Constellation Software: Deploying Capital At Good ROIC

Summary

- Constellation Software's defensive business model, with recurring revenues, low churn rates, and high ROIC, could provide investors with double-digit returns over the following years.

- Even though I believe size matters in CSU's growth strategy, for now, they are being able to deploy all its FCF into acquisitions.

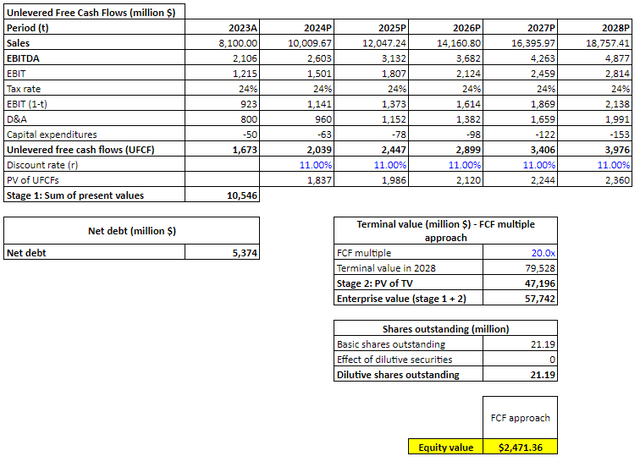

- My fair price for CSU is $2,471, and I consider the stock undervalued.

- In the 2Q of 2023, organic growth has improved and CSU spent $454 million in acquisitions.

Note: All currencies are denominated in USD unless otherwise stated.

canbedone/iStock via Getty Images

Investment thesis

I believe Constellation Software (OTCPK:CNSWF, TSX:CSU:CA) has a strong business model, with highly defensive earnings and outstanding management. The main question is whether CSU will be able to keep deploying its Free Cash Flow into new acquisitions and maintain its high ROIC.

Even though I believe eventually CSU's size will limit its upside, the company is not struggling to deploy its capital and has recently materialized some larger-than-average acquisitions.

From my base case scenario, I consider the stock undervalued and assign it a current fair price of $2,471 using a FCF multiple approach. Even if the returns on capital could diminish over the next years, I believe there is a risk-return asymmetry with higher probabilities in the bull scenario.

For the upcoming years, I expect CSU to be able to pursue 2 large acquisitions and 120 small-mid acquisitions per year, deploying $2 billion with 20% ROIC.

Company background

Constellation Software acquires, manages, and builds vertical market software (VMS) businesses. The company was founded in Canada in 1995 by Mark Leonard with CAD 25 million raised from its former venture capital colleagues. Their IPO in 2006 was a bit unusual, since they went public not to raise new capital, but to provide early investors with a liquidity event.

His background in the venture capital industry allowed him to realize plenty of niche quality companies in the VMS business that didn't have the upside required in VC but were highly cash-flow generative and provided their clients with mission-critical software. VC firms invest in businesses with the goal to sell them later making a profit, while Mark Leonard wants to keep them forever.

Vertical market software businesses address the needs of a specific industry and are highly customized. Its user base is limited, but it can provide high productivity improvements. For example, AgVision provides seed counting and inventory management for agricultural companies, equivant provides case management software for courts, attorneys, and inmate classification, and ConWX supplies weather and energy forecasting for wind and solar power providers.

Constellation has over 800 of these niche companies and operates in over 100 vertical markets in industries like healthcare, asset management, logistics, people transportation, education, hospitality, spa and fitness, storage, mining, oil and gas, homebuilding, library management, and many others.

On the other side, horizontal market software (HMS) that can be used by a wide range of industries. Some examples of horizontal market software could be spreadsheets (Excel), accounting software (QuickBooks), word processors (Word), or CRMs (Salesforce).

