Air Products and Chemicals: It Doesn't Get Much Better Than This

Summary

- Air Products and Chemicals continues to impress with strong earnings growth and a history of dividend increases.

- The company has experienced sustained volume improvement and increased hydrogen demand, contributing to its growth.

- APD's two-pillar strategy and commitment to advancing blue and green hydrogen projects position it for future success.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

vovashevchuk

Introduction

As most readers know, I have a somewhat negative view of the economy. I've warned of slower growth since last year, I'm in the sticky inflation camp, and I believe that the Fed will have to keep rates higher for longer.

It's also why I mainly invest after corrections. I have zero shorts, as I've become a long-only investor.

Having said that, economic growth is declining steadily. The ISM Manufacturing Index has been in contraction for nine straight months.

Bloomberg

In Europe, the situation is worse, as energy prices are even higher and deindustrialization is threatening jobs (secular headwinds).

On top of that, China is now showing serious cracks.

Below is an overview of the most recent headlines that highlight elevated (and further rising) youth unemployment, serious real estate problems, and the related risks of missing growth targets.

Google News

Despite the gloom and doom, one company continues to impress. Air Products and Chemicals (NYSE:APD) continues to do well. It benefits from both volume and pricing gains and successful progress in major projects like hydrogen facilities.

In this article, we'll discuss the latest developments and assess the risk/reward of this company at current prices.

So, let's dive in!

Impressive 3Q23 Results

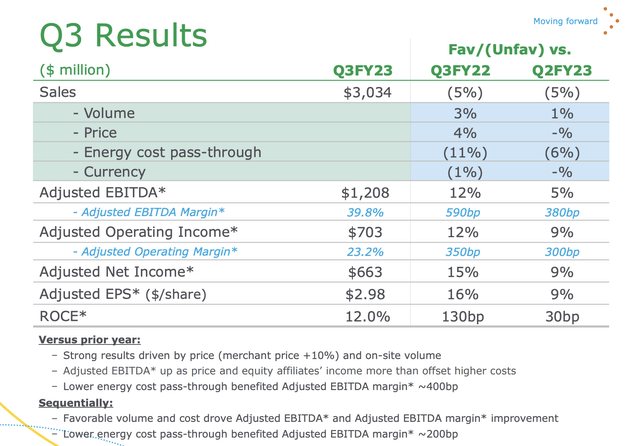

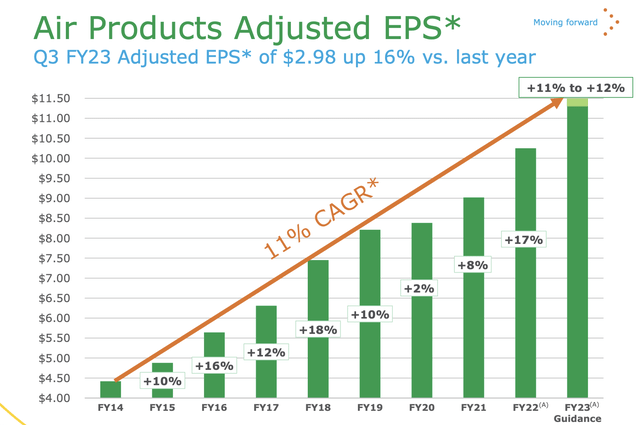

The third quarter was an excellent quarter, as the company reported adjusted earnings of $2.98 per share, which marks a 16% increase compared to the previous year and beat the top end of its guidance for the quarter.

Air Products & Chemicals

The company's strong pricing power and sustained volume improvement over the past nine quarters have contributed positively to its growth.

Additionally, the company has experienced increased hydrogen demand in the Americas and successfully integrated over 30 new assets.

Having said that, the company saw a 3% increase in volume, primarily driven by the on-site business. Merchant prices saw a remarkable 10% rise, marking the seventh consecutive quarter of double-digit price increases.

Positive pricing was observed across all regions. The decline in natural gas costs in Europe and the Americas led to an 11% decrease in sales, positively impacting margins without affecting profits.

- The Americas segment saw an 18% increase in EBITDA compared to the previous year, driven by higher pricing and volume. Merchant prices improved by 11%. Volume grew by 6%, primarily due to strong demand for hydrogen, including on-site production.

- In the Asia segment, despite currency headwinds and higher energy costs, EBITDA increased by 10% compared to the previous year. Positive price and volume outweighed the impact of higher costs, with merchant prices rising by 9% and volume improving by 8%.

