What To Do With Robert Half Inc.?

Summary

- Robert Half experienced a 10% drop in its stock price after announcing its earnings, with a decline of -37.5% from the previous year.

- The company attributed the decline in talent solutions to elongated client hiring cycles due to global macro uncertainty.

- We provide a comprehensive analysis of RHI's balance sheet, revenue, earnings, free cash flow, and growth potential, ultimately giving it a 5-star growth rating and a 4-star income rating.

DKosig

Introduction

When Robert Half, Inc. (NYSE:RHI) announced its earnings on July 26, 2023, the market did not like what it heard. The response was violent with RHI dropping 10% in one day. The earnings announcement showed a surprise of -11.5% and showed a decline of -37.5% from the previous year.

Along with the release, CEO M. Keith Waddell stated, "Second quarter results for talent solutions were impacted by elongated client hiring cycles resulting from ongoing global macro uncertainty. Protiviti was much less impacted with its diversified suite of solutions offerings." The company declined to provide any guidance for the rest of 2023.

Robert Half Inc., formerly Robert Half International Inc., provides specialized talent solutions and business consulting services. It provides these services through its divisions, including Accountemps, Robert Half Finance & Accounting, OfficeTeam, Robert Half Technology, Robert Half Management Resources, Robert Half Legal, The Creative Group, and Protiviti. Its segments include contract talent solutions, permanent placement talent solutions, and Protiviti. The contract talent solutions and permanent placement talent solutions segments provide specialized engagement professionals and full-time personnel, respectively, for finance and accounting, technology, marketing, and creative, legal, administrative, and customer support roles. The Protiviti segment provides business and technology risk consulting and internal audit services. Its marketing and creative includes the provision of creative professionals in the areas of creative, digital, marketing, advertising, and public relations.

This is how others rate Robert Half:

- Morningstar - Buy

- Redburn - Neutral

- UBS - Buy

- Zacks - Sell

- The Street - Buy

- Schwab - Buy

- Thomson Reuters - Hold

- S&P Global - Hold

- Market Edge - Long

Methodology Disclosure

I am a quantitative analyst. I put little stock in making future predictions about what a company will or will not do. My preference is to analyze the revenue of a company over the last five years and make determinations for earnings and free cash flow from there. I contend that most financial results for a company are the function of sales. The direction of sales dictates everything else for a corporation and one will that is the basis of all analysis I do.

Balance Sheet

Before I even consider a stock, the balance sheet must be clean. After running the numbers, this is what I found:

- Debt-to-Equity is 0.13

- Must be less than 0.4.

- The Current Ratio is 1.84

- Must be greater than 1.5.

- Altman-Z is 6.89

- Must be greater than 3.

- Free Cash Flow (TTM) is $683M

- Must be positive.

All these metrics must receive a passing grade.

Revenue Analysis

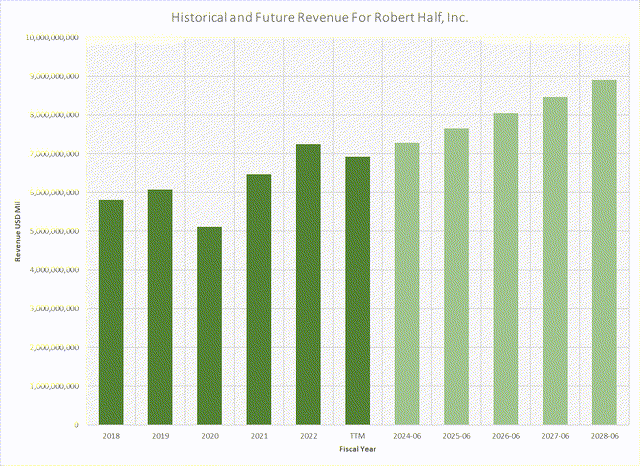

RHI has seen its revenue grow 6.57% per year over the last five years, and I see it growing at a more mundane rate of 5.18% based on historical trends. Its historical Price/Sales ratio has been as low as 1.06 and as high as 2.04. Its five-year average is 1.32.

RHI has a historical beta of 1.04 which gives me a required rate of return of 10.2%. Based on historical metrics, these are the present values for RHI determined by revenue growth:

- Bearish Case: $64.09/share

- Bullish Case: $109.41/share

- Fair Value: $76.11/share

Earnings Analysis

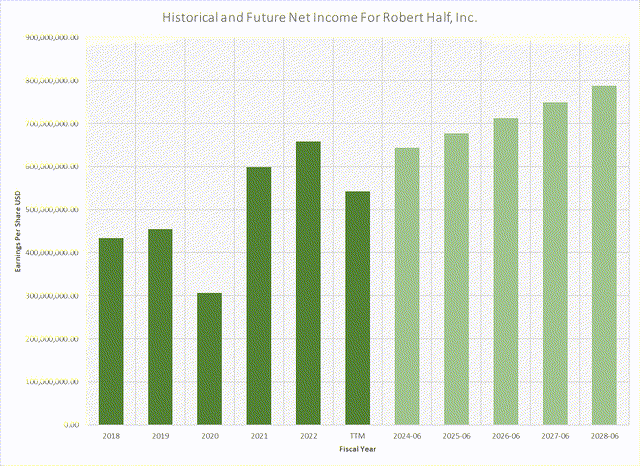

RHI has kept its operating expenses predictable over the years and has returned to its normal -58% rate for its cost of operations of goods and services. Additionally, the rate for SG&A expenses has remained stable at around -30%. Unless there are major changes made with tax legislation, I do not see its historical tax rate of 27% changing. With all of that in mind, I see RHI's earnings growth at 7.76% per annum over the next several years.