Revenues for VMS businesses consist primarily of software license fees, maintenance, professional services, and hardware. This business usually doesn't experience high organic growth and doesn't benefit from scale economies, since the addressable market is limited, but they don't face much competition because of the same fact. Big players don't want to spend the initial capital and R&D that it would require to become competitive in this segment which is relatively small.

VMS represents a small percentage of client expenses, usually less than 1%, and has significant switching costs since most of the time it is tailor-made and mission-critical. This has allowed CSU to have a historical retention rate of over 95%. Even if the client owns the property of the software, which usually is not the case and CSU has been transitioning to a subscription model, it is still hard to change the supplier since it will take some time for a new company to understand the code and be able to maintain it effectively.

Furthermore, the person in charge is usually not going to spend time looking for an alternative to such a small percentage of the expenses, especially in small businesses, where managers have limited time and prefer to spend it on more profitable tasks. This is even better for public companies, which represent about 50% of CSU's revenues, and their lack of incentives to change their software vendor.

CSU's strategy is simple but unusual. Instead of running a single big business with centralized management and scale economies, they expect to be a good owner of hundreds of growing autonomous small businesses that generate high returns on capital and then deploy that cash flow into acquisitions. The mission of CSU is to assemble a portfolio of VMS companies that have the potential to be leaders in their particular market and create a network of relationships between their businesses.

I believe this strategy is highly earnings-defensive since their businesses are in different regions and industries, allowing CSU to isolate itself from the flows of the economic cycle in a specific market and reducing cash flow volatility. Half of their clients are from the public sector, while the other half are private companies.

Mark Leonard and his team's view is that the larger the business gets, the more difficult it becomes to manage. They believe motivated small teams can achieve better results in small markets and it incentivizes innovation. But how do they manage to run 800+ businesses?

Constellation Software Organization

To run over 800 different businesses and keep adding, Constellation Software has created a decentralized model, bringing responsibility to lower levels and creating proper incentive programs. Mark Leonard and his team are strong believers that small-size teams produce better outcomes and more productivity per employee than large organizations.

The larger a business gets, the more difficult it becomes to manage and the more policies, procedures, systems, rules and regulations are generated to handle the growing complexity. Talented people get frustrated, innovation suffers, and the focus shifts from customers and markets to internal communication, cost control, and rule enforcement.

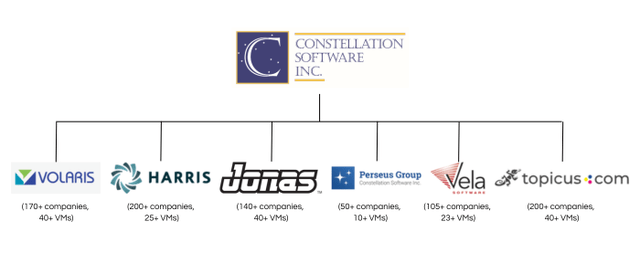

At the top of the organization, we find the head office (HO). The head office is responsible for giving support to six operating groups (OG), approving the bigger acquisitions, and deploying the cash flow generated. Each operating group is responsible for tens or hundreds of business units (BU). Business units typically represent a single VMS company.

Author (Data from: https://www.csisoftware.com/our-companies)

The HO staff represents less than 1% of CSU's employees and is composed of finance, accounting, acquisitions, tax, and legal personnel.

One of the main added values that the head office provides to its business units is acting as a link between them and creating a big network where their learning is shared. Once a business unit faces a problem, it can ask for support, since there is a chance that another BU faced the problem before.

The head office also has a large amount of data from all these years of acquisitions, so they are also in charge of analyzing all this data and extracting conclusions about what works best and what should be improved.

The operating groups have staff in accounting, acquisitions, shared R&D between different BU, IT functions, and varying degrees of HR, tax, and legal. CSU's main markets are North America, Europe, the UK, and Australia. The OGs Volaris, Harris, and Topicus are mainly focused on the public sector, while Jonas, Perseus, and Volaris mainly serve clients in the private sector.

