Pros And Cons Of Investing In Digital Realty Trust

Summary

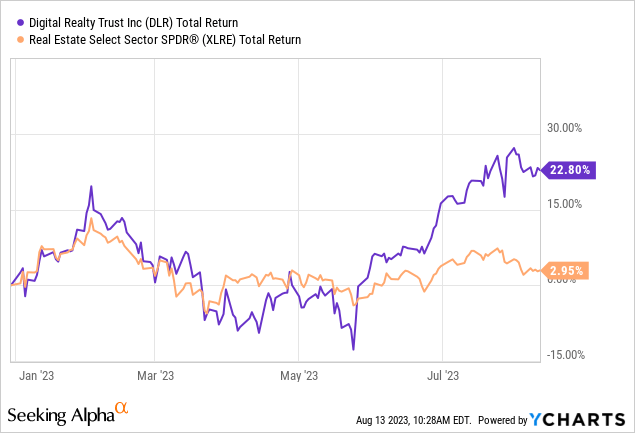

- Digital Realty has outperformed the broader REIT sector with a total return of about 23% this year.

- The company has a strong track record of returning value to shareholders through dividends, having them increased each year for the past 18 years.

- Debt and potential refinancing needs pose a significant risk for the company, and interest rates will play a crucial role in its financial performance.

- From a valuation point of view, we see limited upside from the current levels, based on our dividend discount models.

- For these reasons, we rate DLR as "hold".

Nikada

Digital Realty (NYSE:DLR) brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. Year-to-date the firm has substantially outperformed the broader REIT sector with a total return of about 23%.

The aim of today's article is to show our readers what factors could make DLR an attractive holding in dividend- and dividend growth portfolios, while pointing out some areas where the company could improve. We will start from a broader perspective, and eventually we will narrow our discussions to company-specific factors. So let us dive right in.

1. Owning an equity REIT can be attractive

Equity REITs (real estate investments trusts) can be defined as firms that own and operate income-producing real estate. REITs can be great vehicles to diversify portfolios without the need of deploying significant amount of capital for direct investment, as they are not perfectly correlated to other asset classes. These firms are normally traded publicly on stock exchanges therefore they are much more liquid than physical properties. They also require no management of the property, which is a key factor for many investors.

The REIT structure itself also offers some benefits to shareholders. REITs are legally obliged to distribute a certain percentage of their income in the form of dividends, which in turn allows them to return value to their shareholders in a tax efficient manner.

For us personally, these two factors, the diversification benefits and the stable current income, have been the main drivers when we decided to allocate capital to DLR in our portfolio.

Now that we described why we like the sector itself, we will turn to company specifics.

2. Returns to shareholders

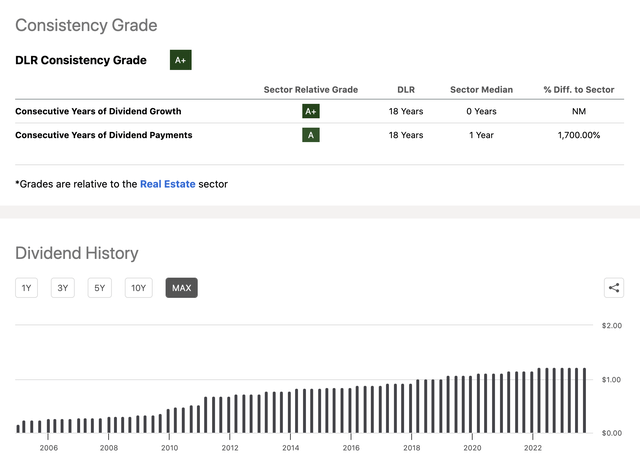

DLR has been returning value to its shareholders in the form of dividends each year for the past 18 years. The company has also managed to increase the dividends every single year in this period.

Dividend history (Seeking Alpha)

Currently, the firm pays a common quarterly dividend of $1.22 per share, equivalent to a roughly 4.1% annual yield.

