Altius Minerals: Shares Can Get Even Cheaper With A Recession

Summary

- Altius Minerals Corporation receives a Hold recommendation due to solid medium/long-term prospects in the energy transition towards zero/reduced CO2 emissions technologies.

- The company's royalty revenues from potash and base metals productions are well-positioned for future growth.

- Short-term headwinds, such as low copper and potash prices, may continue to challenge Altius' royalty income.

iamporpla

A Hold Rating for Altius Minerals Corporation

This article's analysis continues to support a Hold recommendation on shares of Altius Minerals Corporation (OTCPK:ATUSF), a Canadian royalty and streaming company that receives revenue from potash and base metal mines and the operation of energy assets in North America and Brazil.

Solid Medium/Long-Term Prospects that Justify the Hold Recommendation

Consistent with the previous article, Altius Minerals is expected to have a promising growth future as its portfolio of royalty and streaming agreements will benefit from the solid mid- to long-term prospects of copper and other key metals such as cobalt and nickel in the energy transition towards zero or reduced CO2 emissions sources.

In light of the strategies against the global warming effect that scientists believe is responsible for the extreme phenomena of climate change, Altius Minerals continues to cultivate its interest in renewable energy sources through its 58% stake in Altius Renewable Royalties (OTCQX:ATRWF) (ARR:CA). whose royalty revenues, in turn, continue to advance well.

Royalties from potash mine development are also well positioned as demand for this commodity and other fertilizer classes will increase to ensure adequate food supplies for a rapidly growing world population.

Today, the problem is even more serious as a major food crisis looms over the Horn of Africa and other poorer regions of the planet, which would suffer immeasurably from disruptions in the transport of grain and other foodstuffs across the Black Sea due to the conflict in Ukraine.

Altius Minerals Corporation's strong medium/long-term prospects also benefit from the opportunity to earn a higher dividend from its holding in Labrador Iron Ore Royalty Corporation [LIF.TO] (OTCPK:LIFZF) over time. This Canadian iron ore producer in eastern Canada, which in turn owns a 15.10% interest in the Iron Ore Company of Canada, is investing to achieve higher production and longer operating life in the future.

In addition, Altius Minerals is expected to receive a royalty on future DR iron ore production from the Kami Mine in Quebec, Canada, where the foundation for 23 years of open pit mining is being laid.

Altius Minerals also has the potential to benefit in the future from a lithium royalty revenue from its 12.6% founding investment in Lithium Royalty Corp. (OTCPK:LITRF) (LIRC:CA), a Toronto, Canada-based lithium royalty company.

However, Short-Term Headwinds Could Continue to Challenge Altius' Royalty Income

In the near term, however, Altius Minerals stock will most likely continue to suffer from the headwinds of low copper and potash prices, which occurred in the second quarter of 2023 and significantly impacted royalty revenue attributable to the company.

Copper and potash prices will continue to reflect international geopolitical tensions and China's difficult economic recovery. There is also the specter of an economic recession in America and Europe as a result of monetary tightening.

Even Labrador Iron Ore Royalty Corporation's decision to allocate more funds now for future growth than for paying dividends certainly won't be a catalyst for Altius Minerals' stock price rise.

Given the significant downside risks that remain to Altius Minerals' share price, the stock of this Canadian diversified royalty and streaming company does not receive a higher than a Hold recommendation rating. Furthermore, given the real possibility that shares could become significantly cheaper compared to the strong growth prospects over the medium to long term, it would be wise to wait a little longer rather than buy additional stock today.

How Altius Minerals Corporation Is Currently Performing: Q2-2023 Financial Results and Possible Near-Term Trends

Due to lower realized prices for key commodities such as potash and copper, combined with the closure of the 777 zinc-copper mine in Flin Flon, Manitoba, as metal reserves depleted after reaching 18 years of continuous mining and exploration, attributable royalty revenue in Q2 -2023 was significantly lower compared to Q2-2022, which also resulted in lower profit margins.

In Canadian dollar [CAD] currency terms, Altius Minerals' attributable royalty revenue fell 34.7% year-over-year to CAD 18.7 million (or ≈ $14.1 million) in Q2-2023.

