Dividend Challengers Review: Baxter International

Summary

- Baxter International has seen 7 consecutive years of dividend growth, but has not raised its dividend this year.

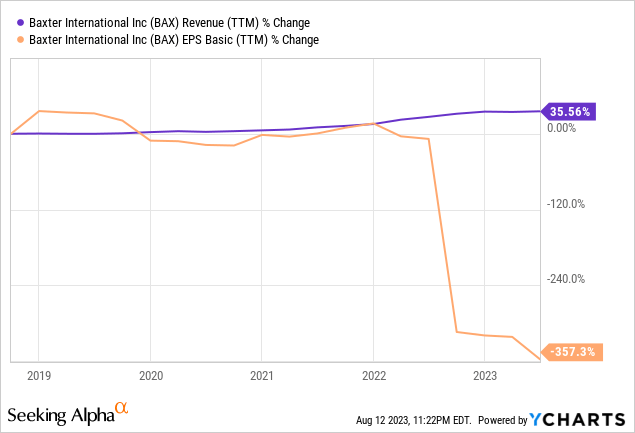

- The company's financials show slow revenue growth and a dramatic drop in earnings.

- Baxter's stock price has declined significantly over the past five years, making it a less attractive investment option compared to peers.

PM Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long-term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided by other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Baxter International (NYSE:BAX).

Baxter International develops and provides a portfolio of healthcare products that are used in hospitals, nursing homes, doctors' offices, kidney dialysis centers, rehabilitation centers, and others throughout the globe. The company sells its products through a direct sales force, as well as through independent distributors, drug wholesalers, and specialty pharmacies in around 100 countries worldwide. Baxter International Inc. was incorporated in 1931 and is based in Deerfield, Illinois.

Dividend

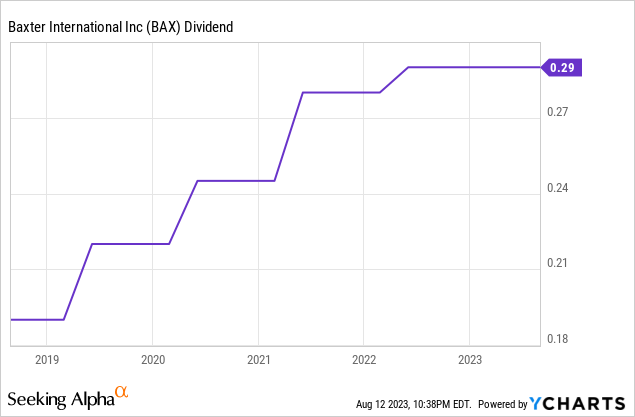

Baxter International has been on the Dividend Challengers list for a few years now as it has seen 7 consecutive years of dividend growth. Looking at the chart below you can see that while Baxter's dividend growth has been fairly consistent, it has not yet raised its dividend this year, which is out of the ordinary as the company raised its dividend in the early part of the year the prior four years.

In 2021, Baxter raised its dividend by 14%, in 2022 the raise was just 4% and as I mentioned already, there has been no raise yet in 2023.

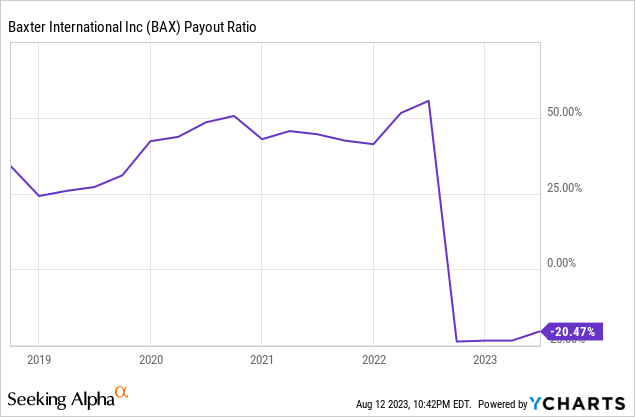

Looking at the chart below, you see why there has not been a dividend raise this year.

