indie Semiconductor: Irrational Dip

Summary

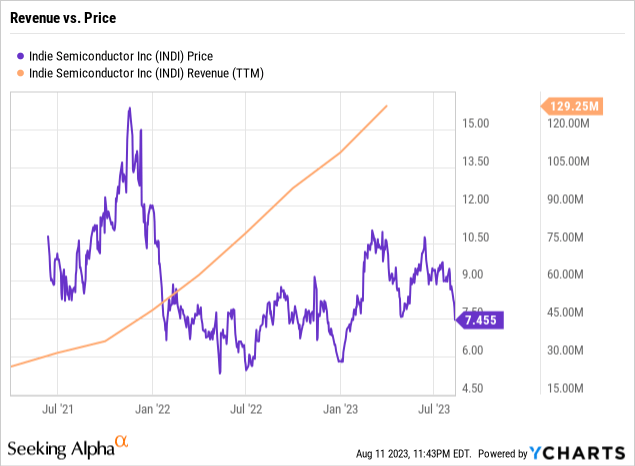

- indie Semiconductor sold off despite strong quarterly earnings, leaving the stock stuck below $10.

- The company forecasts maintaining 100% growth, yet the stock still appears in the penalty box due to the SPAC transaction.

- The stock trades at only 4x forward sales, which is similar to slow growth mega-cap semiconductor stocks.

- Looking for a portfolio of ideas like this one? Members of Out Fox The Street get exclusive access to our subscriber-only portfolios. Learn More »

greenbutterfly

indie Semiconductor (NASDAQ:INDI) had a bizarre sell-off following another great quarterly earnings report. The Autotech semiconductor company continues growing revenues at a 100% clip, but the stock remains stuck below $10. My investment thesis remains ultra Bullish on indie now trading at only $7.50 following the post Q2 selloff.

Source: Finviz

Monster Opportunity

Quarter after quarter, indie Semi. reinforces the monster opportunity ahead in the Autotech sector. The company reported another big quarter as follows:

Source: Seeking Alpha

indie Semi. didn't report an impressive beat, but the real focus should be on the achievement of 102% revenue growth. The stock trades below levels from the last couple of quarters where the company again reported triple-digit growth.

As with a lot of SPACs, the stocks appear stuck below $10 regardless of the quarterly results. indie reported Q2 revenue of $52 million, up from less than $20 million at the end of 2021 when the stock actually traded above $10.

The perplexing part is that indie hit solid gross margins of 52.2%. The goal is to reach 60% gross margins, but the semi. company remains relatively small to max out margins.

Considering the massive $48 billion opportunity in the Autotech space in several megatrends, indie continues to aggressively invest in building the business via acquisitions of key technologies like computer vision and radar. The end result is R&D expenses up ~50% YoY to $42 million.

Due to the ongoing spending, the non-GAAP loss remained at $16 million. The market probably wanted to see indie eliminate some of the ongoing losses in this environment, but indie is probably being too aggressive trying to turn a profit in Q4.

Per the CFO Tom Schiller on the Q2'23 earnings call:

So, it's accelerating growth into Q4, continued gross margin expansion, and then operating leverage. We actually expect Q4 OpEx to tick down because for Q2 and Q3, we're seeing higher tape out costs, mass costs coming through. But that'll reduce in Q4. So, all of those factors get us to profitability next quarter.

Big Guidance

indie forecasts revenue growing at least 100% this year with the Q3 guidance for a revenue run rate of $240 million, equivalent to $60 million for the quarter. The company just reported $52 million in Q2 revenues and guided to a 15% sequential increase, but the consensus analyst estimates were for revenues to reach up to $65 million for Q3.

In order to reach the 100% revenue growth for the year, indie will have to hit at least $70 million in Q4. The consensus estimates are for revenues to top $73 million.

The company has a fully diluted share count of 164 million placing the market cap at $1.2 billion. indie has $156 million in outstanding debt due to some of the deals, but the semi. company has $181 million in cash to offset the debt.

Considering the annual run rate is set to reach $240 million this quarter, the stock is incredibly appealing on this growth rate. The stock only trades at ~5x current sales.

Once looking at 2024 sales targets of $360 million, indie trades at less than 4x sales targets. Both multiples are extremely appealing for a company growing revenues at a 100% clip.

The CEO is very aggressive with a $1 billion sales target for 2028, but the Autotech sector offers a ton of growth. The key here is to buy the stock for the growth opportunities when indie isn't trading like a semi. stock with tremendous growth ahead.

The stock actually trades right in the range of other automotive semi. stocks like NXP Semiconductors (NXPI) and ON Semiconductor (ON). The indie multiple isn't fully accurate in the below chart due to the company reporting GAAP losses and the chart not pulling in the fully diluted shares outstanding. The key is that the above calculation has the forward P/S multiple for indie still below NXP Semi. and ON Semi., though both are struggling to even grow.

The big dip for indie following earnings appears very irrational. In a lot of regards, the semi. company still appears in the penalty box due to the SPAC deal.

The market just has no confidence in guidance from these former SPACs for whatever reason, possibly due to the lack of key analyst coverage. An Autotech semi. company with 100% growth would normally have more than 5 analysts on the earnings call and key IPO investment banks like Goldman Sachs, Morgan Stanley and BoA would normally cover the stock.

Takeaway

The key investor takeaway is that indie is appealing on any dips. The stock trades at a normal valuation for a semi. stock, yet the company is reporting 100% sales growth in the hot Autotech sector.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

This article was written by

Mark Holder graduated from the University of Tulsa with a double major in accounting & finance. Mark has his Series 65 and is also a CPA.

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INDI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.