Palantir: This Is The Inflection Point

Summary

- Palantir's Q2 earnings show continued double-digit growth and the potential for its AI offering to expand its total addressable market.

- The company's customer count grew by 38% YoY, indicating strong demand for its software.

- Palantir's entrance into the generative AI field with its AIP platform is expected to be a game changer, attracting new customers and improving financial performance.

- Looking for a helping hand in the market? Members of BlackSquare Capital get exclusive ideas and guidance to navigate any climate. Learn More »

Marco Bello

Earlier this week, Palantir (NYSE:PLTR) reported its Q2 earnings results which showed that the company is not only able to continue to grow at a double-digit rate in the current environment, but its latest AI offering also has a great potential to aggressively expand the company’s TAM and create more value in the long run. In my latest article on Palantir from last month, I’ve already noted how generative AI applications are more than just a fad like the metaverse as their ongoing adoption is more than likely to have a profound impact on our society.

Considering that in just a couple of months since its launch Palantir’s AIP offering is already used by over 100 corporate clients, it’s safe to say that the company has everything going for it to utilize the current heightened demand for generative AI applications to its own advantage and become one of the leaders of this new technological revolution. Therefore, I remain bullish about Palantir’s future and have no plans to unwind my position anytime soon.

Palantir’s Growth Story Is Far From Over

The earnings report for Q2 that was released at the beginning of this week showed that Palantir managed to increase its revenues during the period by 12.8% Y/Y to $533.32 million, as its commercial and government revenues increased by 10% Y/Y and 15% Y/Y, respectively. At the same time, Palantir has also generated a positive cash flow and was GAAP profitable third quarter in a row, which indicates that the company’s growth story is far from over.

Going forward, there are more than enough reasons to be bullish about Palantir’s future. Despite all the bearish arguments which claimed that it would be hard for Palantir to continue to scale its business due to the high price that it charges clients to use its software, the opposite is currently happening. In Q2 alone, Palantir’s customer count grew by 38% Y/Y to 421 customers, as the management was able to close 66 deals that were worth at least $1 million. If the overall economy continues to improve, then there’s a possibility that Palantir would be able to benefit from the strong commercial spending headwinds later this year and beyond, which could result in further aggressive growth of new customers.

What’s also important to note is that thanks to its high retention rate, Palantir can upsell additional offerings to its existing clients, which helps improve its overall top-line performance and keep the growth story going. In addition, the constant stream of multiyear contract awards, which are worth hundreds of millions of dollars, from the Western military-industrial complex would continue to fill the company’s coffers for years to come thanks to the rise of defense spending due to the increase of geopolitical risks.

Alex Karp Doubles Down On AI

At the same time, Palantir’s entrance into the generative AI field thanks to the launch of AIP at the start of Q2 is likely to become a real game changer for the company as it can greatly expand the company’s ability to attract new customers at an even aggressive rate in the future. The whole generative AI industry itself is expanding at an aggressive rate and is expected to be worth over $1 trillion in the following years, as companies like Nvidia (NVDA), Intel (INTC), and Arm (ARMHF) are even developing chips and platforms specifically for AI applications.

Let’s also not forget that AIP has been launched only a couple of months ago and Palantir’s CEO Alex Karp in his latest letter to the shareholders stated that the new platform is already used by over 100 organizations and the demand for it remains unprecedented. Considering that AIP lets organizations deploy large language models within their own ecosystems to transform their business processes and make them more efficient, it’s likely that more organizations will be interested in using Palantir’s offering so that they avoid the risk of being left behind as the world changes. Since Alex Karp also stated in his letter that Palantir is in talks with over 300 additional organizations to deploy AIP within their ecosystems, it’s likely that with each passing quarter, the new platform would be having a greater positive financial impact on the company’s financials and improve its overall performance along the way.

As a result of this increased demand for Palantir’s generative AI platform, it would be safe to say that there’s nothing not to like about the company at this stage. Its business continues to grow at an aggressive rate and its TAM is about to expand exponentially in the following years. At the same time, most of the major bearish concerns are no longer relevant at this stage. Insider selling has decreased significantly in comparison to 2021, and the business is now able to report GAAP profitability as its stock-based compensations continue to decrease with each passing quarter. In Q2, Palantir’s SBC decreased to $114.2 million against $145.8 million a year ago, while its top-line and bottom-line have been able to improve at an aggressive rate.

