Aehr Test Systems' TAM Is Ever Increasing

Summary

- Aehr Test Systems produced good results and a better CC, during which they described a number of additions.

- These innovations also open up the possibility of entering new segments, increasing the company's TAM.

- While the shares are expensive, AEHR is still in the early innings of a multiple-year ramp.

- Looking for more investing ideas like this one? Get them exclusively at SHU Growth Portfolio. Learn More »

kynny

Aehr Test Systems (NASDAQ:AEHR) has been our most successful pick (at $2.05 in July 2020) as combines a market-leading technology with a rapidly expanding use case.

We still think this is in the early innings and we believe that there is still significant upside in the stock, although valuations are high and the stock tends to swing considerably around its longer-term upward trajectory, so it's important to have a quarterly health check. We believe the Q4 one was pretty favorable.

Q4 results were solid, a little above expectations, but not by much. However, the earnings call gave ample reason to assume that the company faces an ever-increasing TAM.

The simple truth is that wafer-level testing is a huge and rapidly expanding market, and Aehr Test Systems produces by far the best systems for this market.

It is often much cheaper to test at the wafer level, as compared to testing ever more complex packages (Q4CC):

Imagine the implication of the greater than 1% failure rate experienced in burn-in on a module with 48-die. The extrinsic failure rate of high power silicon carbide MOSFETs could cause 25% to 50% yield loss of these modules. For all intents and purposes, this is unmanageable without wafer level burn-in. So wafer level burn-in actually enables these kinds of high-density multi-chip modules.

The company doesn't really have any serious competition in wafer-level testing and its FOX systems produce multiple advantages and are an order of magnitude cheaper than alternatives.

But the CC brought home the insight that their opportunity is expanding faster and is larger than we previously assumed, partly the result of additional innovations from the company itself opening up additional markets and segments. We give you a few pointers.

Silicon Carbide

$52m or a full 79%(!) of FY23 revenues are from their lead SiC customer and this is not all as this customer is planning a 300% increase over the coming years. Also, the second and third SiC customers will likely ramp up this year.

During Q4, the company received the first order from another SiC customer for applications in electric vehicles, trucks, and train traction inverter modules. Train traction inverters are a new significant market opportunity. In all, the company added four new SiC customers in FY23.

The company is working with one of the largest SiC players in the world in qualification, so this could turn into another very large customer (management is confident of that and argues that (Q4CC):

They have told us that their plan is to move all new production capacity to wafer level burn-in and away from packaged part burn-in. This is because they're not only mostly moving to multi-chip modules and known good die sales, but also for the lower cost of test associated with wafer level burn-in over packaged burn-in as well as the significant improvements in yield they achieve with wafer level burn-in.

Silicon Photonics

The company already has six customers in the SiPh (Silicon Photonics) segment (used mostly for photonics transceivers used for connections in and between data centers). That SiPh opportunity is increasing (Q4CC):

We also see on the horizon a significant new market opportunity for test and burn-in of semiconductors such as silicon photonics devices used in optical input/output or optical I/O and co-packaged optics for data farms, computing and artificial intelligence markets... Multiple companies such as Intel, nVidia, AMD, TSMC and Global Foundries have made public announcements regarding their product roadmaps for co-packaged photonics integrated circuits with microprocessors, graphics processors, chipsets for computing and also artificial intelligence applications.

The company gained a new customer, a major SiPh player and one of the largest semiconductor manufacturers in the world in Q4 placing an order for a FOX-XP system with management expecting subsequent orders. And a new segment is emerging, optical (photonics) circuits (Q4CC):

We see the potential to integrate the photonics integrated circuit devices into multi-chip modules as another major market opportunity for Aehr.

Management believes that the SiPh market opportunity could become as large or larger than that in SiC this decade, although William Blair sees SiC wafer demand for just EVs and EV chargers to grow from 220K in 2022 to 4.5M in 2030, a stunning 45% CAGR with other SiC segments (industrial applications, energy conversion, RF amplifiers, etc.) delivering another 2.8M wafers by 2030.

Innovations

The company introduced a number of improvements, further cementing their competitive advantage and increasing the TAM:

- Added voltage ranges

- Patented anti-arcing capabilities

- Increased parallelism per wafer

- New burn-in and stress conditions

- A new fully automated FOX WaferPak Aligner

Given the technical nature of these advantages, we have to quote rather extensively from the CC here. On added voltage ranges (Q4CC):

Our new Bipolar Voltage Channel Module or BVCM for the FOX-P platform of products, which includes our FOX-XP, NP and CP extends our test and burn-in capability to provide a wide range of positive and negative voltage programmability applied to the gate for positive high temperature gate bias or negative HTGB testing. The BVCM can supply gate bias voltage to more than 3000 die per wafer while being able to monitor individual die performance and detect individual die failures.

