Workiva: AI And The Future Of XBRL

Summary

- Workiva and other XBRL providers have the opportunity to use AI to address issues and create efficiencies.

- The SEC's upcoming ESG rules and other new mandates present opportunities for XBRL providers to assist public companies in complying with reporting requirements.

- XBRL issues persist, with some companies missing important financial information in their filings, highlighting the need for improvements.

Blue Planet Studio

Since my previous article, Workiva's stock price has been roughly flat which has aligned with my prior prediction. Today I would like to discuss some updates related to XBRL and artificial intelligence (AI).

Like many organizations, Workiva (NYSE:WK) has the opportunity to use artificial intelligence to help alleviate system issues and create efficiencies for users and stakeholders alike.

In several recent blog posts, the father of XBRL, Charlie Hoffman, discusses the problems not only with XBRL but with the accounting industry (see this article which relates to the PCAOB and audit quality). His view is that AI will play a key role in the evolution of accounting and XBRL.

Let’s dig into the current issues and the opportunities AI could create. I’ll also discuss the Q2 financial results, recent XBRL data quality results, and why I’m still maintaining my “hold” position.

Opportunities and Issues

The large looming opportunity for Workiva and other XBRL providers relates to climate disclosures or environmental, social, and governance (ESG) policies. As Workiva’s CEO, Julie Iskow mentioned on the company’s last conference call, ESG rules will likely be put forth by the SEC later this year.

Aside from ESG reporting, the SEC continues to release new rules and mandates. For example, this quarter many large accelerated and accelerated filers began reporting on insider trading. This new rule required many firms to apply new tags from a separate taxonomy, the Executive Compensation Disclosure (ECD) taxonomy.

These new mandates require the use of different taxonomies (US-GAAP and ECD for example) which make complying with SEC rulings more complex. The need to have a partner such as Workiva, Toppan Merrill, or DFIN (DFIN), who can help public companies navigate the ever-changing financial reporting landscape has never been more critical.

There are various issues present as well. I’ve been reporting on XBRL accuracy which covers the specific accounting rules applicable to the XBRL tags used in public company filings (those results are covered in-depth below) for some time now.

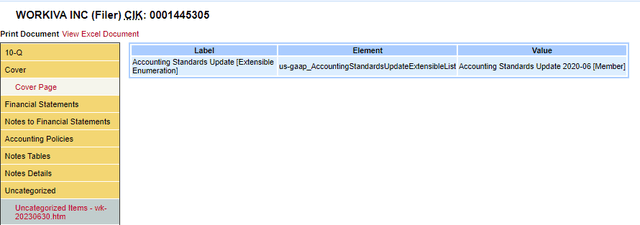

Another issue is organizing a public company’s taxonomy. From the SEC’s website you can clearly see if a taxonomy is not appropriate. If it is not, you’ll get an “uncategorized” error:

As I mentioned in my last article, it’s not a reporting issue so it’s not as significant. However, it’s still an issue with the structure of the XBRL tags and taxonomy.

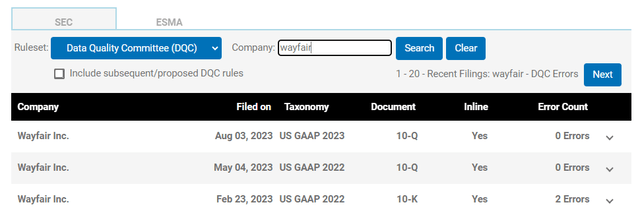

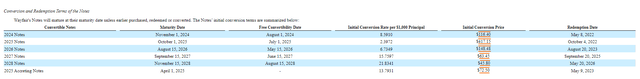

Secondly, you have the issue of missing tagging. As you can see below, Wayfair (W) doesn’t have any XBRL data quality errors from their recent 10Q filings:

However, tagging was missed related to their debt, and thus important investor information is not being properly disclosed:

I was only able to find this issue of untagged information in Workiva filings. I have received comments and feedback that isn’t not Workiva’s “fault” for issues such as XBRL data quality errors and in this instance, missed tagging. It is the responsibility of the external reporting team of the public company filing.

Some may view this as a system issue, a training issue or simply a user error. No matter your perspective, it’s an issue that must be corrected as data consumers can’t be missing key financial information from pubic company filings.

