Churchill Downs: Moving Our Prior Bearish Outlook To A Buy Signal

Summary

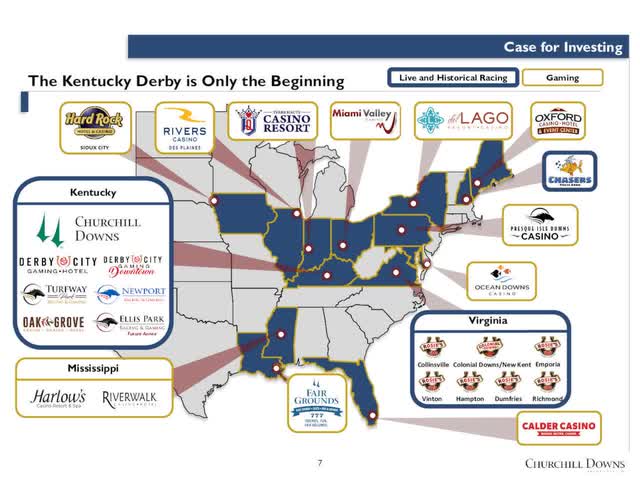

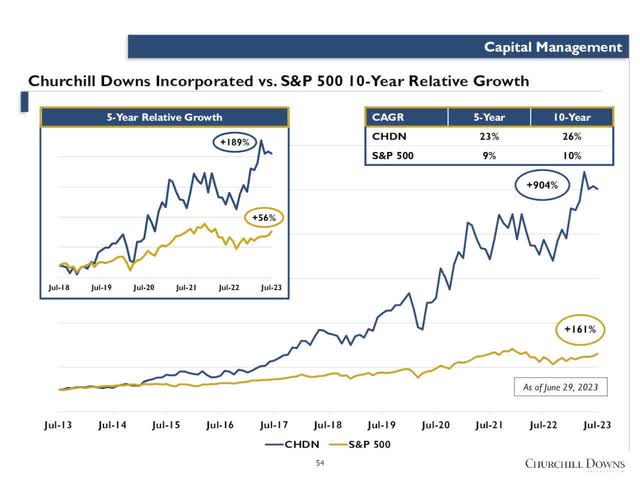

- Churchill Downs Incorporated has consistently performed well in earnings and revenue growth, with a strong capital allocation strategy and successful acquisitions.

- The company has diversified into casinos and online horse race betting, and has a solid portfolio of assets that consistently produces good returns.

- Churchill Downs' strategic vision includes high visibility from the iconic Kentucky Derby, a revival of historic horse racing slots, and its online horse racing platform Twin Spires.

JHVEPhoto

Above: The entrance to the world-famous track complex in Louisville. Its become far more than a track and single event.

Premise

I have been covering the stock of Churchill Downs Incorporated (NASDAQ:CHDN) for over 8 years. During that time, my puzzled, if not bearish, outlook stood despite an overall excellent sales growth and EBITDA performance by the stock. I come from the perspective as an analyst, consultant in the gaming sector, not to mention 40 years as a c-suite executive in multi-billion dollar gaming companies. Prior to that I had been the publisher of the seminal industry publication covering all legal gaming, including horse racing, called Gaming Business Magazine (I sold it in 1983. Today it is known as International Gaming Business).

The thoroughbred racing business was part of our beat. From an inside-out perspective, I quickly learned that its player base of elderly male fans was aging out fast. Casinos and lotteries took their toll on wagering handle and attendance as well. But throughout that great sport of fading glory, the Kentucky Derby and all that surrounded it remained the iconic sports event it has been and remain. Next year the Derby will reach its 150th running with many new spectator amenities.