Then there is their VHVCM (Very High Voltage Channel Module), enabling high-temperature reverse bias testing of silicon carbide and gallium nitride devices on wafers of up to 2000 volts using our proprietary WaferPak contactors. The systems are further enhanced by the patented anti-arcing capabilities that are necessary to avoid high voltage electrical arcing, which (Q4CC):

The amazing part of this is we can manage anti-arcing across the entire wafer, whereas semiconductor functional automated test equipment or ATE tester today are only able to keep devices from arcing in very small areas such as only one or a few devices at a time. This allows an unprecedented low cost of test and burn-in for high voltage wafers such as silicon carbide devices used for electric vehicles, trucks and trains with voltage specifications up to 1700 volts and above.

Systems with the new 2000-volt high-voltage option introduced last year are opening up additional segments (Q4CC):

Gallium nitride is another wide-bandgap compound semiconductor being applied for efficient high speed power conversion and amplifier applications...We're currently working with a large multinational semiconductor supplier to move forward with a full wafer level burn-in evaluation of gallium nitride devices... The gallium nitride market appears to be a potentially significant growth driver for our systems

No surprise, as (Q4CC):

gallium nitride where the primary, if not maybe only the only real failure mode has to do with the high temp reverse bias, which is a high voltage gate breakdown.

As well as high-power systems (Q4CC):

Its ability to test, burn-in and stabilize up to nine 300 millimeter wafers in parallel with up to 3.5 kilowatts of power per wafer is beyond the wafer parallelism and power capacity of any system on the market. This testability is unprecedented in the industry as there are no other competitors that can even test one wafer at a time at these power levels.

Opening up additional segments (Q4CC):

Our new FOX production system configuration, which can be used to test and burn-in these new optical I/O devices up to 3500 watts per wafer expands the market opportunities of the FOX-XP system even further.

The new fully automated FOX WaferPak Aligner can work with multiple FOX-XP systems (which each can have up to 18 WaferPacks with 18 wafers tested at the same time) and operate fully automatically, opening up new segments (Q4CC):

opened several significant incremental markets to Aehr such as high volume processors and chipsets with integrated photonics transceivers, flash and ultimately DRAM memories and higher-mix devices requiring extremely high reliability and 100% burn-in such as automotive microcontrollers and sensors.

Summing it up (Q4CC):

Each of these new product enhancements broadens our total available market and extends our cost competitiveness and application space for our FOX products.

The company is already selling some of these innovations although an aligner sale was pushed into this quarter from Q4.

Possible additional TAM increases

Memory has long been touted as another market that could open up for Aehr, here is what management had to say about that (Q4CC):

investors in Aehr test are can be confident that we have oars in the water and are working towards long term goals of being in memory. Memory makes sense for wafer level burn-in. NAND is easier and closer. DRAM there's a path to wafer level burn-in.

The automated aligner helps here (Q4CC):

And for sure, our new WaferPak automated Aligner is a key piece of that. And we did get feedback from multiple memory companies on that configuration and its capability.

Increasing production capacity

The company increased its production capacity by 3x last fiscal year and aims to double it again this fiscal year. They clearly want to be prepared for any upside in demand as it's difficult to predict the timing of orders.

The company started FY24 with almost $40M in backlog already and expects FY24 revenue to grow 50%+ and come in at $100M+ (with earnings growth at 90%+ coming in at $28M+, clearly the investments in capacity aren't spoiling the operating leverage).

Finances

Some FY23 figures:

- Revenue grew 28% in FY23.

- Annual bookings +30% to $78.3M, a record with another $15M in bookings coming in in the first six weeks of FY24 taking the backlog to $40M.

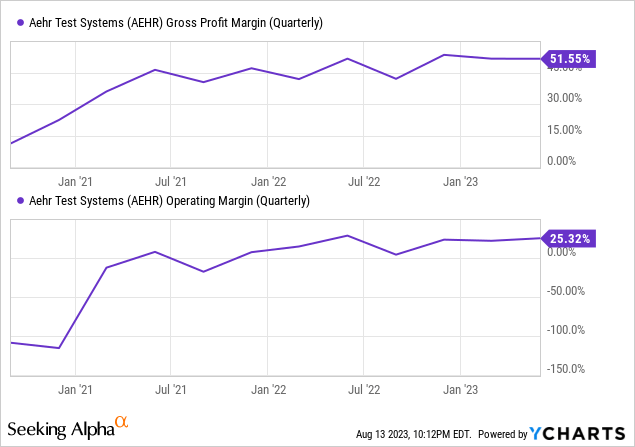

- GAAP gross margin increased 390bp to 50.4%.

