Armada Hoffler: The 7.4% Yielding Preferred Shares Could Be Called Next Year

Summary

- Armada Hoffler Properties is considering retiring its preferred shares, presenting an interesting investment opportunity.

- The REIT's Q2 results indicate that the preferred dividends are safe and well-covered.

- Armada Hoffler has initiated a $50 million repurchase program for both common and preferred shares, with the intention of eventually retiring the entire series of preferred shares.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

damircudic

Introduction

In December last year, I started to have a closer look at Armada Hoffler Properties (NYSE:AHH). Not for its common shares but for the preferred shares which were trading at a discount to their $25 principal value resulting in a preferred dividend yield of approximately 8%. Those preferred shares can be called from next year on and recent comments made by the management team on the Q2 2023 conference call seem to indicate the REIT is looking into retiring the securities. And that could be an interesting opportunity.

A quick look at the Q2 results indicates the preferred dividends are still safe

As my focus for this article will be on the likelihood of seeing the preferred shares being called by Armada Hoffler, I won’t provide an in-depth review of the company and I would recommend you to have a look at my older articles on Armada.

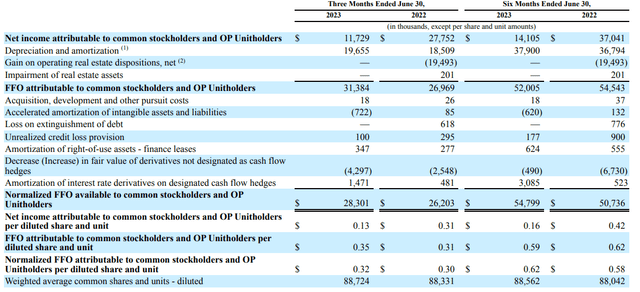

I do want to take a moment to briefly discuss the Q2 and H1 results of Armada as it has been a while since I discussed the results. As you can see below, the REIT generated a total FFO of $31.4M in the second quarter while the normalized FFO was slightly lower at $28.3M for about $0.32 per share. This brought the H1 2023 normalized FFO to $0.62 per share which is a noticeable increase from the $0.58 the REIT generated in the first half of last year.

Keep in mind, the normalized FFO already includes the less than $3M Armada Hoffler needs to cover the preferred dividend payments. So from a dividend coverage perspective, the preferred dividends should be very safe.

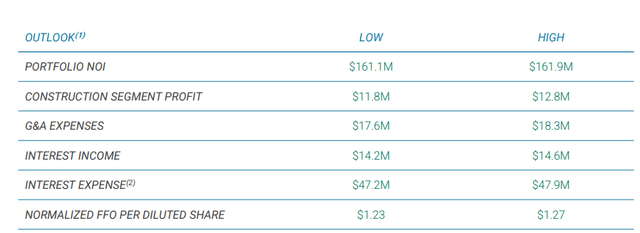

The REIT has now finetuned its full year guidance and it now expects a NOI of $161.1-161.9M which should result in a normalized FFO of $1.23-1.27 per share. This means the second half of the year will likely confirm the strong first semester as the full-year guidance basically implies a normalized FFO of $0.61-0.65 per share. This confirms the preferred dividends will be safe throughout the year as the REIT will need less than 10% of its normalized FFO to cover them.

The REIT plans to buy back preferred shares on the open market – ahead of calling the rest?

There was one interesting tidbit of information I didn’t expect. The company announced in its Q2 press release it initiated a $50M repurchase program for both the common shares as well as the preferred shares. That’s interesting, but the additional color provided on the Q2 conference call was even more interesting.

This initiative is predominantly meant to give us a headstart on retiring our preferred equity shares, which are callable next spring. It is our intent to eventually fully extinguish the entire series.

That’s a pretty straightforward statement: Armada Hoffler would like to retire all of its preferred shares and buying the stock back on the open market appears to be just a prelude before exercising the call option on the preferred shares (as a reminder, Armada Hoffler can call the preferred shares from June 18, 2024 on.

That’s perhaps a bit surprising as equity with a total cost of capital of just 6.75% is not expensive at all, and definitely not in this interest rate environment. One analyst asked the same question:

Lou, you talked on the prepared comments about taking out the 6.75 preferreds. I understand doing that when debt was, call it, 4 something percent, but in the current environment and given that it never has to be repaid and is it treated as at least quasi equity?

And while the answer from Armada’s management team was not a firm commitment to call the preferred shares in June next year, it sounds like if the cost of debt and cost of debt remain unchanged going into Q2 2024,

Well, again, Rob, we'll have to look to see what next spring brings in terms of rates, and whether that still may sense. Currently, with the preferred trading at a discount, we'd actually be purchasing back at basically an 8% rate. So that was the reason for the authorization of the buyback. Whatever we can get at a discount, we are going to take And then we will see what -- we'll see if the market gives us, next May when we could get some more.

And that makes the preferred shares pretty interesting. First of all, Armada Hoffler appears to be keen to buy the preferred shares on the open market at the current share price and this could potentially support the share price. And should the preferred share price go down and Armada steps up its buyback pace, the remaining preferred shares would actually become safer as the total amount of outstanding preferred capital would decrease from the current amount of $171M.

Secondly, the ‘yield to call’ comes into play now as well, although investors need to understand there is no firm commitment yet from the Armada management to call the preferred shares. It sounds like it’s pretty high on the priority list, but it for sure isn’t a ‘done deal’.

Should the preferred shares be called in June of next year, anyone who currently purchases the preferred shares would get four quarterly dividends for a total of $1.55 (there will be three full quarterly dividends and should the prefs be called in June 2024, the final preferred dividend will be pro rata for 2/3 rd of that quarter). The preferred shares are currently trading at $22.84 which means the total return would be approximately 16.2% in just over 10 months as there would be a substantial 9.5% capital gain (the difference between the $25 principal value and the current share price of $22.84).

Investment thesis

I currently have no position in the common shares of Armada Hoffler but I have a long position in the preferred shares. And while I was pretty neutral on those shares (the current yield is approximately 7.4%), the management’s objective to retire the preferred shares makes the potential short-term capital gains appealing as well.

I will likely add to my position.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AHH.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)