Fabrinet: Growth Story At A Fair Price

Summary

- Fabrinet manufactures process technologies for various industries, including optical communications, automotive, medical, and aerospace.

- With LIDAR and VR-related products in the company's portfolio, I believe Fabrinet's growth should continue in the medium to long term.

- Fabrinet is expected to report Q4 results with a slowdown in revenue growth due to customers' inventory adjustments, but its margins should remain quite stable.

- The company's stock has seen significant gains over the past ten years, but I believe its current price already reflects most of its growth potential, leading to a hold rating.

Sundry Photography

Fabrinet (NYSE:FN) is a company that manufactures process technologies for businesses. The company’s focus is on optical and electro-mechanical devices. The company’s stock has seen rapid gains on the stock market, as the ticker’s price has skyrocketed for over ten years. I believe this run could continue, but with a stock price that already seems to reflect growth, I have a hold-rating for the stock.

The Company & Its Financials

Fabrinet produces process technologies for multiple industries, as the company tells on its website – the company’s customers include OEMs in optical communications, lasers, automotive, medical, industrial, and aerospace industries. The company produces its products in Thailand, as the country sets Fabrinet’s production costs low.

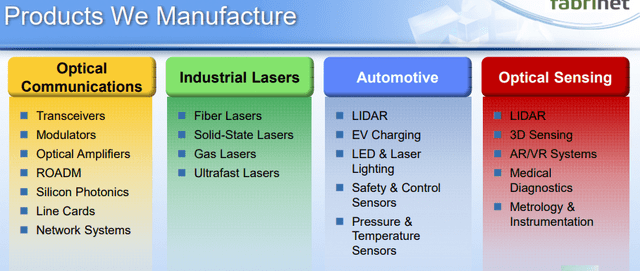

I believe Fabrinet could see a great surge in demand, as the company’s offering includes many products in growing industries as told in their Q3 earnings presentation:

Fabrinet's Offering (Fabrinet Q3 Earnings Presentation)

For example, the company’s LIDAR technology is commonly used in self-driving cars. Also, the company’s optical sensing offering should see an increase in demand as AR/VR systems become more common in households.

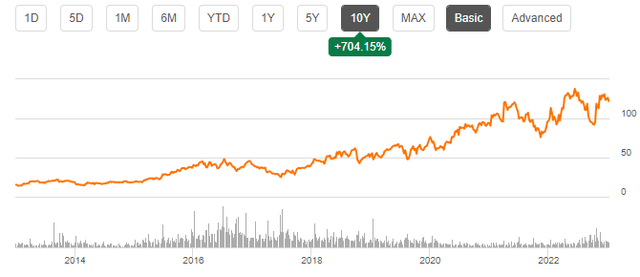

Fabrinet’s stock has had an impressive run on the stock market, as the stock has made gains over 700% in the last ten years:

Stock Chart (Seeking Alpha)

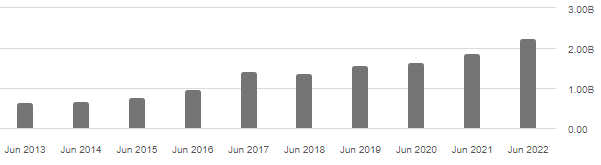

The stock price has been rising along revenues, as Fabrinet’s growth from the past nine years amounts to a compounded annual rate of 15.0%:

Fabrinet's Revenues (Seeking Alpha)

The growth seems to be achieved this growth almost entirely organically, as the company only has one acquisition in FY17 in the mentioned period. The growth is with a moderately good return on capital, as the company’s return on assets sits at 11.99%.

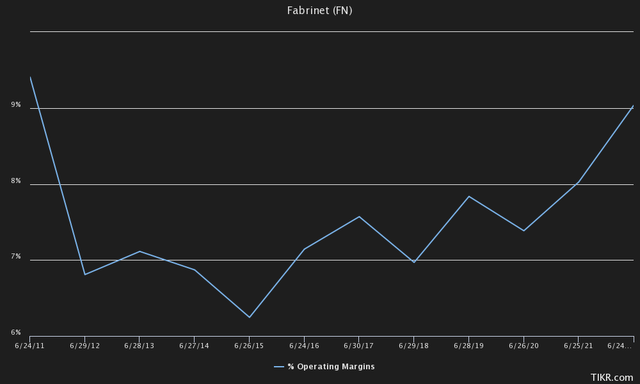

Fabrinet’s operating margin has fluctuated mostly between six and nine percent:

Fabrinet's Operating Margin (TIKR)

With trailing numbers, the company’s margin stands at a high amount of 9.8% - although the company’s facing a bit softer demand in the following quarter, the company’s expecting to mostly maintain their margin – the margin seems to be on a fundamentally good basis. Increasing Fabrinet’s net income margin, the company seems to only pay around a 5% tax rate as the company is based in the Cayman Islands.

Fabrinet has a very healthy balance sheet. The company has around $231 million in cash and $308 million in short-term investments with only $15 million in interest-bearing debt – with the investments, Fabrinet seems to only gain from higher interest rates. I believe the company should have some more debt in their balance sheet to access cheaper capital, leveraging the operations a bit.