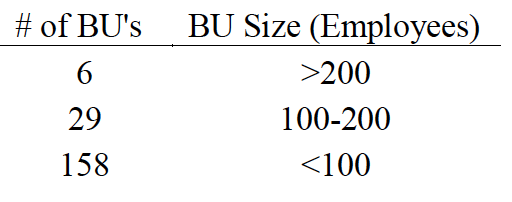

In its 2016 President's Letter, Mark Leonard presented the size of their BU, as we can see most of their BU has less than 100 employees, while only a few have more than 200 employees.

Constellation Software Inc. 2016 President's Letter

Even though CSU has grown significantly since 2017 in the number of BU managed, they're still making their efforts to keep it this way. As the company gets bigger, they are breaking up into smaller units and bringing responsibilities to lower levels. Jamal Baksh, CFO at Constellation Software who joined the company in 2003, explained in a 2022 interview:

The corporate structure has evolved and scaled over time. For the first 10 years of Constellation, most of the activity around M&A was done from the head office. The team would go out and source companies to buy. Once acquired, the team would understand the operations, learn ways to improve operations and take these best practices and share them across the businesses.

During the first 10 years, the team made 6 larger platform acquisitions and these individuals reported directly into head office. We soon realized that we couldn't manage the portfolio of businesses from head office and that the universe of VMS software companies was much, much greater that we had originally anticipated. So the firm pushed down some of the responsibility of M&A sourcing to the individuals that we refer to as operating group heads. Head office retained the authority to approve any of the acquisitions that were made.

Over the next 10 years, each of the operating groups started to make acquisitions and became very proficient in doing that. Eventually, we decided to let the operating group heads approve M&A transactions up to $20 million. Today almost everything that we're buying can be approved by the operating group heads. The 6 operating groups have become conglomerates of vertical market software companies, or essentially mini-CSI's.

When a BU is not generating the organic growth CSU is expecting, they ask themselves if employees and customers would be better served by splitting the BU into smaller units. If that's the case, the original BU Managers run a large piece of the original BU and spin off a new BU.

Another strategy has been spinning out operating groups. In January 2021, CSU spun off one of the six operating groups, TSS which was acquired in 2013 for €240 million, now Topicus.com Inc. (TOI:CA). More recently, in February 2023, CSU spun off Lumine Group Inc. (LMN:CA).

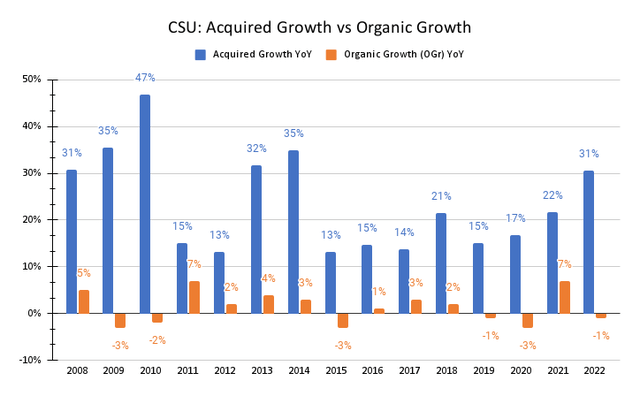

With this organizational model, the company has been able to create an acquisition machine to grow its sales and FCF. Since organic growth is low by nature in its business, most of its growth has been driven by deploying all its cash flow into new acquisitions.

Author (Data from CSU Annual Reports)

Acquisition Model

To deploy its capital, CSU has in place best practices for acquisitions, clear criteria, managers capable of deploying the capital and monitoring their BUs, and the right incentives to ensure their hurdle rates are kept in place with the goal to achieve high returns on invested capital.

Their criteria to consider it an exceptional business include:

- A mid-to-large-sized (minimum $5 million in revenues and $1 million EBIT) VMS that is number 1 or 2 in a niche market.

- Consistent earnings and growth.

