Dividend Challengers Review: Ball Corp.

Summary

- Ball Corporation is a Dividend Challenger stock with six consecutive years of dividend growth.

- The company's financials show positive revenue and earnings growth but negative free cash flow and increasing long-term debt.

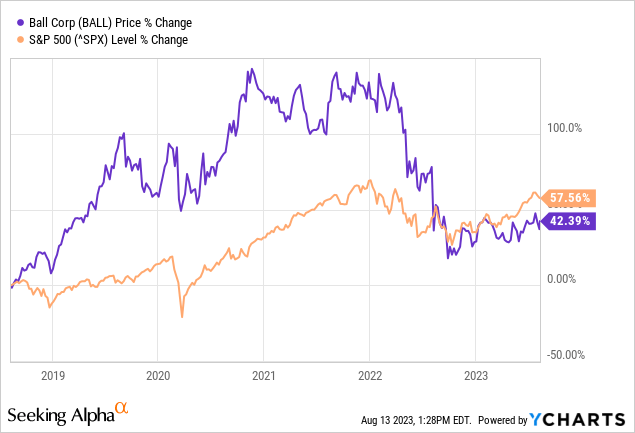

- Ball's valuation is relatively low compared to its historical average, but its stock performance has underperformed the S&P 500.

piranka/E+ via Getty Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long-term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided by other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Ball Corporation (NYSE:BALL).

Ball supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally. The company operates in four business segments: Beverage Packaging, North and Central America; Beverage Packaging, Europe, Middle East and Africa; Beverage Packaging, South America; and Aerospace. Ball Corporation was founded in 1880 and is headquartered in Westminster, Colorado.

Dividend

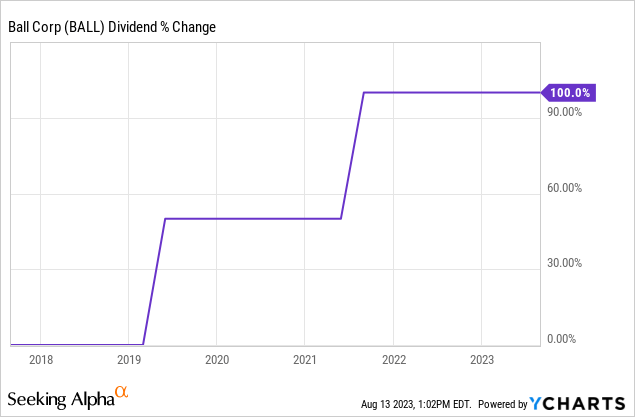

This is the second year on the Dividend Challengers list for Ball as it has six consecutive years of dividend growth. Looking at the chart below you can see that Ball has doubled its dividend during this time period.

If the same trend continues, Ball should be announcing another hefty increase to its dividend in one of its next couple of quarters.

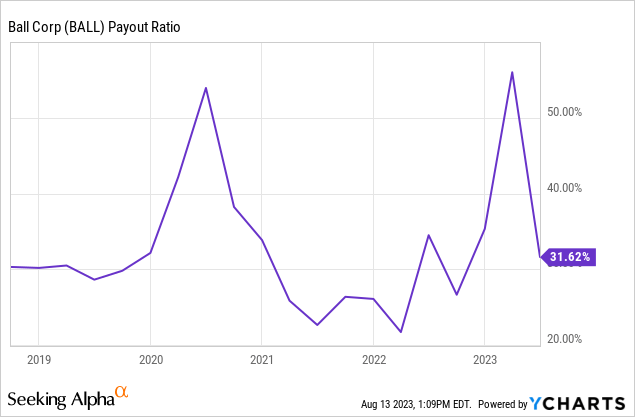

Looking at the chart below, you can see that Ball's payout ratio has seen some ups and downs over the past few years but currently sits right around its recent historical average, which means that future dividend growth should not be negatively impacted.

Ball currently maintains a dividend yield of 1.39%.

