SolarEdge Technologies: Inventory Issues Rattle The Stock

Summary

- SolarEdge Technologies saw strong growth in Europe, but weak sales in the US and rest of the world.

- SolarEdge's outlook for Q3 is lower than expected, with inventory issues in the European market causing concern.

- While disappointing, the sell-off creates an opportunity for long-term investors.

MAXSHOT

Shares of SolarEdge Technologies (NASDAQ:SEDG) were hammered after it reported its Q2 results earlier this month. The stock is now down over -40% since my original March write-up. Let’s catch up on the name.

Q2 Results

For Q2, SEDG reported a 36% rise in revenue to $991.3 million. The consensus was for sales of $995.9 million. Revenue for its solar segment jumped 38% year over year to $947.4 million, and was up 4% sequentially.

The company shipped 335,000 inverters and 5.5 million power optimizers. It also shipped 269 MWh of residential batteries in the quarter. In the commercial market, it shipped 2.6 gigawatts of inverters, up 24% quarter over quarter.

Europe led the way for the company once again, with solar revenue more than doubling to $688.5 million. Sequentially, European solar revenue rose 19%, with Germany seeing 64% growth, Sweden 106%, the U.K. 50%, and Slovenia with 54% quarter-over-quarter growth.

U.S. solar revenue, meanwhile, was a big overhang, with sales down -37% year over year and -23% sequentially to $195.6 million. Rest of World solar revenue, meanwhile, dropped -19% year over year to $63.3 million. Quarter over quarter, ROW solar revenue fell -17%%.

The company said the passage of NEM 3.0 in California and higher interest rates led to a decrease in demand in the U.S. It noted that as a result, channel inventory is high. Its U.S. residential shipments were down -29% quarter over quarter, although sell-through was up 10%

Adjusted gross margin soared 600 basis points year over year to 32.6%. They were also up 10bps sequentially. Adjusted gross margins for its solar segment were 34.7%, up 660bps year over year but down -30bps sequentially.

Adjusted EPS came in at $2.62, well ahead of analyst estimates of $2.56. Adjusted EPS was 95 cents a year ago.

The company had -$88.7 million in operating cash flow compared to a cash inflow of $77.4 million last year. It ended the quarter with $425 million in net cash on the balance sheet.

SEDG’s quarter overall was pretty much in line with expectations. Europe once again shined through, while the U.S. was not surprisingly a drag. That all played out as expected. However, its outlook is where things began to get off the rails. And the once bright spot of the company is also now set to become a drag.

Outlook

For Q3, the company forecast revenue of between $880 million and $920 million. The consensus at the time was for revenue of $1.05 billion. Revenue from its solar segment is projected to be between $850-890 million.

SEDG is projecting overall adjusted gross margins of 28-31%. Adjusted gross margins for its solar segment are expected to be between 30-33%.

The company forecast adjusted operating income of between $115-135 million.

Discussing the state of the European market on its earnings call, CEO Zvi Lando said:

“In Europe, installation rates continue to be high in both residential and commercial. However, the strength in the market is somewhat more moderate than what was anticipated heading into 2023, largely due to a milder winter, reduced concerns over energy resilience and lower electricity prices. With that in mind, our growth in Europe in the second quarter was very strong. … On the supply side, the distribution channels in Europe are experiencing higher-than-optimal inventory levels, especially as it relates to solar modules. During the recent period of shortages and expectations for high growth, distributors placed large orders for modules and inverters in order to ensure stability of supply to support the growing demand. As growth in demand has tapered off, distributors are taking a more cautious approach in order to better manage their cash flow. In addition to taking actions to reduce inventory levels, distributors are also reducing the number of suppliers in their portfolio, which had expanded during the period of shortages. This is the dynamic seen before in the industry during a shift from a period of extreme shortage and accelerated growth to a period of more gradual growth and undisrupted product availability. We expect this inventory adjustment period could continue for the next two quarters, especially when also taking into account the typical fourth quarter seasonality effect in Europe."

When I looked at SEDG’s Q2 results, I did note that Europe becoming more competitive was something to watch out for, and unfortunately this does look like it is becoming more of an issue. Worse, though, is that channel inventory is now too high, which leads to less sales and weaker margins. When demand forecasts suddenly are less than expected it generally takes some time for everything to get back into balance again.

I expected the U.S. market to remain weak, which it has. However, the sudden shift in European demand came as a surprise. I’ve seen inventory issues in numerous industries coming out of over-ordering due to prior component shortages as a result of Covid, but this is happening much later in the game than experienced by most other industries. This speaks to both the prior strength of the industry, as well as the fact that it is not immune to outside forces such as weather and higher interest rates.

Valuation

SEDG stock currently trades at 12.5x 2023 EBITDA estimates of $711.6 million. Based on the 2024 consensus projecting EBITDA of $957.1 billion, it trades at 9.3x multiple.

On a P/E basis, the stock trades at an under 18.5x forward P/E ratio. The current consensus is that the company will generate EPS of $9.26 in 2023. For 2024, it is projected to produce EPS of $11.62, which would be good for a P/E of 14.8x based on 2024 estimate.

The company is projected to grow its revenue by 21% in 2023, compared to 69% growth in 2022. For 2024, sales growth is forecast to be a robust 24%.

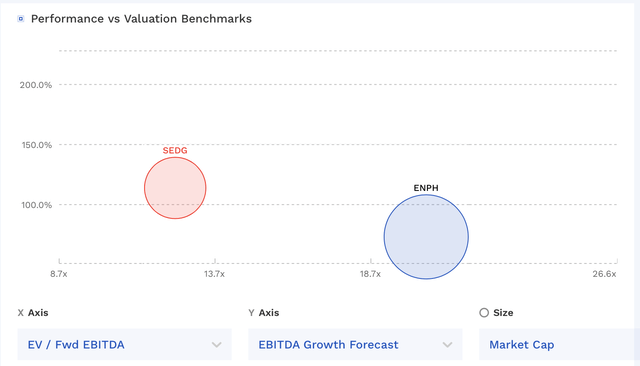

The company continues to trade at a large discount to ENPH, despite its stronger projected growth.

SEDG Valuation Vs ENPH (FinBox)

Conclusion

SEDG’s outlook and the inventory issues it is seeing in the European channel are very disappointing. At the same time, this is not an issue that is going to get fixed quickly. While it was a clear mistake to have a bullish view on the name, the stock’s valuation at current levels is quite attractive for its still solid growth outlook.

I wouldn’t expect the stock to work right away, as inventory issues just take time to work through. However, given the current valuation, I do see the sell-off as an opportunity, and will continue to rate the stock a “Buy” for more aggressive investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.