Hormel Foods: Still Not Worth It

Summary

- Hormel Foods faces inventory problems leading to lower margins.

- The company's dividend yield is low and its dividend may not grow at its historical pace.

- HRL stock is overvalued, and investors may be better off waiting for a further pullback before investing.

Justin Sullivan/Getty Images News

In February, I placed a hold rating on Hormel Foods (NYSE:HRL), and since then, the stock has performed as expected, lagging the market, dropping 7.6% on a price return basis. Investors buy Hormel Foods for the dividend income and low volatility. After seeing excellent revenue growth in 2022, the company is facing tough y/y comparison, and hence, its revenue has dropped over the past three quarters. The stock is still overvalued, and its dividend yield is too low for investors to consider it.

High inventory continues to hamper Hormel Foods

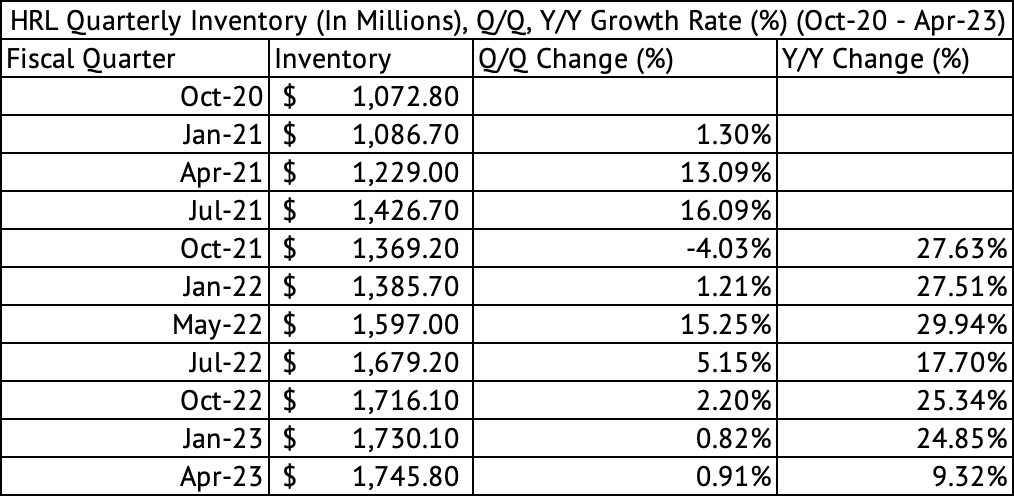

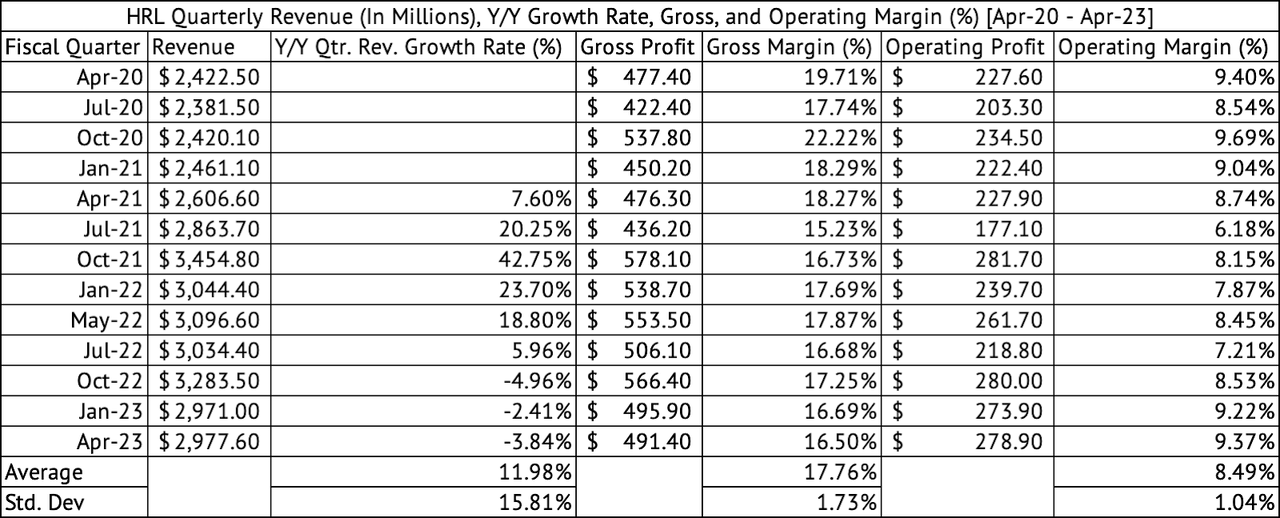

A combination of high demand in 2022, followed by a drop-off in 2023, and poor demand estimation has led to an inventory problem at the company. The company is racing to reduce its inventory, which has reached record levels in the April 2023 quarter (Exhibit 1). The y/y growth in inventory was the slowest in its April quarter, dipping below 10%. The company’s gross margins have dropped below its quarterly average of 17.7%. In the April 2023 quarter, the company recorded a 16.5% gross margin (Exhibit 2). Operating cash flow margins have dropped due to higher inventory costs and cash outflows to suppliers, which reduced outstanding accounts payables.

