2 Great Dividends To Earn A Lifetime Of Passive Income

Summary

- Fear of the unknown is a powerful force.

- Preferred securities can help remove some of that fear.

- We look at two top-notch funds.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

courtneyk/E+ via Getty Images

Co-authored with Treading Softly.

How do you do with heights? Do they scare you, or are you completely unfazed by heights? It should come as no surprise to you that 28% of all adults in the United States have some level of visual height fear, meaning that when they can see that there are extreme heights, they have a heightened level of fear. One would argue that this is a natural evolutionary process - it's a survival instinct. Yet, having a heightened level of fear and perceived risk can also be a detriment.

When it comes to the market, many retirees or individuals will simply write off the market altogether because they fear the unknown. With the recent advent of investing apps and commission-free trading, the market has become a lot more of a gambling house than an investment place for long-term holders. This sense of gambling drives thousands away from the stock market, which would otherwise benefit in the long run. It's undeniable that the stock market is still history's greatest wealth-generating machine. It's also famously said that the stock market is a tool from which the patient can extract money and value from the impatient. Even the most risk-intolerant investors can find investments within the market that can help them meet their needs.

Today, I want to look at two opportunities for people who have low risk tolerance, to be able to achieve strong income for decades to come from the stock market. This isn't going to be a get-rich-quick scheme. This is a get-income-now plan.

Let's dive in!

Pick #1: RNP - Yield 8.4%

Cohen & Steers REIT and Preferred and Income Fund (RNP) is a Closed-End Fund ("CEF") that invests in a combination of blue-chip real estate investment trusts, or REITs, and non-REIT preferred shares. Both investment sectors are interest-rate sensitive and have seen pullbacks over the past year thanks to the Fed. Despite the decline in NAV in 2022, RNP raised its dividend and paid a large special dividend at the end of 2022.

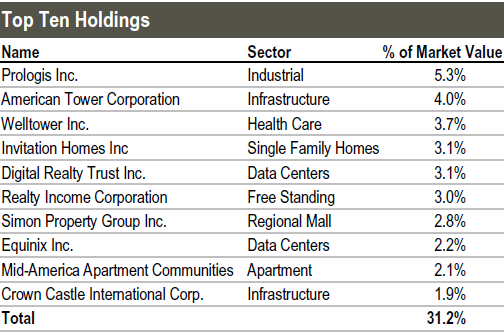

RNP carries approximately a 50/50 mix of REITs and preferred shares. The half invested in REITs is heavily concentrated on the best of the best. Their top 10 holdings account for over 30% of the entire portfolio and over 60% of the REIT portfolio. Source.

RNP Fact Sheet

These are all REITs that we would be very comfortable holding through any economic conditions. They are REITs that have proven themselves to be high quality. They are a great source of dividend growth, and price growth over longer periods.

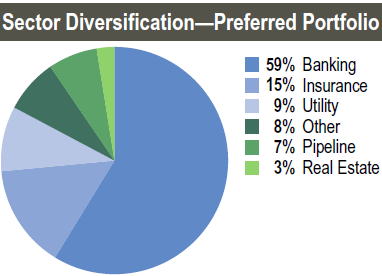

The preferred portfolio that RNP holds is primarily banking, insurance, and utility preferred, and interestingly, there are very few real estate-related holdings.

RNP Fact Sheet

Bank failures in the first half of the year drove the pricing of banking preferred down. While those fears have subsided with bank earnings proving to be very solid for Q2, the prices of banking preferred shares continue to trade at attractive discounts to par.

The cherry on top is that RNP locked in over 80% of its leverage with interest rate swaps, at an average interest rate of just 1.8% and an average term of 3 years.

RNP Fact Sheet

This decision saves a lot of interest expense and will directly benefit investors over the coming year as interest rates remain high.

RNP is trading at a 3% discount to NAV, providing a great opportunity to pick up some more shares!

Pick #2: PFFA - Yield 10%

I've said it before: If HDO operated a preferred stock ETF, it would look a lot like Virtus InfraCap U.S. Preferred Stock ETF (PFFA). When we look at PFFA's portfolio, we see a lot of familiar names. When we look at the top 10 holdings, we see several of our favorites as well. Source.

Virtus Website

This is because PFFA is an actively managed ETF, focusing on high-yield opportunities among preferred equity. PFFA is structured as an ETF, but it operates more similarly to a CEF. What does PFFA do differently than other ETFs?

- PFFA is actively managed. The majority of ETFs follow an index, which in turn follows a predetermined formula for deciding which stocks to buy and in what amounts. There is no person deciding what stocks to buy, and the fund just buys whichever stocks satisfy the conditions. If a stock is in the index the ETF follows, it will be bought without consideration for the current price, the future outlook, or risk. For example, the largest ETF in the preferred space is iShares Preferred and Income Securities ETF (PFF), which tracks the ICE Exchange-Listed Preferred & Hybrid Securities Index (PHGY).