Adjusted earnings per share also fell dramatically at CAD 0.06 (≈ $0.045) in Q2-2023 compared to CAD 0.23 (≈ $0.179) in Q2-2022.

Due to lower royalty revenue, Adjusted EBITDA margin was 73% of total royalty revenue in Q2-2023 compared to an Adjusted EBITDA margin of 85% of total royalty revenue in Q2-2022, while a decrease of 15.1% YoY year (in CAD terms) took place in adjusted operating cash flow to CAD 14.1 million (≈$10.6 million) or CAD 0.30 per share (≈$0.226) in Q2-2023.

A breakdown of royalty revenue in the second quarter of 2023 indicates the following:

Base and battery metals fell nearly 42% year over year to CA$4.834 million as higher revenues and volumes from the Chapada open-pit copper-gold mine operated by Lundin Mining Corporation (OTCPK:LUNMF) [LUN:CA] Mineração Maracá Indústria e Comércio SA was not enough to offset the next two headwinds.

A sharp decline in copper market prices of 11.6% to the average price of $4.35 per pound in Q2-2023 from the average price of $3.84 per pound in Q2-2022 coupled with a significantly longer than expected annual maintenance of nickel processing operations in Labrador, Canada, which are carried out by Vale S.A. (VALE)'s subsidiary Vale Newfoundland & Labrador Ltd.

Although the operational difficulties in Labrador, Canada, are short-lived, the headwinds of a weak copper price are expected to continue as China struggles to revive its economy. The development of China's economy is a key driver of the price of red metal as the Asian country is the world's largest consumer of copper, edging out all other countries by a wide margin, according to Statista.com.

Currently, Trading Economics reports that China is facing not only a weakened economic recovery on the back of the first consumer deflation since 2020 and disappointing trade data, but also a worrying slowdown in China's real estate market, and the latter is a strong driver of copper demand.

In particular, the latest data on Chinese exports - which fell 14.5% to $281.76 billion in July 2023, hitting a five-month low - strongly suggest a very difficult outlook for copper.

This is because the world's largest consumer of copper would have no interest in increasing investment in activities that require the base metal if, on the other hand, its main trading partners such as the US and the EU are not experiencing one of their easiest economic cycles due to tightening monetary policy. And with the US and EU economies teetering on the brink of recession, copper prices are likely to continue to face downward pressure in the near term.

Regarding the US, the world's largest economy, the following trends could anticipate the start of a recessionary cycle.

- A 23.1% year-on-year decline in Chinese exports to the US.

- Employers' intention to put in place the highest January-July job cut since 2020 or the year of the Covid-19 virus pandemic, according to Andy Challenger, a labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc., as reported by Trading Economics. Businesses are likely to expect lower sales going forward, perhaps confirmed by the least positive outlook issued so far this year from service companies (which are by far the largest contributor to the US GDP), but this will certainly impinge consumption, the largest component of the US GDP.

- Morgan Stanley housing analysts' view of an "L-shaped" recovery for the US housing market may also warn of an impending recession, as an "L-shaped" recovery for Investopedia.com typically follows a sharp downturn in the business cycle.

If the US goes into recession, so will the EU most likely, as the European Central Bank mimics the US Federal Reserve in raising interest rates to combat high inflation, although starting a bit later.

Potash royalty revenue fell nearly 47% year over year to CA$ 6.081 million as a result of lower potash prices, but these types of headlines are expected to persist in the coming months.

Lower potash prices in China could affect prices in overseas markets as well, such as in Brazil, where – in line with what is currently happening with other commodities where increasing penetration of imported products makes it difficult for producers to maintain resilient price conditions in domestic markets – players such as the German potash and salt miner K+ S Aktiengesellschaft repeatedly lowered profit expectations this year.

In the US, potash prices are impacted by limited demand and untested supply levels.

According to Statista.com, the People's Republic of China, Brazil, and the United States are the three largest consumers of potash fertilizer in the world, together covering more than 50% of global demand for the commodity in 2020.