Exhibit 1:

Hormel Foods Inventory (Seeking Alpha, Author Compilation)

Exhibit 2:

Hormel Foods Quarterly Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

The company is experiencing lower volumes and sales in its Retail, Foodservice, and International segments. The Retail segment is the one that has suffered the most in Q1 2023, with a 7.1% decline in volume, a 4.2% decline in sales, and a 19.4% decline in segment profits. The Foodservice segment fared better with a low single-digit decline in volumes and net sales but saw segment profits increase by 7% y/y in the quarter. The International segment suffered a 49% decrease in segment profits due to lower sales in China. Although, the overall volumes and sales decrease was in the low single-digits for the International segment.

The company has prioritized inventory reduction as its number one priority for the upcoming year. It anticipates lower freight and warehousing costs and has implemented and announced price increases to help improve margins steadily. The company is driving more promotional dollars to its Planters brand to accelerate consumption. Planters is the centerpiece of Hormel Foods’ ambitions to dominate snacking. The company will continue to fight for every basis point of market share in the retail business.

Almost every consumer staples company focuses on grabbing a share in snacking, while store brands have offered lower prices than branded versions. China, which has seen sluggish recovery after the COVID lockdowns, should continue to recover. Although consumers in that country may be slow to buy new homes or make big-ticket purchases, food and snack sales should improve. The company expects 1% to 3% sales growth for the year.

Investors should also be concerned about the need for more promotional dollars to shore up the sales of Planters. Investors should also expect about 3% long-term revenue growth. Some products, such as Planters, may need to be differentiated more for consumers to pay a premium.

Hormel Foods is richly valued

Against this backdrop, the company looks expensive, trading at 24x forward GAAP PE and 16x EV to EBITDA multiple. The Vanguard Consumer Staples ETF (VDC) trades at a high 25x PE and 4.7x Price-to-Book ratio. The consumer staples sector looks overvalued overall. J.M. Smucker (SJM) trades at an 11x EV to EBITDA multiple. Campbell Soup (CPB) trades at a 10.2x forward EV to EBITDA ratio. If an 11x EV to EBITDA multiple were applied to Hormel Foods, the stock would be trading closer to $28.

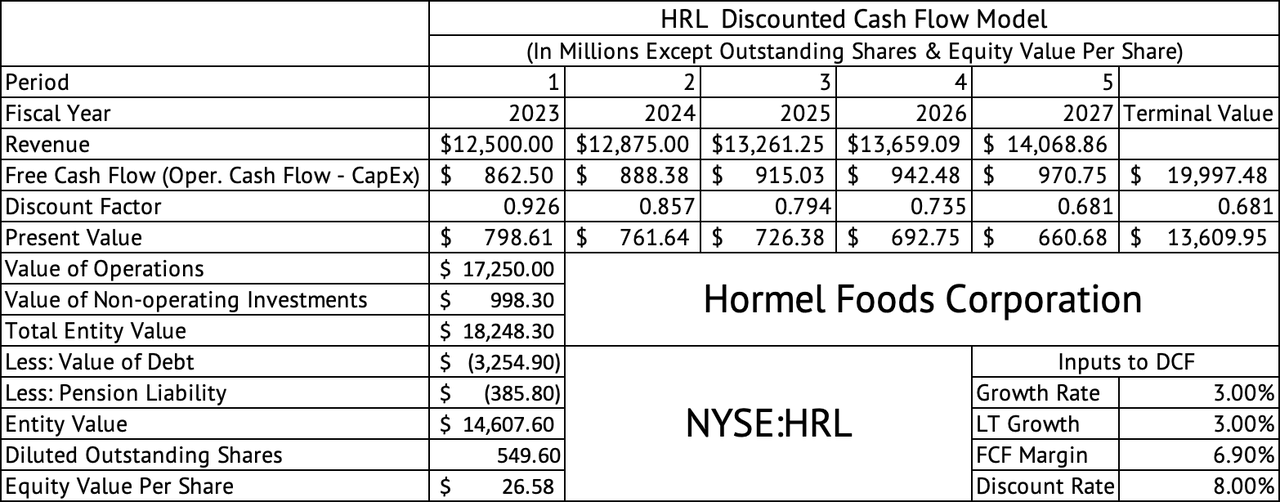

A discounted cash flow model estimates a per-share equity value of $26 (Exhibit 3). This model assumes a 3% revenue growth rate and a 6.9% free cash flow margin, its quarterly average since April 2020. Over the past decade, it has averaged a 7.5% free cash flow margin, which would increase the equity value to $29. By almost every measure, the stock still looks overvalued.