On top of all of this, Palantir will likely be included in the S&P 500 Index in the following quarters, as it would become eligible for the inclusion after the release of the Q3 earnings report later this year when the company is expected to report a fourth consecutive quarter of profits. Considering that its current market cap is greater in comparison to a significant portion of other companies in the index, it’s likely that once exchange-traded funds begin to purchase Palantir after the inclusion, its stock would receive an immediate boost. Add to all of this the fact that the company recently authorized a buyback program of up to $1 billion and it becomes obvious that there are more than enough ways to ensure that Palantir’s stock won’t significantly depreciate to its lows at which it traded a few months ago in the foreseeable future.

Valuation Is The Only Major Concern

At this stage, the only valid argument of the bears is that Palantir’s stock is greatly overvalued and it’s risky to own it at the current levels. While it’s true that at a forward P/E of ~65x Palantir trades at a significant premium, I would say that there are more than enough growth opportunities that are able to outweigh the valuation concerns and help the stock to appreciate further.

First of all, the American economy is robust, the inflation is cooling, and the recession is likely to be avoided at least in 2023. If the improvement of the economy continues, then Palantir shouldn’t have problems improving its top-line performance as clients are unlikely to cut their budgets on software in such an environment.

At the same time, the latest post-earnings depreciation is likely to be caused not by the company’s performance but due to the rebalancing of portfolios after the latest market runup since even Microsoft’s (MSFT) shares slipped after reporting its own results which showed that its profits have skyrocketed.

What’s more is that Palantir’s shares continue to trade significantly above the pre-AIP launch levels, which could be interpreted as an indication that the market still believes in the company’s AI story along with the ability of generative AI to significantly improve its business as TAM expands. Considering that a year ago it was impossible to even believe that Nvidia would have a capitalization of over $1 trillion anytime soon and now its new valuation has become the new normal shows that AI growth opportunities are more important than valuation concerns at this stage.

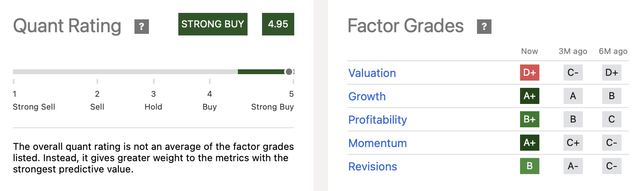

Another important thing that’s important to note is that despite all the valuation concerns, the street has made 10 upward revisions for Palantir’s stock in the last three months, while Seeking Alpha’s Quant system still believes that Palantir is a strong buy as its growth story remains intact.

Palantir's Quant Rating (Seeking Alpha)

The Bottom Line

Palantir remains to be a battleground stock and at this stage, the major debate is about figuring out whether the potential TAM justifies the company’s current premium valuation. After incorporating generative AI applications into my workflow and improving my productivity I tend to think that at this stage the growth opportunities for Palantir in the AI field are endless and such opportunities would be able to outweigh the valuation concerns in the following quarters.

Considering that almost a quarter of Palantir’s clients signed up for AIP in just a couple of months since the platform’s launch, it would be safe to say that the demand for the company’s products remains high and should help the overall business to continue to generate aggressive returns in the foreseeable future. What’s more is that as more organizations adopt generative AI applications, Palantir’s TAM is likely to expand at an exponential rate and lead to more growth in the future.

Brave New World Awaits You

The world is in disarray and it's time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it's worth it for you!

This article was written by

It was there that I started to combine my academic knowledge with a passion for investing to build an all-weather portfolio that could overcome periods of constant economic and political uncertainty. Given the systemic shocks that have been happening to Ukraine in the last decade, I saw firsthand what’s it like to live in an environment where there’s too much unpredictability and no guarantee that your endeavors won’t fail. Despite this, I managed to show strong returns and since 2015 have been sharing some of my ideas here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (12)

Imo