In my opinion, these issues can in turn lead to opportunities for XBRL providers to create efficiencies. Efficiencies which not only make their work easier but also help support the public companies they assist. Article intelligence (AI) is clearly what Workiva and rivals Toppan Merrill and DFIN will try to use to create such efficiencies.

On the call, Iskow mentioned AI, stating, “Generative AI has the potential to revolutionize the business reporting market by further boosting productivity efficiency.” She didn’t do into specifics, yet she mentioned Workiva will have more to share regarding AI at their analyst day in September.

XBRL Quality

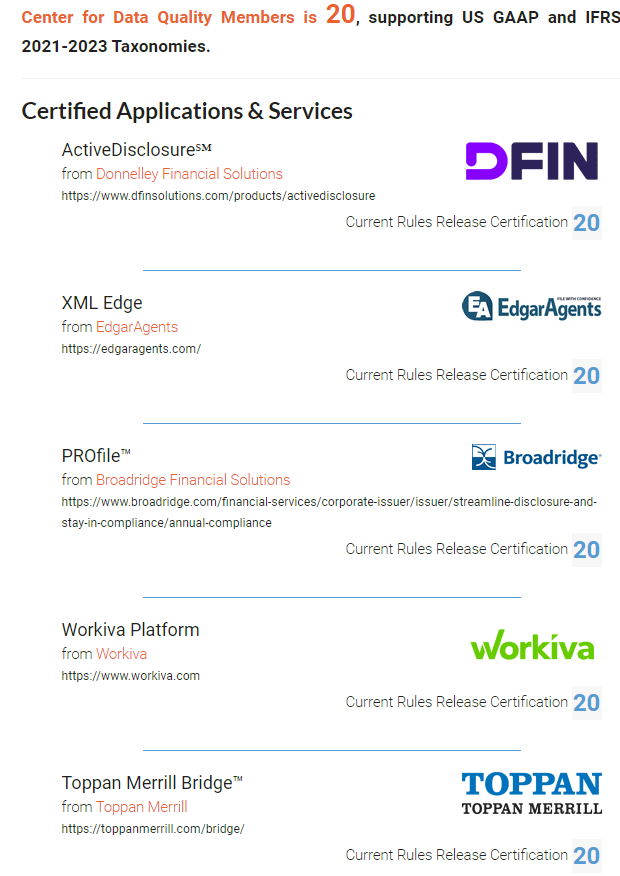

Since my last article, no new set of XBRL rules has been added. Workiva, DFIN, and Toppan Merrill all still support the last XBRL ruleset, ruleset 20. Ruleset 21 will likely be coming out in this fall.

