VS Media Holdings Proposes Terms For $10 Million IPO

Summary

- VS Media Holdings Limited has filed for a $10 million IPO of its Class A ordinary shares.

- The company operates a network of online content creators to promote products and services.

- My IPO outlook is to Sell due to decreasing revenue, increasing operating losses, high valuation expectations, and many risks operating in China.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

ChayTee

A Quick Take On VS Media Holdings Limited

VS Media Holdings Limited (VSME) has filed to raise $10 million in an IPO of its Class A ordinary shares, according to an SEC F-1 registration statement.

The firm operates a network of online content creators to promote products and services.

Given VSME’s decreasing revenue, increasing operating losses, high valuation expectations, and myriad risks operating in China, my outlook on the IPO is to Sell.

VS Media Overview

Hong Kong, PRC-based VS Media Holdings Limited was founded to develop a network of Key Opinion Leaders [KOLs] to market products and services on major social media platforms worldwide.

Management is headed by founder, Chairwoman and CEO Nga Fan WONG, who has been with the firm since its inception in 2013 and was previously founder of Vissible Limited, a fashion and lifestyle social and commerce platform and was previously Senior Director of Global Sales at Yahoo!, according to the F-1 filing.

The company’s primary offerings include the following:

Marketing services

Social commerce.

As of December 31, 2022, VS Media has booked fair market value investment of $16.2 million in equity from investors, including Constant New Limited, CMC Holdings HK, Discovery Networks Asia-Pacific Pte.

VS Media Customer Acquisition

The company acquires customers for its online marketing service network and is paid either through a fixed or predetermined service fee per campaign or from major platforms that pay the firm advertising revenue share.

The firm also generates revenue by reselling brand products to its creators or directly to customers, earning a margin on product sales.

Marketing expenses as a percentage of total revenue have dropped as revenues have decreased, as the figures below indicate:

Marketing | Expenses vs. Revenue |

Period | Percentage |

Year Ended Dec. 31, 2022 | 0.8% |

Year Ended Dec. 31, 2021 | 1.7% |

(Source - SEC.)

The Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Marketing expense, was negative (27.3x) in the most recent reporting period. (Source - SEC.)

VS Media’s Market & Competition

According to a 2021 market research report by Retail In Asia, the Chinese market for influencer marketing was an estimated $210 billion in 2020 and is forecasted to exceed $1 trillion by 2025.

In 2020, there were an estimated 9 million influencers in China with a follower base of more than 10,000.

The Chinese government, both at the national and regional levels, is seeking to facilitate the growth of this industry, with some regions passing development plans and seeking to launch influencer marketing agencies.

Also, major Internet platforms in China actively promote live-shopping influencer marketing efforts, with Alibaba's Taobao accounting for 80% market share and Douyin and Kwai essentially splitting the remaining 20%.

Major competitive or other industry participants include the following:

WebTVAsia

PressPlay

Capsule Group

Others.

VS Media Holdings' Financial Performance

The company’s recent financial results can be summarized as follows:

Decreasing top line revenue

Flat gross profit but higher gross margin

Increasing operating loss

Growing cash used in operations.

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 9,028,187 | -17.5% |

Year Ended Dec. 31, 2021 | $ 10,944,753 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 2,284,982 | 0.1% |

Year Ended Dec. 31, 2021 | $ 2,282,440 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | 25.31% | 21.4% |

Year Ended Dec. 31, 2021 | 20.85% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Year Ended Dec. 31, 2022 | $ (1,643,733) | -18.2% |

Year Ended Dec. 31, 2021 | $ (70,799) | -0.6% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

Year Ended Dec. 31, 2022 | $ 4,116,494 | 45.6% |

Year Ended Dec. 31, 2021 | $ (355,806) | -3.3% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Year Ended Dec. 31, 2022 | $ (2,046,957) | |

Year Ended Dec. 31, 2021 | $ (1,368,966) | |

(Source - SEC.)

As of December 31, 2022, VS Media had $820,570 in cash and $6.0 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($2.0 million).