While in our opinion this level of dividend payment is attractive and likely to be sustainable in the near future, we have to ask ourselves what to expect when looking forward.

On one hand, as technology rapidly advances, including the latest developments in AI, the need for space that can accommodate the required hardware is crucial. DLR definitely offers a solution in this growing market, which can lead to significant growth in the years to come, that could also fuel rapid dividend increases.

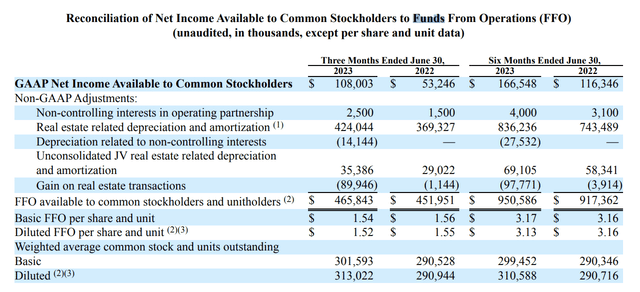

On the other hand, the latest quarterly results do not appear to show signs of this rapid growth. While net income has almost doubled year-over-year, a better metric to assess the financial performance of a REIT is the funds from operations, which has only increased by about 3%.

For this reason, when we are looking to add DLR in our dividend growth portfolios, we need to keep in mind what growth is essentially realistic, based on the current numbers (more on this in the valuation section).

3. Debt

REITs often have significant amount of debt in their capital structures to finance their investments in properties. The level of debt, however, plays a significant role. And we would like to focus on two reasons for this now:

1.) Higher debt usually involves higher risk. And higher risk leads to higher cost of capital. As a result, if there is excessive debt equity holders are likely to demand a higher rate of return, which has a direct impact on the intrinsic value of the firm.

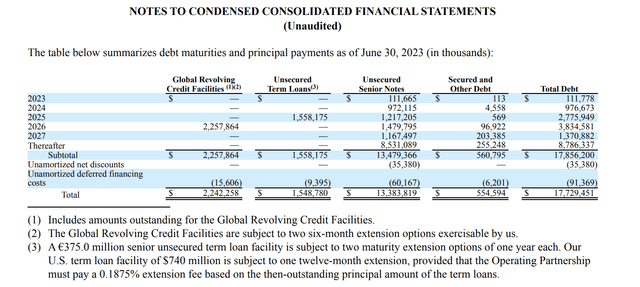

2.) Debts sometimes need to be refinanced. This is not an issue when interest rates are near zero or very low, as it has been the case for the past several years. But the macroeconomic environment has changed. The Fed has started to raise interest rate to combat inflation, making refinancing much more expensive. In our view, the interest rates are likely to remain elevated in the coming years, meaning that if DLR needs to refinance debts, which are maturing in the coming years, it can have a meaningful impact on the firm's financial performance. The following table shows DLR's debt maturities.

As you can see, slightly more than 50% of the outstanding debt matures beyond 2027, which is a good sign as by then interest rates may be lower than they are today. On the other hand, a significant portion of the debt matures in 2025 and 2026, which may need to be refinanced at higher rates. This is also a significant uncertainty and risk that we have to keep in mind, when making an investment decision.

4. Valuation

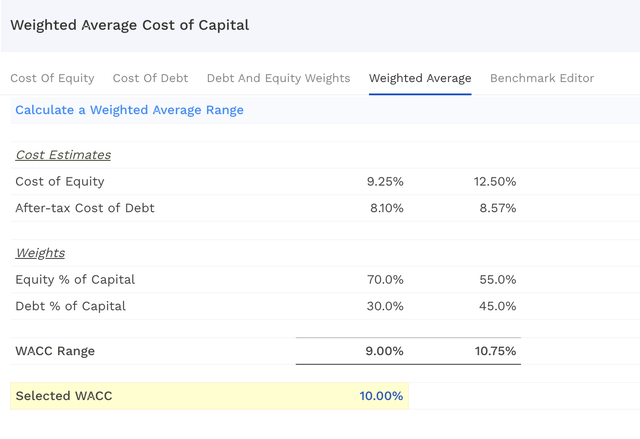

As we are focusing on DLR from a dividend investment perspective, we have decided to value the firm's stock using a dividend discount model. The primary inputs to this model are the required rate of return and the forecasted dividend growth rate in the near term and in perpetuity.