XBRL US

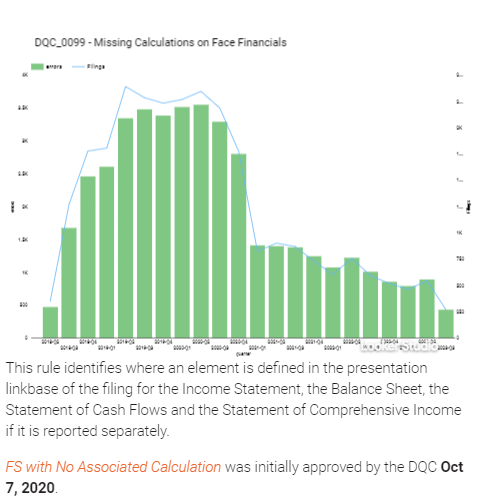

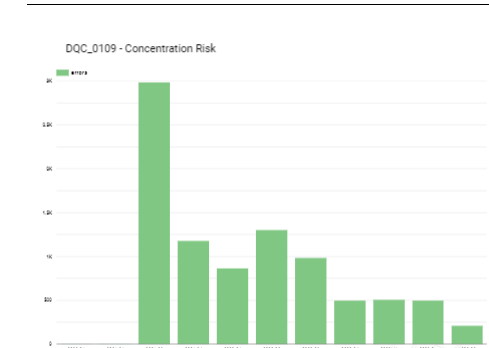

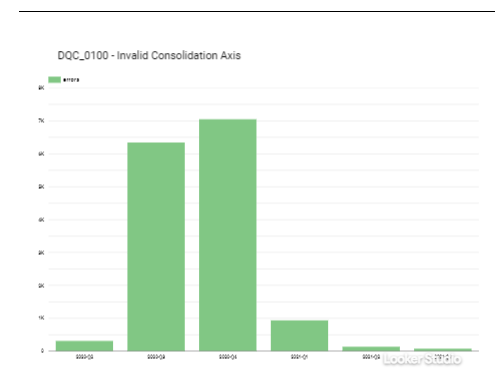

Looking at the overall XBRL industry the trend continues to be positive. The below graphs are all for “newer” DQC rules and like prior articles, the trend is very encouraging as the number of errors continues to decline.

Missing Calculations on Face Financials

XBRL US

XBRL US

XBRL US

In this quarterly review of XBRL data quality, I’ve taken a sample of some new companies and ones I have reviewed previously. The below are the data quality findings for Workiva, Toppan Merrill and DFIN.

Workiva has been providing the XBRL services for the following companies. You can see the following results from the XBRL US website:

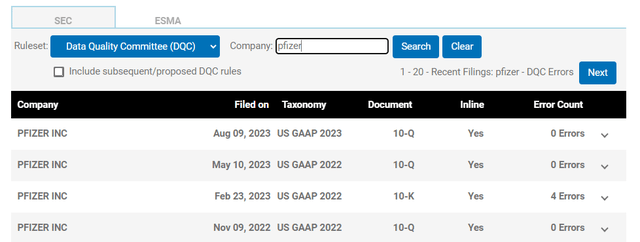

Pfizer (PFE)

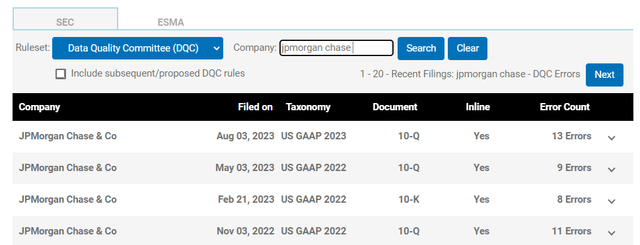

JPMorgan Chase (JPM)

This quarter, there were several issues with Workiva’s XBRL data quality. Pfizer didn’t have any issues in the recent quarter, but JPMorgan Chase certainly did and have had issues during the last year. Again, this illustrates the key point that given the complexities of XBRL, it is very difficult to follow new SEC rules and comply with XBRL data quality standards with an “in-house” model.

Similar to last quarter, I was unable to find any issues with Toppan Merrill filings. Toppan Merrill has been providing the XBRL services for the following companies and you can see the following results from the XBRL US website:

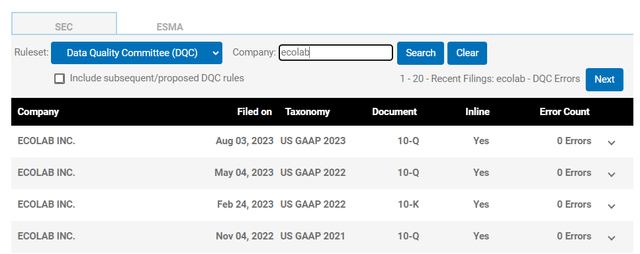

Ecolab (ECL)

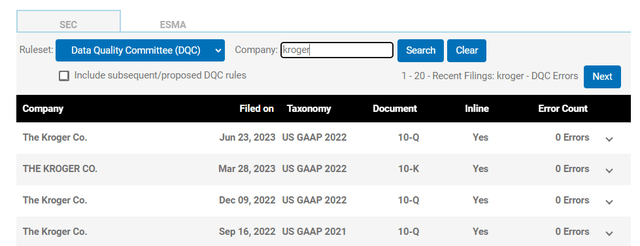

Kroger (KR)

Toppan Merrill continues to have consistent, high quality XBRL data quality results.

