Energy Transfer's Operations Shine, But Risks For Unitholders Remain

Summary

- In the second quarter, Energy Transfer LP's operations outperformed, but EBITDA fell short of expectations.

- Low commodity prices caused the miss, but price momentum has shifted positively in the third quarter as prices recovered.

- We maintain our Buy rating and $15.25 price target.

- Looking for more investing ideas like this one? Get them exclusively at HFI Research Energy Income. Learn More »

Art Wager

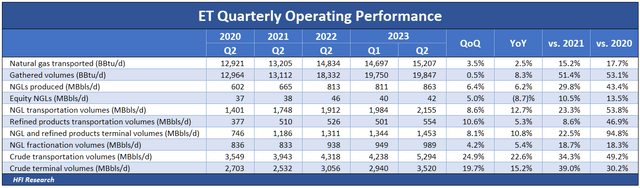

Energy Transfer LP (NYSE:ET) posted an impressive operating performance in its second-quarter results. The company set throughput records in every segment but those related to crude oil. The table below shows the dramatic improvement over the prior quarter and year.

As impressive as these results are, note that longer-term comparisons are distorted by acquisitions, so the outsized improvement relative to 2020 and 2021 are less relevant gauges of performance.

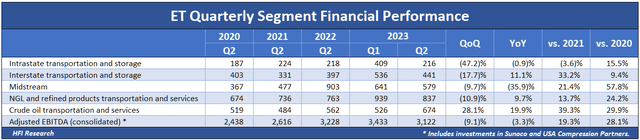

The record throughput gains in Q2 didn’t translate to improved financial performance. Adjusted EBITDA of $3.12 billion fell by 3.3% from the previous year and 9.1% from the previous quarter, while the company missed consensus expectations of $3.21 billion by 2.8%.

Like operating results, longer-term financial results are also distorted by acquisitions. The company’s $9.1 billion of acquisitions over the past two years make it difficult to tease out how much EBITDA growth is attributable to legacy assets versus acquired assets.

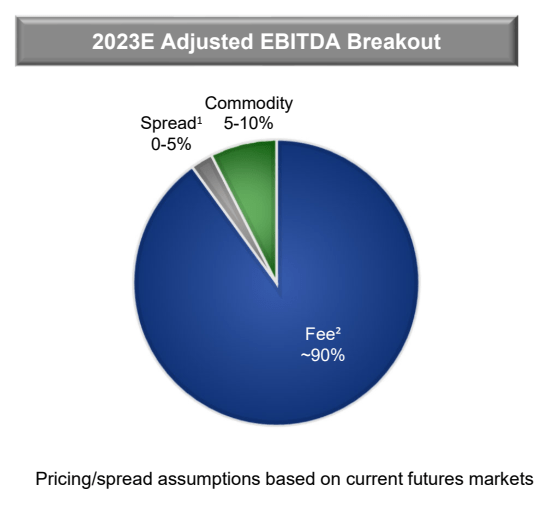

The culprit behind ET’s EBITDA miss during the quarter was its commodity price exposure, particularly with regard to natural gas and NGLs, with ethane having the biggest impact.

With natural gas prices down 70% and NGL prices down 45% from the year-ago quarter, the commodity-sensitive portion of ET's EBITDA took a hit. Approximately 10% of EBITDA is exposed to commodity prices. For the second quarter, that amounts to $312 million of EBITDA, so it’s not surprising that EBITDA missed expectations by around $100 million.

Energy Transfer

Source: Energy Transfer Q2 2023 Earnings Presentation, Aug. 2, 2023.

Results are expected to improve in the second half of the year. Management narrowed ET’s full-year 2023 guidance to $13.1 to $13.4 billion while keeping the midpoint the same as its previous guidance.

