Advent Technologies Q2 Earnings: Liquidity Running Low Despite Ongoing Dilution - Sell

Summary

- Last week, Advent Technologies Holdings released another set of disappointing quarterly results with immaterial sales and sizeable cash usage.

- The company recorded a negative free cash flow of $11.1 million for the quarter, thus resulting in unrestricted cash decreasing to just $10.1 million.

- Funding for the company's key Green HiPo project in Greece continues to be delayed as the Greek state's review has not yet concluded.

- Company might be required to pay an additional €4.5 million for the ill-advised acquisition of the company's operations in Denmark and Germany two years ago after the seller recently filed for arbitration.

- Given the high likelihood of substantial near-term dilution, I would advise investors to avoid the shares or even consider selling existing positions.

Naeblys

Note:

I have covered Advent Technologies Holdings (NASDAQ:ADN) previously, so investors should view this as an update to my earlier articles on the company.

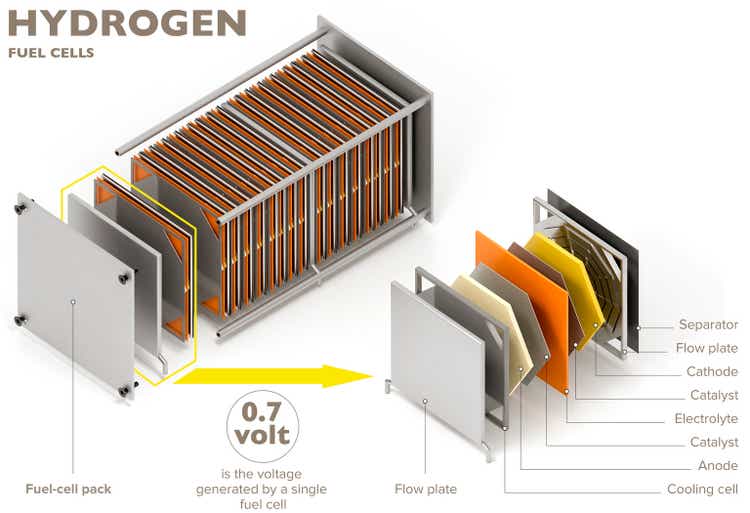

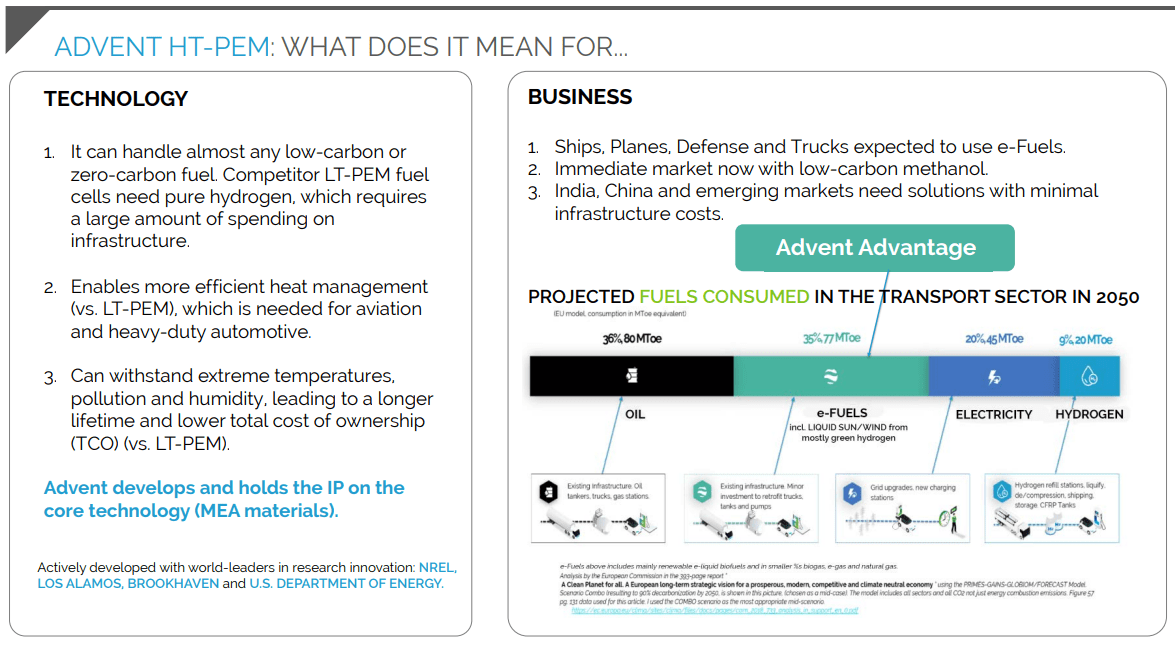

Advent Technologies Holdings or "Advent" is a small, Boston-headquartered fuel cell company primarily focused on high-temperature polymer electrolyte membrane ("HT-PEM") technology.

HT-PEM fuel cells do not require pure hydrogen and can handle almost any low- or zero-carbon fuel. In addition, Advent asserts its technology to be highly resilient and enables a more efficient heat management.

Company Presentation

The company used the 2020/2021 ESG hype to obtain a backdoor listing by combining with SPAC AMCI Acquisition Corp. in February 2021.

The transaction raised an aggregate $158.3 million in capital, including $93.3 million of AMCI's cash in trust and $65 million from a PIPE investment led by Jefferies LLC and Fearnley Securities.

Over the past two years, the company has spent most of the funds for covering operating losses as well as a number of acquisitions which haven't played out as expected.

Last week, Advent released weak second quarter results and subsequently filed its quarterly report on form 10-Q with the SEC.

