APA Corporation Rallies On Strong Q2 2023 Performance And Rising Oil Prices

Summary

- APA Corporation reported strong Q2 2023 performance and expects even better results for Q3 and Q4.

- The company foretasted increased oil production and free cash flow for the rest of the year.

- APA stock has gained 32% over the last year and may continue its uptrend if oil prices stay elevated and financial performance remains strong.

- I rate APA as a buy and recommend short- and long-term strategies.

bymuratdeniz

APA Corporation (NASDAQ:APA) recently reported strong Q2-2023 performance and its stock has gained 32% over the last twelve months. The news of its earnings beat brought the stock price up to $45, a gain of 7.5% over a week. The company expects even better results for Q3 and Q4, while oil prices are predicted to remain elevated for the rest of the year. The company forecasts higher production for the rest of the year. APA consistently reports net income and free cash flow. APA has reported decreasing revenues compared to 2022, which has caused recent analysts on Seeking Alpha to rate the company as a hold. One should read the previous coverage before digesting my thesis.

The price of oil has come down from its 2022 highs, while APA still produces about the same amount of barrels per day, if not more than 2022. Oil (WTI Crude) is currently trading at its 2023 high and may reach $85 per barrel before the year ends. The price of oil and natural gas have a great effect on the company's revenue numbers and the numbers are likely to increase. I rate the company as a buy and recommend both short- and long-term strategies. If the stock price settles at $50 per share in the long-term, then gains of 10% to 12% may be realized.

There are some risks to consider with future performance of the company and the oil sector. Although Diamondback Energy (FANG), Occidental Petroleum (OXY), and other peers of APA have better balance sheets and valuations, I feel that APA has room to grow. The price of oil is expected to remain high because of the Ukrainian War. As to APA's stock price, there is long-term resistance at $50 per share and we will want to see if and when the stock breaks that line.

Operations

APA Corporation is an energy exploration and production corporation with a strong record of financial performance. The company receives revenue from the sales of crude oil, NGLs, and natural gas. The company's financial performance relies on the price of energy contracts and its total production of BOE per day.

APA operates in the US (Permian Basin), Egypt, and the UK (North Sea). It seemingly has plans to begin operations sometime in the future in the waters near Suriname (South America). The company has large operations in Egypt, mostly in oil production, but some natural gas. The company's operations in the Permian Basin are a mix of natural gas and oil production. The company produces a similar mix in the North Sea.

The company has a long-term natural gas supply contract with Cheniere (LNG), which became active as of August. The company expects that the contract will produce $120 million in free cash flow over the next five months. The contract should contribute $385 million in free cash flow over 2024.

Q2-2023 Results

APA attributed its strong financial performance to good oil performance in the Permian Basin and Egypt coupled with lower lease operating expenses and G&A costs. The company cited some items which are weighing down its performance. The company has curtailed its natural gas production in the Permian Basin due to low prices and there are issues with downtime in the North Sea. Overall, natural gas and NGL contracts are low compared to last year.

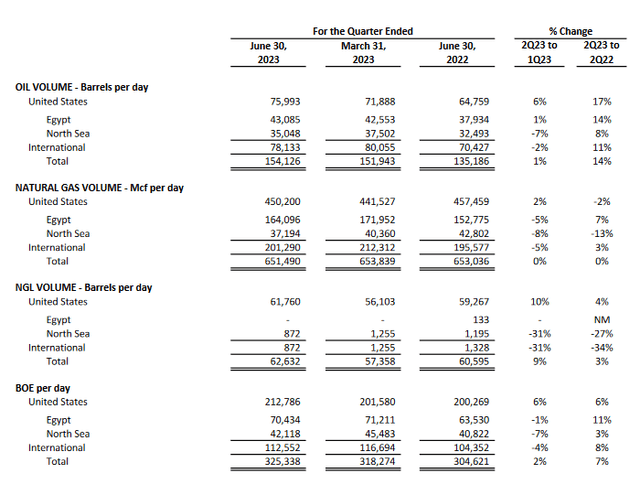

The company reported the production of 325,000 BOE per day for Q2-2023. This number excludes Egyptian non-controlling interests. The number represents a 2% increase from last quarter and a 7% increase YoY. The company reported a total of 154,000 barrels of oil per day, a 14% increase YoY.

The company reported US oil production of 75,900 barrels per day. US oil production was up 6% compared to the previous quarter and up 17% YoY. Egyptian oil production was 141,000 barrels per day. Egyptian oil production was up 1% from the last quarter and 14% YoY.

The company expects US oil production to increase around 6% during Q3-2023. The company expects Egyptian oil production to increase 5% during the next quarter and expects further increases for Q4-2023.

