Ardmore Shipping: An Improving Market And A Probable Special Dividend

Summary

- Ardmore Shipping's 2Q 2023 financial results were lower than expected due to higher refinery maintenance, impacting demand for product tankers.

- 3Q 2023 financial results are expected to be weaker than 2Q 2023 due to lower TCE rates and refinery outages.

- Despite these expectations, the product tanker market outlook is in favor of Ardmore, and TCE rates are likely to increase in the future.

- Higher European product imports, higher Chinese product exports, and changed trading patterns may increase tonne-mile demand.

- Ardmore's Board of Directors might decide to pay a special dividend in the following quarters.

Lisa-Blue

Ardmore Shipping's (NYSE:ASC) 2Q 2023 fleet TCE per day, and adjusted earnings were significantly lower than my expectation (see my previous article on Ardmore) as higher-than-normal refinery maintenance in May and June 2023 hurt the demand for product tankers. Also, I expect Ardmore's 3Q 2023 financial results to be weaker than in 2Q 2023. But it does not mean that my buy position on the stock has changed. In fact, I am even more bullish on Ardmore now as the product tankers market outlook is in favor of Ardmore. The stock is a buy.

Why do I think Ardmore's 3Q 2023 is not going to be strong?

As of 9 May 2023, based on approximately 50% of total revenue days fixed for 2Q 2023, Ardmore had an average spot TCE rate of $34000 per day for MR eco-design tankers, and an average spot TCE rate of $33600 per day for chemical tankers. However, the company was not able to make favorable contracts (as favorable as before) for its non-fixed days as rates were impacted by above-average refinery maintenance. Due to significantly lower rates for non-fixed days compared to fixed days, Ardmore recorded a fleet TCE per day of $24541 in 2Q 2023, lower than my expectation in June 2023. As a result of lower TCE rates, the company's adjusted earnings per diluted share decreased from $1.04 in 1Q 2023 to $0.57 in 2Q 2023, down 45% QoQ. Subsequently, based on the company's variable dividend policy of paying out dividends on its shares of common stock equal to one-third of adjusted earnings, the Board of Directors declared a cash dividend of $0.19 per common share for the second quarter of 2023, compared to $0.35 per common share in 1Q 2023.

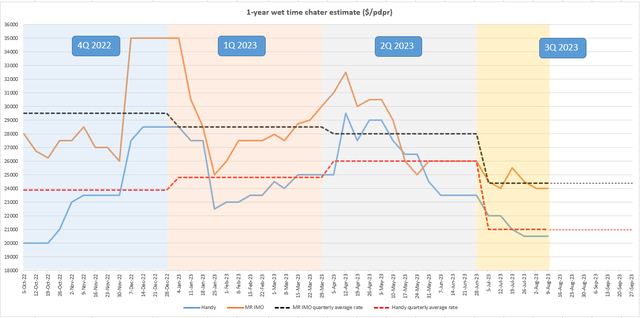

For the third quarter of 2023, based on approximately 45% fixed days, ASC's average spot TCE rate is about $24100 per day for MR eco-design tankers. Also, based on approximately 63% of fixed days, ASC's average spot TCE rate for the third quarter of 2023 is about $20400 per day for chemical tankers. In the second quarter of 2023, ASC's MR eco-design tankers and chemical tankers earned an average spot TCE rate of $27460 per day, and $24555 per day, respectively. The rates decreased further in 3Q 2023, and according to Figure 1, ASC's fleet TCE rates in 3Q 2023 can be significantly lower than in the previous quarters. One might say that refinery maintenance season is over, and in the second half of August and in September, TCE rates can jump. This argument may not be right. According to EIA, a series of unplanned refinery outages this summer have limited refinery operations. EIA decreased its outlook for refinery utilization and refinery gasoline yield for the rest of 3Q 2023 and the start of 4Q 2023. Moreover, Reliance Industries, an Indian multinational conglomerate, which operates the largest refining complex globally and can process 1.4 million barrels per day, is planning a maintenance shutdown at its refinery units for September to October. Thus, Ardmore's fleet TCE ate in 3Q 2023 can be weaker than in 2Q 2023. It means that the company's adjusted earnings and quarterly dividend in 3Q 2023 can be lower than in 2Q 2023. However, in a few months, everything can change for Ardmore Shipping and its investors.