- The Europe segment reported a more than 20% increase in EBITDA compared to the previous year, driven by positive pricing actions. Merchant prices improved by 10%, and modest volume growth was achieved, particularly in hydrogen.

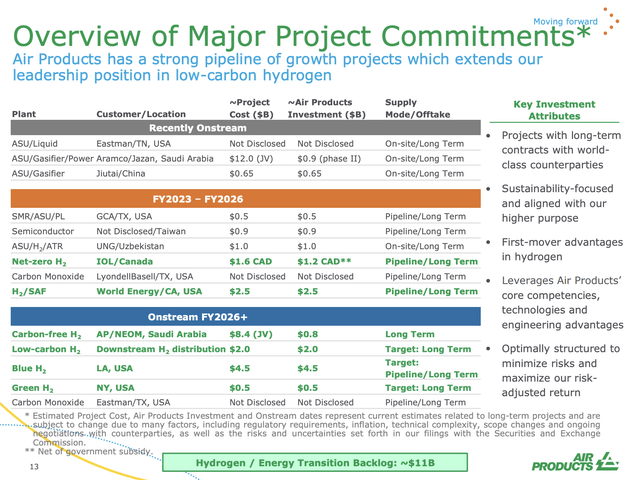

APD also saw progress in major projects.

For example, the Jiutai gasification project in China was finished successfully despite COVID-19 lockdowns (zero-COVID policies) and disruptions in the supply chain.

The project was also completed under budget.

Air Products & Chemicals

The Gulf Coast ammonia project in the United States also faced challenges but overcame them quite successfully, with the facility now in the start-up phase.

Hydrogen delivery to the pipeline system is expected to start soon.

The company also announced the $1 billion acquisition of the natural gas-to-syngas plant in Uzbekistan. As part of one of the most advanced energy plants in the world, according to APD.

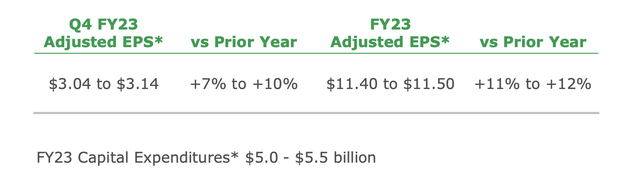

Thanks to a strong third quarter, APD raised its fiscal year 2023 earnings per share guidance. The new range is $11.40 to $11.50. The fourth quarter guidance reflects a 7% to 10% increase in earnings per share over the previous year. The full-year guidance reflects between 11% and 12% growth.

Air Products & Chemicals

With this in mind, the company has a history of generating strong growth.

The Bigger Picture Is Impressive

Air Products has achieved a cumulative average growth rate of 11% in earnings per share over the past nine years.

Air Products & Chemicals

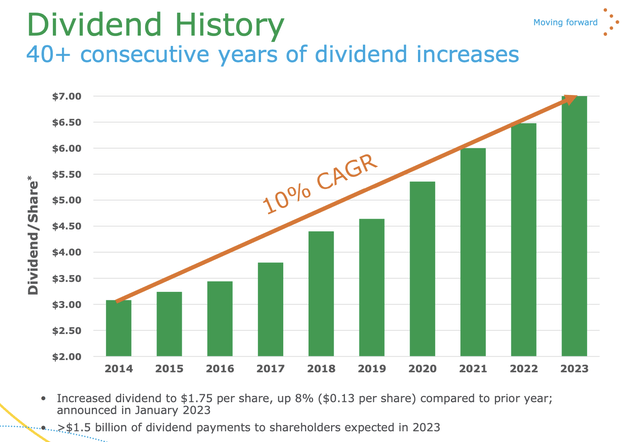

This is also reflected in its dividend. During its earnings call, the company highlighted its impressive track record of over 40 consecutive years of dividend increases. The average annual dividend growth rate since 2014 was 10%, which beats most peers with dividend aristocrat status.

Air Products & Chemicals

- The current dividend yield is 2.5%

- This dividend is protected by a 60% net income payout ratio.

- The cash payout ratio is negative, but more on that later in this article.

This year, the company expects to return more than $1.5 billion in dividends to shareholders.