Financials

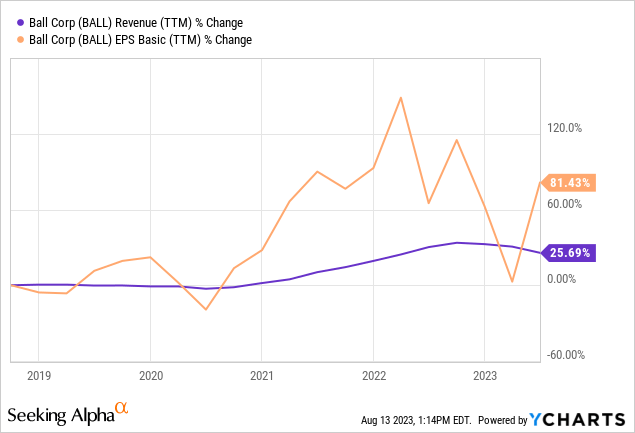

Ball has seen ups and downs in terms of its revenue and earnings growth over the past several years. Looking at the chart below you can see that both revenue and earnings have seen overall positive growth during this period with Ball's earnings being more variable compared to its more consistent revenue growth.

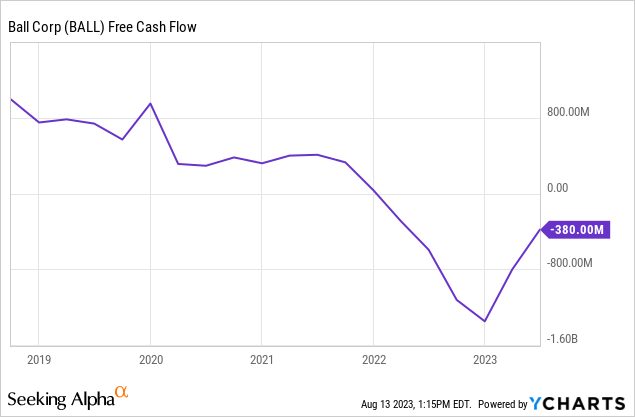

When looking at cash, you can see that Ball's free cash flow is currently negative which unlike its payout ratio could have a negative impact on future dividend growth.

It has been on the upswing so far this year, but still needs to improve by about $400M to get back into the positive.

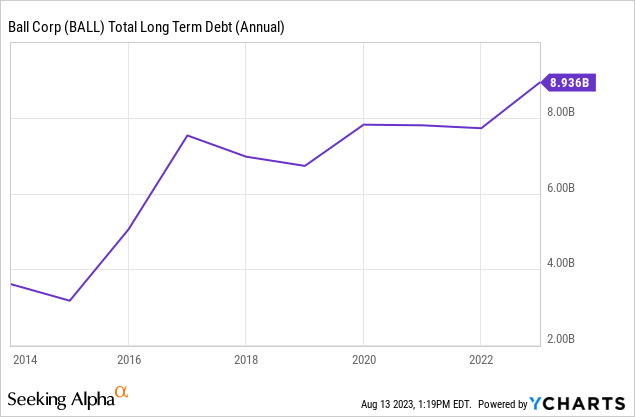

An area that might make this more difficult is Ball's growing long-term debt. You can see in the chart below that this value has more than doubled since 2015 and continues to climb.

Valuation and Performance

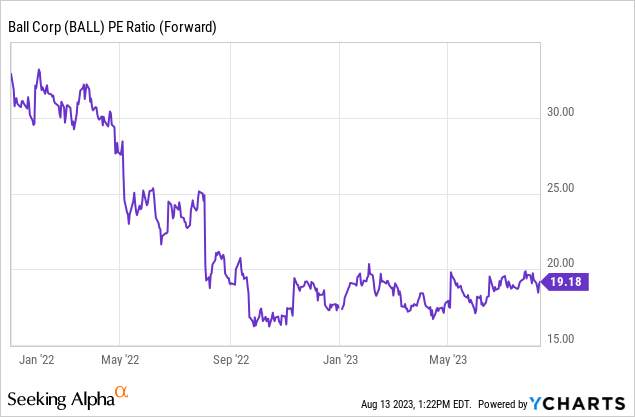

Ball currently has a forward PE ratio of 19.18. Looking at the chart below, you can see that this remains on the low end of its recent historical average.

