Vaalco Energy: Steadier Growth Ahead

Summary

- Vaalco Energy, Inc. has businesses in Africa and Canada.

- The offshore business Africa will provide large if lumpy growth.

- The onshore business in Africa is likely to provide steady growth and some cash flow.

- Management has chosen projects that the "big boys" are not interested in.

- The debt free balance sheet and strategy reduce a lot of upstream risks.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Jeremy Poland

Vaalco Energy, Inc. (NYSE:EGY) is a United States-based company that has successfully navigated the African environment to establish some solid growth potential ahead with a strong balance sheet.

For many years, many of the companies I followed that did business in Africa were "money pits" that just basically sucked investors dry. Many had no source of income and those that did were "not going anywhere fast." Recently that has changed with the emergence of Vaalco Energy and others like Africa Oil (OTCPK:AOIFF) as companies with decent growth potential on one of the really last frontiers for oil and gas.

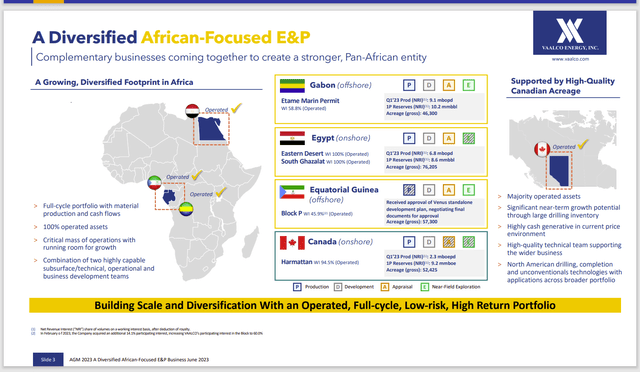

Vaalco Energy Summary Of Operations (Vaalco Energy Annual Meeting Corporate Presentation June 2023)

Most of the company's production comes from Gabon and Egypt. The Egyptian production is primarily secondary recovery production which keeps the company from competing with the "big boys" that also operate in Egypt. Similarly, the production in Gabon is an established reservoir that really does not interest large companies. But a small company like this one can make a very profitable return on projects like these.

Egypt is a country that is very supportive of the industry while also showing unusual stability for the Middle East. Gabon, likewise, supports the industry for the income that the government receives.

Before the merger with TransGlobe Energy (TGA), the company was largely dependent upon rather large offshore projects. That often meant no growth shown for a time period and then significant growth because even one well is very expensive for a company of this size. Platforms and all the accompanying steps needed several years of cash flow even if there were partners.

The market is not really happy about erratic growth. So, the combination with TransGlobe Energy adds production that can be easily increased as the wells are relatively cheap. Even the startup of a secondary recovery project (which often requires an up-front investment) is much more practical for a company of this size.

Furthermore, the business combination adds cash flow that makes larger projects more feasible. The Egyptian properties can show production growth every year while the offshore business will likely show a lot of growth "all at one time." Mr. Market generally likes an "every year" growth story. Positive quarterly production comparisons are likely to result in a higher business valuation.

Egyptian Business

Management appears to be bringing a new energy level to this business that shareholders of TransGlobe Energy had not seen in some time. This is going to benefit the shareholders of both companies for some time to come.

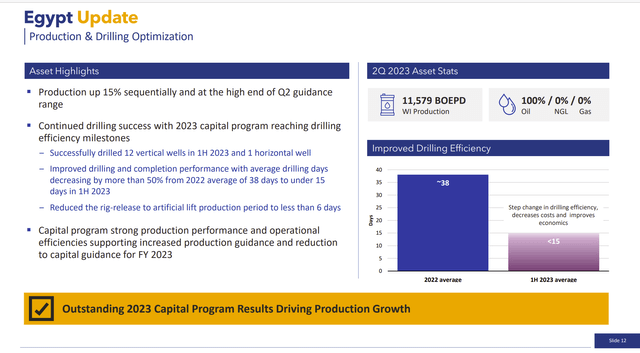

Vaalco Summary Of Egyptian Business Accomplishments (Vaalco Energy Corporate Presentation Enercom Denver August 14, 2023)

Vaalco Energy has managed to significantly decrease well costs by reducing drilling times. That reduces reliance on the excess recovery cost part of the contract that the company has with the Egyptian government (which has to be a good thing).

It also appears that management has chosen some rather productive wells to drill. Long time readers may remember that these wells often cost less than $1 million to drill and just as often slightly more than a million total when hooked up and producing (as a rule). Therefore, paybacks on these wells will be fast. Egyptian margins may not be as good as elsewhere but when combined with the cost picture, these wells could be the most profitable wells in the company portfolio.

Because they payback quickly in the current environment, management can have a robust drilling program and still collect some cash flow to use elsewhere. That is what made TransGlobe such an attractive acquisition candidate.