Baxter's payout ratio turned negative in late 2022 and remains negative today, meaning that it is currently paying out more in dividends than it is making in earnings. Most of the time that is a bad sign for the company's financial health.

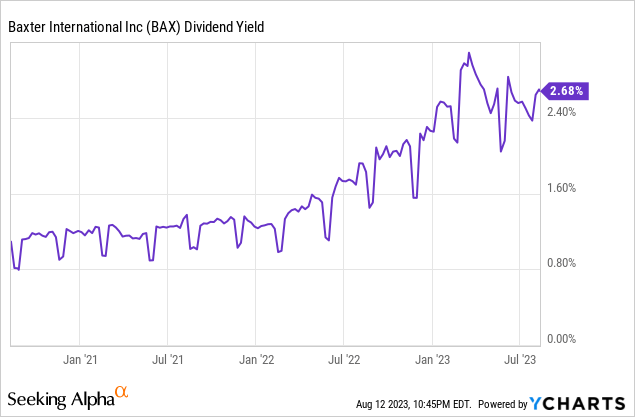

Baxter currently maintains a dividend yield of 2.68% and looking at the chart below you can see that is above its recent historical average.

Financials

Baxter has seen slow and steady revenue growth over the past five years, while its earnings have been more up and down during this time. Looking at the chart below you can see that while revenue has remained fairly consistent, Baxter's earnings have seen a dramatic drop in the past year.

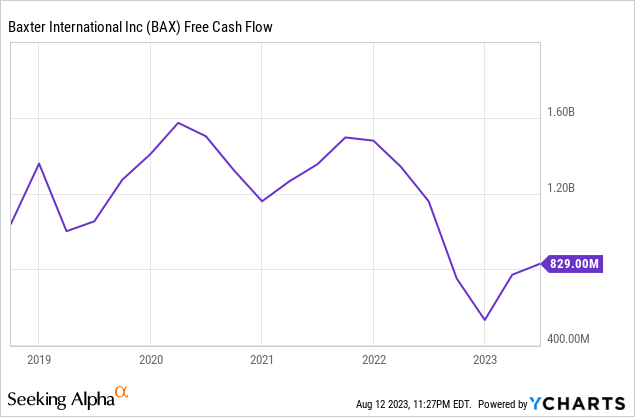

When looking at cash, you can see that Baxter's free cash flow remains at a respectable level and has seen an uptick since a low at the beginning of the year.

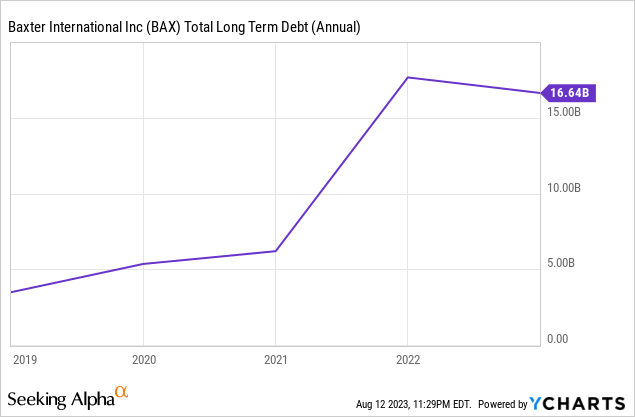

Baxter's long-term debt has declined recently but remains at a high level compared to its recent historical average.

Valuation and Performance

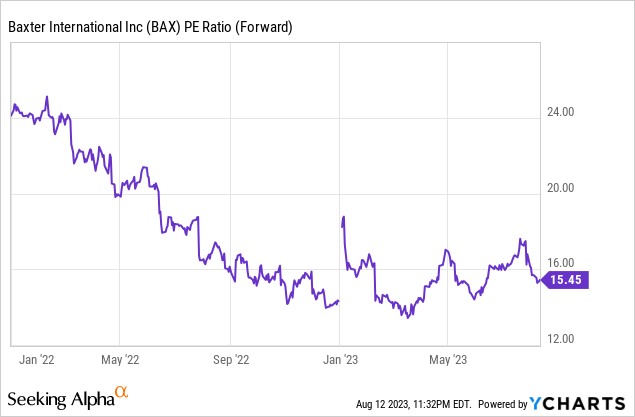

Baxter currently has a forward PE ratio of 15.45. Looking at the chart below, you can see that this remains low compared to its recent historical average.

