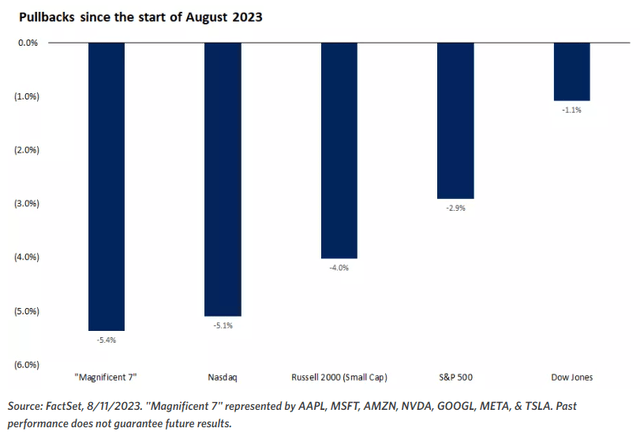

Soft Landing And Bull Market Still On Track

Summary

- Pullback in stocks expected to be brief and relatively modest, with mega-cap tech stocks taking the brunt of the punishment.

- Inflation remains under control, with housing accounting for the majority of the overall increase.

- Consumer confidence shows lower inflation expectations, indicating progress in managing expectations and bringing inflation rate down.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

phive2015

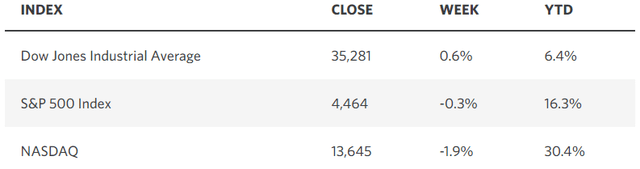

As the highly anticipated pullback in stocks ensued last week, the underlying fundamentals for the market and economy continue to move in positive directions. That tells me that this pause will be brief, and the drawdown relatively modest in percentage terms. Also as expected, we are seeing the mega-cap technology names that fueled a majority of the index gains this year taking the brunt of the punishment. The “Magnificent 7,” as shown in the chart below, have collectively declined more than any of the major market indices. This is the result of improving market breadth, which is mitigating the damage to the broader market. This is a healthy rotation that was necessary to support a continuation of the bull market.

As for the fundamentals, we saw more progress on the inflation front, as the Consumer Price Index (CPI) for July was better than expected, with the core rate falling from 4.8% to 4.7%, while the overall rate rose from 3% to just 3.2%. The Producer Price Index (PPI) saw a small uptick from 0.2% to 0.3% for July, but the overall rate is just 0.8%. The disinflationary trend in both remains intact.

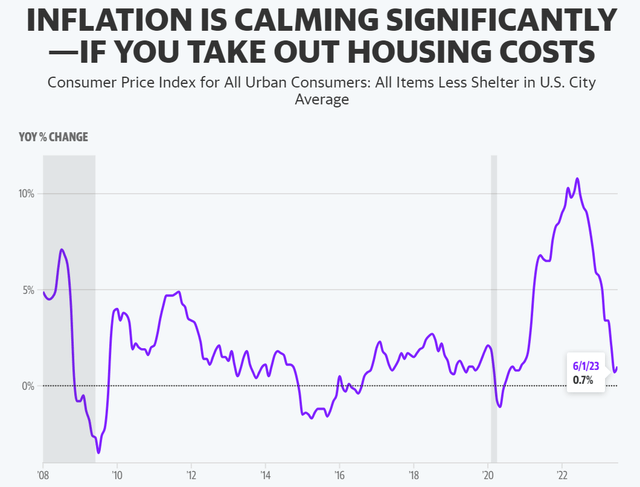

The most positive aspect of the inflation report was that housing accounted for 90% of the overall increase. As Yahoo Finance notes in the chart below, when we exclude housing costs the rate falls to less than 1%.

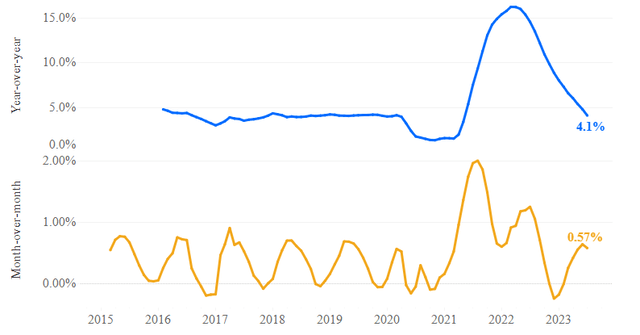

The reason this is positive is that annualized rent inflation, as measured by the Zillow Observed Rent Index, has fallen to its long-term average of approximately 4.1%. Rent growth typically slows during the late summer and outright declines in the fall, which should result in a continued decline in the annualized rate. Additionally, nearly one million multi-family units were under construction as of May on an annualized basis, which will significantly increase the supply of rentals and weigh on future price increases.