- PFFA utilizes leverage. PFFA aims to use 20-30% leverage, which allows it to payout a much higher dividend. For valuation, leverage can cut both ways. When share prices are falling, a leveraged investment will fall more than an unleveraged one. When prices are rising, a leveraged investment will rise faster. In the preferred space, prices tend to be less volatile than common stocks, and the income from investments is a lot more stable than you see with common stocks. As a result, PFFA is going to be more volatile than peer PFF, but in the long run, it should produce a higher total return.

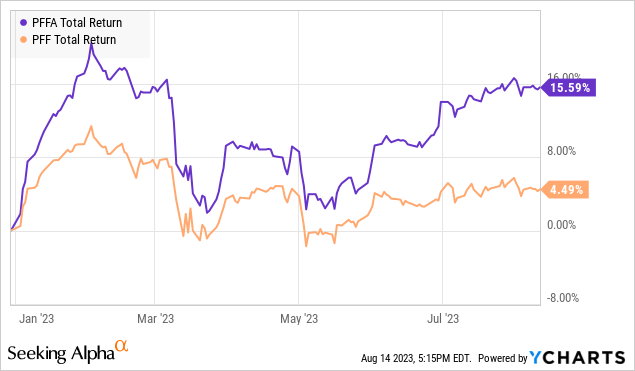

The proof is in the pudding; PFFA has been running circles around PFF this year while paying out a substantially higher yield.

We expect preferred shares will continue to recover, especially with the Federal Reserve likely done with its hiking cycle. PFFA's positioning in higher yielding preferred and using leverage, should allow it to continue outperforming to the upside.

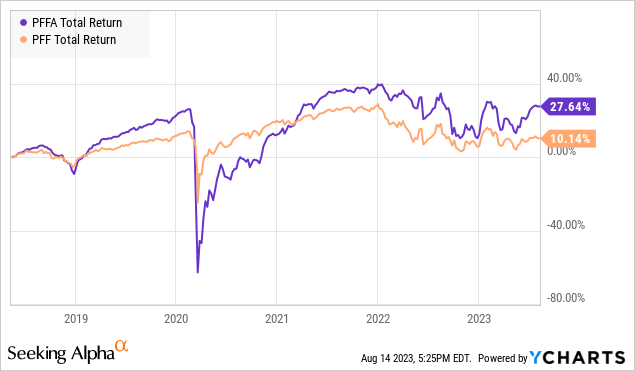

What if the market collapses? The greatest risk with investing in a leveraged fund is what happens when prices collapse quickly. Being leveraged, the price will fall more aggressively. The greatest risk is being forced to deleverage at poor prices. PFFA went through a real test in March 2020, when the prices of everything, including preferred, collapsed.

But, it came out the other side outperforming. PFFA is a great way to own a diversified portfolio of high-yield preferred stocks.

Conclusion

With these two investments, you can enjoy strong income from preferred securities.

Do you hate an unsure thing? If you do, it probably means that you have a low-risk tolerance. With preferred securities, you can have an understanding of exactly what income you should be receiving from your investments. Fixed-rate preferred securities offer you a set amount of income every year, and you simply just get to pick the price that you're buying them for. This is why I have a large portfolio of fixed-income investments. The drawback is that individual preferred can be illiquid. By using these two investments, you can own a wide swath of preferred securities and simply choose your timing of when to buy or sell. Getting the economic benefit of a portfolio of preferred, in one investment.

When it comes to retiring, the last thing you'll want to be doing is having to adjust your portfolio every day or worry about what young gambling-type investors are doing. Instead, you'll want to be enjoying your days, relaxing, and finding new hobbies or spending time with family. By investing for income, you can unlock large sums of income for the market to pay for your expenses. That way, you can become a professional investor and proudly declare that this retirement is brought to you by dividends!

That's the beauty of my Income Method. That's the beauty of income investing.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale for 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years of experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. I am the lead analyst at High Dividend Opportunities, the #1 service on Seeking Alpha for 6 years running.

Our unique Income Method fuels our portfolio and generates yields of +9% alongside steady capital gains. We have generated 16% average annual returns for our 7,500+ members, so they see their portfolios grow even while living off of their income! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. Our motto is: No one needs to invest alone!

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and of course, on Seeking Alpha. Follow me on this page to get alerts whenever I publish new articles.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side, each of whom invest in our own recommendations, you can count on the best advice. (We wouldn't follow it ourselves if we didn't truly believe it!)

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space including dividend stocks, CEFs, baby bonds, preferreds, REITs, and more! To learn more about “High Dividend Opportunities” and see if you qualify for a free trial, please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFFA, RNP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.