- Experienced and committed management.

- Hundreds or thousands of customers.

By 2017, the last time CSU disclosed the number of personnel dedicated to M&A, there were 26 OGs and Portfolio Managers spending over half of their time on acquisitions and 60 full-time M&A professionals. The company has nearly tripled in size since then and cash acquisitions have multiplied by ten, so I'd guess there are currently over 300 full-time professionals spread across the OGs working on acquisitions.

CSU's favorite acquisitions are those that they buy from founders. They usually look to buy 100% of the business and never sell it, but they are open to buying a smaller portion if vendors wish to continue in the business.

CSU accumulated a lot of data through all these years of acquisitions, and the head office is constantly analyzing it to achieve better outcomes and learn from past acquisitions.

An investment only becomes a lesson if we diligently track its post-acquisition performance and take the time to analyse the outcome while the investment is still fresh in everyone's mind. We have a process for this that we call a post-acquisition review, or "PAR". We try to schedule the PAR's about a year after the initial investment.

Even though the cash flow available for acquisitions has grown significantly, CSU still looks for small acquisitions and one or two big acquisitions per year. Mark Leonard has been very hesitant about lowering the hurdle rate since he believes it will affect not just marginal acquisitions, but all of them, reducing ROIC.

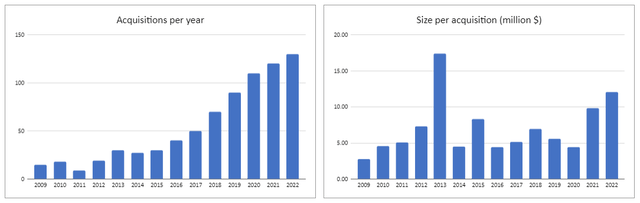

Author (Data from CSU Statutory Fillings)

CSU used to disclose the number of acquisitions per year until 2016, and I approximated the data for the following years from different sources like management discussions, transcripts, news, and the number of BUs per year in each operating group.

As we can see in the size per acquisition chart, CSU has an average purchase price of $5 million per acquired company. In 2013 we saw some increase because of a larger-than-usual acquisition of TSS (€240 million). The company has managed to keep acquisitions small, even though they are facing an increasing need for larger acquisitions since their free cash flow has grown significantly, and they would need about 250 acquisitions per year to keep buying small VMS businesses.

In 2021, they acquired bigger businesses like SSP Ltd., FICO's (FICO) Collection and Recovery business, and Datapro. The company didn't disclose the acquisition price, but from FICO's 2021 financial statements, we can determine that their C&R Business was valued at $25.5 million and they realized a $92.8 million gain. The acquisition price was about $118,3 million.

In 2022, the Harris OG acquired Allscripts Healthcare Solutions (now Alterra) for $700 million, which added $556 million in revenue and $96 million in net cash flow from operating activities for the year.

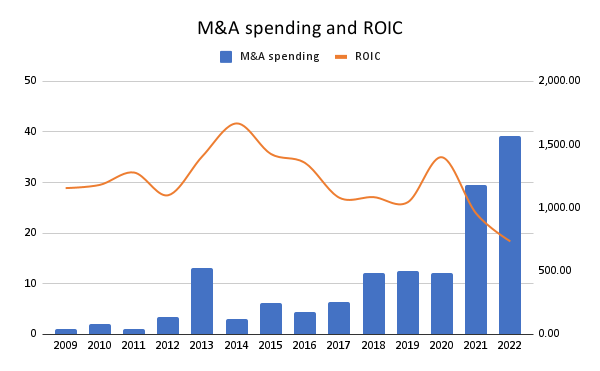

Author (Data from CSU Statutory Fillings)

As we can see in the chart above, as M&A spending goes up, the ROIC has been diminishing for the last few years. To calculate ROIC I used the Free Cash Flow Available to Shareholders (FCFA2S), which is a metric that CSU has been providing consistently over the years and Invested Capital.