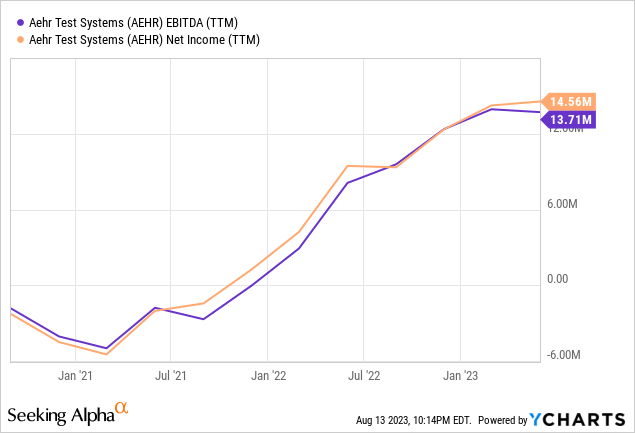

- Non-GAAP earnings grew at 62% to $17.3M.

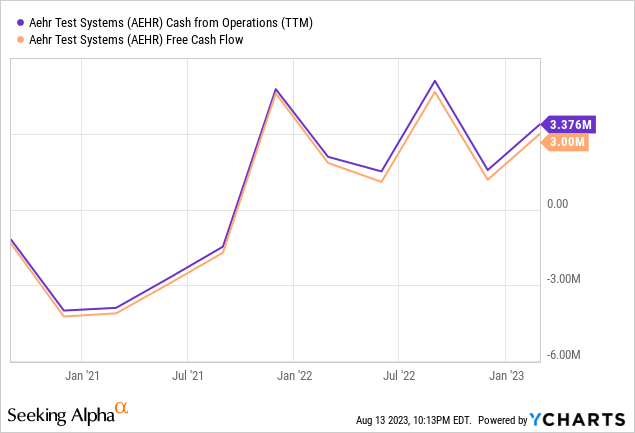

- Operating cash flow grew 500%+ to $10M.

With respect to the $100M+ guidance (Q4CC):

There are a very large number of companies that are expressing interest and leaning forward with us for our wafer level test and burn-in products across several markets. It's going to be a very busy year for us. The forecast does include a good number.

Given that the timing of orders (a FOX-XP with WaferPacks amounts to $4M) there is upside if some of these companies move faster.

Operating leverage and cash flow

GAAP figures don't show a lot of operating leverage recently:

Neither does cash flow, although the tiny gap between operating and free cash flow surprised us, considering the huge increase in production capacity:

But earnings do, even in their GAAP version:

Costs will increase in FY24 as the company embarks on expanding R&D, G&A, and S&M, but they still see earnings rise much faster (90%+) compared to revenue (50%+).

The balance sheet of the company is very solid with the company having no debt and cash and cash equivalents of $47.9M at the end of FY23 (+52% y/y).

Surprisingly, the company embarked on a $25M ATM offering in Q3/23 under which they already sold 209K shares delivering $7.3M with the remaining $17.7M to be offered during FY24.

Valuation

There are 1.48M options outstanding (at least at the end of Q3, the latest available figure) so the total market cap (at $49 per share) is $1.34B with the EV at $1.29B.

Valuation is very steep at 12x EV/S although less extreme on an earnings basis with FY24 earnings expected to come in at $1.04 and FY25 earnings coming in at $1.49. Valuation is the reason we can't advise to go all-in here.

Risk

We don't really see much of a risk to their business but the possibility that things could move slower than they are guiding for can't be entirely excluded.

The main risks are the high valuation and something happening to stock market sentiment or a significant recession.

Conclusion

The company keeps going from strength to strength, cementing its competitive advantage by introducing innovations and additions that also make wafer-level testing relevant to new segments, increasing the TAM.

We're still in the early innings as a whopping 79% of the company's revenue comes from just one customer in one segment and it's not even the biggest player in that segment (SiC), with others starting to join the party.

There is a considerable amount of operating leverage as earnings growth moves much faster than revenue growth and the company is already cash flow positive and has a healthy balance sheet.

The shares are expensive, but this is a market leader that is still in the early innings of a multiple-year ramp that looks set to continue unabated for the rest of the decade.

If you're not in, buy a first tranche under $50 and wait for a pullback for additions, but realize full well that the pullback might not come anytime soon and the shares could run further.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.

This article was written by

I'm a retired academic with three decades of experience in the financial markets.

Providing a marketplace service Shareholdersunite Portfolio

Finding the next Roku while navigating the high-risk, high reward landscape.

Looking to find small companies with multi-bagger potential whilst mitigating the risks through a portfolio approach.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.