Among other positives in the quarter were management’s new target of 3% to 5% annual distribution increases. ET also has growth projects underway that will contribute to EBITDA and cash flow over the coming years. Its Mont Belvieu Frac VIII fractionator is expected to enter service in a few weeks, while its Nederland export capacity expansion is on schedule to be completed in mid-2025. Other notable expansions likely to enter service over the next few years include a new Permian Basin processing plant and a capacity addition to the Gulf Run Pipeline.

ET is still pursuing its Lake Charles LNG project. Management expects to file a new export authorization with the Department of Energy this month. ET has already entered into 3.6 million tons per year of LNG offtake agreements and has lined up potential equity partners. Lake Charles shows potential for adding to EBITDA by 2028.

Leverage is Too High for Comfort

These positives are offset by negatives that pose risks to ET unitholders.

First, the company’s leverage ratio ended the quarter at a lofty 4.5-times. Despite its recent success in bringing the ratio down from more than 5-times, leverage remains too high for unitholder comfort. Consider that Enterprise Products Partners (EPD), which also operates a large-scale diversified midstream business, operates with a leverage ratio of 3.0-times, the low end of management’s target range of 3.0 to 3.5-times.

ET’s high debt load relative to EBITDA is one reason its units trade at a discounted multiple relative to peers. The market knows that in the past, ET management has overextended the company at great risk to common unitholders by running up debt to fund overexpansion and excessive common distributions. ET’s currently elevated leverage increases the risk that management will do so again.

For ET, reducing debt would do more to increase the unit price than distribution increases. A lower debt balance would reduce risk to equity owners and increase the cash flow multiple at which ET units trade.

We would prefer management to continue prioritizing deleveraging, but its commentary indicates it’s back to expansion mode. Judging from comments made on the second-quarter earnings call, we put management’s capital allocation priorities as expansion, deleveraging, distribution growth, and unit repurchases—in that order.

What came through most clearly on ET’s second-quarter conference call was that management is downright giddy when it came to expansion. It mentioned “acquisition” 11 times, “expansion” 16 times, and “growth” 25 times over a span of 48 minutes.

ET’s enthusiasm for expansion has been costly to unitholders. For one, ET’s expansion has not increased its return on capital, though it has increased its financial and operating complexity. For ET, there’s no “knitting” to stick to; every midstream asset is fair game in its quest for greater size. Such undisciplined expansion runs the risk of being reckless if EBITDA synergies don’t materialize or if assets aren’t properly integrated.

Second, ET’s expansion has resulted in unitholder dilution, as deals are funded through the issuance of undervalued units. Most recently, ET issued 44.5 million new units at approximately $12.36 per unit as part of its $1.45 billion acquisition of Louts Midstream in April. We view ET units as being significantly undervalued, so the acquisition’s cost is more than meets the eye from management’s promotion alone. In this deal, the 1.4% dilution is closer to 2% in terms of value per unit.

In addition to acquisitions, ET will continue to expand by pursuing new growth projects. Management bumped up its annual growth capex estimate to the range of $2 to $3 billion and even mentioned that it hoped growth capex would exceed $3 billion. In light of the company’s leverage, these comments don’t inspire confidence that management will avoid the errors of its past.

Conclusion

We’re maintaining our Energy Transfer LP Buy rating and our price target of $15.25. Midstream analysts tend to assign higher price targets than ours, with the average around $17 and the high at $22. In our view, the risks in the picture make us comfortable with our lower valuation. Unless circumstances change for the better, we plan on selling our units when they reach our price target and we can find attractive alternatives.

Outperform!

At HFIR Energy Income, we strive to outperform with every pick recommendation. Since inception in 2021, the HFIR Energy Income Portfolio has returned 80.5%, versus its benchmark's return of 41.7%.

This article was written by

I have been a full-time professional energy investor since 2015, specializing in deep value opportunities and special situations. I have managed a private investment partnership since 2007 and separately managed accounts since 2020. Prior to managing the partnership, I served in various investment and research roles in the financial industry since 2000.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

🤔🤔🤔