PENN Entertainment Hits The Jackpot With ESPN Bet: $134 Price Target For 2028

Summary

- PENN Entertainment (PENN) is a deep-value stock with a market cap of $3.5 billion and a P/E ratio of 6x earnings.

- Penn's acquisition of Barstool Sports for $551 million was unsuccessful, but the company is now rebranding as ESPN Bet, capitalizing on the growing sports betting market in the US.

- ESPN Bet has the potential to generate billions in revenue per year and capture a significant portion of the sports betting market, especially with the support of ESPN's large TV audience.

- If executed properly, PENN shareholders can expect to make 5x their investment or more in the next five years. And if you like PENN, consider buying GLPI as well.

Arseniy45/iStock via Getty Images

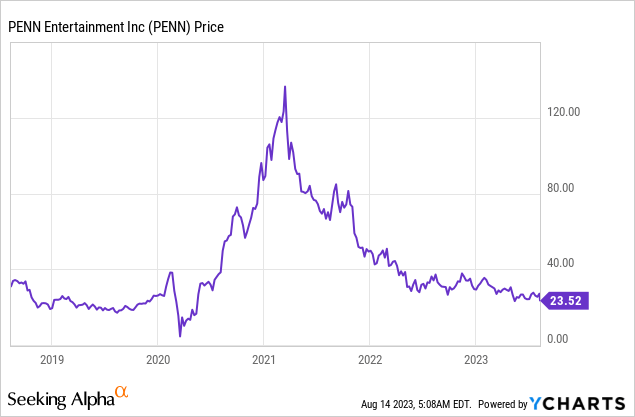

The U.S. Supreme Court legalized sports betting on a federal level in 2018 in its landmark Murphy vs. NCAA ruling, sparking a modern-day gold rush by operators looking for a piece of the estimated $30 billion per year US sports betting market. Investment capital flooded the market, and sports betting companies soon went state by state to secure licenses to operate legal sportsbooks in the United States. Advertisements for sports betting soon flooded the TV airwaves. Bookmakers soon started offering massive signup bonuses in the hopes of gaining market share. To this day, if you live in a legal sports betting market like New York or New Jersey, you can make up to $10,000 with virtually no work just by milking every sportsbook signup bonus in town and hedging your bets at other books. You might be able to see where this was going, but too much capital flooded the market, making the initial launch of sports betting a disappointment for investors' impossibly high expectations. Any flaws in execution were then severely punished by investors expecting the moon on a silver platter. Enter PENN Entertainment (NASDAQ:PENN), former meme stock turned deep value stock. The $30 billion per year sports betting market is still up for grabs, the only difference is that now you can buy in cheaply after the hype has faded out. And Penn just inked a 10-year deal to rebrand as ESPN Bet, making it the exclusive betting app of ESPN.

Why This Opportunity Exists In PENN

At this point, Penn is back to being a deep-value stock. Thanks to cash flow from its casino properties, the stock literally trades for 6x earnings, while sports betting competitors trade for "infinite" P/E ratios because they lose money every single quarter.

Penn was an established casino operator before the gold rush started. Instead of sinking billions on marketing to try to fight for market share, they tried a novel approach, which was buying a popular sports media company, Barstool Sports for $551 million. It almost worked. Penn soon became a meme stock, driven by Barstool founder Dave Portnoy's cult following. Portnoy is known for a series of high-profile stunts including protesting at the NFL headquarters in New York City against the NFL suspending Tom Brady for four games for his role in the "deflategate" scandal in the 2014-2015 playoffs. He was then banned from NFL games, but later went to the 2018-2019 Super Bowl disguised with a fake mustache and got kicked out by NFL security (though the Patriots won that game). Portnoy also has attracted controversy for boozed-soaked Barstool parties and for sexual assault allegations published in Business Insider. This is relevant for Penn Entertainment because states have morality clauses attached to gambling licenses, and it was thought that Portnoy's reputation likely cost Penn its New York gaming license. At this point, it was clear that Penn and Portnoy were a bad fit. Penn recently sold Barstool back to Portnoy for $1, albeit with 50% of the upside (a.k.a. shmuck insurance) if Portnoy subsequently resells Barstool.