Historically, RHI's Price/Earnings ratio ran from a low of 9.67 to a high of 30.72. The five-year average for the P/E ratio is 17.24. Here is how I see the value of RHI as determined by earnings growth:

- Bearish Case: $54.65

- Bullish Case: $140.81

- Fair Value: $85.64

Free Cash Flow Analysis

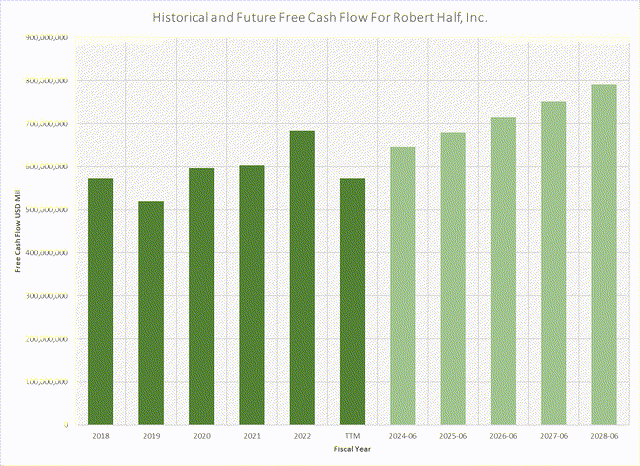

RHI has been able to consistently maintain its net operating cash flow at an average of 8.9% of sales per year. I see no reason for that to deviate.

I am making other assumptions too. I see its cost of debt at 6.3% and its WACC at 8.3%. When I conduct my sensitivity tests, I usually assume an assumed long-term growth rate of 1%-3%. With that, here is how to value RHI as determined by its future free cash flow:

- Bearish Case: $90.66

- Bullish Case: $118.57

- Fair Value: $102.39

Growth Rating

We now have three net present values for RHI and are now able to give it a growth rating:

- Balance Sheet: Pass

- Revenue Analysis: Pass

- Earnings Analysis: Pass

- Free Cash Flow Analysis:

- Pass Growth Rating: 5-Star (Strong Buy)

It is worth noting that the growth history is not in double-digit territory, but that does not mean there are no opportunities based on its future growth metrics. The reason that one might want to consider RHI is that is selling around 15% below its traditional multipliers.

Dividend Analysis and Rating

If I were to consider a stock as an income investment, there exist some basic requirements for my consideration.

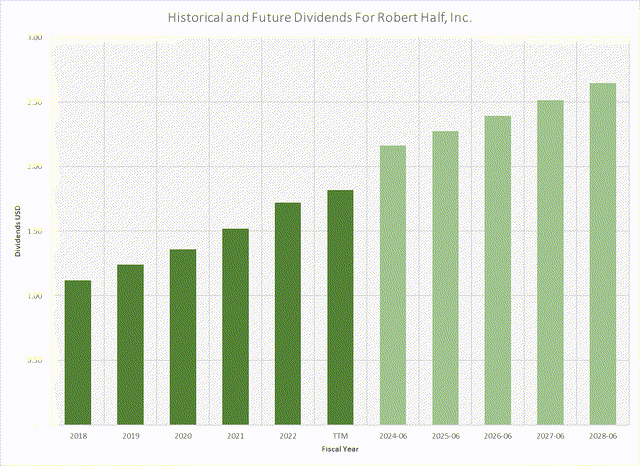

- The current yield is 2.56% and the historical yield is 2.20%

- Must be greater than 2%

- Annual dividend increases for 19 consecutive years

- Must be for at least 10 consecutive years

- Exception for unusual years such as 2020-2021 if the company renewed the dividend in 2021-2022

Based on the revenue trends from the last five years, this is how I see the future dividends growing for RHI. I am assuming a regressed dividend growth rate of 7.76%.

Based on future dividend growth, I calculate RHI's present value at $72.76/share. This is less than its current price of $75.11. This is how I score RHI as a dividend stock:

- Balance Sheet: Pass

- Current Yield: Pass

- Free Cash Flow Analysis: Pass

- Discounted Dividend Analysis: Fail

- Income Rating: 4-Star (Buy)

My Take

Robert Half offered no guidance for the balance of 2023. As a side note, I wish companies would do that more often, but I digress. This much we know, the current unemployment rate is 3.5%. Historically, unemployment is 5.7%. Of course, there is always the ~6% that is never included in the data. Regardless, we are at a historical low for unemployment, and many businesses and agencies are finding it difficult to fill available slots. Unless there is a massive upheaval in the job market, organizations still need help finding qualified workers. Even if unemployment increases, it is believed future workers will need hiring agencies to help them find jobs, even those that are temporary. I see no reason for the industry not to continue to grow. It might be slower, but it will still be a necessary expense for companies who are looking for technologies and efficiency in the hiring process. While Robert Half is not the largest recruiting agency in the country, I believe their focus on diversity and women makes that viable choice for those job seekers who want to compete on an even playing field.

As a recommendation, RHI is an appropriate stock if one is seeking growth and income in the midcap space. Of course, always perform your due diligence.

Good luck and have fun.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.