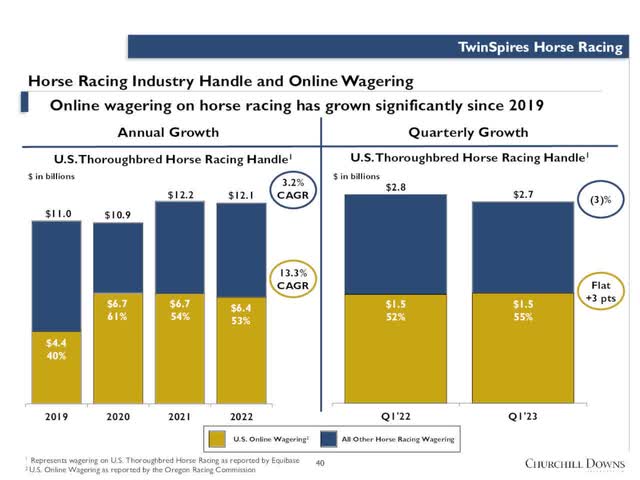

Over time, CHDN diversified into casinos and online horse race betting at the live tracks they owned. They serviced horse bettors nationally under the online Twin Spires brand.

The company became a small scale, diversified gaming operator that punched way above its weight sprung from the fact that their iconic track and world famous event every year drew sold-out attendance and massive TV audiences among the top sports must see events of the year.

Yet by comparison to its peers in the U.S. gaming sector, it was as the legendary Godfather character Hyman Roth told Michael Corleone, "it was small potatoes."

Compare its U.S.-only peers

Company | 2022 Revenue | Stock Price | Outstanding Shares |

Penn Ent. | $7b | $27 | 153m |

Boyd Gaming | $3.55b | $67 | 101m |

CHDN | $1.8b | $123 | 74.8m |

Jointly, Penn and BYD own 72 casinos in the U.S. against CHDN's 11 (9 of which are fully owned, 2 partially).

Other than the clear disparity in the valuation of the stocks relative to the outstanding shares, there did not appear any reason to me as to why CHDN was trading at so high a premium to its peers. I followed their impressive earnings releases, praised their management for making the most out of a very small footprint in the sector, but remained at sea as to why the shares continue to trade where they did.

Then a series of corporate moves began to throw the light of day to me and add a dimension to my take on the company I had not originally thought mattered. The answer was in the skill set of asset allocation in acquiring related businesses and having found them to be more troublesome than anticipated at the deal time, unloaded them. CHDN ever took a big bath. In fact, on one deal, they left the table ahead.

CHDN buys Big Fish

Seeing the CAGR in the social online gaming sector, CHDN decided in 2014 to pursue diversification in that business by acquiring Seattle based Big Fish games for $880m. Per the usual happy talk that is part of all investor calls these days, CHDN proclaimed its entry into social gaming a great leap forward in addressing the future of overall gaming, social and online gambling. Then after a while, reality bit.

The corporate culture of the good old boys of Louisville, many c-suite veteran operatives out of belt-and-suspenders GE clashed with the laid back tech bros style of the Seattle based Big Fish operatives. Performance wasn't terrible, but well below CHDN aspirations. Not a blade of grass grew under CHDN feet and whoosh, by 2018 Big Fish was sold to Australian's gaming machine giant Aristocrat Leisure (OTCPK:ARLUF) for $990m.

That meant not only did CHDN get their money out, but also had Aristocratic pay $31m of a $150m lawsuit settlement against Big Fish and Churchill. The lesson one of all business learned from the great stars of the poker tables: Know when to hold 'em. Know when to fold 'em. CHDN walked away without a scratch financially ready for the next challenge.

In the meantime, CHDN had been active setting its light footprint down in the casino business. It added to its brick and mortar casino portfolio step by step in markets where competitive pressures were never frenetically overheavy. This put them in Florida (racino), Iowa, Indiana, Louisiana, Maine, Maryland, Mississippi (2) NY (upstate) Pennsylvania. Illinois and Ohio have CHDN casinos with 50% to 61% equity. Coming before the end of this year, they add Terre Haute, Indiana with a small $270m, bought Exacta Systems Inc. for $250m in cash. Exacta is a tech stack supplier in gaming. It is part of the larger vision CHDN has for the expansion of its horse racing slots installations, in particular at its recent acquisition of Colonial Race Track and Rosie's slot emporium both in Virginia.

BetAmerica not in the money

Above: CHDN has exited online wagering on sports but retains its legacy business in horse racing. Sticking to one's strengths is good policy.