It sounds like a disaster, right? Buying a company for $551 million and selling it back for a dollar can't be good. But there's reason to believe that Penn's management might be crazy like a fox here. Competitors like DraftKings (DKNG) actually spent billions on marketing to get market share, but they're losing money and the cash on their balance sheets is slowly dwindling. Penn could have spent $500 million per year on marketing for its sportsbook, and instead, it chose to buy Barstool instead, for a significantly cheaper all-in cost. The deal went about as badly as it could have gone, but Penn takes a tax write-off here and is now free to rebrand as ESPN Bet, exactly at the time when competitors are running out of promo money. ESPN likely wasn't ready to go all-in on sports betting a couple of years ago, but they are now, so the timing is right.

Why Penn is so cheap:

- Investors are shell-shocked about the Barstool deal because Penn lost about a year's worth of earnings buying high and selling low in M&A.

- Dave Portnoy owns a lot of PENN as a shareholder, and he's now selling all his PENN stock. As Penn is a smallish-cap company, a major shareholder selling all its stock all at once without really caring about the price is likely depressing the share price in the short run.

- PENN is a highly leveraged company. Their real estate was separated years ago into Gaming and Leisure Properties (NASDAQ:GLPI). The idea is that by separating the real estate and the casino business, owners of both can limit their downside. Separating real estate from the operating business is a classic strategy to improve the risk-adjusted reward of running any business. Therefore, I recommend owning both.

- Investors believe that because sports betting didn't make them rich when it first launched that it never will. However, the opposite is true because the price has now changed. I covered PENN in 2021 when it was a meme stock and noted that investors should look at GLPI instead because it was too expensive. Now, if PENN stock is able to get back to its 2021 share price, new investors will make a killing. Everyone wanted in on sports betting investments when the price was high, now the potential is still there but the price is low. With most states still not allowing betting, there's massive room to grow.

Why ESPN Bet Is A Multi-Billion-Dollar Idea

I've framed the opportunity. PENN's overall market cap is only $3.5 billion, while the company had $735 million in net income available to common shareholders over the past 12 months. On its own, PENN is a good value investment here. The bar for ESPN Bet is not incredibly high. If the project makes $500 million per year in net income, then that's worth close to double the market cap of PENN's entire business right now. For reference, Nevada sportsbooks make about that amount per year, despite only having 1% of the US population.

ESPN's flagship Monday Night Football sees 10-13 million viewers in a typical broadcast, rising to over 20 million for marquee games. Partnering with Penn here to host the ESPN sportsbook for 10 years, they're going to get market share. The only question is how much.

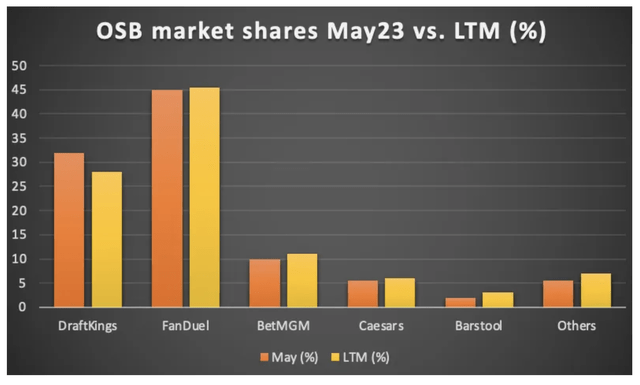

Here's the recent market share breakdown for the US.