Exhibit 3:

Hormel Foods Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

Lackluster dividend yield and share repurchases

Hormel is a Dividend Aristocrat, which may be the primary reason behind its high valuation. The rich valuation has pushed down the yield, with the stock offering a 2.6% dividend yield. The dividend has grown slowly over the past year, increasing by 5.9% compared to its five-year average of 8% and ten-year CAGR of 12.6%. Investors may be better off waiting for the stock to yield 3% or more before investing. The stock would have to get to $36.6 to yield 3%.

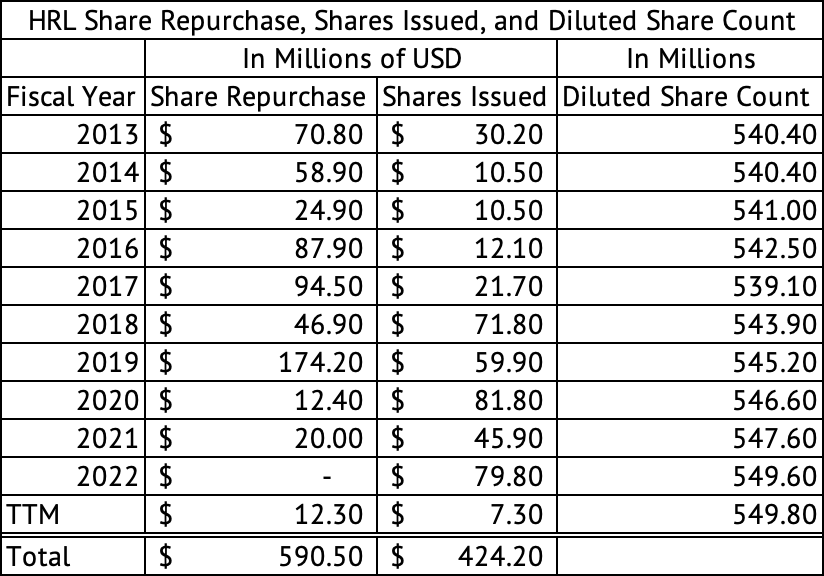

Over the past decade, the company has spent $590 million on share repurchases and $424 million on issuance, nullifying repurchases' impact. The share count has increased over the past decade from 540 million to 549 million (Exhibit 4). Given the company’s struggle with revenue growth and margins, increasing its share purchases would not be easy.

Suppose the company struggles with growth when the US and world economy is not in a recession. What would happen to spending, especially on snacking, if the economy enters a recession? Given the inverted yield curve, the New York Fed estimates a 66% probability of the U.S. entering a recession over the next twelve months. This is the highest probability predicted by the inverted yield curve since the 1980s.

Exhibit 4:

Hormel Foods Share Repurchases (Seeking Alpha, Author Compilation)

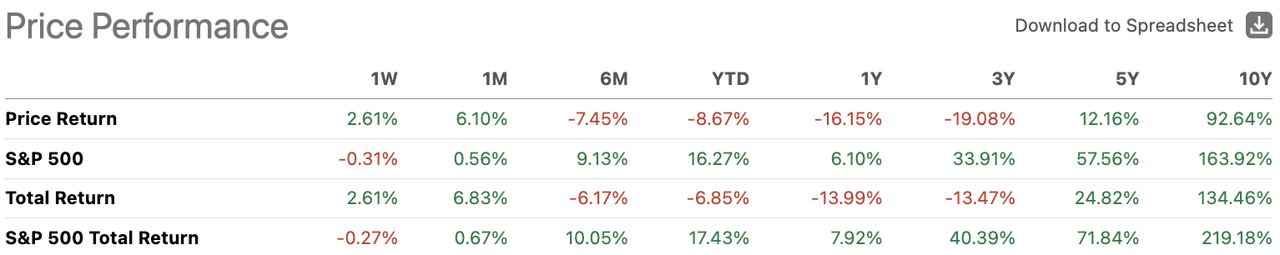

The stock has trailed the S&P 500 Index over the past decade, returning 134% compared to 219% on a total return basis for the S&P 500 Index (Exhibit 5). About 42% of the stock’s returns were due to the dividend. Given this lackluster record and continuing struggles, the stock is only worth owning as a defensive holding due to a low beta of 0.19. The stock has lost 16% over the past year compared to a 6% gain for the S&P 500 Index and a 2% gain for the Vanguard Consumer Staples Index ETF.

Exhibit 5:

Hormel Foods Price Performance (Seeking Alpha)

Hormel Foods faces multiple challenges, from high inventory costs to more significant promotional expenses for Planters. The economy faces significant headwinds, from the restart of student loan payments to high-interest rates and rents, further sapping economic activity. Given its growth prospects, the stock is richly valued, and the dividend yield is not high. If its past performance is any indication, this company may not outperform the index over the long-term. The stock’s dividend has shown mediocre growth over the past year due to low cash generated by the business. It may be best to wait for a further pullback in the stock before investing in Hormel Foods.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HRL, CPB, SJM, VOO, VDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.