In early 2012, CHDN launched its BetAmerica online sports betting platform by rebranding its existing horse racing site Twin Spires. Now bettors could access action on every racetrack plus every pro and college sports games offered by sector leaders like FanDuel and DraftKings. Once more, the mandarins of Louisville put their crosshair lens on the sports betting sector in general. What they saw was pretty ugly. Billions being spent to acquire players in new states, more multi-million giveaways in mature states to hold market share. In brief, a dead-end street for their most lofty ambitions to set BetAmerica among the leaders. They had neither the resource base nor the will to fight it out for pennies with the biggies.

CHDN cried "no mas" and politely left the field of play. It retained the ability to book sports bets live in its 11 properties, but reverted its legend Twin Spires horse racing only online business. It cited the rationale, namely they said in public what a lot of sports betting operators were nail biting about in private: this was a low margin, mass volume business with immense marketing expense that they had no prospect of making an inroad to reasonable market share. So bye Bye BetAmerica. The lesson again: CHDN folded them.

So I began to see what was becoming apparent: The capital allocation skills and ever open mindedness to potential acquisitions that held certain odds that met internal numbers crunchers as a bet worthwhile taking. was It was an indispensable part of why CHDN had consistently performed well in earnings and revenue growth, slow and steady wins the race, they were a frisky turtle not a frenetic hare.

Meanwhile, back at the track

Some of the big bets CHDN made during the period was in the acquisitions to its casino portfolio.

So now with assets reallocated, with capex directed at expansion of its home track facility and its three brethren in Kentucky, plus its Derby City slot parlor and the expansion of its reinvented historic horse racing slots across its system Add the tech stack company to run its operations, and you have one clear vision of how to build revenue in a new vertical you invent.

Also add to that the 11 casinos and of course the immense weight of the Kentucky Derby and all that goes with it and you have a nicely balanced gaming entrant---with results punching above its weight related to a management that is both imaginative, capex wise, and opportunistic. Historic horse racing slots are a jazzed up version of old time machines with screens that played tapes of unidentified horse races you bet on and watched. By the time I came into the gaming business, they were all but extinct. CHDN has gussied them up, loaded them with tech wizardry, and created a hot new game platform for its own properties as well as one sold to the industry,

Vertical 2022 total revenue

Live racing-all tracks, KY, ILL, Ohio and

Historic horse racing slots $614.6m.

Twin Spires online race book 436.m.

Gaming (11 properties) 755m.

Total $1.8b*.

*TTM figure rises above $2b.

Where it's going: CHDN's strategic vision offers investors exposure to the iconic world class track and event providing high visibility to the stock, an innovative revival of a discarded old slot machine game that is already producing powerful revenues, and in Twin Spires, its online historic horse racing platform. It services its core bettors without the baggage of having to fight ferocious battles for tiny percentages of handle from pro and college sports. Overall this points to investor goals in very good hands. The proof continues in CHDN's 2Q23 earnings release.

A snapshot of a smartly managed, keen vision operator with a solid portfolio of assets which on the surface may seem meh (as it did to me for a time) but ones which consistently produce good returns. This performance has not been missed by institutional holders among the largest of whom are: FMR LLC, Vanguard, Blackrock, State Street, Charles Schwab. The entire institutional holding runs ~78%,

Why would institutions of this scale be buying into what is a relatively small, gaming operator which neither dominates market shares where it lives, or presumes to make exponential leaps with multi-billion dollar expansion programs?

Here among others, is the reason:

2Q23 earnings $2.24 (miss by $0.27)

Revenue $768.50 (miss by $24m).

However, longer term: Double digit EBIDA growth:

2021: $627 2022: $765m

Returned to holders over 8-year period $1.6b.

$185m paid in dividends.

$1.5m repurchased stock.

(There is another $270m authorized).

There has been no move we can discern reading earnings calls and conferring with our racing friends over time, for CHDN to play what could seem a winning card: Issue more equity to finance broader based expansion seeing that the company's cost and capital disciplines have proven so effective.

That is not the case here. What appears to be happening over the last decade is a determined set of policies to keep the outstanding dead pooled around 75m shares, as one way to help command triple-digit prices on the stock. Secondly, the company's overall performance TTM is impressive:

Revenue: Moved above $2b.

EPS: $7.21.