Now, before the merger, TransGlobe management began to bid on some smaller light oil prospects that the "big boys" were not interested in. There is not an update on those leases right now. So, we will have to see if this management is as interested in that business as the previous management was or will the new management focus strictly on the secondary recovery business (which is heavier oil).

Gabon

This part of the business just completed a major project that should save costs.

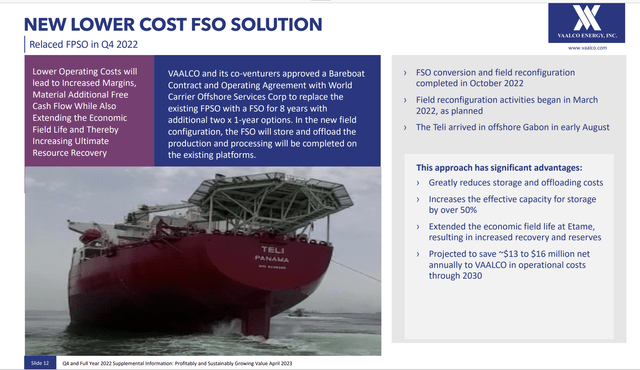

Vaalco Energy Summary Of New Configuration To Save Offshore Costs (Vaalco Energy Fourth Quarter 2022, Earnings Conference Call Slides)

The new offshore situation should save the company a lot of money. It will also add reserves to the reserve report as it likely enables more wells to be possibly drilled for commercial production.

Equatorial Guinea

This country has approved a development project that will take some years to bring online. Given that the market usually responds to the start of cash flow from a major project, the stock price may not make much headway based upon the progress of the project. But it will likely become a major cash flow producer in the future.

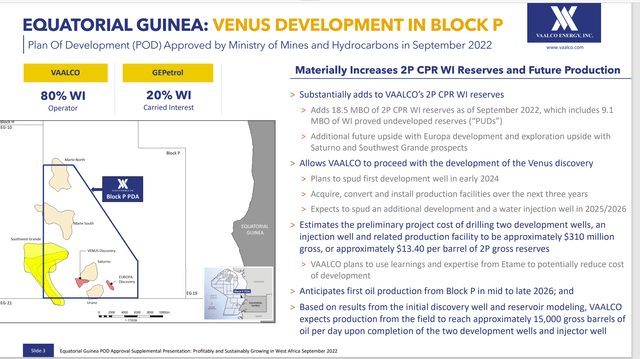

Vaalco Energy Summary Of Equatorial Guinea Project Development Plan (Vaalco Energy Corporate Presentation September 2022)

This project illustrates the benefits of the business combination that happened. The two companies have far more cash flow to invest in a project like this. Shown above is the original summary of the proposed project. Management still anticipates first oil in 2026. The thing to notice is the cost of the project. That cost is substantial for a company the size of Vaalco.

Many of these "discoveries" were basically known by larger companies that considered them noncommercial. But a small company that operates with lean management can often make good money off this field.

Furthermore, technology is currently advancing so fast, that management can often project better recoveries than was the case when the field was discovered. The result is a more profitable project than was originally anticipated.

Here, management is going to use knowledge gained from the Gabon operations to likely be successful in reducing costs significantly from the projection shown in the slide. No guarantees of course.

This offshore business, as a result, is not quite as risky because management is going with known areas to develop. So it is not a true exploratory project in the sense that some upstream companies engage in. That keeps overall costs down as well also.

Key Takeaways

The cash flow tends to be lumpy because production is picked up periodically both offshore and in Egypt. The combined company will of course have more of these periodic sales than did either company by itself. That is likely to reduce cash needs for the combined company.

The combined company maintains a debt free balance sheet. That alone will sharply reduce the upstream risks of the offshore business. The low visibility industry probably mandates a debt free balance sheet with a decent cash balance.

Nonetheless, companies with strong balance sheets often get the chance to "try again" if they need to whereas leveraged companies often have no such leeway.

This management has built and sold companies before. That experience also reduces the small company risk.

Nevertheless, Vaalco Energy, Inc. is a very small player in a very large project part of the industry. That alone can be risky. But even here, management has reduced the competition by finding small projects that the larger industry competitors are not interested in.

The result of all of this is that Vaalco Energy, Inc. is likely a strong buy consideration for patient investors. Management has reduced a lot of risks inherent in the business. That makes this small upstream player a lot safer than many larger competitors in the industry (which is very unusual).

The offshore business will grow in lumps. But the onshore business should smooth that pattern out somewhat to provide steady growth year in and year out. That should result in a higher valuation for the combined company than it did for two separate companies. This will take some time though, to come about.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I analyze oil and gas companies like Vaalco Energy and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.