Figure 1 - Wet time charter estimates ($/pdpr)

Author (based on hellenicshippingnews.com data)

Why despite my 3Q 2023 expectations, I am still bullish on Ardmore?

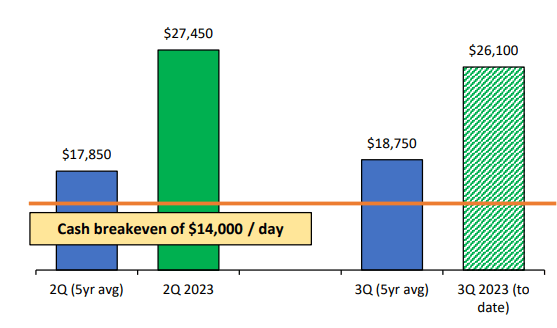

TCE rates are still above Ardmore's cash break-even points (see Figure 2). For its MR tankers, Ardmore has a cash breakeven of $14000 per day, which is lower than MR TCE rates in 2Q 2023 and 3Q 2023. Ardmore's revenue is 100% exposed to spot rates as the management wants to fully benefit from the elevated market and anticipated seasonal strength that the company expects to happen in the next few months. EU embargo is continuing to positively affect the product tanker market by adding to tonne-miles. The number of product tankers carrying Russian cargo since the EU embargo has increased by 50%.

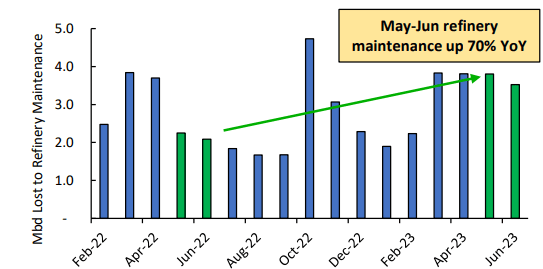

As mentioned earlier, due to higher-than-expected refinery maintenance in the second quarter of 2023, the demand for tankers decreased. Figure 3 shows that in May and June 2023, refinery maintenance was 70% higher than in May and June 2022. However, refineries may ramp up production in 4Q 2023 as global profit margins are improving. Due to strong demand growth and low inventory levels, global refiners may be able to become more profitable in the following months. More diesel, jet fuel, and gasoline production mean more demand for product tankers. EU refined product embargo started on 5 February 2023. Since then, European inventories decreased by 25%, and soon, the EU has to increase the import of products.

EU product imports in the fourth quarter of 2023 are expected to increase significantly, and due to changed trading patterns, more EU product imports can significantly increase the demand for tankers. Furthermore, due to the return of refining (which is not finished yet) from higher-than-expected seasonal maintenance, Russia's seaborne diesel exports in July 2023 were 5% higher than in June 2023, as the country's diesel exports to Brazil, the Middle East, North Africa, and Turkey increased. In the next few months, I expect Russia's seaborne diesel exports to increase further.

Thus, as much as I don't expect Ardmore's 3Q 2023 fleet TCE rate to be better than in 2Q 2023, I expect the company's fleet TCE rate to increase in the fourth quarter of the year. It is worth mentioning that in the week ending 26 July 2023, TCE rates for MR tankers decreased. Also, in the week ending 2 August 2023, TCE rates for MR tankers decreased again. However, in the week ending 9 August 2023, TCE rates for MR tankers remained flat, which can be a good sign for Ardmore. Another thing that can support TCE rates is that product export from China can increase in the following months, which can have a significant effect on the product tanker market.

"Notably, an increased number of product tankers carrying Russian cargo resulting in fewer ships trading in the global fleet, we believe this bifurcation of trade is persistent and ultimately creates more inefficiencies in the product tanker market, thus supporting stronger rates," the CEO commented.

