XP Inc.: Ongoing Recovery, Yet Exercising Caution

Summary

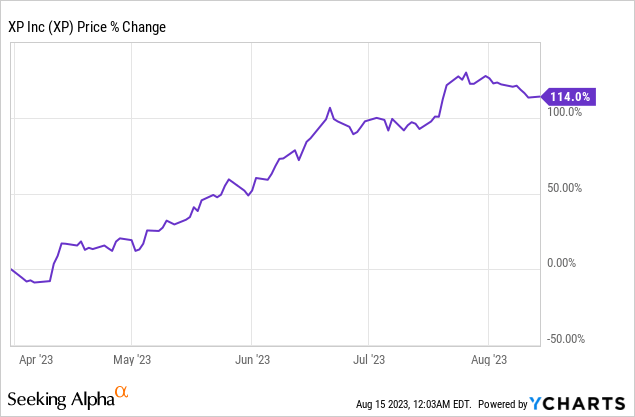

- XP Inc. shares remain about 50% below their all-time high despite a surge in share price this year.

- The company's Q2 results showed growth in earnings and an improved take rate, positioning it to benefit from Brazil's expected interest rate decline.

- Significant competition, strong performance of major banks, and unattractive valuation are potential barriers to a bullish stance on XP Inc.

Hero Images Inc

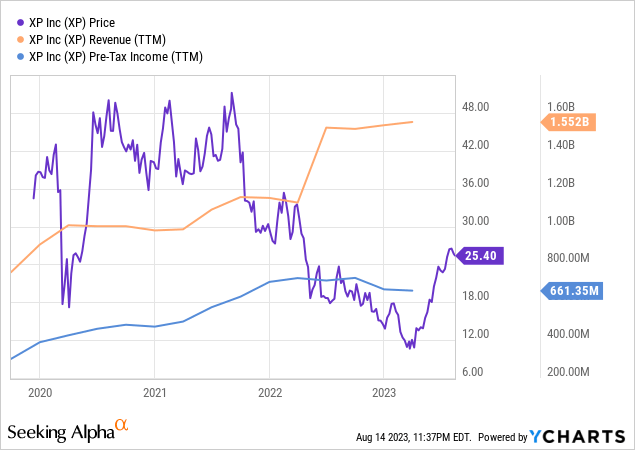

XP Inc. (NASDAQ:XP) has experienced highs and lows since its IPO in 2019. However, from 2021 until now, the company has faced more challenges than successes. Despite a surge in share price this year, XP Inc shares remain 50% below their all-time high from two years ago.

The recent Q2 results of the company were great, showcasing growth in earnings and an improved take rate when compared to Q1. This positions XP Inc favorably to benefit from Brazil's expected interest rate decline in the coming quarters.

While interest rates are predicted to decrease, they are still far from the levels observed in the past two years. This will likely prevent the company from reaching the peak of financial expansion in Brazil, as the persistently high-interest rates could continue to deter retail investors.

Even though XP Inc's financial results and revenue yield have demonstrated commendable stability over the years, primarily driven by a well-balanced product mix, significant competition, the strong performance of major banks, and an unattractive valuation are potential barriers to adopting a bullish stance on XP Inc.

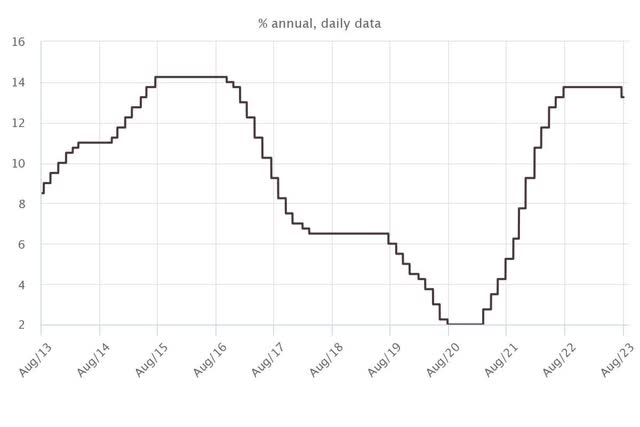

A victim of Brazil's interest rates

Since its IPO, XP Inc has shown a solid exponential growth curve in its revenues and pre-tax income. However, specifically since last year, these curves have flattened - with EBT even experiencing a slight decline - primarily due to the trajectory of the Brazilian basic interest rate, Selic. This deceleration is challenging for the shares of a growth-focused company like XP Inc.

Approximately 80% of the company's gross commissions are derived from retail business. This substantial revenue primarily stems from various sources such as brokerage, futures, derivatives, RLP (retail liquidity provider), and management fees from proprietary and third-party sources.

Several critical points warrant attention. These encompass the impact of the low-interest rate environment witnessed in recent years, competition posed by major banks, and XP's responsiveness to prevailing events. XP's growth trajectory has been robust, although a cyclical slowdown has also been observed.

Brazil's shift into a low-interest rate cycle has already commenced, with the Brazilian Central Bank reducing rates by 0.5 percentage points in the latest meeting cutting to 13.25%. Despite a projected end to interest rates in 2023 at 12.25%, the outlook for 2024 and 2025 of Selic below 10% remains optimistic yet still comparatively high compared to 2020-2021 when interest rates in Brazil hovered around 2%.