Q-on-Q revenue growth 31.90$ (partially a flawed comp due to a certain amount of covid aftermath in early months).

Cash on hand: $374m.

Total debt: $4.62b.

Current ratio 0.90.

Levered FCF $1.31b.

So CHDN's total capex ahead is $670m including maintenance and financing of all expansion in horse race machines, Terre Haute Casino and considerable upgrades of Churchill Downs track itself in advance of the 2024 Kentucky Derby.

The Horse Health questions linger for the industry

Twelve horses tragically died at Churchill Downs this year, causing the company to suspend racing until various authorities investigated possible sources of the disasters. After the studies were concluded, CHDN commenced racing again. We bring this issue into our analysis of the investment because the death of horses seen at the legendary track are not isolated by any means. They occur and have occurred for decades at tracks all over the nation. What is worrisome, however, is that more deaths percentage-wise are happening. It is an issue that the top equine health authorities have been wrestling with for many years.

To get a clearer picture, I called upon an ex-colleague who is a retired executive from a long career in the industry. He has confirmed that the industry has taken many steps to assure horse health as they can, but much more could be done and probably will be done.

In brief, here is what he states are the cold realities.

The average thoroughbred horse weighs 1,000 pounds. And it races on what are in effect, relatively spindly legs.

- Top stables once bred horses for endurance first and then speed. More recently, horses are bred for speed predominately. And they breed far too many to fill far too many races. More horses. More catastrophes.

- In a perfect world, these animals should not be allowed to race as two-year-olds, our source said. Their anatomical strengths are there, but overall there would be far less deaths if racing of 2 year olds were banned, according to my associate. The difference in the percentage of deaths of two and three-year-olds confirm my colleague's conviction that such a move could significantly reduce deaths. His opinion--shared by some, not all.

We not want to get into a rabbit hole about equine safety in an article about investing in CHDN. But because CHDN's position and revenues are so dominated by its live and online racing businesses, we feel a rounded view is warranted if and when there are dramatic changes in the industry regarding equine safety and long health for top racing action.

CHDN will be among the major powers in the industry committed to recommendations down the coming years regarding equine safety.

Conclusion

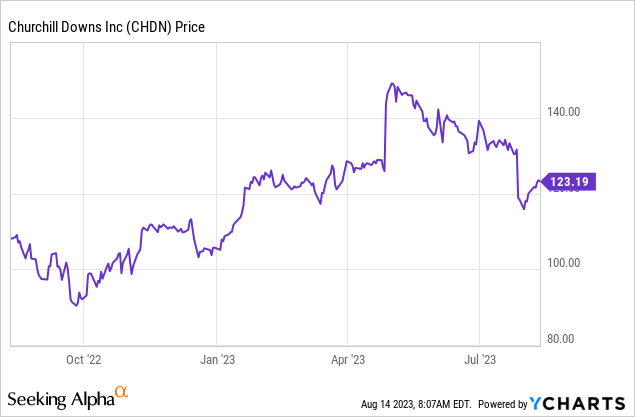

I continue to believe that the relatively smaller than average number of shares outstanding for a gaming stock and daily trading volumes are among the key factors that support a premium price to CHDN shares. But from the post-covid performance in delivering FCF, earnings and sales growth it is clear to me that the margin of safety for the stock at its current trading range is high.

But mostly because the company simply does not sit on unproductive assets and muse forever on them, a la Disney (DIS), I think it warrants a STRONG BUY rating here.

I think it has wisely allocated capital, avoiding mass upscaling of ambitions such as moves onto the Las Vegas strip, or internationally. It has put money on home town assets, and grown organically without sinking into unmanageable debt.

I see this as an addition to a well-balanced gaming portfolio both for returns as well as little exposure for its current markets to be challenged by more supply anytime soon.

I am setting a PT of $155 by the end of this year. The stock reached a 5-year high last May of $135. Clearly related to Kentucky Derby buzz. With what the planning for 2024's event bringing together so many of CHDN's new facilities and gaming positions with its Horse racing slots, I'm staying bullish even if a recession hits before then.

No consumer discretionary business is recession-proof, but my dive into the history of Churchill Downs Incorporated suggests to me that it can retain a nice earnings arc despite possible reduced revenues.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.