A similar trend can be seen when looking at its price-to-book value.

At first glance, this seems like a positive and appears to make Baxter an attractively valued stock; however, this does not take into consideration Baxter's price performance during this time period.

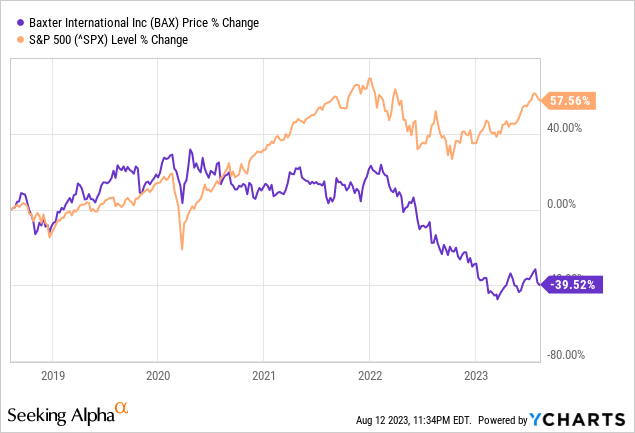

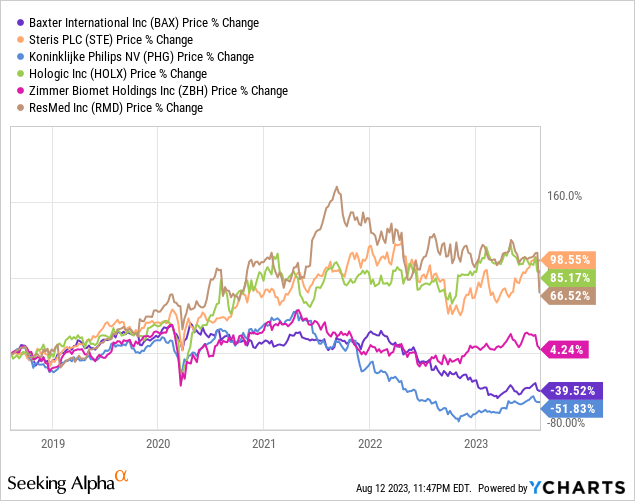

Looking at the chart below, you can see that Baxter's performance has been almost an inverse of the S&P 500 over the past five years as Baxter's stock price has declined by nearly 40% and the S&P 500 is up over 57% during this time period.

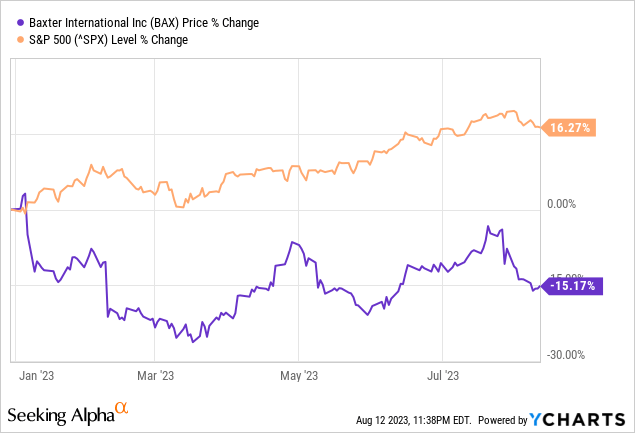

Looking at a more recent timeline and the same trend appears with Baxter dropping in price by 15% YTD while the S&P 500 is up 16% YTD.