VS Media Holdings Limited IPO Details

VS Media intends to raise $10 million in gross proceeds from an IPO of its Class A ordinary shares, offering 2 million shares at a proposed price of $5.00 per share.

Class A ordinary shareholders will be entitled to one vote per share, and the Class B shareholder, company founder, Chairwoman and CEO, Nga Fan WONG, will be entitled to 18 votes per share.

Immediately post-IPO, the firm will be considered a ‘controlled company’ by Nasdaq’s rules.

The S&P 500 Index (SP500) no longer admits firms with multiple classes of stock into its index.

The company is also registering for sale 3 million shares from existing investors. If these shares were to be sold on the market by their holders, they could potentially cause a significant decline in the share price in a short period of time.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $103 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 9.09%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

Management says the firm qualifies as an ‘emerging growth company’ as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

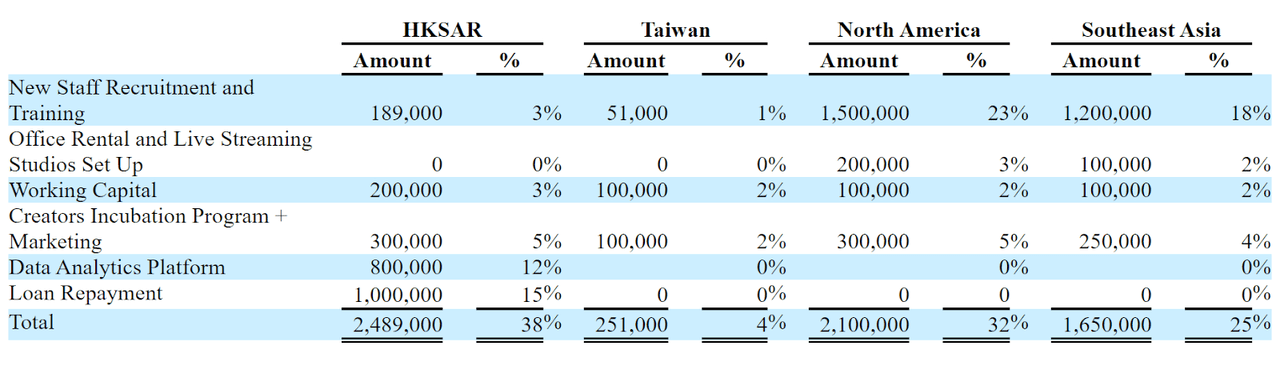

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

The firm does not currently have an equity compensation incentive plan but intends to create one in the future. This has the potential to be a significant source of value creation by incentivizing employees to increase the company's value, but it also could represent potential dilution for shareholders.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company or its subsidiaries is not currently a party to any pending legal proceedings.

The sole listed bookrunner of the IPO is Univest Securities.

Commentary About VS Media’s IPO

VSME is seeking U.S. public capital market investment for its general growth and working capital needs.

The company’s financials have produced declining topline revenue, little change in gross profit but higher gross margin, and growing operating loss and cash used in operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($2.0 million).

Marketing expenses as a percentage of total revenue have dropped recently; its Marketing efficiency multiple fell to negative (27.3x) as revenue decreased.

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment back into the firm's growth and working capital needs.

The company is further constrained by laws in the British Virgin Islands and in China regarding the transfer of funds and payment of dividends.

VS Media has not made any capital expenditures in the trailing twelve-month period.

The market opportunity for influencer marketing in China is large and expected to grow quickly as it receives greater government support and consumer interest.

Univest Securities is the sole underwriter, and the four IPOs led by the firm over the last 12-month period have generated an average return of negative (51.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government's crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

The Chinese government may intervene in the company's business operations or industry at any time and without warning and has a recent history of doing so in certain industries.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 11.37x on declining revenue from a small base.

Given the firm’s decreasing revenue, increasing operating losses, high valuation expectations, and myriad risks operating in China, my outlook on the IPO is to Sell.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.