Upcoming Q4 Result

The company is going to report its Q4/FY23 results on August 21st. Fabrinet has guided towards a revenue of $630-650 million, with analysts expecting revenues totalling $641 million – around the middle point of the guidance. The expected revenues would represent a growth of 9.1% - this would be a slowdown from the previous quarter’s growth of almost 18%. The company’s management explains this slowdown as related to inventory changes in the company’s customers, as Csaba Sverha, Fabrinet’s CFO, explains in their Q3 earnings call:

“Now I will turn to our guidance for the fourth quarter. As Seamus indicated, we are seeing the impact of inventory adjustments at our customers and their customers in the optical components market. As a result, we expect telecom revenue to be down sequentially in the fourth quarter. While our datacom business is also experiencing the same inventory headwinds, we expect the continued growth from certain high data rate programs to more than offset this impact, resulting in sequential growth in Q4.”

Fabrinet’s margins should still be somewhat protected in the quarter – the company guides towards a normalized EPS of $1.76 to $1.83, compared to previous year’s $1.68 – the middle point would indicate an EPS growth of 6.8%, meaning a very slightly lower margin compared to the previous year’s period. As customers’ demand seems to have a temporary cooldown, I think this would represent healthy pricing power from the company.

As Fabrinet guides its following quarter quite tightly, I don’t believe investors should see too much of a surprise in the earnings – I believe it’s important to look towards the company’s Q1/FY24 guidance, and whether we see a further drop in growth for the time being.

Valuation

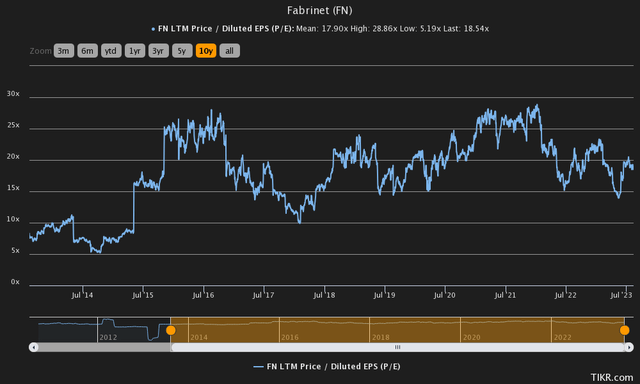

Fabrinet currently trades at a trailing price-to-earnings ratio of 18.54, around the company’s historical valuation:

Historical P/E Ratio (TIKR)

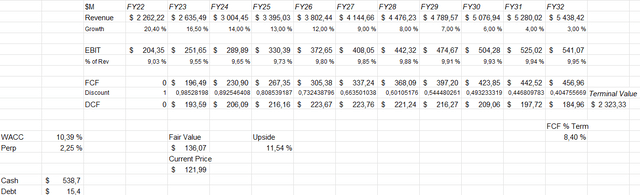

To further analyse the company’s valuation, I constructed a discounted cash flow model in my usual manner. For the current year I’m expecting a growth of 16.5% in the model – as most of the current financial year’s quarters are already reported, the figure should be quite set in stone. Going forward, I’m forecasting a growth of 14% in FY24, an amount that is slightly below the company’s 10-year average, as I believe a conservative approach is sensible in constructing a DCF model. The growth slowly fades away into basically no growth in real terms, although the model still expects a good growth runway in the future – the growth slows down from 14% to 2.25% in perpetual growth.

I believe Fabrinet’s margins should stay quite stable, with possibly small increases as the company scales up – in the model, the company achieves an operating margin of 9.95% in FY32 that continues into perpetuity. These expectations along with a weighted average cost of capital of 10.39% put the estimated fair value of the stock at $136.07, around 12% above the current price of $121.99:

DCF Model of Fabrinet (Author's Calculation)

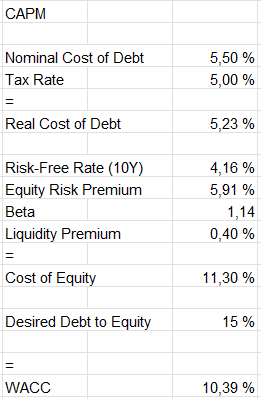

The cost of capital is derived from a capital asset pricing model with the following assumptions:

CAPM of Fabrinet (Author's Calculation)

As Fabrinet has almost no debt, I believe it is most sensible to approximate an interest rate for the company. I believe a 5.5% interest represents a healthy margin for the company. With a desired debt-to-equity ratio of 15%, I assume the company won’t leverage too much debt in the medium-to-long term either.

I use the United States’ 10-year bond yield as the risk-free rate, with the yield currently being 4.16%. The used equity risk premium is Professor Aswath Damodaran’s estimate from July. Yahoo Finance estimates Fabrinet’s beta to be 1.14, which I use in the model. Finally, I add a liquidity premium of 0.4% to address the stock’s liquidity, crafting a cost of equity of 11.3% and a WACC of 10.39%.

Takeaway

At $121.99, I believe Fabrinet is nearly fairly priced as my DCF model suggests. With a likely rising demand in some products the company manufactures, I believe Fabrinet’s growth story has a solid foundation to continue on its track. Unless the stock price takes a small hit, or the company shows excellence in their operations that go further than my estimates, I believe a hold-rating is appropriate for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.