I believe FCFA2S is a measure that gives us a better idea of CSU's profitability, and I prefer it instead of Net Income since it is adjusted for amortization for intangible assets, which for CSU are really high and amortized at fast peace. CSU amortizes its intangibles at about 15% per annum while its acquired businesses can operate for decades. FCFA2S is calculated as cash from operating activities plus interest and dividends received less interest paid, credit facility costs, lease obligations, property and plant purchased, and non-controlling interests. I believe Free Cash Flow from operations could also be used for this purpose.

As CSU needs to look for bigger acquisitions to deploy all of its FCFA2S, they need to pursue bigger acquisitions. During 2009-2011, CSU was able to acquire VMS businesses for less than 0.5 times sales. When the company has done bigger acquisitions, the EV/Sales multiple goes up. When CSU purchased TSS in 2013, it paid 2.7x net maintenance revenues, and its more recent acquisition of Allscripts was at 0.75x gross revenues.

Outstanding Management

In the same way CSU likes to acquire its VMS businesses from founders, as an investor I also look for companies that are still managed by their founders with strong skin in the game. I believe Constellation Software has one of the best management teams I am aware of, and Mark Leonard's transparency over the years has earned my trust.

The management team and CSU's employees have a strong skin in the game with the company and aligned incentives. Management at CSU receives 20-25% of their salary in cash (except for Mark Leonard, whose salary is zero), and the rest is received as an incentive bonus based on ROIC and net revenue growth. The incentive bonus requires investing at least 75% in shares and is held for four years.

Mark Leonard is not receiving any compensation from CSU since 2014, even though he still holds over 2% of CSU's shares.

Last year I asked the board to reduce my salary to zero and to lower my bonus factor. CSI had a great year, so despite those modifications, my total compensation actually increased. This year I'll take no salary, no incentive compensation, and I am no longer charging any expenses to the company.

I've been the President of CSI for its first 20 years. I have waived all compensation because I don't want to work as hard in the future as I did during the last 20 years. Cutting my compensation will allow me to lead a more balanced life, with a less oppressive sense of personal obligation. I'm paying my own expenses for a different reason. I've traditionally travelled on economy tickets and stayed at modest hotels because I wasn't happy freeloading on the CSI shareholders and I wanted to set a good example for the thousands of CSI employees who travel every month. I'm getting older and wealthier and find that I'm willing to trade more of my own cash for comfort, convenience, and speed … so I'm afraid you'll mostly see me in the front of the plane from here on out.

I love what I'm doing, and don't want to stop unless my health deteriorates or the board figures it's time for me to go. We have an impressive board. I trust them to determine when I'm no longer adding value as the senior executive in the company.

I like the fact that CSU is not increasing its outstanding shares to compensate its managers with stock options but buying them instead. It is like a perpetual buyback, and even if it doesn't reduce the shares outstanding, it gives strong incentives to the management to perform over the long term.

The CEOs of the different operating groups own between $150-$560 million in shares, while their salaries range between $1.7-$2.8 million.

Expected growth

Since acquisitions are what mainly drives CSU's growth, I believe it is important to review how its acquisition model is going to perform over the next years.

From the most recent developments, I don't think CSU is struggling to deploy its FCF into new acquisitions. First of all, the company stopped its special dividend since it could still invest its cash and obtain higher returns for shareholders.

Secondly, CSU is focusing on bigger acquisitions, a segment where they have only deployed about 10% of its FCF in its almost 30-year history. They believe every year between 40 and 70 large VMS businesses are sold and they are focused on increasing this segment.

Over the last five years, we were aware of about 80% of the large VMS businesses that were sold, but their brokers only invited us to participate in 16% of the sales processes.

We are building a small, dedicated team at head office to pursue large VMS acquisitions and to work with M&A brokers. If we drop our hurdle rates for these acquisitions, I believe that competent and diligent M&A brokers will include us in more auctions.