Peer Comparison

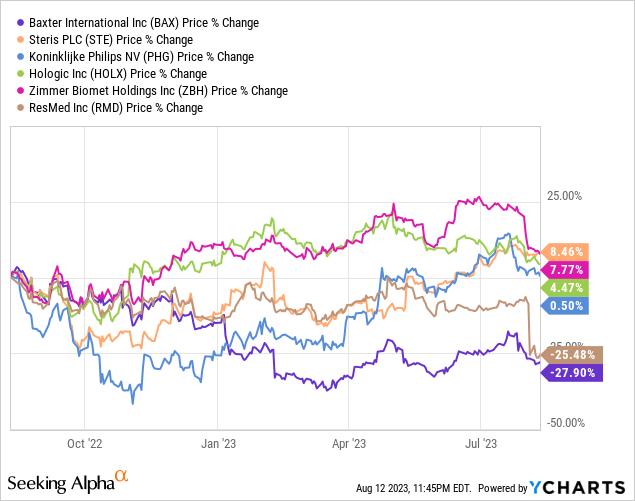

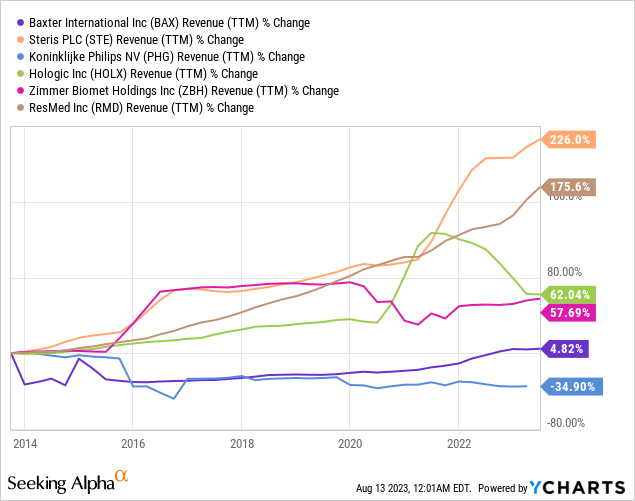

A few stocks within the same industry as Baxter include STERIS plc (STE), Koninklijke Philips N.V. (PHG), Hologic, Inc. (HOLX), Zimmer Biomet Holdings, Inc. (ZBH), and ResMed Inc. (RMD).

In terms of stock price, you can see Baxter has performed the worst over the past year and is one of two stocks out of the group of six with a decline in stock price during this time.

Looking further back, things don't get much better for Baxter as it goes from worst to second worst with a decline of 40% in stock price over the past five years.

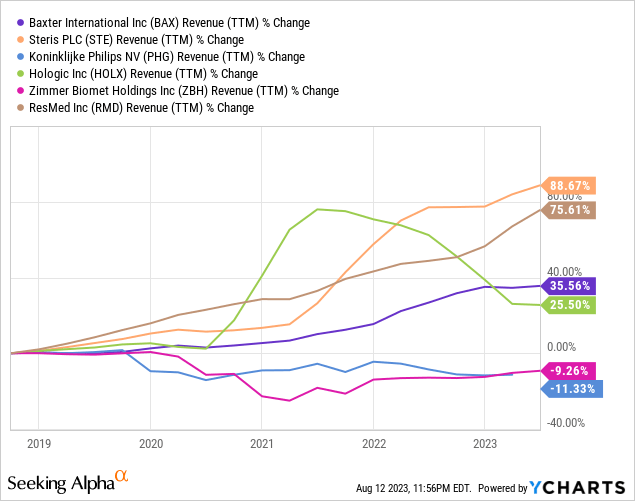

When looking at revenue growth over the past five years Baxter falls into the middle of the group.

Looking back 10 years and Baxter falls closer to the bottom of the pack with revenue growth of just under 5% during a ten-year stretch.

