering the question: is the current share price a buy opportunity right now or not?

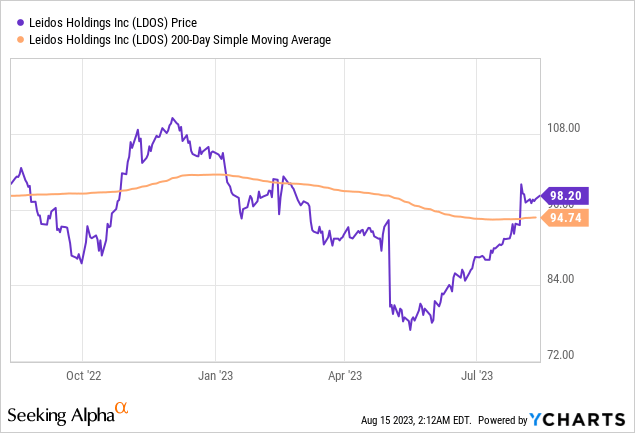

The first step is to see where the share price is right now. In the pre-market on August 15th, the latest price was $98.20, as of the writing of this article.

In the YCharts below, I am tracking the price vs the 200-day SMA of $94.74, which is used as a long-term trend indicator to avoid trying to "time" short-term movements.

The next step is to determine an investing timeframe, a target goal for return on capital, but also a target maximum paper loss I am willing to take. My holding timeframe is 1 year, to earn the full year dividend income, then to sell at a capital gain. This creates two potential tax events: capital gains income and dividend income.

Each investor will have different risk tolerance, but for simplicity let's say my goal is a +10% return on capital in 1 year, and my risk tolerance is a maximum negative return of -5% in 1 year.

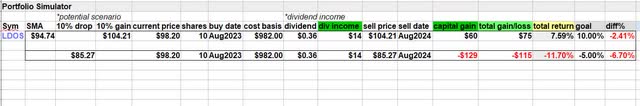

The following spreadsheet tests a scenario if the current 200-day average goes up by 10% in 1 year, but also if it drops by 10% in a year.

Leidos - trade simulator 1 (author spreadsheet)

In the scenario above, if I buy 10 shares at the current trending price of $98.20 and sell in a year at 10% above the current SMA, I will come up short on my goal for return on capital. At the same time, if I have to sell at 10% below the current SMA, the loss exceeds my risk tolerance by a lot. It would mean a negative return on capital of -11.70%.

Now, if you test the scenario at a lower buy price, like $91, in 1 year it would exceed my goal for return on capital, but also stay within my maximum loss tolerance as well.

Leidos - trade simulation 2 (author spreadsheet)

Hence, my target buy price for this stock is $91, which means I do not recommend the current trending price until it drops back to $91 or less.

The investing idea shown is simply a rough framework for thinking about potential risk/reward assuming the moving average will go one way or another in a year's time. Actual performance, of course, may vary.

Dividends: Not Recommended

If you read my articles here lately you know I am a dividend-oriented analyst always looking for hidden dividend gems or quick picks to recommend to the general reader. I cannot say I found that in this stock, however.

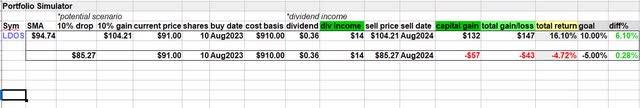

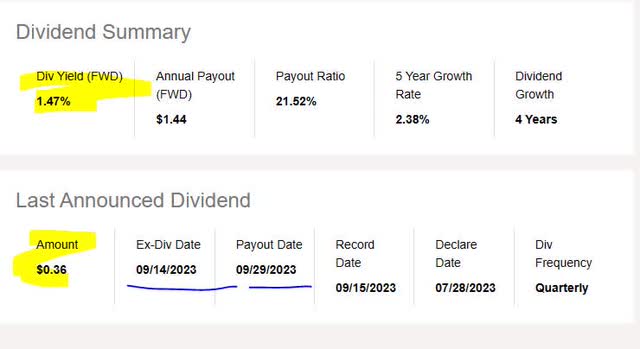

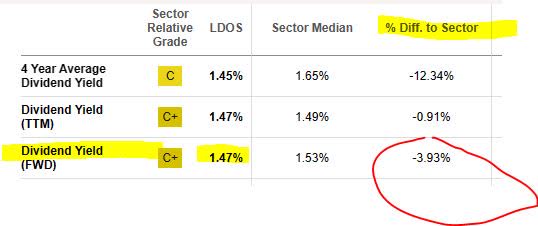

Its dividend yield as of Aug. 15th is a paltry 1.47%, according to official data, however the payout of $0.36 per share has an ex-date coming up in September for those wanting to take advantage:

Leidos - dividend yield (Seeking Alpha)

Disappointingly, the yield is almost 4% below the sector average, earning a "C+" grade from Seeking Alpha.