The addressable market for CSU in the VMS segment is estimated to be worth more than $200 billion with over 40,000 potential targets. CSU still only has a small share of that market, which is expected to grow at 12% until 2032.

Thirdly, CSU is also exploring new circles of competence outside the VMS business. Even though this could be seen as risky, we believe CSU is already a specialized holding company and management has demonstrated over a long period of time that they can deploy its capital effectively. I wouldn't mind seeing some small capital allocations in new sectors if they meet the criteria.

For the 1H of 2023, CSU spent $977 million in acquisitions (less $93 million of cash acquired), while its FCFA2S was at $467 million. The company is spending over its free cash flow, so I don't see any reason to think it is having issues deploying its capital. We will have to monitor its ROIC over the next quarters since they are pursuing bigger acquisitions. They recently entered into an agreement to acquire Black Knight's Optimal Blue business from Intercontinental Exchange, Inc. (NYSE:ICE), and Black Knight, Inc. (NYSE:BKI) for $700 million.

In my base scenario, I expect CSU to materialize 2 big acquisitions per year lowering their hurdle rates and continue with 120 small-mid acquisitions per year keeping their hurdle rates in this segment for 2023. This would mean deploying about $600 million in small-mid acquisitions and $1,400 million in large acquisitions for 2023.

For the next years, I expect CSU to materialize 2 big acquisitions per year ($1,400 million) and 150 small-mid acquisitions per year ($750 million) until 2028. Organic growth is expected to be at the historical average of 3%.

I assume big acquisitions are at 1.5x EV/Sales and small-mid size acquisitions at 0.5x EV/Sales. It'd give us an average price of 1.2x EV/Sales for 2023 and 1.15x EV/Sales for 2028.

Using an 11% discount rate (WACC) and a Free Cash Flow multiple approach, which I believe is a better one than perpetuity since I don't expect CSU to stop acquisitions, my fair price is $2,471.36 and I consider the stock highly undervalued given our assumptions.

I used an 11% discount rate from 0.86 beta, a 4% free risk rate, and a risk premium of 6.5% given the latest CSU debt issuance on August 3rd, 2023.

This model assumes CSU will be able to deploy over $2 billion every year for the next five years maintaining its current 20% FCF margins. If CSU is not able to deploy its capital into new acquisitions and needs to give it back to shareholders through dividends and/or share buybacks their growth would be seriously diminished, and a 20x FCF valuation would be too optimistic for a company with low organic growth.

2Q 2023 Results

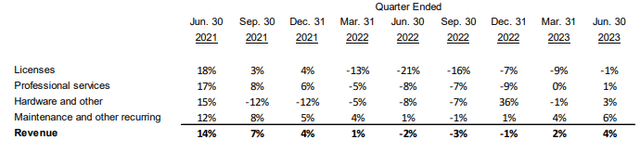

CSU's results for the second quarter have been as expected, with revenues growing 26%, mainly because of acquisitions. Organic growth hasn't disappointed, growing 6% compared to the same period the year before and improving in all segments.

Constellation Software Inc Q2 2023 Management Discussion and Analysis

Cash flow from operating activities has been $755 million, a 31% increase, and FCFA2S increased 40% to $467 million.

Expenses for the quarter increased less than revenue and accounted for 77% of total revenue, staff being the main expense ($1,112 million).

On the expenses side, it is important taking into account that there are two non-cash expenses that are actually positive for CSU.

Firstly, the redeemable preferred securities expense related to the WideOrbit acquisition of $94 million. Since the sellers of WideOrbit received Preferred Securities that can be converted into Lumine shares, the increase in Lumine's shares is accounted as an expense in CSU's income statements.

Secondly, the liability related to the Topicus.com spin-out. Since the Joday Group owns 30.29% of Topicus Coop's shares and under the IRGA agreement is entitled to sell its shares to CSU, and from December 31, 2023, CSU has the right to buy Topicus Coop shares, it is recorded as a liability.