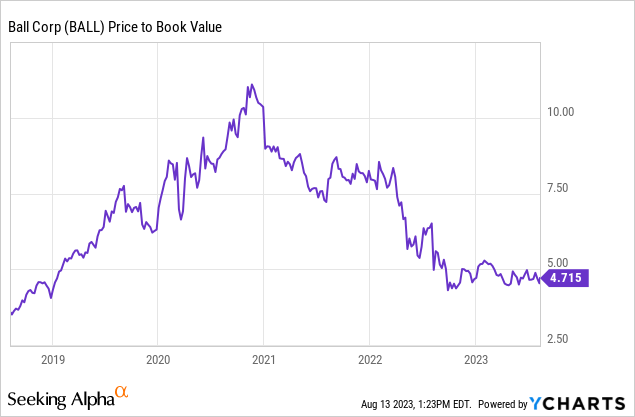

A similar trend can be seen when looking at the company's price-to-book value with its current valuation at the low end of its five-year average.

At first glance, this seems like a positive and appears to make Ball an attractively valued stock; however, this does not take into consideration Ball's price performance during this time period.

Looking at the chart below, you can see that Ball's performance has been closely aligned with the returns of the S&P 500 even though it has underperformed the index over the past five years.

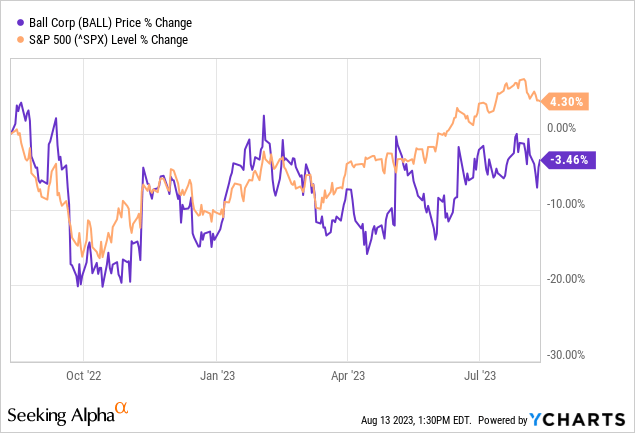

The same can be said for Ball's more recent performance as the stock has declined by just over 3% over the past year while the S&P 500 has increase by just over 4% during this time.

