Sage Therapeutics: Undeserving Selloff Presents A Buying Opportunity

Summary

- Sage Therapeutics, Inc. has a virtual monopoly in treating postpartum depression, a condition that affects 15%-20% of postpartum women.

- The company's pipeline focuses on treating CNS disorders by modulating GABA and NMDA receptors.

- The major depression and essential tremor indications should further boost the stock price.

kieferpix Sage Therapeutics Logo

Sage Therapeutics, Inc. (NASDAQ:SAGE) was founded in 2010 and is based in Cambridge, Massachusetts.

Sage has a virtual monopoly in treating postpartum depression, which affects 15%-20% of all postpartum women

The company's pipeline is focused on treating CNS disorders by modulation of GABA and NMDA receptors. The GABA system is the major inhibitory signaling pathway of the brain and NMDA is the major excitatory pathway. The company's pipeline candidates are intended to alter the activity of the receptors and aim to restore the balance between excitatory and inhibitory signals within the brain.

The company has two approved products. Zulresso or brexanolone is an IV neurosteroid that is approved for the intravenous treatment of postpartum depression, PPD, which is believed to affect 15 to 20% of postpartum women or approximately 720,000 women annually just in the U.S. Women with PPD are at higher risk of substance abuse and suicide. Unresolved PPD may lead to prolonged, maternal morbidity and mortality.

Last week, the company received FDA approval for an oral neurosteroid Zurzuvae (Zuranolone) to treat postpartum depression. The stock, which dipped since the FDA did not approve the company's application for major depression, has recovered approximately 8% from the dip this week so far.

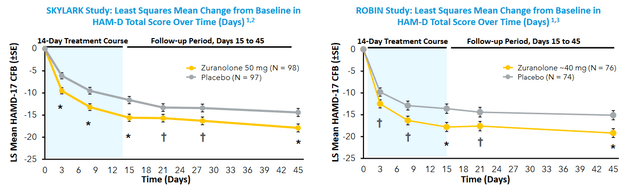

In the pivotal SKYLARK and ROBIN studies, Zuranolone showed an improvement in depressive symptoms as early as day 3, which was maintained at day 45. A statistically significant improvement in depressive symptoms compared to placebo was seen even after a 14-day short course of treatment. The drug was effective as a monotherapy, as well as an add-on to existing anti-depressive treatment.

Zuranolone Phase 3 data in PPD (Investor presentation)

Currently, the company's products have a virtual monopoly over the treatment of PPD, which was previously treated with off-label use of anti-depressants. Even at a conservative price estimate of $25,000 per year per patient, this could be a $1.8 billion annual revenue opportunity just in the U.S.

Biogen partnership adds validation to the pipeline

The company has a partnership with Biogen (BIIB) to jointly develop and commercialize Zuranolone and SAGE-324 in the U.S. Biogen paid the company $1.5 billion in cash, including an upfront payment of $875 million and a $650 million equity investment as well as potential milestone payments, profit-sharing, and royalties.

A good shot at essential tremor, another larger target market

Another key pipeline candidate is SAGE-324, partnered with Biogen, which is being developed to treat essential tremor, one of the most common movement disorders in the U.S. affecting approximately 6.4 million Americans. In a phase 2 study, there was a 36% reduction in the upper limb tremor amplitude from the baseline at day 29. In the more severe population, there was a 41% reduction in the upper limb tremor amplitude compared to the baseline at day 29. Patient enrollment in a phase 2b trial will be completed in late 2023, and the results are expected in 2024.

Experienced management for effective pipeline execution

CEO Greene served as the President of Alnylam Pharmaceuticals (ALNY), and general manager for oncology at Millennium Pharmaceuticals. Chief Business Officer Benecchi served as Vice President, Global Head of Commercial Excellence at Alexion. Senior VP, drug safety and pharmacovigilance Colquhoun worked as a trained physician in the U.K. and served as the Program Lead for the brexanolone and SAGE-324 programs. Chief Development Officer Doherty served as the Director and Head of the Neuroscience Department at AstraZeneca. Chief Medical Officer Gault served as the Vice President, Therapeutic Area Head for Neurology and Ophthalmology at Alexion/Astra Zeneca Rare Disease.

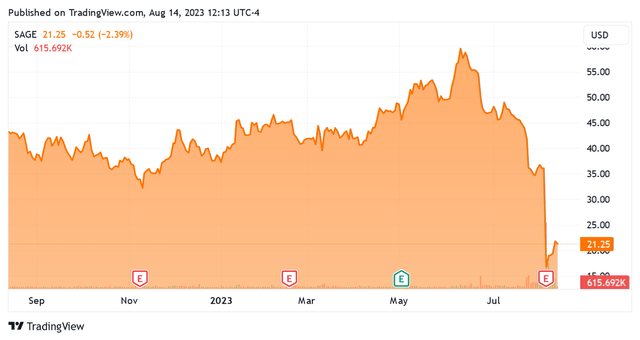

The stock is a good buy after the irrational selloff

Q2 2023 revenue was $2.47 million, which grew by 64.8% year-over-year. The company had cash reserves of $1 billion at the end of Q2, 2023. There was no long-term debt. Cash reserves are expected as enough for at least the next 12 months at an operating cash use rate of approximately $400 million in the last 12 months.

The average Wall Street analyst price target on the stock is $27, or approximately 27% upside potential. Analyst estimates for peak sales of Zuranolone are $200 million/year in the U.S. The current enterprise value of the company is just $165 million.

Moreover, the much larger major depression indication is not dead yet. FDA asked the company to conduct additional trials. I expect a two-year delay in the approval, however, Zuranolone has Breakthrough therapy indication in this condition which affects 8.3% of the U.S. population or 21 million people.

Rating Buy.

SAGE stock price chart (TradingView)

Risks in this investment include the inability of the company's products to gain significant market share. Investing in biotech/pharma companies without significant revenue is risky, and it is possible to lose capital. This note represents my own opinion and is not investment advice. Please conduct your own due diligence before making any investment decisions.

Premium service reviews

"The best I have ever seen in the biotech space..."

"Great service with in-depth research on biotech stocks."

"If you want to invest in biotech following events (catalysts), this is the right service for you."

This article was written by

Money Manager. Registered Investment Advisor.

M.B.B.S., M.D., MBA Finance (NYU-Stern).

Founder of Vasuda Healthcare Analytics, a catalyst-driven biotechnology/pharmaceuticals-focused service. Ranked 5-star on Tipranks. SumZero contributor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SAGE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.