Iron ore revenue fell 15.3% year-over-year to CA$2.431 million in Q2-2023, but this revenue comes from the dividend that Labrador Iron Ore Royalty Corporation pays to Altius Minerals Corporation as Altius is a shareholder in the social capital of Labrador Iron Ore, holding ~3 million shares (or ~4.7% of total shares outstanding of Labrador).

In short, the decline is due to the issuer's decision to allocate more funds to growth projects, which of course lays the foundation for a future increase in the dividend. In the near term, Labrador Iron Ore Royalty Corporation is expected to continue this type of corporate policy in relation to the allocation of funds.

Investing in Labrador Iron Ore Royalty Corporation provides a 9.48% 12-month dividend yield for U.S. OTC shares and a 9.49% 12-month dividend yield for shares traded on the Toronto stock exchange.

Thermal coal royalty revenue decreased nearly 42% year-on-year to CA$ 2.626 million due to lower attributable production volumes that were made at the Genesee Mine near Warburg, Alberta, Canada. The segment is on track to report progressively lower royalty revenue as the Genesee power plant plans to move from coal to natural gas by the end of 2023.

The company's 58% interest in Altius Renewable Royalties recorded attributable royalty revenue of CA$1.310 million, growing 71.7% year over year, from the subsidiary's 50% joint venture interest in Great Bay Renewables.

Great Bay Renewables royalty revenue portfolio has recently benefited from the addition of wind projects, and another project - the El Sauz project, which is under construction - will be added to the portfolio sometime in the fourth quarter of 2023 when it is expected to reach the commercial stage.

There are other growth plans underway for this segment of Altius Minerals Corporation, but renewables still account for a very small percentage of the company's total sales.

The Financial Condition

As of June 30, 2023, Altius Minerals Corporation's balance sheet was characterized by CAD 79.3 million (or ≈ $59.8 million) in cash on hand and marketable securities (up 3.3% sequentially), while total debt stood at CAD 116.7 million (or ≈ $87.5 million). It is also worth noting that 68.7% of total cash and cash equivalents were held by the company's 58% interest in Altius Renewable Royalties.

The debt outstanding resulted in interest expenses of CAD 8.7 million (≈ $6.6 million) for the 12-month period ending Q2 2023, and this compared to the 12-month EBITDA of CAD 66 million (≈ $49.8 million), leads to an interest coverage ratio of 7.6x. The index is calculated as a 12-month EBITDA divided by the 12-month interest expense.

The latter indicator of financial leverage means that Altius Minerals can pay the interest expense on its outstanding debt, despite a significant year-over-year decline in total operating profitability in the second quarter of 2023. As noted in the analysis, before medium and long-term growth prospects start to play in favor, short-term headwinds from lower commodity prices combined with lower dividends from iron ore interest and lower royalty income from the conversion of thermal coal to a cleaner gas-fired power plant could challenge the index a bit further.

However, the margin of safety of 7.6x against 1.5x, which is generally considered by investors to be the minimum tolerable level, is quite large, which should allow investors holding a position in Altius Minerals not to worry too much even in the event of a serious recession in the US and Europe, which could scratch the company's operating royalty portfolio significantly.

However, taking into account the Altman Z-Score of 3.94 (scroll down this page to the Risk section), which is better than the 3.76 from the previous analysis, it means that the company has no chance of going bankrupt.

The Altman Z-Score measures the likelihood that a company will face bankruptcy problems. If the value is less than or equal to 1.8, the balance sheet is in distress zones, which means a high probability of bankruptcy within a few years. When the ratio is between 1.8 and 3, the balance sheet is in a gray area, which still implies a risk of bankruptcy, albeit moderate. While a score of 3 or higher means that the risk of financial insolvency is extremely low or non-existent.

Overall, Altius Minerals Corporation's financial position is sound, and for the time being, this should be more than enough for investors who Hold their position to accept a further deterioration in this company's profitability as a possible outcome of the economic factors highlighted in this analysis.