Peer Comparison

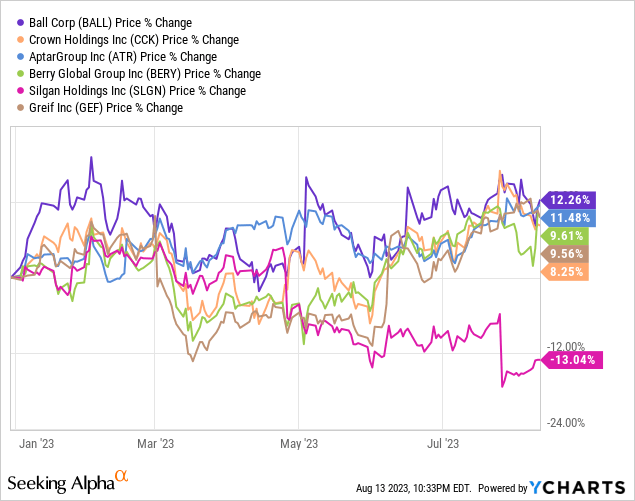

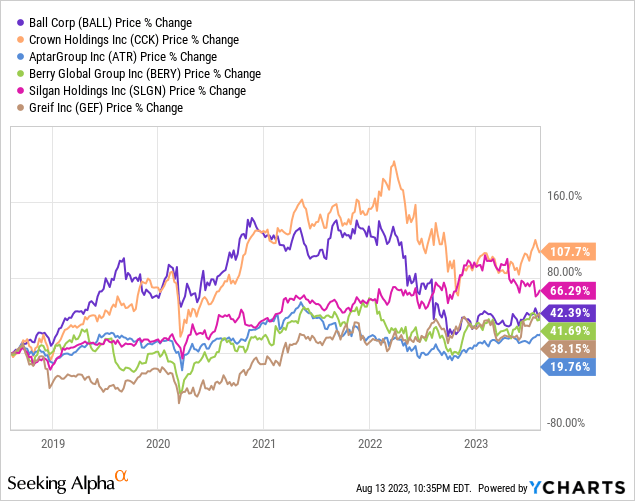

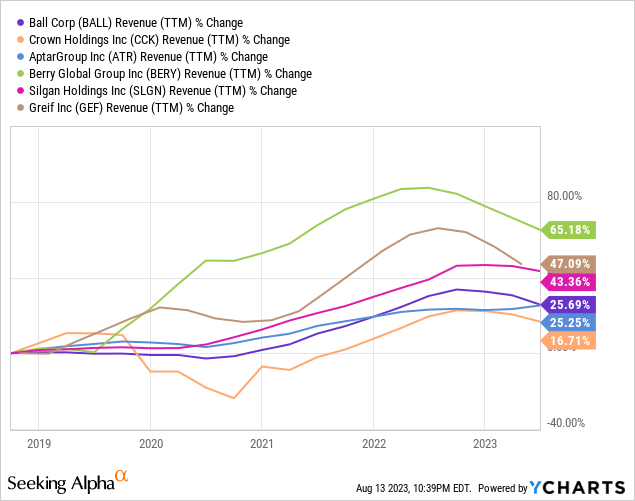

A few stocks within the same industry as Ball include Crown Holdings (CCK), AptarGroup (ATR), Berry Global Group (BERY), Silgan Holdings (SLGN), and Greif (GEF).

In terms of stock price, you can see that Ball has the best price appreciation year to date. Each of the six stocks has fairly similar price paths during this time with the exception of Silgan Holdings which has seen a 13% decline YTD.

Looking back a bit further you can see from the chart below that Ball is in the middle of the pack when it comes to price appreciation over the past five years.

When looking at revenue growth you can see that Berry Global Group has seen the highest growth over the last five years, with Ball ranking 4th.

When looking at 10-year revenue growth, Ball ranks 2nd, 3-year revenue growth it ranks 3rd, and 1-year revenue growth it once again ranks 4th.

Similar trends can be seen when looking at earnings growth for these companies. Looking at the chart below, you can see that Ball ranks 2nd in earnings growth over the past five years.

Ball ranks 3rd when looking at 10-year earnings growth, 2nd when looking at 3-year earnings growth, and 4th when looking at 1-year earnings growth.

Recent News

Earlier this month, Ball announced its 2nd quarter results. Earnings per share came in at $0.55 per share a beat of $0.07 per share compared to estimates. Revenue was $3.57B, which was a miss of $278.18M compared to estimates.

A few months ago, it was reported that Ball is exploring a sale of its aerospace business unit. The price tag is expected to be over $5 billion. Shortly after the news was reported both Advent and Blue Origin are two potential buyers with interest in the purchase.

In May, Ball priced an underwritten public offering of $1 billion worth of senior notes due 2029. The company is expected to use the funds to repay $800 million in outstanding borrowings.

Conclusion

As noted above, Ball's 2nd quarter results were mixed. Reviewing the earnings call transcript, there were both positive and negative impacts on performance but the bottom line is that management is forecasting full-year flat global volume growth. I don't see anything that suggests the company's initiatives aimed at providing growth are going to be able to offset the current headwinds the company faces (including the negative impact of its Russian sale and the decline of global beverage volumes).

While I understand the short-term challenges, what troubles me more than the flat volume growth forecast is the company's public offering a few months ago to pay off debt. When I see a company make a move like this it reminds me of the saying "Robbing Peter to pay Paul" and it usually means that the financial health of the company involved is not in great shape. And we know this is true for Ball based on its negative free cash flow and climbing long-term debt.

In the company's earnings call, Dan Fisher stated " And as leverage continues to come down and free cash flow expands, our return of value to shareholders will grow in 2024 and beyond."

I would like to believe him but in 2022 I heard a similar statement from him, "Our global beverage teams have positioned their businesses for slower growth in the fourth quarter, inclusive of preparing for temporary actions to achieve year-end inventory goals, keeping supply/demand tight and preparing for optimal financial improvement in 2023."

I don't think we have seen optimal financial improvement so far in 2023 and based on most recent forecasts, it doesn't appear that we will end 2023 having seen it either.

I do believe that Ball remains a legitimate long-term investment opportunity for investors who already own the stock, but with its poor revenue growth, negative cash flow, and ballooning debt, I cannot recommend it as a buy for investors who don't already have a position in the stock.

If the aerospace unit sale does go through, I believe that will provide a short-term bump in the stock price and be a brief win, but I am not sold on the fact that it will be a net benefit for long-term investors. As always, I suggest individual investors perform their own research before making any investment decisions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.