US Sports Betting Market Share (Earnings + More (Substack))

Fanduel is the clear market leader and is majority owned by Irish parent company Flutter Entertainment (OTCPK:PDYPY). DraftKings is second, and existing casino companies Bet MGM (MGM) and Caesars (CZR) are in third and fourth, respectively. Then we have Barstool (soon to be ESPN Bet), with a measly 2% in market share. Of course, this is just for the legal sports betting market, as local bookies and offshore books still control much of the betting market in the US.

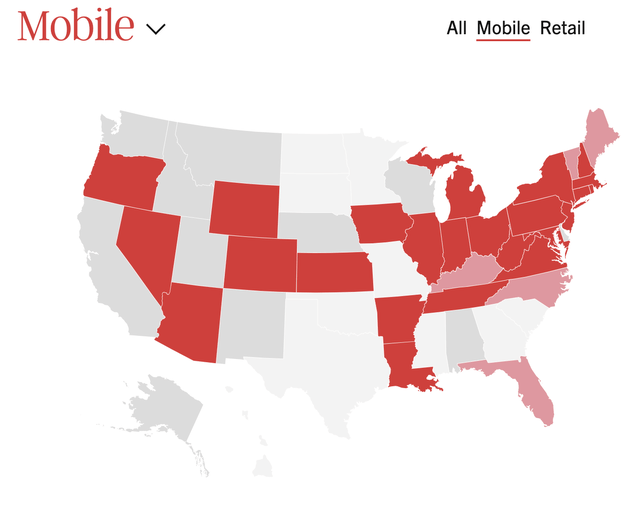

And here's where sports betting is currently legal in the US (excluding in-person-only states). Dark red is fully legal, light red is legal but not yet operational.

Internet Sports Betting Legality By State US (American Gaming Association)

Note what states do and don't allow legal sports betting here. Sports betting is widely available on the east coast, but not in California (39 million population), Texas (30 million population), or Florida (22 million). These three states make up nearly a third of the US population. In Florida, betting was legal for only a few weeks in 2021 and shut down since while different operators fight in court with the Seminole tribe over who has the right to offer it. Everybody wants their money, and the case may also end up in the U.S. Supreme Court. Still, the legalization campaign marches on. Kentucky launches in September, North Carolina launches in January, and Vermont will likely launch in January as well. The more states that end up online, the bigger the market is. Bigger population states are likely to see the dollar signs sooner or later. California in particular is likely to have tax revenue problems that push it to legalize sports betting sooner or later.

At the same time, Penn is working to rebrand as ESPN Bet, and they need to score licenses as well after having a ton of difficulty due to the optics of Barstool. The timing may actually be favorable for them– in New York, some of the initial entrants want out so Penn can get its gaming license on the cheap. This is also true in Connecticut, where Penn has yet to get a license. Penn's national market share struggles here are somewhat of an optical illusion because of the huge influx of customers in the tri-state area and Massachusetts when they came legal.

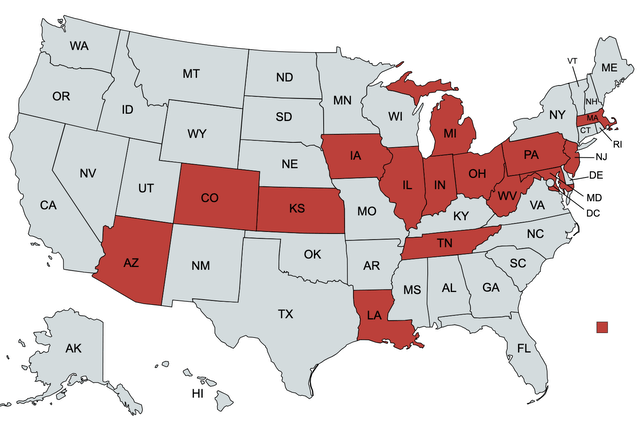

Here's my home-drawn map of where Barstool (soon to be ESPN Bet) is legal.