Leidos - dividend yield vs sector avg (Seeking Alpha)

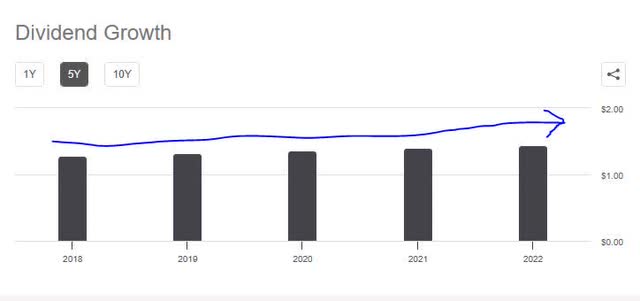

Additionally, a positive to mention is their positive 5-year dividend growth rate, although it is not a significant growth by any means.

Leidos - dividend 5 year growth (Seeking Alpha)

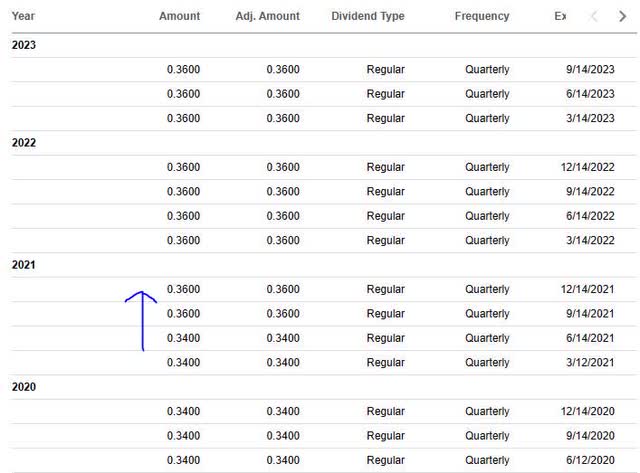

Their dividend payouts so far since 2020 appear to have been steady and without cuts, but for most of 2022 and 2023 the dividend has remained the same:

Leidos - dividend history (Seeking Alpha)

Now, in comparison to some peers in the federal contracting space, I think an investor can do better on dividend yield with some of those. For instance, the yield right now at L3Harris is 2.45%, while at General Dynamics you are looking at a dividend yield of 2.33%.

Again, we are comparing within a similar industry, as I usually do, because outside this sector you can find much higher yields with some bank and insurance stocks, for example, if that is your only goal.

When comparing to stocks within this industry, though, I don't think this firm is competitive against some of its peers on dividend yield.

Valuation: Recommend

In this rating category, I am looking for stocks that are reasonably or undervalued vs their industry average, when possible, or in line with their sector average but not incredibly higher.

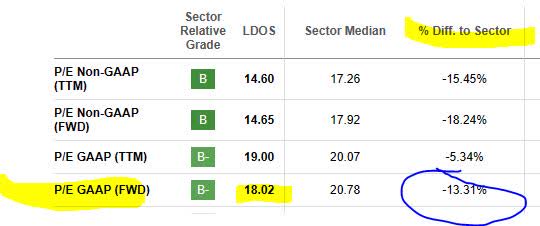

To rate this, I use the forward P/E ratio and forward P/B ratio, based on valuation data from Seeking Alpha.

With a P/E ratio of 18.02, as of Aug. 15th, this stock is an attractive valuation being that its price to earnings is over 13% less than the sector average which is hovering close to 21x earnings. I like it at the 18x to 20x range, and it even earned a grade of "B-" from Seeking Alpha.

Leidos - P/E Ratio (Seeking Alpha)

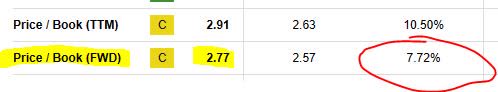

The price-to-book value is another story, although not a terrible one. With a forward P/B ratio of 2.77 today, it is almost 8% above its sector median which is closer to 2.6x book value.

I don't think it is a huge difference, and I am willing to go with a book value up to 8% above average, so long as the price to earnings looks good, which it does.