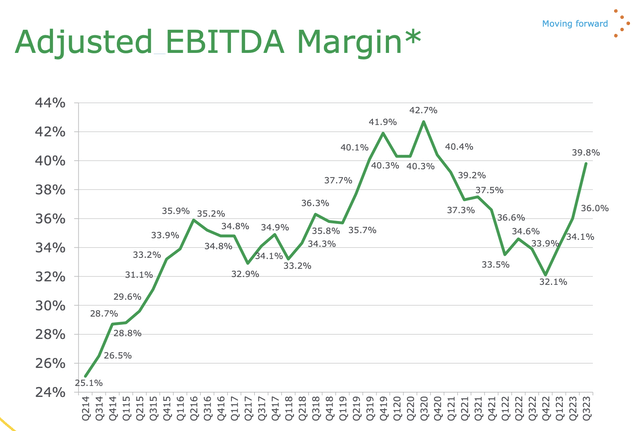

This EPS (and dividend) growth streak was supported by improving margins.

While margins have gone sideways since 2019, the company has improved adjusted EBITDA margins by roughly 15 points since 2014.

Air Products & Chemicals

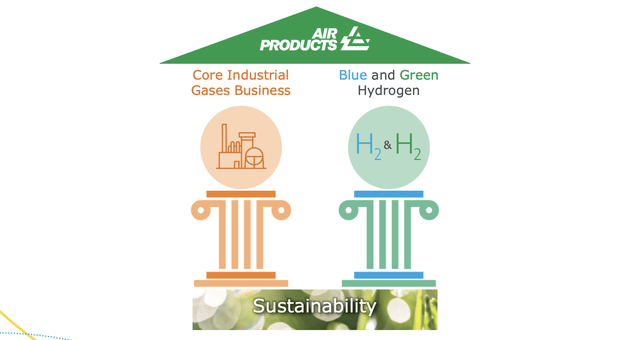

A big part of its success is its two-pillar strategy, which sets it apart from a lot of smaller businesses that expose investors to much higher risks.

Air Products & Chemicals

Essentially, by maintaining efficiency in its existing operations, Air Products has achieved double-digit earnings per share growth in eight of the last quarters.

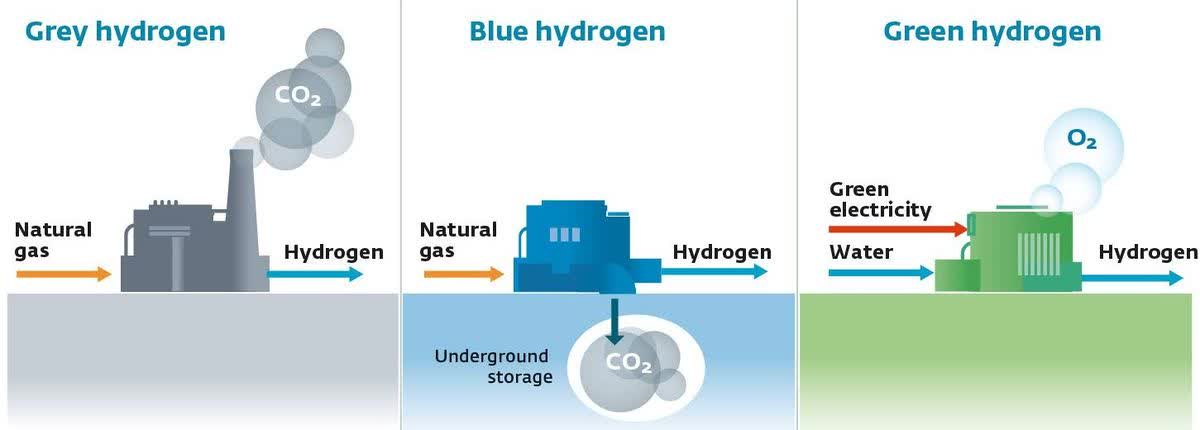

It uses its existing (mature) capabilities to fund operations in blue and green hydrogen projects to contribute to the decarbonization of transportation and heavy industries, further strengthening its future profit stream.

Energy Education

Smaller companies operating in the hydrogen business do not have a profitable business to build on, which often comes with significant risks for shareholders.

This two-pillar strategy is why I've admired APD for so long - especially as a play on hydrogen.

It also helps that the company has a healthy balance sheet, which it currently uses to protect its dividend.