Brazilian interest rate (Selic) (Banco Central Brasil)

Furthermore, XP Inc, representing a quintessential entity encapsulating multiple favorable factors, is strategically poised to capitalize on banking deconcentration. The Brazilian investment banking sector is experiencing an annual growth rate of around 10%, with smaller players capturing a market share. While prominent banks still command the lion's share of assets, XP offers a viable alternative for dissatisfied clients seeking an alternative.

The investment thesis for XP encompasses various factors, including market sophistication, financial product accessibility, evident growth trajectories, reinvestment prospects, and ingrained entrepreneurial culture. This investment perspective extends beyond XP to peers like BTG Pactual and major banks such as Itaú Unibanco (ITUB) and Banco Bradesco (BBD).

Q2 Results

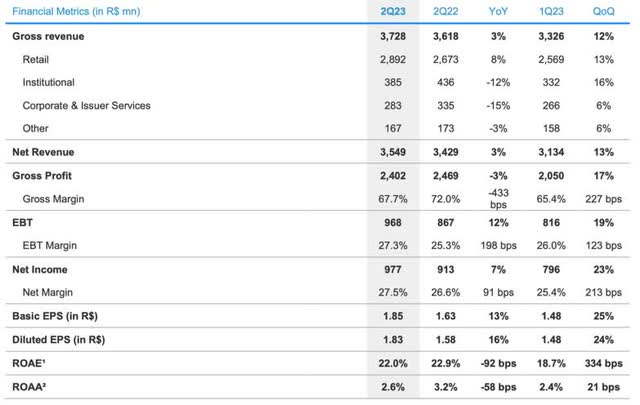

The latest financial results released by XP Inc. show a 23% increase in net income compared to the first quarter and a 7% increase in the annual comparison, reaching R$977 million. EBT (Earnings Before Taxes) reached R$968 million, marking a 12% year-over-year increase and a 19% increase compared to the first three months of 2023.

As a result, the EBT margin advanced to 27.3% in the second quarter, an increase of 2 percentage points (p.p.) in the annual comparison and 1.23 p.p. compared to the period between January and March of this year. This aligns with the guidance (projection) of 26% to 32% annually between 2023 and 2025.

While net revenue rose 13% quarter-on-quarter and 3% year-over-year to R$3.55 billion in the second quarter, gross revenue totaled R$3.728 billion. This is a 12% increase compared to the first quarter and a 3% increase compared to the same period in 2022.

XP Inc, IR

The retail segment primarily propelled the growth, which generated R$2.89 billion, constituting around 78% of the total gross revenue. This represents an 8% increase in the annual comparison and a 13% rise within the quarter.

Two revenue streams particularly distinguished themselves within the retail segment. Firstly, emerging revenue verticals exhibited substantial growth. The combined revenue from cards, pensions, credit, and insurance grew by 9% compared to the previous quarter (Q1 2023) and a remarkable 54% annually, contributing nearly R$400 million in gross revenue during the second quarter. The cards segment doubled its revenue year-on-year, reaching R$232 million in 2Q23. Likewise, the insurance vertical experienced a notable 57% surge, reaching R$36 million during the same period.

The second area of growth was attributed to the recovery of the fixed-income segment. Revenue generated from this segment escalated by 74% compared to Q1 2023, surging from R$332 million to R$578 million. Compared to Q2 2022, there was a stabilization, maintaining proximity to R$580 million.

This recovery was spurred by improved volumes in the private credit market following a stagnant Q1 2023, which was influenced by solvency concerns regarding companies like the retailer Americanas and Light, a Brazilian electric utility company.

Conversely, revenue from the variable income segment reached R$1.06 billion, remaining relatively steady in quarterly and annual comparisons due to the persistent high-interest rate macroeconomic environment. The revenue of the fund platform advanced by 9% compared to Q1 2023, reaching R$341 million, yet still experienced a decline of 14% compared to Q2 2022.

XP Inc also successfully expanded its total client assets by 21% year-over-year to R$1.024 trillion, reporting an annualized retail take rate of 1.30%. This is a slight decrease from 1.40% in the previous year (Q2 2022), accompanied by a 9 basis points (bps) growth compared to Q1 2023. While the take rate remained relatively stable compared to Q2 2021, this consistency underscores the resilience of the ecosystem and ongoing product development, positioning XP as a primary beneficiary of the continuing financial deepening in Brazil.

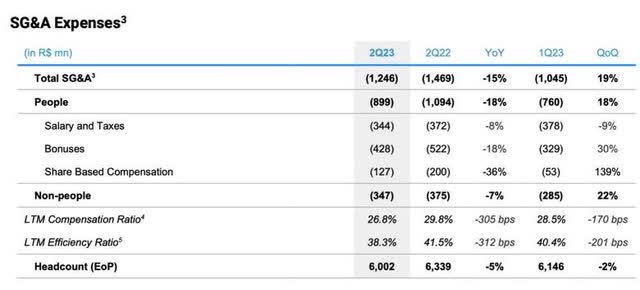

Better controlled costs

After implementing a cost control and efficiency improvement process, XP Inc has started to witness positive outcomes in the most recent quarter, as the company expanded its margins and increased profitability.