Despite not being a development-stage company, Advent's second quarter sales came in just slightly above $1 million which doesn't exactly inspire confidence in the company's ability to live up to consensus expectations for revenues increasing to $35.9 million this year, up from a paltry $7.8 million in 2022.

Advent reported negative free cash flow of $11.1 million for the quarter, thus leaving the company with unrestricted cash and cash equivalents of just $10.1 million at the end June.

Advent's dangerously low liquidity position has resulted in the requirement to include a going concern warning in the 10-Q:

Based on the Company’s current operating plan, the Company believes that its cash and cash equivalents as of June 30, 2023 of $10.1 million will not be sufficient to fund operations and capital expenditures for the twelve months following the filing of this Quarterly Report on Form 10-Q, and the Company will need to obtain additional funding. (...)

If the Company is unable to obtain sufficient funding, it could be required to delay its development efforts, limit activities and reduce research and development costs, which could adversely affect its business prospects. Because of the uncertainty in securing additional funding and the insufficient amount of cash and cash equivalents as of the financial statement filing date, management has concluded that substantial doubt exists with respect to the Company’s ability to continue as a going concern for one year from the date the unaudited condensed consolidated financial statements are issued.

During the quarter, the company started to utilize its discounted stock purchase agreement with Lincoln Park Capital. In aggregate, Advent sold approximately 5.39 million shares for net proceeds of $3.4 million.

Subsequent to quarter-end, the company sold another 1.44 million shares to Lincoln Park Capital for net proceeds of $1.0 million. Please note that a share price below $0.50 would preclude Advent from selling additional shares to Lincoln Park Capital under the agreement.

As a result, outstanding shares have increased by almost 15% since the time of the company's first quarter report in May.