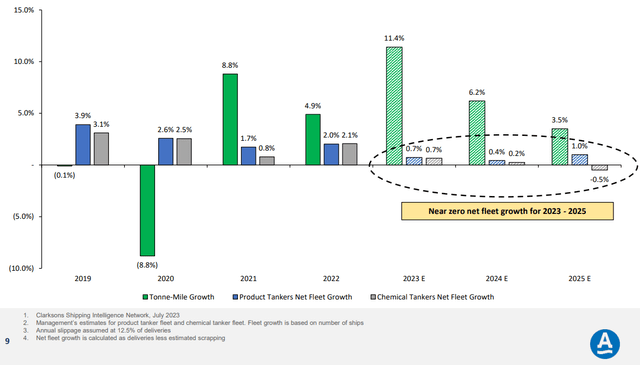

With higher tonne-mile growth, and with the current global fleet capacity, TCE rates are very likely to increase again. In 2023, tonne-mile growth is expected to be significantly higher than the net fleet growth of product tankers and chemical tankers. According to Clarksons Shipping Intelligence Network in July 2023, tonne-mile growth in 2023 is expected to be 11.4%. Also, it is expected to be 6.2% in 2024. On the other hand, Ardmore estimates product tankers net fleet growth and chemical tankers net fleet growth to be 0.7% in 2023. Also, the company estimates product tankers net fleet growth and chemical tankers net fleet growth to be 0.4% and 0.2% in 2023 and 2024, respectively (see Figure 4).

Figure 2 - Ardmore's MR TCE rates

Ardmore's 2Q 2023 presentation

Figure 3 - Expanded global refinery maintenance season

Ardmore's 2Q 2023 presentation

Figure 4 - Product and chemical tanker demand vs. net fleet growth

Ardmore's 2Q 2023 presentation

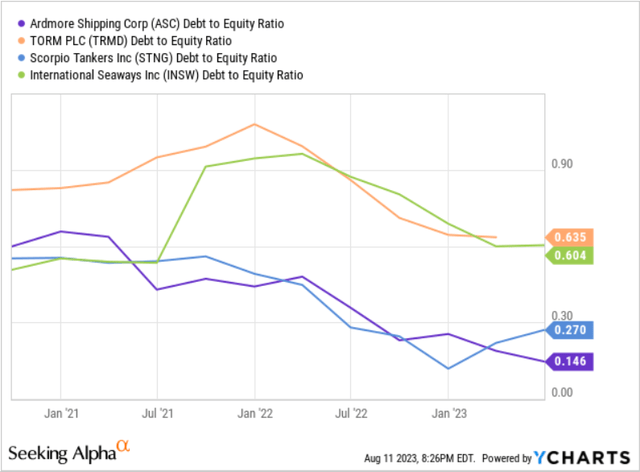

There might be a special dividend

Based on its current capital allocation policy, Ardmore pays a quarterly dividend equal to one-third of its adjusted earnings. The company uses more than one-third of the adjusted earnings on capital expenditures to upgrade its performance and decrease the cost of operations and uses the rest for deleveraging. According to Figure 5, in the past three years, Ardmore improved its debt-to-equity ratio in a significant way. We can see that compared to its competitors, Ardmore has a better debt-to-equity ratio and the company improved its debt-to-equity ratio at a faster pace than its competitors. At the company's 2Q 2023 Conference Call, Anthony Gurnee, the CEO of the company said Ardmore will not continue deleveraging at nearly the same rate as it did last year. Also, he said that the Board of Directors is thinking about paying a special dividend under the right conditions. Ardmore does not make a promise about paying special dividends, and its Board of Directors prefers to not give guidance on it. However, according to the company's current payout ratio, the successful deleveraging in the past year, and a better tanker market outlook, paying a special dividend in 4Q 2023 or 1Q 2024 is likely. Even in 3Q 2023, the Board of Directors might decide to pay a special dividend.

Figure 5 - Ardmore's debt-t-equity ratio vs. peers

End note

Due to refineries' significant maintenance in May and June 2023 that affected the product tankers market negatively, Ardmore's 2Q 2023 financial results were weaker than my expectations. Also, Ardmore's 3Q 2023 financial results are not expected to be stronger than in 2Q 2023. However, in the following months, TCE rates may increase again, and Ardmore's earnings is expected to improve in the fourth quarter of the year. Also, there might be a special dividend as the company is now paying out just one-third of its adjusted earnings. The stock is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.