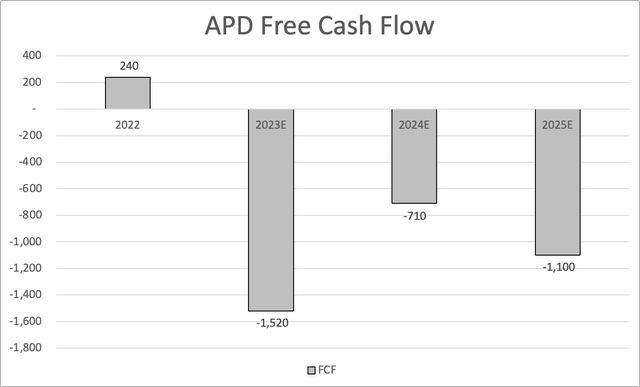

Looking at the chart below, the aforementioned projects are so expensive that the company is not expected to generate free cash flow in the next few years.

Leo Nelissen (Based on analyst estimates)

This means the company has to borrow money to fund its operations.

It obviously also means that the company has to borrow money to fund its dividend.

That's the difference between the net income payout ratio and the cash payout ratio. Net income does not take CapEx into account.

As a result, the company is expected to grow net debt from $4.3 billion in 2022 to $12.4 billion in 2025.

However, the net leverage ratio is not expected to exceed 2.2x (EBITDA).

Credit rating agencies aren't worried either, as the company enjoys an A credit rating.

Valuation

Using 2024 estimates, including $1.2 billion in minority interest and $10 billion in expected net debt, the company is trading at 14.3x EBITDA.

In my prior article, the valuation was two points lower. The higher valuation is the result of lower expected EBITDA.

The current consensus price target is $330, which is 16% above the current price.

I agree with this price target and maintain a Buy rating.

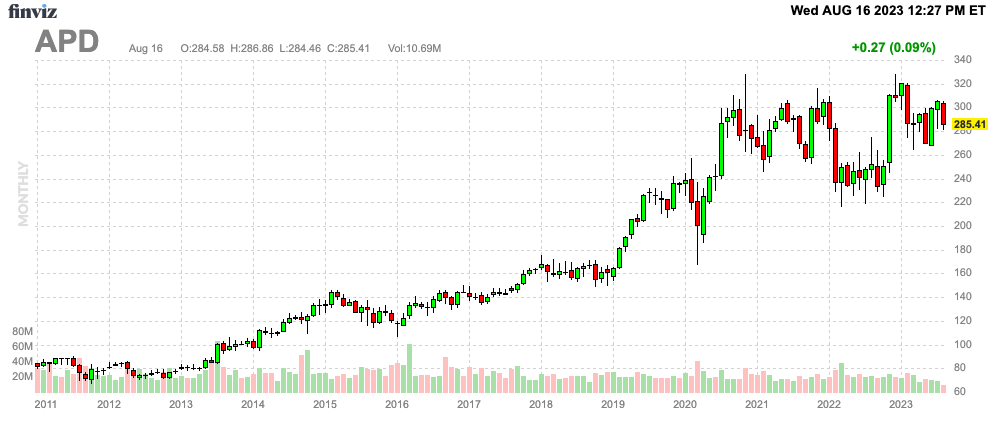

However, I do not expect the uptrend to be without obstacles. The stock is still trading at 2020 levels after failing to break out in 4Q22.

FINVIZ

Global economic growth challenges are likely to keep a lid on this stock (at least for the time being), with downside risks to the $250-$260 range.

While waiting for better prices comes with risks, I believe this is a good buying range for long-term investors.

Takeaway

In a challenging economic landscape, my focus remains on long-term investments that can weather the storm. Amidst global uncertainties, Air Products and Chemicals stands out as a remarkable choice.

Its impressive Q3 earnings, fueled by strong pricing and volume gains, have proven its resilience and growth potential.

With a history of consistent dividend growth and a two-pillar strategy that combines efficiency with future-oriented hydrogen projects, APD presents a unique opportunity.

While potential obstacles loom and global growth concerns persist, targeting a buying range around $250-$260 seems prudent for patient long-term investors.

I maintain my Buy rating on APD due to its strong fundamentals, making it a reliable investment even in turbulent markets.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

On Mar. 20, 2020, I bought 100 shares of APD at $184.92. Today, that investment has returned 54.32% (ex. div.) and 57.36% (inc. divs.). That growth is not too shabby – or should I be expecting more?

What about the quality of each company?

Is APD of the same quality as Linde?

FYI - I have owned APD since 2015, and have a limit order on Linde.

I often like to hedge against competitors.

For instance, AMT and CII, neither of which is working out well.... for now.