The Stock Valuation

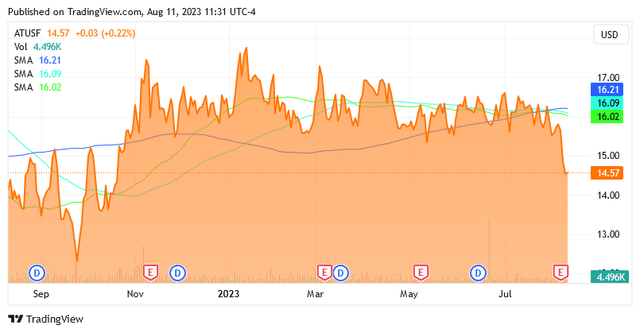

Altius Minerals Corporation shares are trading at $14.57 apiece at the time of this writing, giving it a market cap of $690.10 million.

Shares are trading slightly below the middle point of $15 of the 52-week range of $12.00 to $18.00, and are also trading significantly below the 200-, 100-, and 50-day simple moving average lines of $16.21, $16.09, and $16.02, respectively.

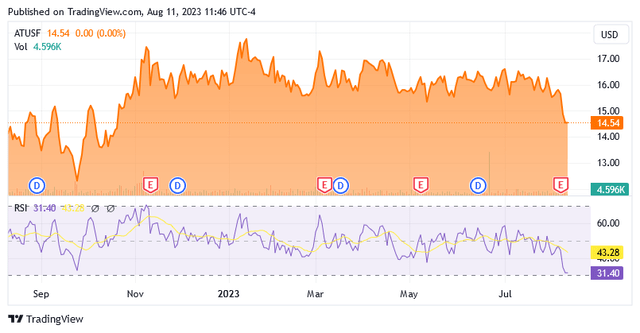

The chart below from Seeking Alpha, which reports a 14-day Relative Strength Indicator [RSI] of 31.40x, indicates that the stock has approached an oversold level, so there is no room for the stock's market price to fall significantly below current levels. However, this does not rule out further declines in the share price in the following weeks should the US stock market begin to factor in the recession that this analysis suggests.

Based on a 24-month beta of 1.23x (scroll down this page to the "Risk" section), shares of Altius Minerals should decline faster than US-listed stocks if the recession hits financial markets.

The US stock market index [US30], which serves as a benchmark for stocks listed in the US, is expected to trade at 31506.46 points in 12 months, down from the current 35276 points. Altius Minerals' stock should thus reach lower levels than the current ones after they regain some lost ground.

Likely, a pause in the next US Federal Reserve’s decision on interest rates versus elevated inflation could provide a tailwind to help Altius Minerals shares recover somewhat from the oversold levels. Rate traders are forecasting an 88.5% chance that the Federal Reserve will not hike rates at its September 20, 2023 meeting.

The scenario of a lower stock price than the current levels after the recovery post Fed's interest rate pause may also not materialize and as such, market prices now offer an amazing opportunity to increase the position in this stock with solid medium/long-term growth prospects.

However, given all the macroeconomic warnings of an imminent recession, this analysis concludes that the likelihood that Altius Minerals shares will not be valued significantly more attractively than they are today is very slim.

Shares also trade on the Toronto Stock Exchange under the symbol (TSX:ALS:CA). Shares were trading at CA$19.44 per unit on the TSE as of this writing for a market cap of CA$927.62 million. Shares are trading below the 200-day simple moving average of CA$ 21.83, below the 100-day simple moving average of CA$ 21.55, and below the 50-day simple moving average of CA$ 21.26.

Shares are also slightly below the middle point of CA$ 20.425 in the 52 Week Range of CA$ 16.85 to CA$ 24. Also, the 14-day Relative Strength Indicator of 31.39 suggests that shares are near oversold levels.

Altius Minerals Corporation will pay CAD 0.08 per common share quarterly dividend on Sept. 15, 2023, leading to a forward dividend yield of 1.64% for both stocks traded on the US over-the-counter and Canadian markets, as of this writing.

Conclusion

Altius Minerals Corporation looks set to face headwinds in the near term as downside risks continue to weigh on copper and potash prices, as well as the dividend it receives from its stake in an iron ore miner.

From a medium/long-term perspective, Altius Minerals Corporation has significant upside potential and shares may become cheaper in the coming weeks (under the negative impact of an expected recession) but not before recovering somewhat from current oversold levels.

So for now, investors should Hold the position.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.