We normally use the firm's weighted average cost of capital as the required rate of return. According to the latest estimates, this is about 10%.

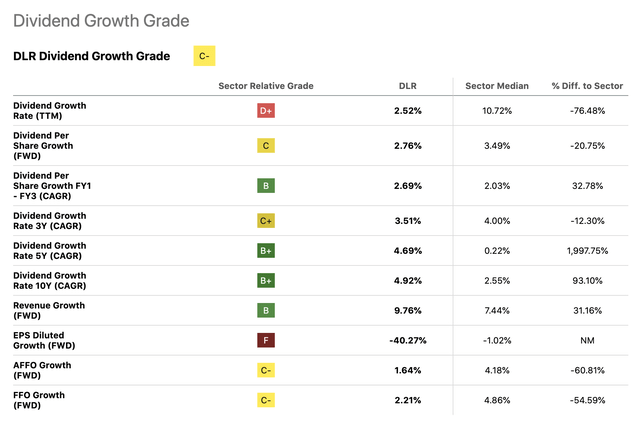

To carry out a meaningful evaluation, we have to make sure that our dividend growth rate assumptions are realistic. For this reason, we will be referring to DLR's past dividend growth, which has been between 2.5% and 5%, depending on the time frame we are looking at. We will be looking at different scenarios in order to come up with a range of estimates, instead of just one, to capture both upside potential and downside risk.

Dividend growth (Seeking Alpha)

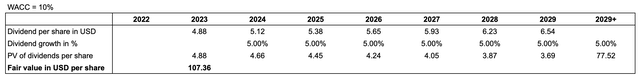

Scenario 1. - Mid-case

In this scenario, we assume that DLR's dividend will keep growing at its long-term average of roughly 5% in perpetuity.

This calculation gives us a fair value of $107 per share, representing a roughly 11% downside from the current price levels.

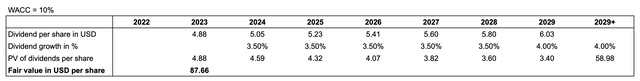

Scenario 2. - Low case

One may argue that the long-term average dividend growth of 5% is too high, as in the recent past the company has only managed to grow its dividends by 2.7% to 3.5%. Further, the 5% in perpetuity may also be somewhat aggressive.

Assuming 3.5% growth in the next five years and from then onwards 4% in perpetuity results in a fair value of $88 per share, which is about 27% below the current share price. In our opinion, this may be too pessimistic of a scenario as it does not capture any potential growth opportunities in the near term.

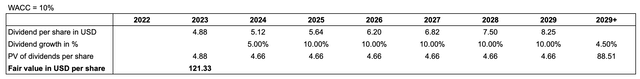

Scenario 3. - High case

In this case, we assume that in the next few years, due to the demand for data center space, DLR will grow rapidly. This growth will however last only a few years, after which dividends would grow at 4.5% in perpetuity.

This calculation result in a fair share price of $121, which is about in line with the current share price.

Conclusions

Owning a REIT can be attractive for investors who are looking for an asset class that could provide diversification benefits and current income, without the need of deploying significant capital to directly invest in real estate, which could be illiquid and have high management costs.

DLR has a strong track record of returning value to its shareholders in the form of dividend payments. They have paid and increased their dividends in each year in the past 18 years.

When investing in REITs, debt plays a significant role. Keep in mind the upcoming maturities and the potential need for refinancing. The interest rates are crucial to follow.

While the firm appears to be within our estimated fair value range, we believe that there is limited upside potential from this level.

For these reasons, we rate DLR as "hold".

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DLR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy, and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)