Barstool Sports Operating States (Logan Kane)

ESPN Bet is set to launch in November, and I believe they'll be able to cut quick deals to get the New York metro fully online later this year. Getting the rest of the eastern seaboard online should dramatically increase the number of customers who can bet on sports with Penn. The roadblocks are now gone.

Penn CEO Jay Snowden on the latest quarterly conference call:

But we’re not doing this deal to be 4% or 5% market share players. That’s not going to be acceptable for us. It’s not going to be acceptable for ESPN. And so, you should assume if those are the ranges you’re in, that’s not going to work out long term.

As a general rule, sports betting customers are worth about $1,000 to $2,000 per year in revenue on average, with casual players being worth less and action gamblers being worth more. Penn's ability to make ESPN Bet a success is just a math problem based on what they're paying ESPN. I estimate they'll need to get about 100,000 to 300,000 customers for ESPN Bet to break even, which is a reasonable target to hit. There are 20-30 million people who bet on sports in the US each year, so this isn't unreasonable at all.

You can generally divide sports bettors into four categories:

1. Sports fans

These make up the majority of sports bettors, they bet on their team and on big events. They might be worth a few hundred per year to the book. Millions of ESPN viewers fall into this category.

2. Parlay/teaser players

These make up a minority of sports bettors, and they're the best customers in my opinion. This is where the real opportunity for ESPN Bet comes in. By betting $50 on an 8-game parlay, the typical payout is somewhere around $8,000 if you win, while the book has a profit margin of 30-40%. That's great, but ESPN could ramp this up further by offering 15-game parlays (i.e. every game on the NFL slate for the week). $50 here would win you $1,000,000, and the winners would be decided during Monday Night Football each week, which is conveniently broadcast on ESPN. Penn can give people these parlay bets for free for a cheap price in terms of customer acquisition. This is a huge marketing opportunity for ESPN because they could reach out to those who won the first 14 games and give them the choice of hedging some of their win before MNF, and televise the million-dollar winners.

3. Action gamblers

Action gamblers are a minority of customers but make up a significant percentage of most sportsbooks' volumes, and they can be a blessing or a curse. Action gamblers are typically younger men with above-average intelligence who use their knowledge of sports to put their money at risk in the hopes of profit. Most of them get into sports betting through their fraternity. In my experience 80% of them lose, 10% roughly break even, and 10% make good money at it. The 10% aren't really frat kids however, they're usually aided by software, statistics like linear regressions and historical data mining, and some knowledge of popular psychology. In general, when action gamblers get into trouble with betting it's usually from bad bankroll management rather than losing large amounts of money. Action gamblers gravitate to local bookies because of the ability to bet on credit, and to avoid getting income tax forms over winning a measly $601 betting on the Patriots for a year as is the case at regulated books.

4. Problem gamblers

Problem gamblers will bet on anything until they run out of money, if there are slot machines or blackjack handy they'll bet on those. Part of running a sportsbook business is to identify people who are degenerates and try to not take their bets. The UK has had legal sports betting for far longer than the US, and they didn't take this problem as seriously as they needed to when they started to offer legal sports betting in the 1960s. ESPN Bet, if successful, should be marketed to sports fans and parlay players, with a neutral stance on action gamblers. Rebranding to ESPN Bet from Barstool should reduce the proportion of heavier action gamblers and degenerates in the customer base, which is in line with ESPN's corporate/family-friendly image. Similarly, there's nothing to prevent people from abusing a bottle of red wine, but the potential for abuse is much less than drinking vodka straight from the bottle.

How To Net $1 Billion Per Year From Sports Betting

Essentially, in the coming years, Penn needs to get 5 million customers from ESPN Bet and have them pay in $2,000 per year. That would make $1 billion in revenue. They could also get 10 million customers and have them pay in $1,000 per year. 10 million customers paying $2,500 per year would be $2.5 billion (easier over time with inflation).