Following a staffing adjustment between the end of 2022 and the beginning of this year, XP's general administrative expenses totaled R$1.2 billion in Q2 2023. This marked a 20% growth compared to Q1 2023, but there was a 15% drop compared to Q2 2022. This result aligns with the annual guidance of R$5.0 to R$5.5 billion for 2023.

XP Inc, IR

The increase was primarily attributed to bonuses aligning with the improved capital market activity in the second quarter. Share-based compensation also returned to pre-Q1 2023 levels when a one-time impact was due to headcount reduction. Additionally, marketing expenses, known to be seasonal, contributed to the increase.

Valuations are not so cheap

From April to mid-August of that year, the shares of XP Inc appreciated by more than 115%. This significant increase was propelled by positive developments that foreshadowed a reduction in interest rates and easing inflation. Additionally, Itaúsa (the holding company of Itaú Unibanco) made the strategic decision to move forward with its plans to divest its stake in XP Inc, which subsequently led to Itausa's departure from XP Inc's board of directors.

Itaúsa had a 4.28% stake in XP's capital after gradually selling company shares in 2021. The agreement to terminate this arrangement was reached among shareholders and significantly bolstered XP Inc's corporate governance practices and the composition of its board of directors.

Despite the remarkable recovery of XP Inc's shares throughout this year, they remain approximately 50% below their all-time highs reached in September 2021, when Brazilian interest rates were at 2%.

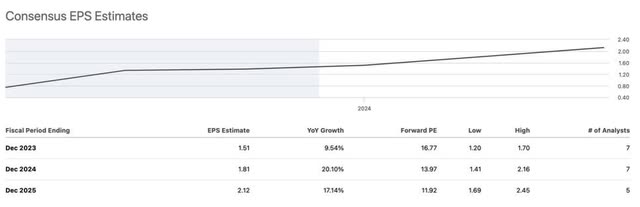

The current valuation indicates that XP Inc is trading at multiples 100% higher than the industry average, with a P/E ratio 19x. Looking ahead to 2023, XP Inc's forward P/E is projected to be 60% higher than the industry average, at 16.5x. Forecasts for 2024 and 2025 suggest P/E ratios of 13.9x and 11.9x, respectively, factoring in an anticipated EPS growth of 20% and 17% for those years.

Seeking Alpha

There is a notable valuation gap between XP Inc and its primary domestic peer, BTG Pactual, which trades on the Brazilian stock exchange (Ibovespa) at a P/E ratio of 15x. BTG Pactual has gained prominence recently as Brazil's second-largest lender to micro-enterprises and has a significant presence in investment banking.

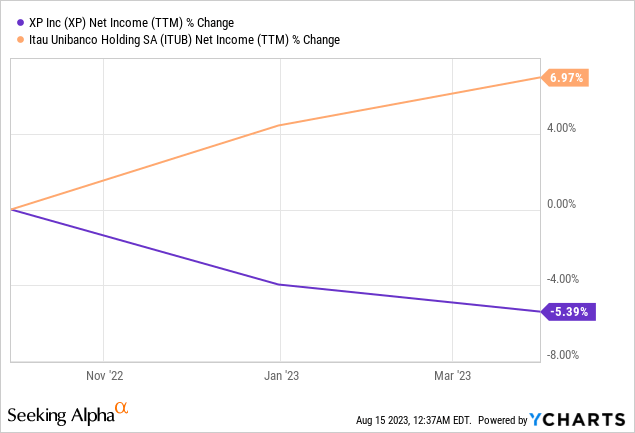

Furthermore, prominent banks like Itaú have maintained impressive profitability and efficiency, demonstrating profit growth from mid-last year within an adverse macroeconomic backdrop. Itaú is traded at a forward P/E multiple of merely 7.7x.

The bottom line

Despite the reluctance of major banks to adjust to Brazil's evolving landscape by expanding into the retail investment market, the stability of XP's take rate and its sustained growth present engaging aspects, particularly in the wake of a promising Q2 performance, mainly highlighted by better control of its costs.

In the larger picture, XP is viewed as a long-term investment, with its value proposition, market positioning, and growth potential forming the basis of this perspective, even in the face of potential challenges and uncertainties that may emerge.

Investors should, however, temper their expectations. The prevailing Brazilian interest rates make it improbable for XP Inc to reach the levels it achieved in mid-2021 when its shares attained their all-time highs. Valuations remain higher than those of its peers. I find identifying a significant differentiating factor in investment products challenging, especially as Brazil's investment market has become increasingly standardized.

Given the unease stemming from valuations, particularly when compared to the start of the year, I am inclined to adopt a cautious stance toward XP Inc. In the present circumstances, I am currently more inclined to invest in other market participants, such as major Brazilian banks, which showcase heightened resilience in high-interest scenarios and trade at significantly more appealing valuation multiples.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ITUB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)