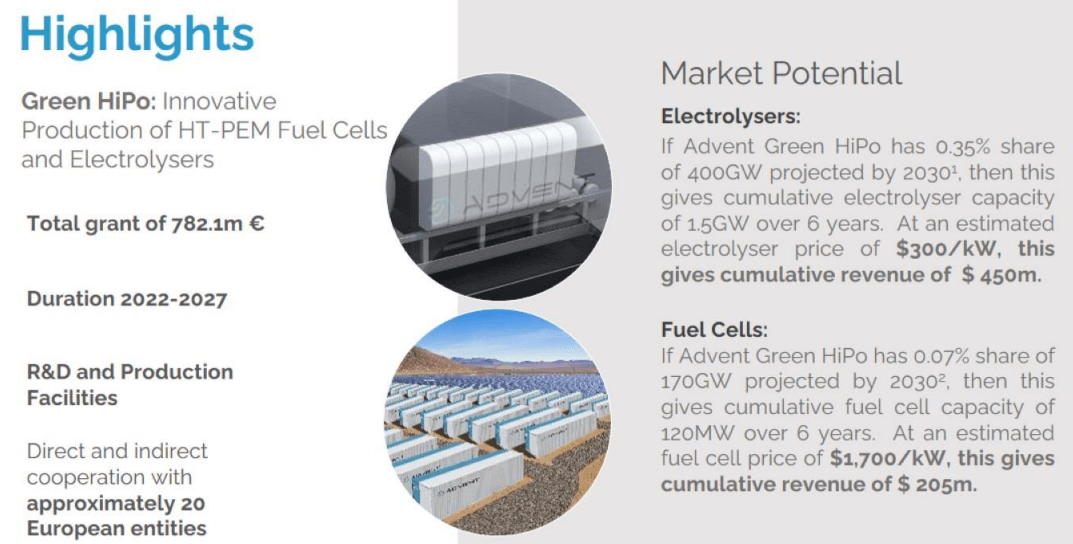

Given Advent's dangerously low liquidity, investors will have to prepare for dilution continuing unabatedly, particularly after funding for the company's key Green HiPo project continues to be delayed as the Greek state's review has not yet concluded:

On August 4, 2023, Advent was informed by the Ministry of National Economy and Finance that the Greek State is currently reviewing the financing for IPCEI Hy2Tech. Accordingly, and as a pre-requisite for unlocking the State Aid funding for Green HiPo, the Greek State is examining and planning ways to implement actions and to strengthen initiatives that will contribute to the transition of the productive and growth model of the Greek economy towards climate neutrality. Parameters for the planning of such actions include implementing projects at specific times, the viability of the completed proposed plans, as well as compliance with regulatory obligations and guidelines regarding the management of European funds.

On the conference call, management stated its dissatisfaction with the ongoing delay but expected the issue "to be resolved very, very soon".

Company Presentation

But with the Greek State apparently still in the process of establishing a framework for reviewing and potentially advancing the project, I do not expect a funding agreement anytime soon.

On the conference call, management projected quarterly cash burn of between $7.5 million and $9.0 million going forward and expected to sell sufficient amounts of newly issued shares to either Lincoln Park Capital or under its recently established ATM program with H.C. Wainwright & Co., LLC.

Quite frankly, given the $0.50 stock price limitation under the terms of the Lincoln Park Capital agreement and considering the shares' mediocre trading volume, I expect Advent having a hard time to sell sufficient amounts of shares under these agreements.

But even if the company manages to stay afloat for the time being, shareholders would be diluted materially.

Assuming H2 cash usage of $15 million and an average selling price per share of $0.65, the company would have to issue approximately 21.5 million new shares until the end of this year thus increasing total outstanding shares by more than 35%. Please note that this projection already includes cash raised from share issuances quarter-to-date.

Adding insult to injury, Advent might be required to pay an additional €4.5 million for the ill-advised acquisition of the company's operations in Denmark and Germany two years ago:

On June 7, 2023, the Company was served a Request for Arbitration from F.E.R. fischer Edelstahlrohre GmbH (“F.E.R.”), pursuant to the arbitration provisions of the Share Purchase Agreement dated June 25, 2021 whereby the Company acquired Serenergy and FES, which acquisition closed on August 31, 2021.

The arbitration will be held in Frankfurt am Main, Germany in accordance with the Arbitration Rules of the German Arbitration Institute. F.E.R. is asserting that it is due approximately 4.5 million euro based on the cap and corresponding value of the share consideration at the date of closing.

The Company believes that the claim is without merit and intends to defend itself vigorously in these proceedings; although we cannot accurately predict the ultimate outcome of this matter.

Remember also that Advent might have to consider a reverse stock split in the not-too-distant future as the company remains out of compliance with the Nasdaq's $1 minimum bid price requirement. That said, Nasdaq has provided the company a 180-day grace period until November 20 to regain compliance. Under certain conditions, the company would be eligible for a second 180-day grace period.

Bottom Line

While management remains optimistic regarding its ability to secure near-term state funding for its key Green HiPo project, I do not expect the Greek State to conclude its review anytime soon.

As a result, dilution is likely to continue unabatedly for the time being. Quite frankly, I wouldn't be surprised to see outstanding shares increasing by at least 35% until year end.

Given the high likelihood of substantial near-term dilution, I would advise investors to avoid the shares or even consider selling existing positions.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.