Redwood Trust: An Emerging Winner In The Regional Bank Chaos

Summary

- Silicon Valley Bank's collapse in March caused financial market turmoil.

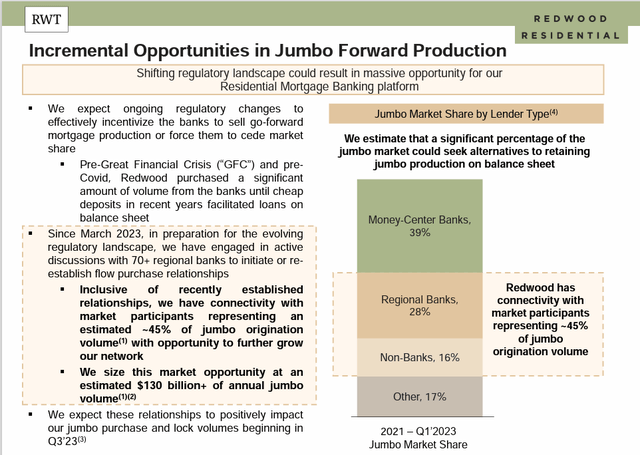

- Redwood Trust is capitalizing on the changes in the banking system and becoming a capital conduit for regional banks.

- Redwood Trust has established relationships with over 45% of new annual jumbo mortgage origination and is experiencing significant growth in its residential mortgage banking segment.

designer491

Silicon Valley Bank’s collapse in March roiled financial markets around the world. Was it another systemic banking crisis or just excess and carelessness within a localized system? As the trauma settled and it appeared we would survive, we hoped, like in prior times of financial dislocation, an entity would emerge, ready to capitalize on the turmoil.

Over the last fifteen years, accommodative monetary policy that sustained near zero interest rates enabled depositories (banks) an arbitrage in writing below market-rate mortgages and funding them with low-cost/no-cost deposits. The Fed’s aggressive rate hiking cycle of the last eighteen months, however, not only vanished the rate-spread arbitrage, but it also helped bring about the collapse of high-flying regional banks and, in response, rafts of new capital requirements for large banks. These environmental changes have reset the competitive playing field and Redwood Trust (NYSE:RWT), a non-bank lender and mREIT, couldn’t be more excited.

Redwood Trust

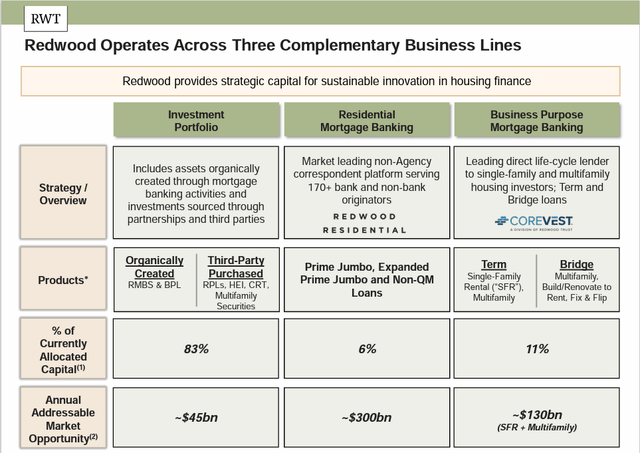

Redwood is structured as a mortgage REIT with a strict focus on non-agency housing finance. The table below describes RWT’s operations and capital allocations across three complimentary business lines. Recent changes in capital markets and the regulatory environment are combining to significantly shift new capital allocations to residential mortgage banking in the form of purchase and securitization of jumbo mortgages.

RWT

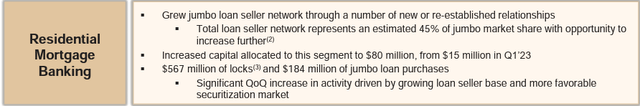

During the second quarter, RWT increased the capital allocation to residential mortgage banking more than 5-fold to $80MM from $15MM in Q123.

RWT

What brought about such dramatic change?

Righting the Banking System

This spring’s banking chaos laid bare a number of regulatory shortcomings. Among them, the accounting treatment that allowed banks to carry designated issues as “held to maturity” and thereby not acknowledge the mark-to-market impairments to their capital accounting that should have been recognized/reported in the plunging values of fixed income securities. In response, on July 27th, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued a joint press release designed to strengthen capital requirements for large banks. In practical terms, it is going to become much more expensive/uneconomic for banks to hold non-agency/jumbo mortgages as assets on their balance sheets. Banks will still want to do the good service business of mortgage origination; they will just be compelled to sell the loans and not carry them.