North Sea operations produced 42,000 barrels of oil equivalent per day. The production was below expectations because of compressor downtime. The company expects production to increase between 46,000 and 48,000 BOE per day. The company has opened a new well (North well) as of June.

The company reported an overall decrease in the production of natural gas and NGLs. Below is a breakdown of the company's oil and natural gas production for the quarter:

The company is speculating on a well site in the Krabdagu and Sapakara area near the Suriname coast. APA has completed its exploration of the area. Although it is not stated in the company's Q2-2023 transcript, it is plausible that the next step for this area will be drilling a well. For now it has no further immediate plans in the area.

The company reported $366 million of free cash flow for the first half of 2023 and returned most of it to shareholders through share buybacks and dividends. The company reported Q2-2023 free cash flow of $94 million.

APA reported net income of $381 million or $1.23 per share. The number includes some unusual items including its stock ownership of Kinetik (KNTK) and profits made from Waha basis swaps. The swaps concern the difference in natural gas contracts between the Permian Basin and the US Gulf Coast, where the company delivers some products. The company reported its adjusted income to exclude these items. Adjusted net income was $264 million or $0.85 per share.

The company expects operating costs to decrease for the rest of the year. The company said that reductions in North Sea drilling and the completion of exploration work at Suriname will reduce spending. Market consensus for the company's Q3-2023 revenue is $1.93 billion and an EPS of $0.91.

Historical Financial Performance

Here is a table of the last five quarterly reports:

In $US Millions | Q2-2023 | Q1-2023 | Q4-2022 | Q3-2022 | Q2-2022 |

Revenues | 1,796.0 | 2,008.0 | 2,209.0 | 2,887.0 | 3,047.0 |

Other Revenues | 114.0 | (32.0) | 41.0 | (2.0) | 37.0 |

Total Revenues | 1,910.0 | 1,976.0 | 2,250.0 | 2,885.0 | 3,084.0 |

Cost of Revenues | 570.0 | 615.0 | 531.0 | 1,036.0 | 981.0 |

Gross Profit | 1,340.0 | 1,361.0 | 1,719.0 | 1,849.0 | 2,103.0 |

Operating Expenses | 510.0 | 476.0 | 683.0 | 622.0 | 554.0 |

Operating Income | 830.0 | 885.0 | 1,036.0 | 1,227.0 | 1,549.0 |

Net Income to Company | 462.0 | 326.0 | 539.0 | 530.0 | 1,067.0 |

Minority Interests | (81.0) | (84.0) | (96.0) | (108.0) | (141.0) |

Net Income | 381.0 | 242.0 | 443.0 | 422.0 | 926.0 |

Adjusted Net Income* | 264.0 | ||||

Cash & ST Investments | 142.0 | 154.0 | 245.0 | 268.0 | 282.0 |

Receivables | 1,364.0 | 1,518.0 | 1,466.0 | 1,928.0 | 1,894.0 |

Total Current Assets | 2,599.0 | 2,732.0 | 2,708.0 | 3,135.0 | 3,083.0 |

Total Assets | 13,244.0 | 13,213.0 | 13,147.0 | 13,629.0 | 12,924.0 |

Total Current Liabilities | 2,630.0 | 2,454.0 | 2,916.0 | 2,984.0 | 2,813.0 |

Total Liabilities | 11,548.0 | 11,780.0 | 11,802.0 | 12,078.0 | 11,419.0 |

Total Debt | 5,678.0 | 5,941.0 | 5,753.0 | 5,643.0 | 5,406.0 |

Net Debt | 5,536.0 | 5,787.0 | 5,508.0 | 5,375.0 | 5,124.0 |

Financial numbers from Seeking Alpha. *Adjusted Net Income from Q2-2023 transcript.

The revenue numbers for the company have decreased from quarter to quarter. The same trend may be seen in operating income and net income. If Q3-2023 revenue numbers increase, then the trend will have changed. The company has consistently reported a gross profit and net income.

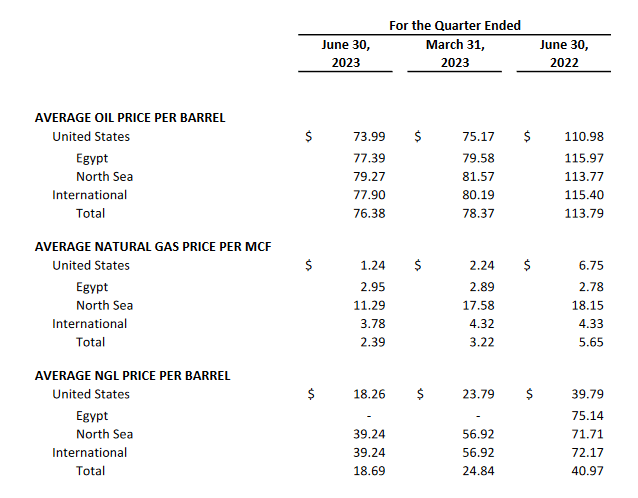

One item to consider for the flux of revenue numbers is the average contract price per barrel. Here is a table of the company's average contract prices for Q2-2023 and comparison quarters.

