H&E Equipment Services: Still Undervalued With The Potential To Provide Good Returns In The Short Term

Summary

- H&E Equipment Services stock has risen 38% in less than three months and is still undervalued.

- Q2 FY23 results show a 22.2% rise in total revenue, driven by strong growth in used equipment sales and equipment rentals.

- Technical analysis suggests the stock has the potential to reach its all-time high of $56, making it a good short-term trade.

guvendemir

H&E Equipment Services (NASDAQ:HEES) is one of the largest integrated equipment services organizations in the United States. Since my last report on HEES was published, its stock price has risen by 38% in the last three months. They recently announced their Q2 FY23 results, so I considered writing a follow-up. In my opinion, despite rising 38% in recent times, they are still undervalued and can provide good returns in the short term. Hence, I assign a buy rating on HEES.

Financial Analysis

HEES announced its Q2 FY23 results. The total revenue for Q2 FY23 was $360.2 million, a rise of 22.2% compared to Q2 FY22. I believe the major reason behind the revenue rise was strong revenue growth from its used equipment sales and equipment rentals. The revenues from the used equipment sales grew by 110.5% in Q2 FY23 compared to Q2 FY22. The used equipment market was thriving in Q2 FY23, and the management capitalized on this opportunity by making specific types of equipment more readily available, which I believe was the main reason behind the revenue increase in its used equipment sales. Now talking about the equipment rentals, its revenue grew by 28% in Q2 FY23 compared to Q2 FY22. I believe higher rental rates and growth in its rental fleet were the main reason behind the revenue rise. The rental rates in Q2 FY23 were higher by 7.1% and 1.1% compared to Q2 FY22 and Q1 FY23.

Its gross profit margin for Q2 FY23 was 46.7% which was 44.9% in Q2 FY22. I believe improved gross margins on parts sales and a significant improvement in used equipment sales margins were the main reason behind the rise in gross margin. The gross profit margin on used equipment sales in Q2 FY23 was 59.1% which was 47.6% in Q2 FY22. As a result of increased revenues and gross profit, its net income grew by 56.4% in Q2 FY23 compared to Q2 FY22. In my view, its financial performance in Q2 FY23 was quite impressive. They posted double-digit revenue and net income growth in the first quarter and did the same in the second quarter. To maintain such a high growth rate with improving margins is quite impressive, and I believe due to the solid financial performance, we are seeing a strong appreciation in their stock price.

Technical Analysis

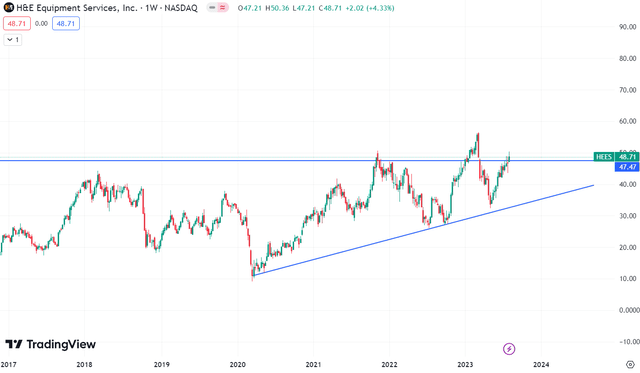

It is trading at the $48.7 level. In the last three months, the stock has risen by 38%, indicating that strength is present in the stock. Recently it broke out of the important resistance zone of $48; the stock tried to break the resistance zone in November 2021 but failed miserably, but the second time it broke the $48 level and created a new all-time high of $56. So this is the third instance that the price is near the breakout level, and the positive thing is that it gave a closing above the breakout level of $48. So looking at the strength and momentum in the stock, I believe it has the potential to reach its all-time high of $56 because there are currently no resistance zone or barriers to stop the price. Hence I believe it can be a great short-term trade. Looking at the price chart, I assign a buy rating on HEES one can buy it at the current level with a stop loss of $45 and a target of $56. This would give us a risk-to-reward trade of 1:2.

Should One Invest In HEES?

In the last three months, the stock price has gone up by 38%, and you must be thinking that the movement might exhaust now and the stock might not provide returns in the short term. But I have a different view; the technical chart of the stock is looking strong, and it is a possibility that we might see a strong upward momentum in the stock price in the short term. In addition, if we look at its valuation. It has a P/E [FWD] ratio of 11.27x, lower than the sector ratio of 17.74x, and its five-year average ratio of 16x. It has an EV / EBIT [FWD] ratio of 12.23x, compared to the sector ratio of 15.61x. After looking at the ratios and its solid growth rate, I believe it is undervalued, and even after rising 38% in recent times, I think it still has room for growth. Hence, looking at its positive technical chart, solid financial performance, strong growth rate, and undervaluation, I believe HEES can still provide solid returns to its shareholders. Hence, I assign a buy rating on HEES.

Risk

As of December 31, 2022, they had 2,307 employees who were neither represented by unions nor protected by collective bargaining agreements, whereas 68 employees in Utah, a sizable portion of their Intermountain region, were covered by such agreements. Periodically, different unions try to organize some of their nonunion workers. Work stoppages, slowdowns, or strikes by some of their employees could result from union organizing attempts or collective bargaining agreements, negatively impacting their ability to serve their consumers. Additionally, a reduction in the number of employees covered by collective bargaining agreements or a rise in the number of actual or threatened labor disputes could have unanticipated impacts on labor costs, productivity, and flexibility.

Bottom Line

HEES posted another solid quarterly result with solid revenues and net income growth. I think it is still undervalued and can provide good returns to its shareholders in the short term. Hence, looking at the solid financial performance and positive technical chart, I assign a buy rating on HEES.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)