That’s where Redwood Trust comes in.

The Design of Decades

For almost 30 years Redwood Trust has competed in the sometimes-difficult market for origination and long-term management of non-agency residential mortgages. In their 2Q letter to shareholders, they made notice of the recent, marked changes in this market.

As investors continue to grapple with regional bank fallout and a mortgage market still under the thumb of the Fed, the foundational shifts that we believe will drive the next big cycle of growth for Redwood have already begun. Empirical evidence points to profound changes in how many financial assets are owned, particularly mortgages. And as these changes occur, they carry a familiar theme. The latest era of Fed accommodation that allowed banks to hold almost limitless amounts of 30-year, fixed-rate mortgages by funding them with low-cost deposits is now over. The impact of this change – on capital, liquidity, and overall business models – is likely to influence investment across various asset classes. For many of these banks, continuing to offer competitive mortgage products to retain their clients (both consumer and, to an extent, commercial) will be imperative, and will likely require liquidity from outside capital partners. In this regard, the solutions Redwood has always offered to depositories have never been more relevant.

More importantly, they noted their history and experience makes the process scalable.

Since our founding, we have completed over 140 securitizations across our platforms, sourcing assets from experienced operators who specialize in jumbo, non-QM, and other mortgage products. This deep institutional knowledge is a requisite for shepherding banks through the process of originating and selling loans efficiently into the private capital markets.

Effectively, RWT has made notice that it intends to become a capital conduit/clearing house for regional banks to continue the lucrative, high-touch service of providing mortgage lending to affluent customers and remain in compliance with stricter regulatory standards. Redwood’s relationship to the banks will shift from competitive to something more symbiotic.

The Change is Now

The slide at the top of this report describes that RWT’s Investment Portfolio and Business Purpose Mortgage Banking divisions are significantly more capitalized than its Residential Mortgage Banking efforts. Those ratios are rapidly changing and the scale potential is immense.

RWT

In the 2Q23 investor presentation Redwood described that they were jumping in with both feet and establishing relationships with more than 45% of the $130 billion of new annual jumbo mortgage origination.

The Real World

The rapidly rising interest rate environment that brought regional banks, and the broader financial markets for that matter, to their knees took a toll on RWT as well. With mark-to-market accounting of their investment portfolio, Redwood’s book value declined materially. Additionally, they slashed their quarterly dividend from $0.23 to $0.16.

Going forward, at the 8/15 $7.80 closing price, the shares are priced at a 16% discount to their $9.26 book value. The reduced dividend translates to an 8.2% going in yield.

Bold Projections

Every quarter we see REIT management teams put their best, optimistic foot forward. Redwood’s 2nd quarter presentation was definitely in that vein, but an August 15th 8-K released in advance of a Keefe Bruyette & Woods event lends some credibility to any boasting.

Quarter to date residential jumbo loan lock volume of approximately $700 million, exceeding lock volume for the full second quarter by approximately 25% Successfully priced SEMT 2023-3 securitization, backed by $338 million of residential jumbo loans, in early August 2023

We have continued to make significant progress in our Residential Mortgage Banking segment since our last update a few weeks ago,” said Christopher Abate, Chief Executive Officer of Redwood. “Halfway through the third quarter, we have already surpassed our full second quarter lock volumes by approximately 25%. Our network of banking partners continues to grow, and we are moving new partners through our onboarding process and towards the phase of selling Redwood their jumbo loan production. Approximately 50% of our lock volume to date in the third quarter is with bank loan sellers, a percentage that is growing steadily and reinforcing the opportunity we see with depositories in these very early stages.

It is easy to imagine that this kind of volume can translate into net interest income and book value growth. In filling the void in the flow of capital in non-agency mortgage banking, Redwood is a strong buy.

For a full toolkit on building a growing stream of dividend income, please consider joining Portfolio Income Solutions. As a member you will get:

- Access to a curated Real Money REIT Portfolio

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Portfolio Income Solutions, we don’t only share our ideas, we also discuss best trading practices and help you become a better investor.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $33.25/month (paid annually) before it expires!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation. I am an investment advisor representative of 2nd Market Capital Advisory Corporation, a Wisconsin registered investment advisor along with fellow SA contributors Simon Bowler and Dane Bowler.

Full Disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RWT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles. It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.