I'm making assumptions about margins here, as there will be payroll and expenses. Since betting is taxed at both the federal and state level, the amount of revenue would need to be above this to equal $1 billion in net income. If we figure the revenue needed would be about $2.5 billion to get $1 billion in after-tax net income, then PENN would need to secure about 10% of the overall sports betting market in the US.

How they get here:

- The legalization campaign continues, increasing the size of the market. This is a 10-year game for ESPN and Penn. During this time, adding states like California or Texas can dramatically increase their customer base.

- Penn can take market share from competitors. I'm thinking DraftKings may be a good place to get market share as they're deeply unprofitable and antitrust concerns won't let them be bought out by Fanduel. At some point, DraftKings is going to either need to massively cut costs, or they'll be out of business. Higher interest rates are going to crush all of the growth-at-any-price companies in due time, and even if DraftKings makes the necessary cuts to break even or make money, they may not be able to maintain market share. Additionally, Penn is already looking to acquire gaming licenses from the first round of gold rush entrants that want out.

- ESPN Bet needs to appeal to the high-margin parlay customers, which is a good fit for the large TV audience of ESPN. This increases the customer base and the profit per customer. They're getting what they pay for because some people are getting rich and retiring, which is a fair trade for losing $1,500- $2,000 in a football season rather than $500.

Valuation: 5-Year Price Target For PENN

If Penn does a reasonable job of running its casinos, revenue should continue on a steady path there. At 6x earnings, PENN is a deep-value stock. PENN made about $735 million in the trailing 12 months, vs. a market cap of $3.5 billion.

The play here in the stock is fairly simple, heads you win, and tails you don't lose much. Casino profits need to increase to about $1 billion per year, and sportsbook profit needs to be about $1 billion. And if the sportsbook venture is successful, the market will remove PENN's discount to peers.

This happens frequently in casino stocks. Caesar's now trades for about 13x 2024 earnings after struggling with debt in the 2010s, and shareholders made over a 10x return if they bought when things were more uncertain (20x if they sold at the top in 2021). Casino stocks are obviously cyclical, but if we apply a 13x multiple to PENN stock on net income of $2 billion, then that's a market cap of $26 billion. ESPN has warrants that will give them 20% of PENN if ESPN Bet is a huge success, so we take this down to $20 billion or so. That's good for a return of 5.7x your initial investment if ESPN Bet is a success, or a price target of $134. They don't even need to beat top dog Fanduel in terms of market share, they just have to take market share from DraftKings and become the #2 sportsbook in America.

There are risks in investing in PENN stock– it's a highly leveraged company and 5.7x upside doesn't come without downside risk as well. Contrary to popular belief, casinos tend to struggle in recessions, though Penn's casinos aren't destination casinos in Las Vegas and more local casinos in unglamorous places. For these reasons, I think PENN should be fine no matter the direction of the economy, although a recession could pose a risk to the company's 5-year plan. The best way to mitigate this is to invest in GLPI as well as PENN, so you get both sides of the business in one. PENN gives you the upside, while GLPI gives you stability and yield.

Bottom Line

I believe PENN stock is the single best opportunity in the market over the next five years due to its deep discount to peers before the launch of ESPN Bet. PENN trades in deep-value territory, but the company now has huge growth potential. While PENN is a highly leveraged company that has plenty of downside risk, I believe ESPN Bet will be a huge success, making current shareholders multiples of their current investment. I rate PENN a strong buy with a 5-year price target of $134. Consider buying GLPI as well to take the edge off.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PENN, GLPI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

Opening in the middle of Football season will be problematic. how many users of other sights will just pick themselves up & leave to go to ESPN? How much money will Penn spend on promotions in an attempt to get users? Penn said on their site ESPN won't be profitable till 2027.

To me this seems like a high risk/reward trade as Penn had barstool & failed. They are in less states than FanDuel & DraftKings. There seems to be a defacto boycott of Disney. How this will effect ESPN is to be seen

This seems like a high risk time will tell all scenario, not so sure there will be a rush to drop platforms people have been using for many years

Good Luck