Leidos - P/B Ratio (Seeking Alpha)

To compare Leidos with another major federal contractor, Booz Allen Hamilton, that other firm has a forward price to earnings of 26.5x, considerably higher than Leidos as well as the sector average. Its trailing price to book value is also a lot higher.

So, I would recommend this stock in terms of its valuation metrics, and consider it a good undervaluation opportunity for my readers.

Earnings Growth: Recommend

This rating category looks for stocks that are showing longer-term improvement trends in their bottom line, an indicator that they are managing the top line and expenses efficiently. This company fits that bill, with a decent YoY net income growth from the same quarter a year ago:

Leidos - net income YoY growth (Seeking Alpha)

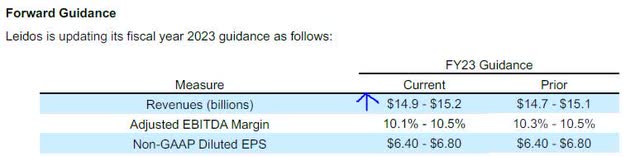

A positive note to mention is that from a top-line perspective, the company has increased its forward revenue guidance for the year:

Leidos - forward guidance (Leidos - quarterly earnings release)

It is important to say something about the nature of this type of business and the role that government contract awards play in the financial outlook for this firm. Often, contracts are signed for a multi-year or longer-term program/project, and some of those that Leidos has received lately can speak to the level of work in their pipeline going forward.

According to their Q2 release, some notable contract awards include:

A $428MM prime contract to test prototypes for US Army, a $197MM contract with Medicare for compliance support work, a $105MM contract with Royal Saudi Air Force, and a Defense Information Systems Agency contract worth $69MM to do enterprise IT solutions work.

I think this and other work will keep their pipeline full for quite some time, as with its peers in this space too.

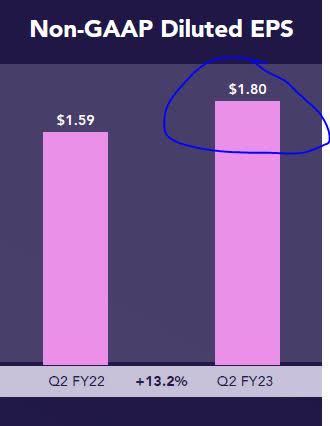

It is worth mentioning that the earnings per share saw a 13% YoY increase as well, on a non-GAAP diluted basis:

Leidos - EPS growth (Leidos - quarterly presentation)

What I see in this firm is a revenue powerhouse with a healthy bottom line, a positive earnings growth trend, and forward-looking growth potential. So today it is a recommend in this category.

Capital Strength: Recommend

I will be looking at a few fundamental financial metrics and grouping them into the category of "capital strength" for simplicity.

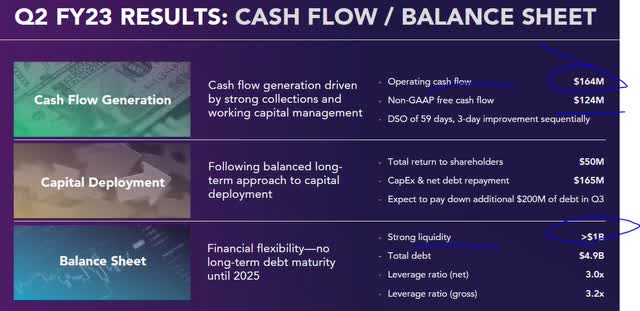

For starters, take a look at the following graphic from their recent 2023 Q2 presentation:

Leidos - capital strength - 1 (Leidos - Q2 presentation)

What interests me is their very strong cashflow positions, with $124MM in free cash flow, as well as over $1B in liquidity, and a commitment to return capital back to shareholders.

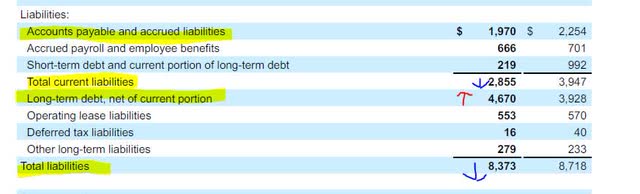

These are all positive tailwinds I think. One thing to keep an eye on, I think, is also their level of debt.. and it seems they are near $5B in total debt!

However, despite their long-term debt going up YoY, as the table below shows, their total liabilities have decreased YoY.

Leidos - liabilities (Leidos - quarterly earnings release)

I think this firm has the adequate capital strength to continue going forward, and so I would recommend on this category without hesitation.

