SCHG: Stepping Off The Risk

Summary

- The stock market is exhibiting irrational exuberance, with asset prices reaching unsustainable levels despite steep valuations and elevated interest rates.

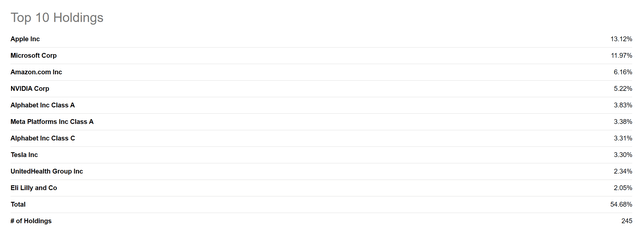

- The biggest stocks in Schwab U.S. Large-Cap Growth ETF are Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, United Health Group, and Eli Lilly and Co.

- Many of these stocks have seen stagnant or declining growth, yet their valuations remain high, indicating a disconnect between market expectations and reality.

- While prediction of the future prices of this ETF is futile, the risks of holding this ETF far outweigh the benefits and I rate it as a Sell.

urfinguss/iStock via Getty Images

The current environment appears to be characterized by a state of irrational exuberance within the stock market, a phenomenon where market participants become overly optimistic and push asset prices to unsustainable levels. Despite the backdrop of steep valuations and elevated interest rates set by central banks, the stock market's persistent approach toward all-time highs seems to defy conventional logic.

I do understand the age-old adage of the stock market staying irrational longer than you can stay solvent but it's hard to dismiss the big disconnect in stock prices and underlying fundamentals, setting the stage for a potential market correction or even a downturn. History has shown that such periods of exuberance often come crashing down as market sentiment gives way to a sobering assessment of reality.

While I am invested in certain areas of the stock market as timing is futile, there are certain stocks that I tend to disagree with. I firmly believe the risks far outweigh the benefit of holding on to these stocks. There are multiple ETFs that hold these stocks and in this article, we will focus on SCHG - Schwab U.S. Large-Cap Growth ETF and the stocks in the ETF which have significant weighting. We will briefly spend time on the components and performance and more time on why for many of these holdings the risks far outweigh the benefits.

Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG)

With a very low expense ratio of 0.04%, the fund aims to track aims to track the performance of large-cap growth companies across various sectors in the U.S. stock market. This ETF is crafted to offer investors exposure to companies that are anticipated to achieve growth above the norm in both earnings and stock prices. When you look at the holdings, a lot of the names are familiar.

ETF Top Holdings (Seeking Alpha)

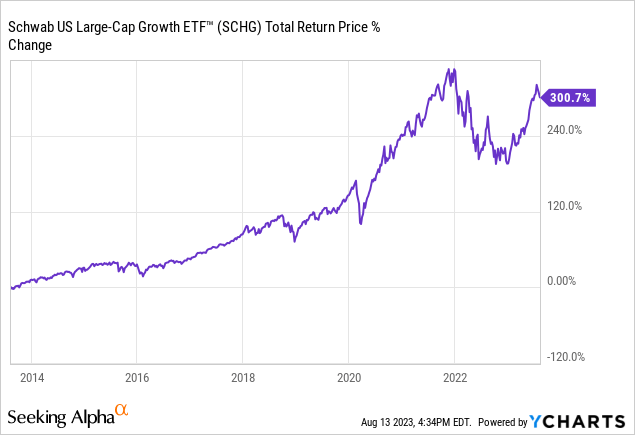

The fund has inched closer to all-time highs once again mainly based on the performance of some of the underlying stocks. But on an individual fundamental level, how have the biggest components fared?

Apple (AAPL)

The highest holding in this ETF has seen its growth stall. Comparable LTM revenue has dropped by 0.9% and comparable LTM diluted EPS has dropped by 1.5%. Yet when you look at its price performance and its valuation, it is priced like a growth stock. It trades at a PE of close to 30x and currently scores a valuation grade of F in Seeking Alpha.

Microsoft (MSFT)

The second-highest holding in this ETF has shown growth in revenue but not in EPS (6.9% and 0.3% respectively). It trades at a PE of 33x and currently scores a valuation grade of F in Seeking Alpha

Amazon (AMZN)

The third-highest holding in this ETF has shown a 10% growth in revenues and a 12% growth in diluted EPS. This is quite far from the growth rates it has put in the last decade. Its average growth has been above 20% and its elevated valuation has always expected the company to put stellar numbers quarter after quarter. But with declining growth, its PE of 110 looks quite inflated and overall has a valuation grade of D- in Seeking Alpha. Maybe Amazon is past its prime.

Nvidia (NVDA)

Perhaps, no other company embodies the overvalued sentiment as much as Nvidia. Revenues have dropped by 12% and diluted EPS by 48%. Yet the stock touched its all-time highs in the last month. What gives? If you have not yet heard, we have an AI mania gripping the market, and Nvidia is expected to benefit from it the most. This means that the market thinks that its PE of 213x and PS of 39x is justified and some savvy and experienced investors have already been calling this stock a bubble. Bubble or not, we have seen narratives flip quite a bit in the last few years and Nvidia could become a victim if the market turns and would hit indices harder than most stocks.

Alphabet (GOOG)

Revenues have grown by 4% and diluted EPS has declined by 12%. Valuation has a D grade with PE at 27.4x. Hard to make the case that this is still a growth stock but out of all the stocks in this list we have seen so far, this is the only company that is the most reasonably valued.

Meta Platforms (META)

Meta probably went through one of the deepest drawdowns for a large cap in near history. The stock fell more than 75% as the market believed the headwinds faced by the company along with its spending on its futuristic VR project would not benefit its investors. It was even briefly hovering over value territory at one point. But now the stock has gained more than 200% from its lows, revenues have remained flat at 0.9%, and diluted EPS is down by 29%. It has a valuation grade of D+ and trades at a PE of 35x

Tesla (TSLA)

The most controversial company in terms of valuation and this has been the case for over a decade. Bulls and bears alike have had lengthy debates on why this is undervalued and overvalued and so far the bulls have been proven right. Against all odds, the company has been able to grow and prove the impossible. Revenues have grown 40% and EPS has grown 27%. This is the only company on the list that still deserves the "growth" tag. But where do we go from here? Mounting competition means the future is less certain. The current valuation indicates that the market expects this company to keep growing at the same rate. It trades at a PE of 69x and has a valuation grade of F. In my opinion, it could be much harder to keep future growth justified to its valuation.

UnitedHealth Group (UNH)

Most of the companies we discussed so far were related to the Technology sector. This company is in the healthcare sector and perhaps has the most resilience through economic downturns. It has seen its revenue increase by 14% and diluted EPS increase by 17%. It trades at a more reasonable PE of 23x. Personally, I would be more comfortable holding this stock through a downturn than many others we have discussed so far.

Eli Lilly and Co (LLY)

Another healthcare company among the top ten holdings, the company has clearly gone ex-growth. Its revenues increased by 1.5% and yet it trades at 16 times sales and 73 times earnings (has a valuation grade of F). The current valuation indicates a lot of optimism baked into the stock but again since this is in the healthcare sector, it may not move like the rest of the market.

Wrapping up

In the current conditions, I would rate this ETF as a Sell. Most of the big components of this ETF no longer exhibit the growth that is typically expected from a growth stock. But this is not a deal breaker in itself. In addition to this, there is a clear disconnect between the valuation or the market expectation and the present reality of these stocks. I am not a predictor of stock market prices and this may well continue for longer than even the most bullish investors anticipate. But I believe the risks far outweigh the benefits at this point and there are other corners of the market that I would feel safer investing in.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.