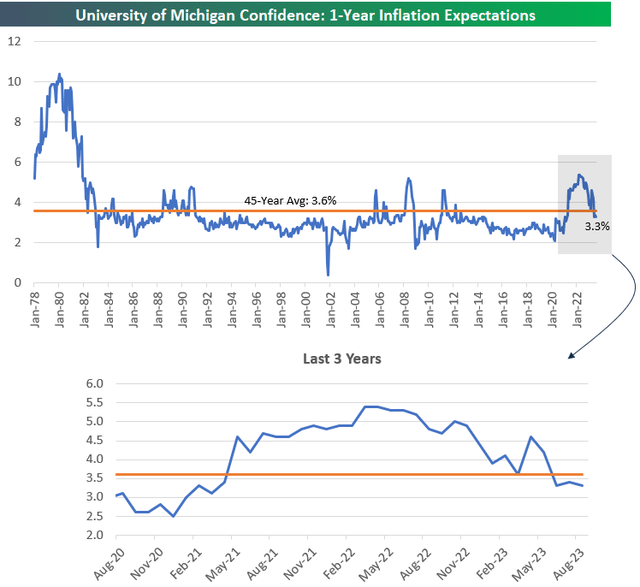

Consumers seem to be well in tune with these developments. Last week’s University of Michigan Consumer Confidence survey showed the consumers’ inflation expectations for the coming year fell from 3.5% to 3.3%, which is below the 45-year average. This is an important number for the Fed. Chairman Powell has indicated that expectations must be managed to bring the inflation rate down to target. It looks like that battle has been won.

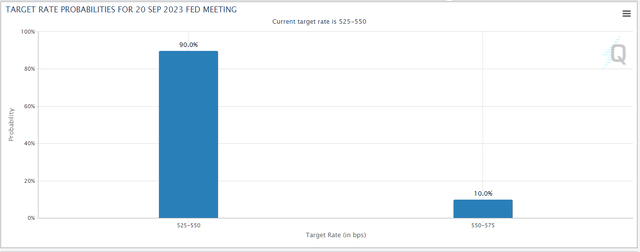

The progress in returning the rate of inflation towards the Fed’s target of 2% is the reason investors see the Fed’s rate-hike cycle having ended in July. The Fed funds futures market sees a 90% probability of no rate hike at the September meeting with a greater than 60% of no rate hike in November and December. Historically, stocks have performed well in the months following the conclusion of a rate-hike cycle during disinflationary environments.

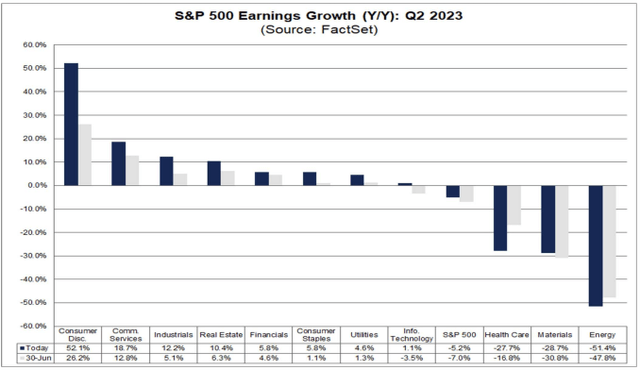

Lastly, corporate profits are coming in better than expected for the second quarter, and we are on the cusp of growth again in the year-over-year numbers for the S&P 500. Bolstering that prospect is the fact that the Fed’s GDPNow model shows a rate of economic growth in the current quarter of 4.1%. That is an acceleration from the 2.4% rate in the second quarter, which was an acceleration from the 2% rate in the first. That is a hugely positive rate of change. In a similar vein, the trough in earnings growth looks to be behind us. The expectation at the end of the second quarter was that S&P 500 earnings would decline 7%, but nearing the end of the season the decline has narrowed to 5.2%. We should see a resumption of annualized growth in the second half of this year.

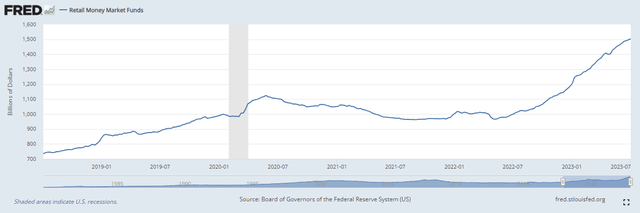

This year’s market rally has been in anticipation of these developments. There is plenty of fuel left in the tank to power stocks higher, as retail money market fund balances have surged to what the Investment Company Institute estimates to be over $2 trillion. My outlook for a soft landing for the economy and new bull market in 2023 remains on track.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has been managing portfolios for individual investors for 30 years, starting his career as a Financial Consultant in 1993 with Merrill Lynch and working in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. In addition to writing for Seeking Alpha, he is also a Leader on the new fintech platform at Follow.co.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)