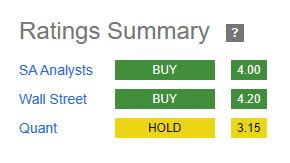

Rating: Neutral/Hold

Today, this stock won in 3 of my 5 rating categories, earning it a "hold" rating. This is in line with the consensus from the Seeking Alpha quant system which also rated it hold, however is more neutral than the bullish consensus from Wall Street and analysts which rated it "buy", as shown below.

Leidos - ratings consensus (Seeking Alpha)

A hold rating can also be a positive, depending on when you entered this stock. If you bought during the April price dip and held until now, you already have an unrealized gain on your hands.

My hold rating assumes the stock price going forward will not drop significantly back to that spring dip anytime soon, but also does not currently present a great buying opportunity in my opinion.

I don't think a "sell" rating is warranted either just yet, as there may be money getting left on the table then.

Risk to My Outlook: Govt Shutdown

A risk to my neutral/hold outlook would be another government shutdown, if it occurs, and if it lasts for an extended period. This could make my rating overly optimistic on both this stock and its sector, since they can take a funding hit if appropriations get frozen, and investors may scramble to get out of these stocks ahead of time.

During the last federal shutdown in 2019, there was an article in NBC News highlighting how the Antideficiency Act usually prevents federal agencies spending money that was not appropriated by Congressional authority.

This not only may affect furloughed federal employees but also certain contractors and their employing companies, and we already established that Leidos is a major federal contracting company.

Consider the impact to such companies:

The companies themselves face their own hardships. Generally, if under our contract we can't work during a shutdown, we're not going to get reimbursed for the expenses we incurred, including salaries, for those individuals.

However, government contracts don't typically provide for time to restart after a shutdown. When the agency reopens its doors, the contractors must begin immediately. So, the companies cannot afford to lay off people and hope they will remain available in a tight labor market where they have more options.

The result is that companies spend when limited revenue is coming in, causing cash flow problems.

The positive news is that it appears some headway is being achieved to prevent the next shutdown ahead of time.

According to an Aug. 15th article in Roll Call:

House Republicans are planning to take up a short-term stopgap funding measure next month to avoid a partial government shutdown, Speaker Kevin McCarthy, R-Calif., told members of his conference during a Monday night call, sources familiar with the conversation said.

The continuing resolution is expected to extend current funding until early December, giving lawmakers a few extra months past the Sept. 30 deadline to complete fiscal 2024 appropriations.

Hence, I think this company and its peers in this sector can sleep more easily at night, for the time being, and this risk.. although a worthy one.. is not one to be imminently concerned about.

Analysis Wrapup

Here are the key points we went over today:

Today this stock got rated a hold, in line with the rating from the Seeking Alpha quant system.

Positives: Capital strength, earnings YoY growth, valuation lower than sector average.

Headwinds: Share price vs 200-day average, dividend yield below sector average.

Concluding Thoughts

This is the latest equity I have covered in this sector, and the common running theme across these companies seems to be... "innovation".

It is not an argument for or against the defense industry, as it is clear these firms are knee-deep in areas beyond just the military. And that is the real value driver, I think, is the innovation they can provide to segments like homeland security, public health, and critical civil infrastructure.

Just imagine the sheer amount of land, air, and sea borders the US federal government is by law charged with keeping an eye on.. which also includes rescues at sea and catching smugglers. Beyond that, there is the threat of cyber-attacks, which do not recognize borders at all! Having been in the IT sector, I know firsthand how every enterprise is always a potential cyber-attack target, some more than others.

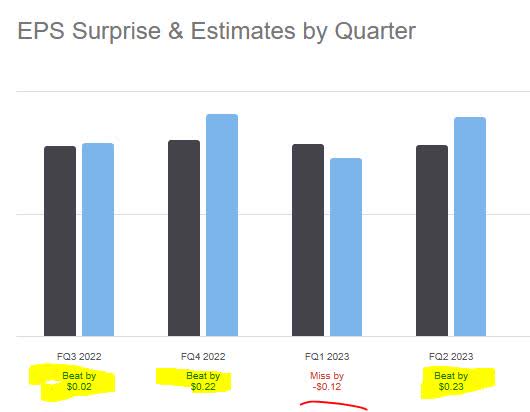

With that said, although I am currently on hold and neutral about this stock being a buy opportunity, I remain positive that they likely could beat their next earnings estimates, as they have done in three of the last four quarters. So, I will go ahead and call it.. for Q3, I predict a 75% likelihood of an earnings beat of around $0.09.

Leidos - earnings beats (Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.