DFIN has been providing the XBRL services for following companies. You can see the following results from the XBRL US website:

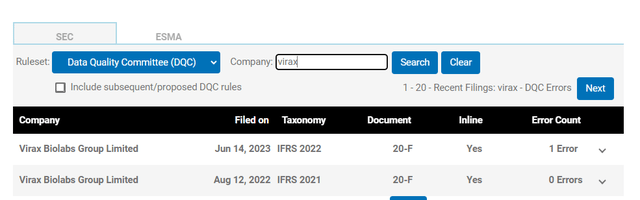

Virax Biolabs (VRAX)

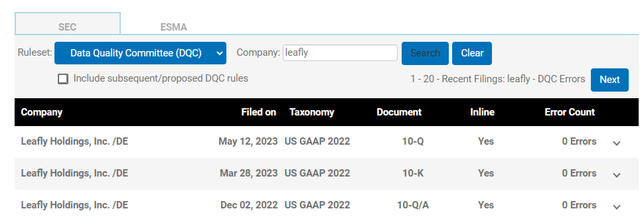

Leafly (LFLY)

DFIN had one issue in the sample I found but overall, the results were good.

Financials

Workiva delivered another quarter of solid results in Q2 2023. The company generated revenue of roughly $155 million in Q2 2023 which is an increase of nearly 18% compared to Q2 2022. Most of this revenue was generated from subscription and support revenue and revenue from professional services accounted for the rest. Subscription and support revenue was roughly $137 million, an increase of 21% compared to prior year’s second quarter. New logos and account expansion helped drive this growth. Professional services revenue was roughly $18 million for the quarter, which was relatively flat compared to prior-year second quarter.

Client count continues to rise as well as Workiva finished Q2 2023 with 5,860 clients, which is an increase of 479 customers compared to Q2 2022. For the current quarter, the company added 106 net new customers. Retention remains outstanding as well, as the subscription and service revenue retention rate was roughly 98% for the quarter.

Management noted that larger subscription contracts have continued to increase as Workiva had 1,470 contracts valued over $100,000 per year, which is an increase of 28% compared to Q2 of 2022. The number of contracts valued at over $150,000 per year totaled 823, which is up 28% compared to the prior year. The number of contracts valued at over $300,000 per year totaled 272, which is up 40% compared to Q2 2022.

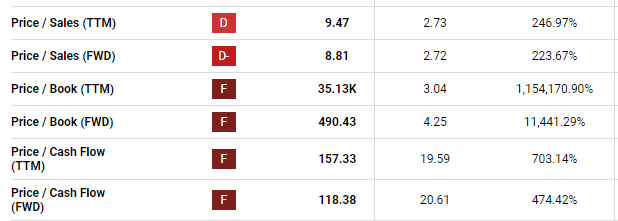

Valuation

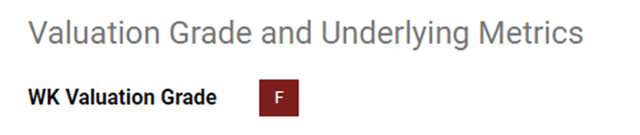

Workiva still has yet to achieve profitability and is a very expensive stock. As you can see from the below valuation metrics from Seeking Alpha, the overall value grade is a “F.” Workiva is higher than the sector median for many of these metrics such as the price to book and price to cash flow metrics illustrated below:

Seeking Alpha

Given the current price to sales of 9.27 I think a more attractive entry would be closer 7.28 which the company obtained in the second quarter last year. Until Workiva gets to more attractive entry point, I’ll be waiting.

Conclusion

The XBRL industry has never been more complex. With new SEC mandates and likely more rules on the horizon (such as ESG), the filing complications public companies face has never been greater. This means public filers will rely on the expertise of companies like Workiva, DFIN, and Toppan Merrill to navigate the ever-changing regulatory environment.

Despite continuously adding XBRL data quality rules and despite the continuous improvements, many public companies continue to file with errors. Additionally, many such as Wayfair, are excluding important financial information from their XBRL data which is an issue as well.

As the SEC continues to adopt new rules, the complexities in this industry continue to increase. For example, the creation and usage of numerous taxonomies. I find it unlikely the SEC will be able to create and harness the power of Generative AI within the coming years but perhaps a XBRL provider can create efficiencies using AI to tackle the numerous issues I’ve mentioned.

For now, I’m going to wait to see what Workiva has to say on their analyst day regarding AI. However, like Hoffman, I believe AI will play an essential role in the future of XBRL.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.