Q2-2023 News Release

The contract amounts on oil, natural gas, and NGL have all decreased since last quarter and since last year same quarter. The decrease in average contract price may explain the trend of decreasing revenue amounts. The price of oil is expected to increase for the rest of the year. The price of natural gas is low at the moment and will find some momentum from seasonal highs in December. Natural gas prices will not return to their 2022 highs, unless something unexpected occurs or there is a sudden difference between supply and demand. The company expects production to increase for the rest of the year and the outcome of the contract prices will ultimately decide the financial performance.

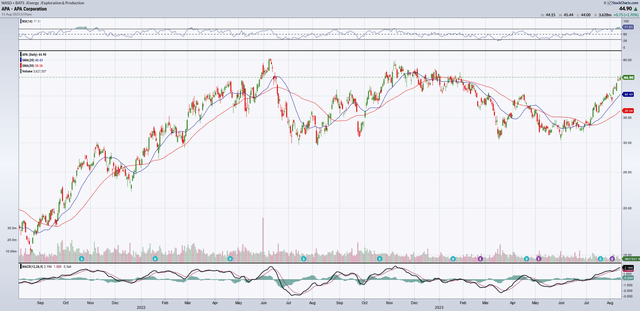

Stock Price Performance

The stock price has increased 32% over the last twelve months, 36% over the last three months, and 21% over the last month. It is currently trading above its 20/50/200 moving-day averages. The two-year stock price trend has included a few attempts at hitting the $50 mark or above. From the two-year trend, one may see that the stock price drops after dividends are completed and then begins to accumulate again. Whether the stock will find stable price channels higher than $45 per share in the near future is uncertain. The market consensus median price target for APA's stock is $55 per share. If contract prices continue to increase and production by the company increases, then the stock may continue to increase.

The company's stock is held by large institutions (83%) and it is currently undergoing short conditions (99% float). The price will drop after dividend cut-off date, but it will come back each time, assuming the price of oil and energy increases or stays the same. High institutional ownership may be equated to strong market sentiment.

Valuation and Investment Strategy

APA's stock is currently overvalued. According to the company's balance sheet found on Seeking Alpha, its book value per share is $2.31. This number reflects the high debt burden which the company carries. High debt is very common for the success of a company of this magnitude. The company's NTM Total Enterprise Value / Revenues ratio is 2.52x. The number indicates slight overvaluation. Market sentiment, likely from large institutions, and continued strong financial performance keeps overall market sentiment high for APA's stock.

Other oil companies like Diamondback Energy (FANG) and Occidental Petroleum (OXY) are also overvalued and have high debt. Diamondback Energy has a more impressive balance sheet and uptrend, but how much further can Diamondback Energy uptrend? I feel that APA has a lower entry price and room to grow over time. It already reports strong performance and growth.

The long-term forecast of oil prices is not entirely clear. In the short-term, oil prices are expected to rise. Whenever disruptions of energy trade caused by the Ukrainian War subside, then one should reconsider global energy conditions. Even then, it will take time for conditions to return to a new normal.

One should watch news of APA's future financial performance. The hope is that the company will continue strong performance for the rest of the year. New considerations for investment may be needed after that time. A simple long-term hold strategy could produce between 10% and 12% gains, if the stock price moves to the $50 mark. In the short-term, one may take advantage of the accumulation cycle between earnings through a call option strategy. It may be wise to look at strike days occurring at or around three months of post earnings accumulation. Call options for Oct 20th have increasing volume and high investor interest. Remember that all call option strategies are high risk and the long-term hold strategy is low risk.

Conclusion

APA reported strong financial performance for Q2-2023 and has shown consistently strong performance over the last year. The company often reports net income and free cash flow. The company's stock has been on a 32% uptrend over the last twelve months and may have more to go, if market conditions stay the same or improve. APA expects higher production for the rest of the year, as well as lower operating costs. The unknown factor concerns the future prices of oil and natural gas. Current forecasts for oil contracts indicate a possible high of $85 per barrel in the near future. The ongoing war in Ukraine will continue to disrupt the global oil market. I rate the company as a buy and recommend short- and long-term strategies.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of APA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.