Since the valuation of TSS has gone up 6% for the 2Q 2023, it is recorded as a $31 million expense for the quarter.

Finally, I believe it is also important to take into account that CSU's business is sensible to seasonality and usually second quarter of every year is the lowest, while usually first quarter is the highest.

Risks

I see a range of bear scenarios for CSU, even if I don't assign them to high probabilities of happening.

The VMS market, as highlighted before, is growing and I do not see any short-term change in the trend.

One of the risks is the increasing competition when acquisitions become larger and more known. The main competitor from a publicly traded company is Roper Technologies (NASDAQ:ROP), an industrial conglomerate specializing in engineered products for niche markets, and VMS which is currently spending over $4.3 billion a year in acquisitions (2022 Annual Report). In the private equity space, CSU could face competition from Vista Equity Partners and Thoma Bravo.

From the macroeconomic point of view, I don't like to try timing the economic cycles because of the number of unpredicted variables that can affect the outcome in the short term, but I will shortly analyze what a higher interest rate scenario would mean for CSU.

CSU has been hesitant over many years about using debt to leverage its acquisition model, and even though they have increased in recent years, its net debt is $5,374 million (1H 2023) and FCF is expected to be $1,673 million, giving a 3.2 FCF/Net Debt ratio.

Even though the cost of debt could go up, diminishing CSU's margins, higher interest rates could lead to lower valuations on the VMS market, allowing it to achieve better returns on capital.

From an earnings perspective, I believe CSU's business model is highly defensive. Earnings are recurring, and the churn rate is low given the high switching costs. In the GFC, the company grew its sales by 1% organically in 2007 (plus 15% through acquisitions) and 5% in 2008 (plus 31% through acquisitions). In 2009, the company declined by 3% in organic sales but increased by 35% in acquisitions.

Some of the bear scenarios could be the company being unable to deploy its cash flow into new acquisitions and give it back to shareholders. In this scenario, CSU's growth would slow significantly and its valuation should go down given its low organic growth. If the valuation goes down to 15x FCF, the company could buy back about 6% of the shares annually (assuming no acquisitions are made). In that scenario, investors shouldn't expect returns over mid-single digits.

A more halfway-bear scenario would be CSU deploying just part of its FCF with the goal of keeping its hurdle rate. In that case, we could see some diminishing growth over the next years with a 2-3% dividend or buyback.

Finally, CSU could fail to keep up with its hurdle rates but deploy all of its capital at higher prices and get lower returns on capital. This would diminish CSU's ability to generate a high ROIC and future growth.

Mark Leonard wrote in 2018:

One day Constellation may find that VMS businesses are too expensive to rationally acquire. If that happens, I hope we'll have had the foresight and luck to find some other high ROE non-VMS businesses in which to invest at attractive prices. I am already casting about for such opportunities.

If we don't find attractive sectors in which to invest, then we'll return our FCF to our investors. Even if re-investment opportunities become scarcer, Constellation doesn't end… it will continue to be a good (hopefully great) perpetual owner of its existing VMS portfolio, and will still deploy some capital opportunistically.

Conclusions

I expect Constellation Software to continue deploying its free cash flow into new acquisitions, but I believe size matters.

ROIC has been diminishing for the last few years as the company gets bigger and pursues larger acquisitions and lowers its hurdle rate.

Still, I believe CSU has an outstanding business with great management and room to grow. With the current valuation of 20x NTM FCF, it presents a good opportunity since I assign higher probabilities to the upside (still deploying capital but at higher prices) than to the downside (not being able to deploy its free cash flow).

Constellation has deployed over its FCF in 1H2023 and announced a large acquisition ($700 million) in July 2023. I don't expect the company to find its limit any time soon and assign it a strong buy rating with a current fair price of $2,471 using a FCF multiple approach.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSU:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)