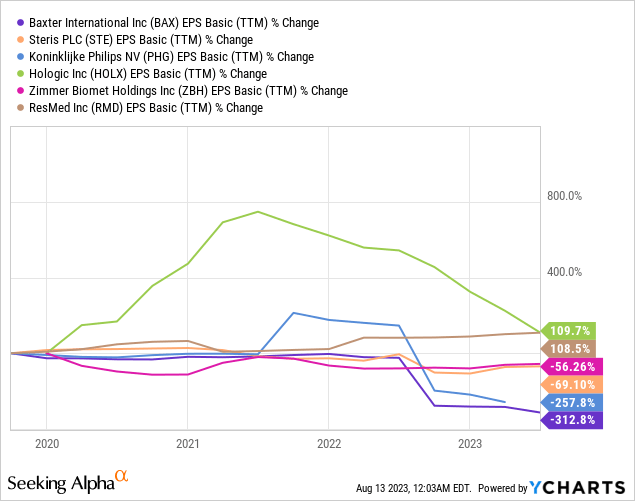

With its recent drastic drop in earnings, Baxter also falls to the bottom of the group when comparing earnings growth over the past five years.

Recent News

At the end of last month, Baxter had to issue an urgent software update for certain Spectrum infusion pump in the US and Puerto Rico.

Late last month, Baxter reported its Q2 results missing both its revenue and earnings estimates. Revenue, which was up 3.3% compared to prior year missed by $80M and earnings per share missed by $0.06.

Shortly before Q2 earnings were reported, Baxter launched PERCLOT Absorbable Hemostatic Powder. PERCLOT is a passive, absorbable hemostatic powder that Baxter is working with hospitals on to add it to their standard of care for low level bleeds.

Baxter is spinning off its Renal Care and Acute Therapies business. The spinoff will be called Vantive and is scheduled to be independent by July of next year.

In reviewing Baxter's Q2 earnings call transcript, a few things stood out to me:

- Even though Baxter missed the consensus earnings and revenue estimates, management seemed happy about the Q2 results.

- While there were definitely some highlights in terms of performance within various areas, I feel like there were more questions and risks

- The company seems to be putting a lot of weight on future success on the hope of hospital capital spending to improve moving forward and the assumption that the pending sale of its BPS business and the announced spin-off of its renal care/acute therapies business will lead to greater overall efficiency with the company.

- While overall sales were up, there were still a number of concerning areas related to future growth including:

- A decline in Patient Support Systems

- Lower sales in BPS (reported through discontinued operations)

- Negative outlook of APAC performance due to declining China sales

- Management stated that the company continues seeing strong demand for its Spectrump LVP pump (which helped contribute to the 7% sales growth in Medication Delivery, but how will the recent urgent software fix affect that demand moving forward?

- Declines in Clinical Nutrition sales in the U.S.

Conclusion

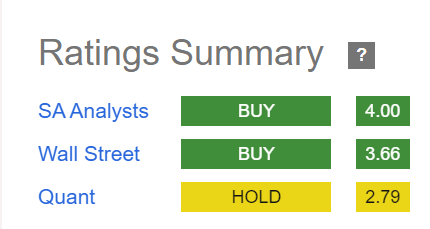

Baxter International is a big name in the Health Care Equipment industry and Wall Street likes the stock. Looking at the ratings summary below, you can see that it is rated a buy by both SA Analysts and Wall Street.

Seeking Alpha

I, however, don't have the same positive view of the company, at least not at this time. My view is closer to the Quant rankings and feel that the stock is more of a hold for investors that already own the stock. For investors that don't own the stock currently, I can't suggest purchasing it at this time. The company's revenue growth has been fairly flat recently. Revenue in FQ1 2022 was 3.71B and revenue in FQ2 of 2023 was also 3.71B, while the company's earnings have decreased dramatically.

The actual price of the stock has continued to decline and you have to go back nearly a decade before seeing a positive return on investment (loss of 15% YTD, loss of 27% the past year, loss of 38% the last five years, gain of 12% of the past decade). Unfortunately, that's not a track record I see reversing course any time soon.

Even the company's dividend is coming into question as this is the first year in four that the company hasn't increased its dividend early in the year and with its current negative payout ratio, that increase might not come which would cause it to drop off the Dividend Challengers list.

I feel that there are better investment options in the Health Care Equipment industry such as ResMed that are more likely to deliver better long term results compared to Baxter. As always, I suggest individual investors perform their own research before making any investment decisions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.